- The British pound initially tried to rally against the US dollar during trading on Thursday, but gave back gains, plunged, and then turned right back around.

- I think there were a lot of things going on at the same time that had brought in a little bit of noise into the pound peripherally, not necessarily things that were happening in Great Britain.

- For example, the ECB did cut rates and were a little dovish and it's hard to imagine that a shrinking European economy won't have an effect on Great Britain.

Another Bank Cuts

Top Forex Brokers

The Swiss cut interest rates by 50 basis points instead of the expected 25, which again tells you that part of the world might not be doing that well. And then right after both of those we had the PPI numbers come in on the United States as expected in the core reading, but a little stronger than anticipated in the full reading.

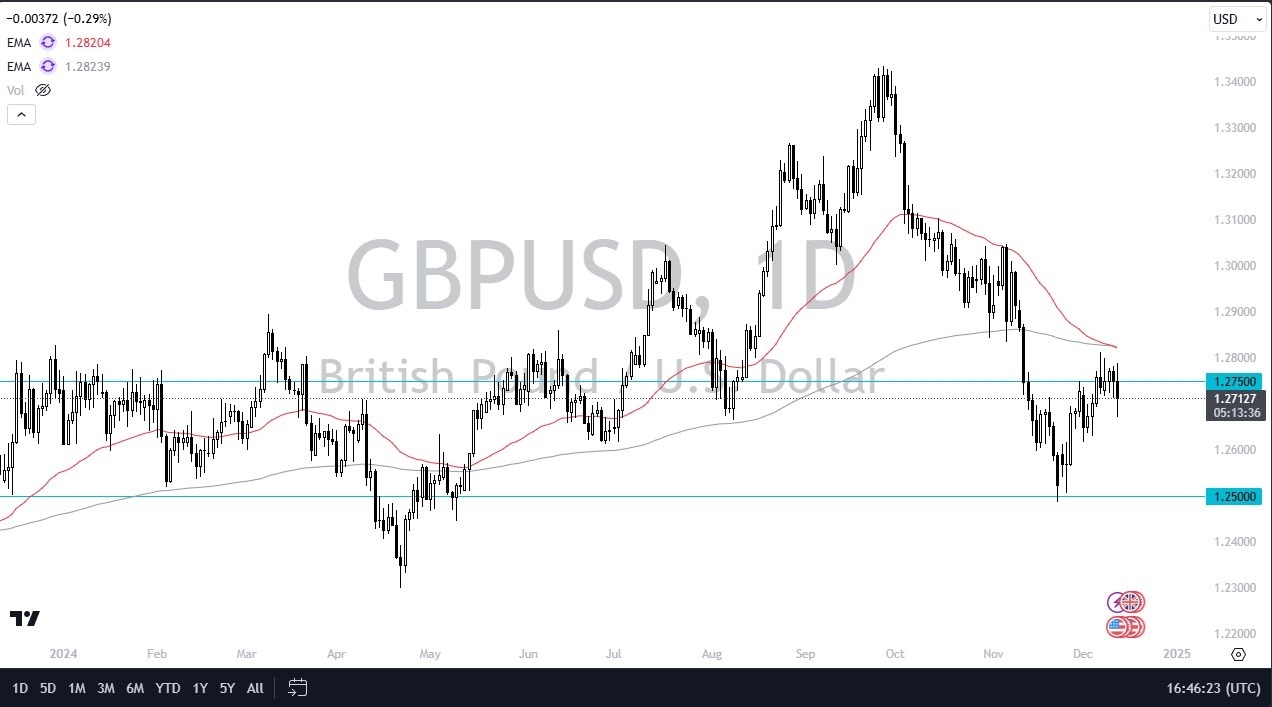

There's a lot of noise in the total reading. So, I don't think that had too many people concerned. So, with this, we have turned around and bounced, and now we're just hanging around the 1.2750 level. If we could break above these moving averages near the 1.2825 level, then I think that releases a lot of inertia and FOMO traders will jump into this market trying to get to the 1.30 level. On the other hand, if we were to break down below the 1.2666 level, then we could see more of a drop from there, perhaps down towards 1.25.

I do favor the US dollar against most currency, but the British pound has been a little bit more resilient than some of the others. So, my main takeaway from this chart might not even be to trade this GBP/USD pair. It might be to do something like buy pound against yen or buy pound against Swiss franc if it holds its weight against the US dollar. I really don't like the idea of shorting the US dollar right now, although I recognize it is overbought. There are a whole litany of reasons why the greenback will continue to be strong.

Ready to trade our daily GBP/USD Forex analysis? Check out the best forex trading company in UK worth using.