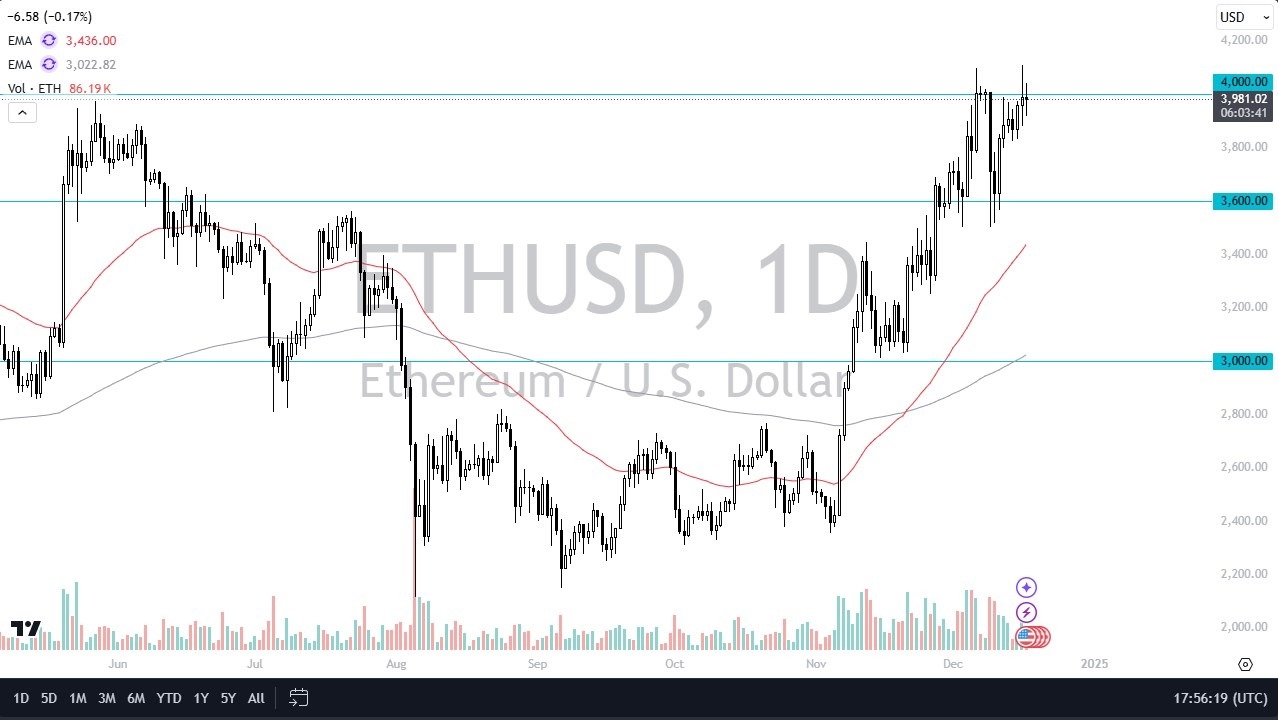

- The Ethereum market has been back and forth during the trading session as we continue to hang around the $4,000 level.

- This is an area that's been acting a bit like a major barrier, and I think at this point in time, we're basically waiting to get the “all clear” from the Bitcoin market.

With Bitcoin being so strong, it does make a certain amount of sense that Ethereum has followed right along with it, but the $4,000 level is an area that's been resistant previously and has also the massive amount of psychology attached to it of being a large round psychologically significant figure.

Top Forex Brokers

A short-term pullback at this point does offer value with a potential drop all the way down to the $3,600 level. That would be a loss of 10%, which in the crypto world is a fairly common thing. But it also has the 50-day EMA racing towards it, and it also has previous action to suggest that there are buyers in that region. So, with that being said, I have no interest in shorting the market, and I look at any pullback at this point in time as a potential value play.

Ethereum Supports Everyone Else

Keep in mind that there are a whole host of other coins that run on top of the Ethereum ecosystem, so it does make a certain amount of sense that Ethereum attracts attention anyway. The small coins right now are basically on fire, and that translates to people needing more Ethereum if they're going to be moving these coins around.

That being said, Ethereum is not Bitcoin, so it won't be as resilient on these rallies. Don't get me wrong, I think it does go higher eventually, but it needs Bitcoin's help. Right now, Bitcoin looks like it's a little stretched, so I wouldn't be surprised at all to see this thing pull back a little bit, offering value in Ethereum.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.