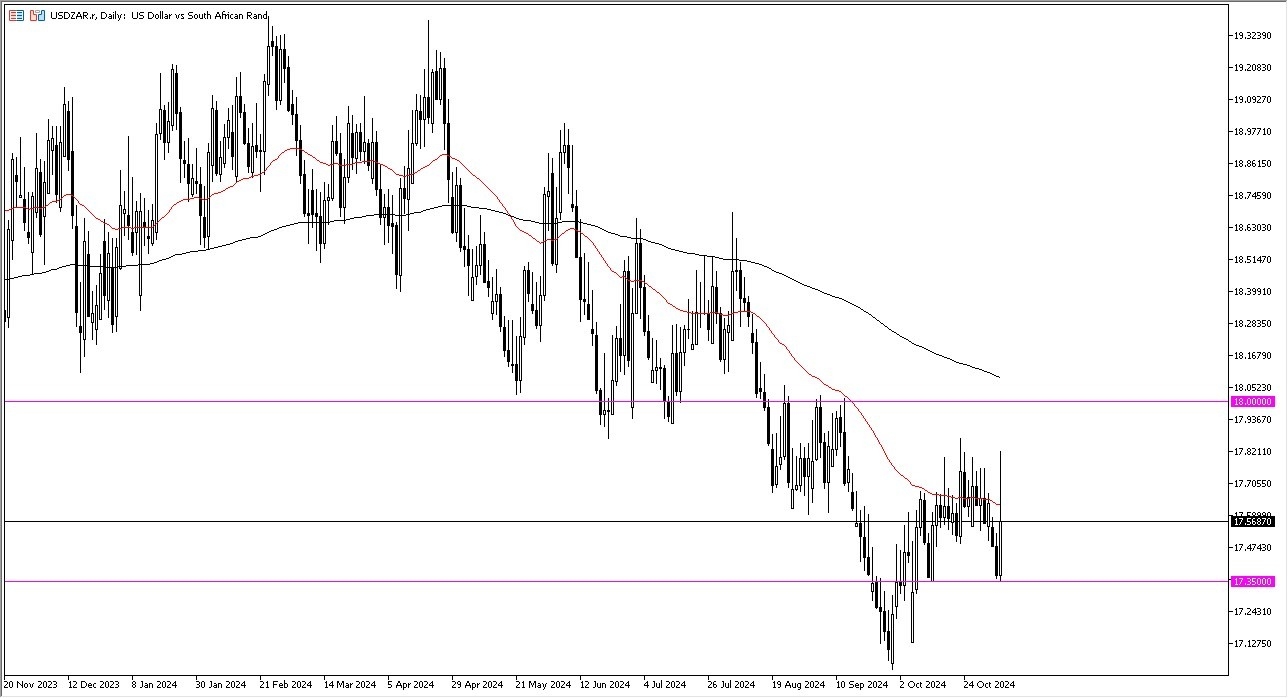

- The US dollar has rallied rather significantly against the South African Rand breaking above the 50-day EMA after the US election result but have since then given back about half of the gains.

- What this tells me is that there are a lot of questions about the US dollar right now and the overall trend and the wouldn't necessarily be a huge surprise because we have the Federal Reserve interest rate decision on Thursday which is expected to be a 25 basis point rate cut.

- This is probably already “baked into the price.”

It’s the Statement

Top Forex Brokers

Perhaps more importantly we also have to pay close attention to the interest rate statement which could give us an idea as to what the Federal Reserve is going to do over the longer term. Keep in mind if they sound extraordinarily dovish that's probably going to be bad for the greenback, but we'll just have to wait and see how that plays out.

The technical analysis in this market is rather negative with the market breaking above the 50 day EMA only to give up those gains. Now the question is, will the 17.35 level underneath continue to offer support?

If we turn around and rally from here, I think that the 18 level is an area that is going to be significant in its resistance with the 200 day EMA racing towards it as well. It's really not until we break through all of that that I think that the trend has changed. So, while I do think that we get the occasional pop like we got during the trading session on Wednesday, I don't know if it's going to be easy to hang on to this move until we clear that 18 level. If that were to be the case, the market will probably be strong for the US dollar overall, especially against the Emerging Market currencies.

Ready to trade our daily USD/ZAR analysis? Here's a list of the best forex trading platforms South Africa to choose from.