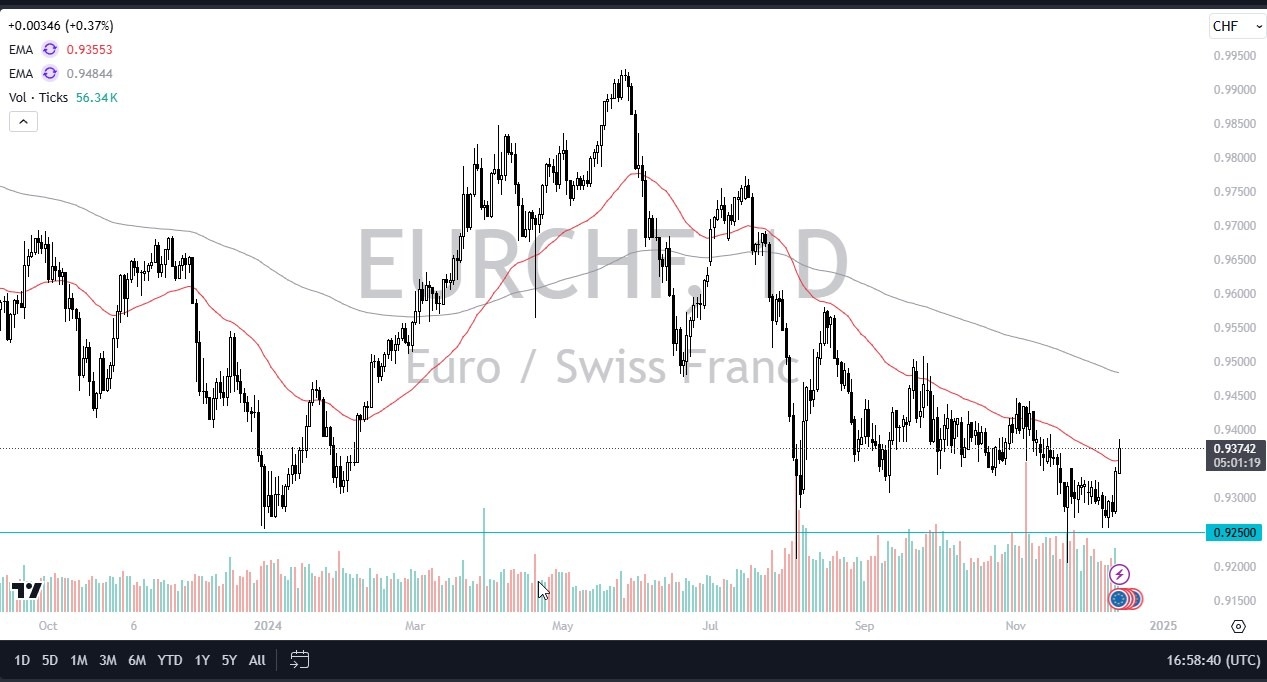

- During my daily analysis of major cross pairs, the EUR/CHF pair has got to be one of the more interesting pairs, because we have so many things lining up at one time to suggest that we might be in the midst of a major turnaround.

- That being said, you always have to be very cautious and therefore be responsible with your position size.

- Furthermore, you also have to recognize that betting on a trend change is a bit of a risky endeavor, but it is also the way for the biggest gains to be made in the markets.

Top Forex Brokers

Swiss National Bank

The Swiss National Bank has cut interest rates by 50 basis points this week, while the European Central Bank only cut 25. This suggests that perhaps the Swiss are panicking a bit and are willing to go negative rates yet again in order to weaken the Swiss franc and stimulate exports. Unfortunately for Switzerland, roughly 85% of their exports to end up in the youth, meaning that this is a fight between 2 serious lightweights.

Nonetheless, it looks like the market is going to continue to be fighting breaking down below the 0.9250 level, so this might be more of a “push and pull” type of turnaround. I recognize that the last couple of days have been a little overdone, so a bit of a pullback is probably going to be required in order to find “value” in the euro. This is a currency pair that I’m not necessarily excited about owning either currency, but the Swiss franc by far is probably one of my least favorite currencies in the world right now.

All of that being said, if the market were to break down below the 0.9250 level, then I think you could see this market drop another 250 pips. That would be a major shift in attitude, and more likely than not it would probably feature a complete “risk off move” around the world. This would not only be a week euros situation, but it would also probably be a situation where a lot of people are freaking out about a lot of different things. I prefer the US dollar more than both of these currencies, but I do think that we are in the midst of trying to build up a base to turn things around. This is a pair that is definitely worth watching.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.