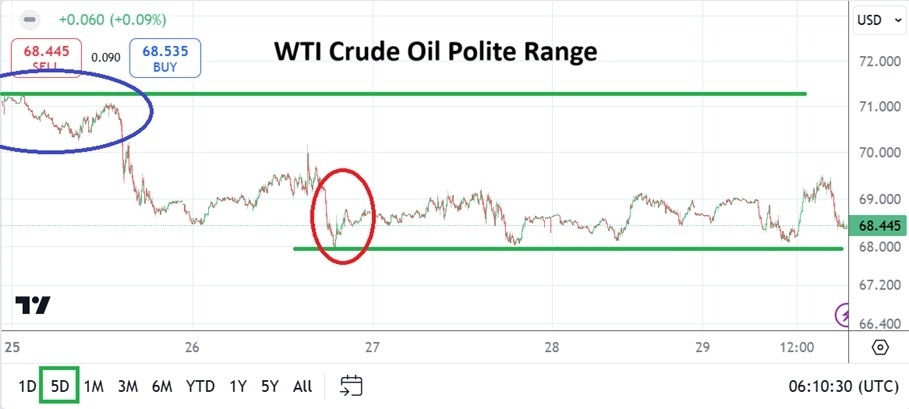

WTI Crude Oil went into this weekend near the 68.480 ratio, the price range of the commodity found durable support near 68.000 most of the week which saw light holiday trading that matched expectations.

- The price range of WTI Crude Oil last week was almost too predictable regarding value and this might make some speculators a bit nervous because getting the results one expects is not always easy.

- After rising in price the week before but showing resistance was rather durable, last week’s trading action began near the highs seen in previous days but then incrementally began to sink lower.

Top Forex Brokers

After a test of the 68.500 ratio early last Tuesday and then a reversal higher which momentarily challenged the 70.300 vicinity late in the day, WTI Crude Oil then began to sell off harder. By late in the day Tuesday the 68.000 level was tested. After this rather solid show of slight volatility the commodity than fell into a holiday trading range consisting between 68.000 and 69.300 with outliers.

The Week to Come and Speculative Mindsets

Thursday’s Thanksgiving holiday in the U.S shuttered the oil market; Friday’s trading was light but after an initial rise challenging near-term resistance the commodity then reverted lower. The price of WTI Crude Oil last week may be put to the test considering that heavier volume will be seen this coming week. However, speculators need to ask if last week’s values were a preview of things to come. The fact that last week’s polite trading met price range expectations sets the stage for a potential repeat performance.

The ability of WTI Crude Oil to trade comfortably within an expected range and prove that resistance levels above seen in the previous week when the 71.000 level was momentarily penetrated, could not sustain high values may make traders believe they are starting to see the Trump effect coming into WTI Crude Oil. In other words U.S energy policy will certainly allow for more production and this should have a calming affect on WTI Crude Oil prices.

Range of WTI Crude Oil

While WTI Crude Oil closed near the 68.500 vicinity and leaves the door open to early speculative trades tomorrow as short-term support and resistance are wagered, traders without deep pockets may want to watch the opening for clues. If WTI Crude Oil opens with some momentum lower it will be interesting to see if the 68.000 is again brought into sight. Early momentum could lead to traders jumping in, but they always need to be careful of reversals.

- An early test of lower support on Monday may mean that selling sentiment may be lingering and that some think the commodity could explore prices to new depths.

- A move higher early tomorrow to the 69.000 level and above will prove interesting for resistance, 69.250 may prove to be the real testing ground for WTI Crude Oil.

- It would be surprising to see WTI Crude Oil sustain bullish momentum and test prices above 70.000 this coming week.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 67.600 to 70.200

WTI Crude Oil is likely to see another rather calm week of trading in the coming days. Saber-rattling threats certainly linger from the Middle East and Eastern Europe, but calmer heads do look like they are starting to prevail. Economic dynamics remain important regarding fundamentals in the energy sector, and production, supply and demand do seem to be rather well synchronized.

The price of WTI Crude Oil will not be boring in the coming days because if support and resistance levels do prove to be effective, it could open the door for technical traders to try and wager on momentum they perceive. The secret to productive trading in WTI Crude Oil will be patience, conservative leverage and not being overly ambitious regarding targets this week. The coming change in U.S energy policy is a Trump card, pun intended.

Ready to trade our Crude Oil weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.