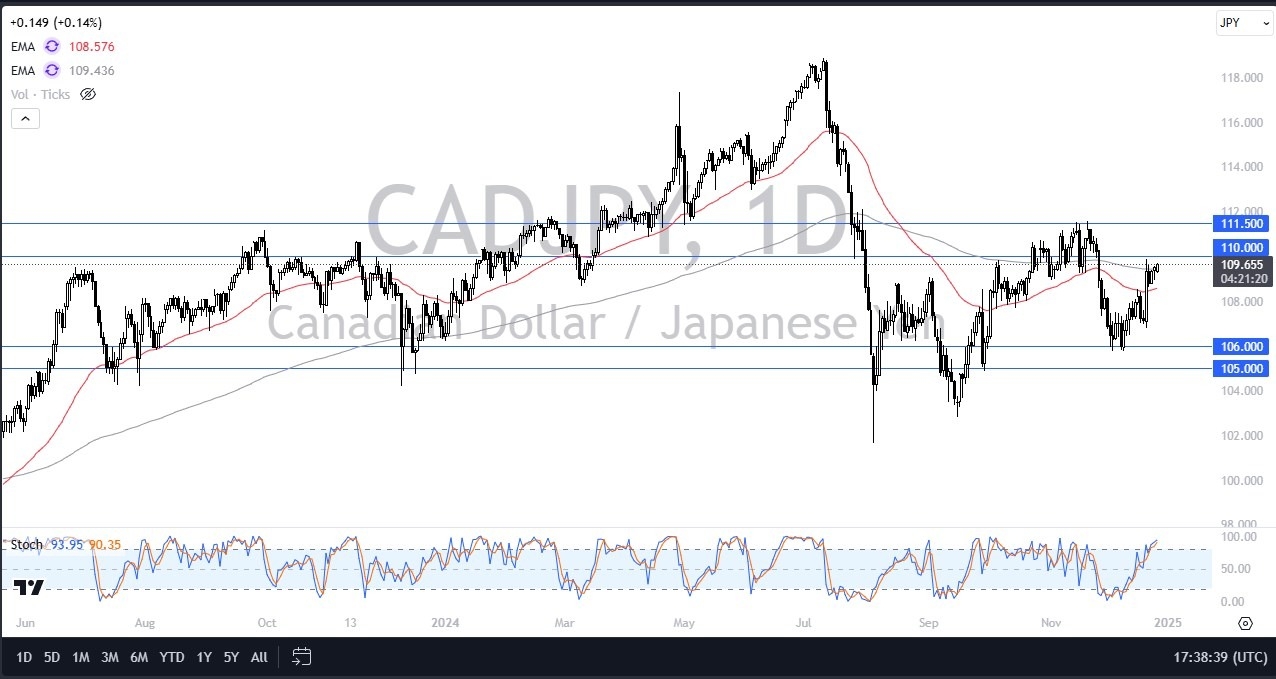

- The Canadian dollar initially did rally a little bit during the trading session, but it is somewhat stagnant at this point, which makes a certain amount of sense as we are getting close to the crucial 110 yen level.

- The 110 yen level is the beginning of a zone of resistance that extends to the 111.50 yen level.

- So, I think you have to look at this as a process, not necessarily something that just takes off.

Now, having said all of that, the US dollar is beating up on the Japanese yen, and I think that does have a little bit of a knock-on effect, but it's also worth noting that we are at the 200-day EMA. The stochastic oscillator is starting to crossover in the overbought condition as well, and as this market has been somewhat sideways over the last several months, that could come into play.

Top Forex Brokers

Interest Rates Not as Big Here

However, the interest rate differential between most currencies and the Japanese yen is still fairly wide, although it's probably worth pointing out in Canada, not as much as many of the other majors. The biggest thing that this pair has going for it is the fact that it's denominated in Japanese yen. I do not like the Canadian dollar at all, but in this case, the Canadian dollar just is a touch stronger than the Japanese yen.

You still get paid swap at the end of every day, assuming that you're with a reputable broker, but you also have to recognize the fact that there is going to be quite a bit more work to do here than there would be in say the US dollar against the yen or maybe even the pound against the yen. Short-term pullback should be thought of as buying opportunities with a 50 day EMA, probably offering quite a bit of support as well. Furthermore, we also have the 106 yen level that drops down to the 105 yen level offering a large region of support. I'm a buyer, not a seller, but not an avid buyer.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.