Potential Signal:

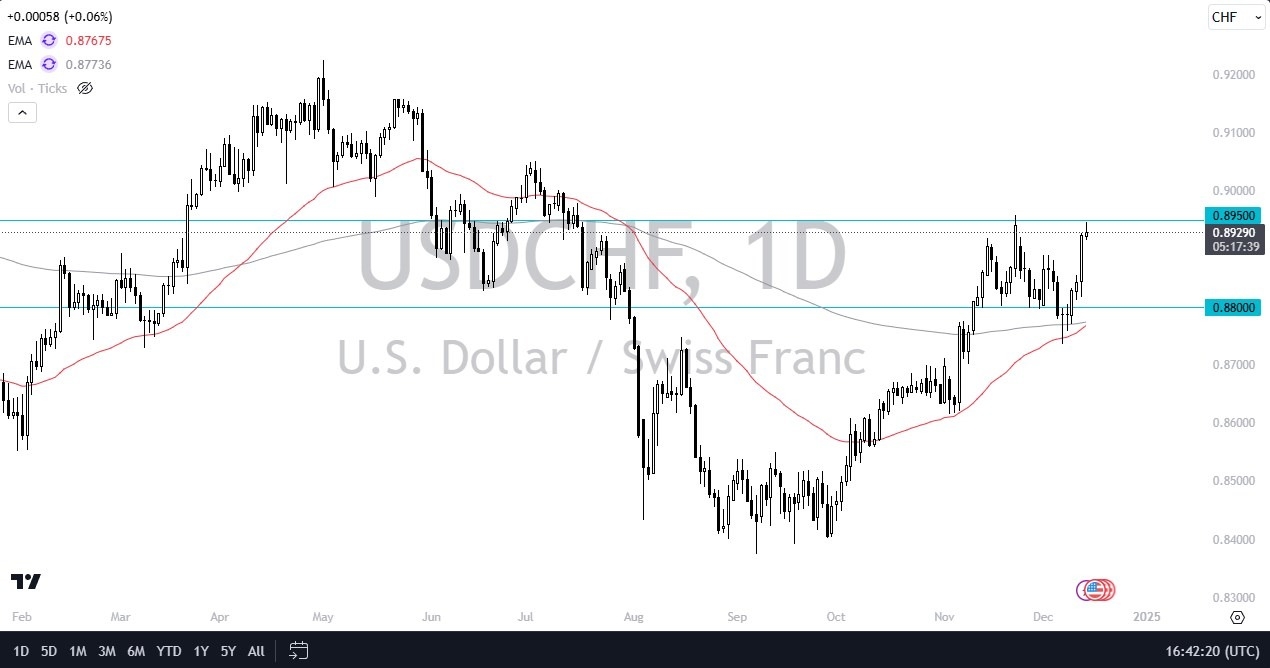

- I’d be a buyer this pair on a daily close above the 0.8950 level.

- At that point, I’ll be aiming for the 0.92 level, with a stop loss near the 0.89 level.

- During my daily analysis of major currency pairs, I continue to watch the USD/CHF pair, as it has been extraordinarily bullish as of late.

- Furthermore, the market has shown itself to be very reactive to the behavior of the Swiss National Bank, as they had recently cut interest rates by 50 basis points, instead of 25 as anticipated.

- Because of this, it does make a certain amount of sense that people are shying away from the Swiss franc, as the Swiss obviously see something very toxic out there.

Top Forex Brokers

Technical Analysis

The 0.8950 level is an area that has been resistant more than once, as well as supportive. If we can break above there, then I think the market is likely to continue going higher, and it is probably worth noting that the 50 day EMA is getting ready to cross above the 200 Day EMA, kicking off the so-called “golden cross.” All of this being said, I do think that we will probably continue to see bullish pressure, but I also recognize that we are struggling a little bit during the Friday session. A short-term pullback is very possible, and quite frankly I think it would make a certain amount of sense considering that the market has previously seen a lot of noise in this area. If the market were to break down from here, I see a massive amount of support near the 0.88 level, which also happens to be just above those moving averages.

In general, I think you will have to be very cautious with your position size until we get a clean breakout or offer some type of value in a short-term pullback. After all, you don’t want to be “buying at the top” for the short term and get caught on the wrong side of the market. That being said, I have no interest in shorting this pair, because I do believe that the US dollar is going to continue to be one of the preferred currencies around the world.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.