- Ethereum initially did fall during the early hours on Monday but has since turned around quite drastically.

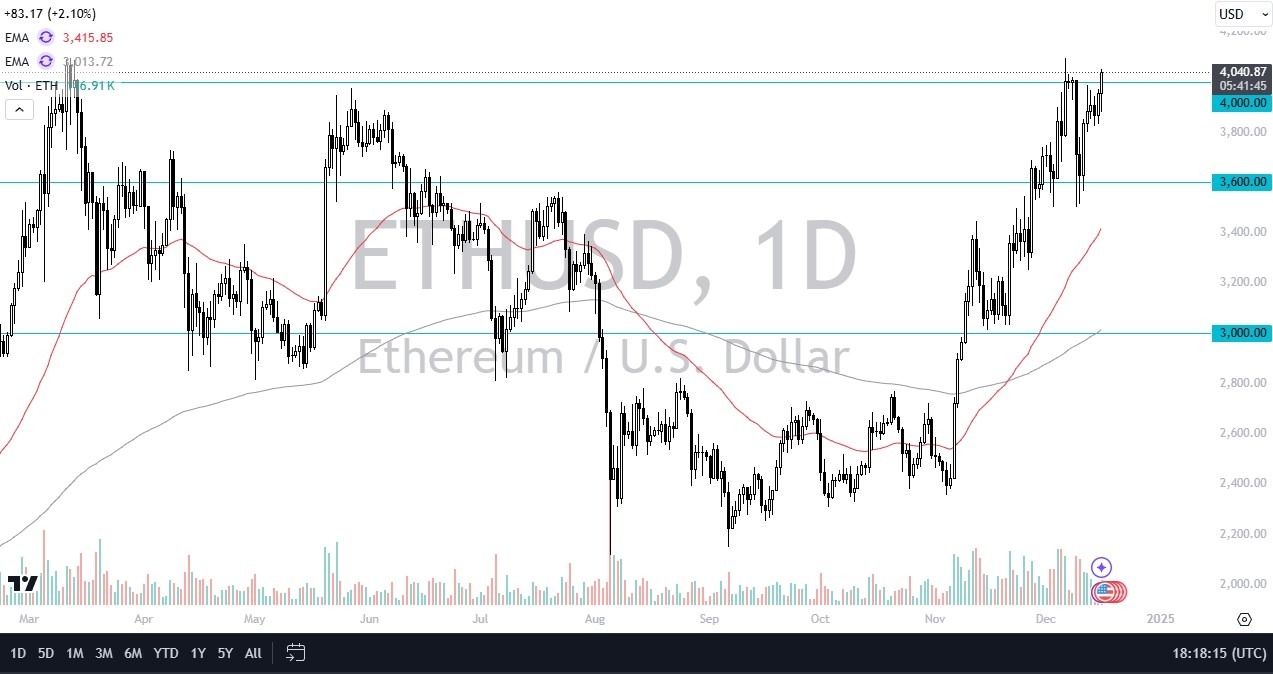

- At this point, we are above the 4,000 level and it looks like we are trying to take out this major resistance barrier.

- If we can continue to go higher, then I think we will go looking to the all-time high, which is essentially $4,800.

- This is an area that the market has run from the last time but is likely to run towards this time.

Keep in mind that Bitcoin has broken out again and that provides a little bit of momentum for pretty much anything digitally related. And of course, Ethereum always plays second fiddle to Bitcoin. The other smaller coins out there typically run on Ethereum. So, as they're rallying, Ethereum gets a little bit of a boost from that as well. After all, Bitcoin gets all the headlines, but Ethereum is the backbone for so many of the most exciting crypto projects in the world.

Top Forex Brokers

The Technical Analysis

From a technical analysis standpoint, the $3,600 level did offer a significant amount of support. But I think in the longer term, we need to pay more attention to the idea of a market that is simply trying to do everything you can to break above a significant ceiling. If we do, like I said, I'll probably be looking at the $4,800 level as a target.

Underneath, I see the $3,600 level as a potential support level. And then after that, we have the 50 day EMA, which is right around the $3,400 level. As usual with Ethereum though, you have to be very careful on what's going on in the Bitcoin market. If Bitcoin suddenly turns around, Ethereum tends to fall right along with it. As Bitcoin has broken out, things look good. People start to take risks on other coins like this one.

Ready to trade our Ethereum forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.