- The Euro has rallied rather significantly during the trading session on Friday as we continue to see the Japanese Yen itself get eviscerated.

- Keep in mind, the Bank of Japan just simply cannot tighten interest rates, and this shows just how weak the Yen is because the Euro is very weak as well.

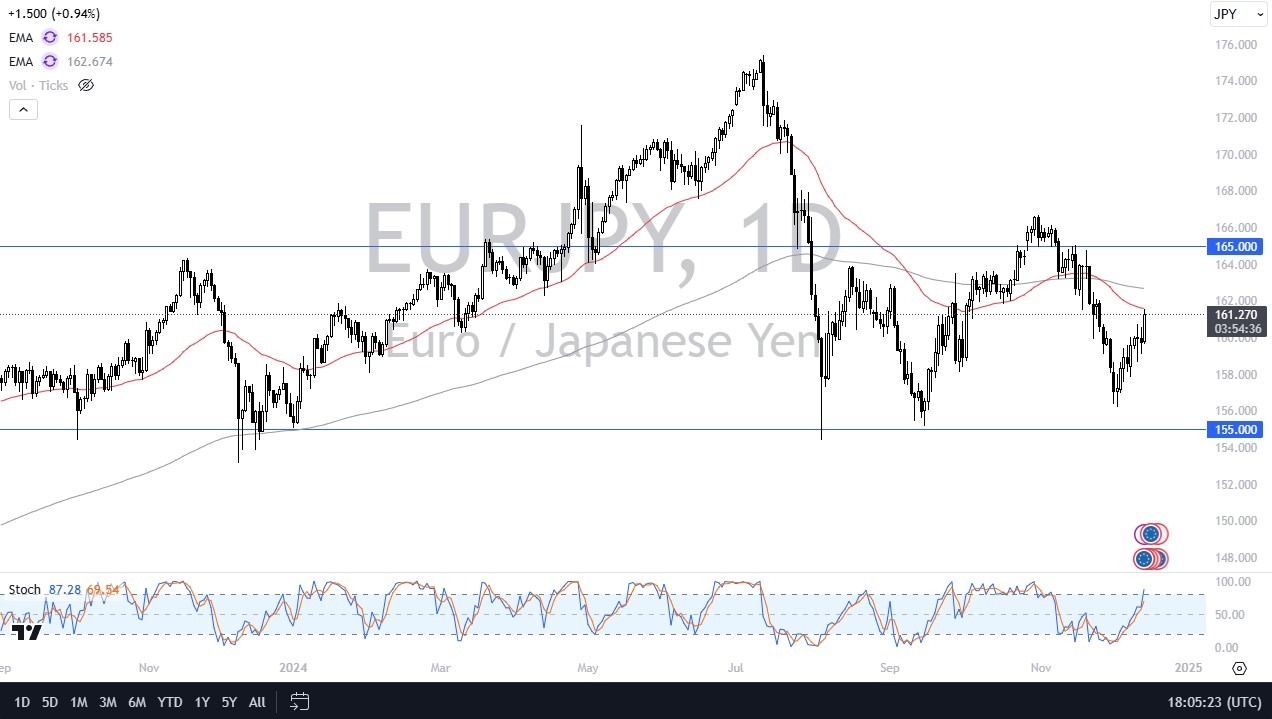

- All things being equal, this is a market that I think will continue to go back and forth, perhaps trying to reach the top of the range above at the 165 yen level.

This is an area that will be somewhat difficult to break above, but I think we would have to pay very close attention to the market if we get anywhere near it.

Top Forex Brokers

Just Below Current Levels

Underneath, we have the 155 yen level as a floor. As we are basically in the middle of this, it makes quite a bit of sense that we see a lot of volatility here. The size of the candlestick is something worth paying close attention to as it does say that there's alert into the euro against the yen or maybe a better way to put it is money's just leaving Japan.

Either way EUR/JPY is a market that looks positive, and we have just formed a massive triple bottom so I do think we will probably turn things around. Again, while I don't like the euro, I really don't like the yen and therefore this is a battle of two very weak currencies although obviously, Europe is in better shape than Japan is, as the Japanese economy is crushed under the weight of debt and higher interest rates in that country would just wipe out economic progress. So, with all that being said, I think this remains a buy on the dip market, albeit probably not my favorite yen related pair.

Want to trade our daily forex analysis and predictions? Here's a list of forex brokers in Japan to check out.