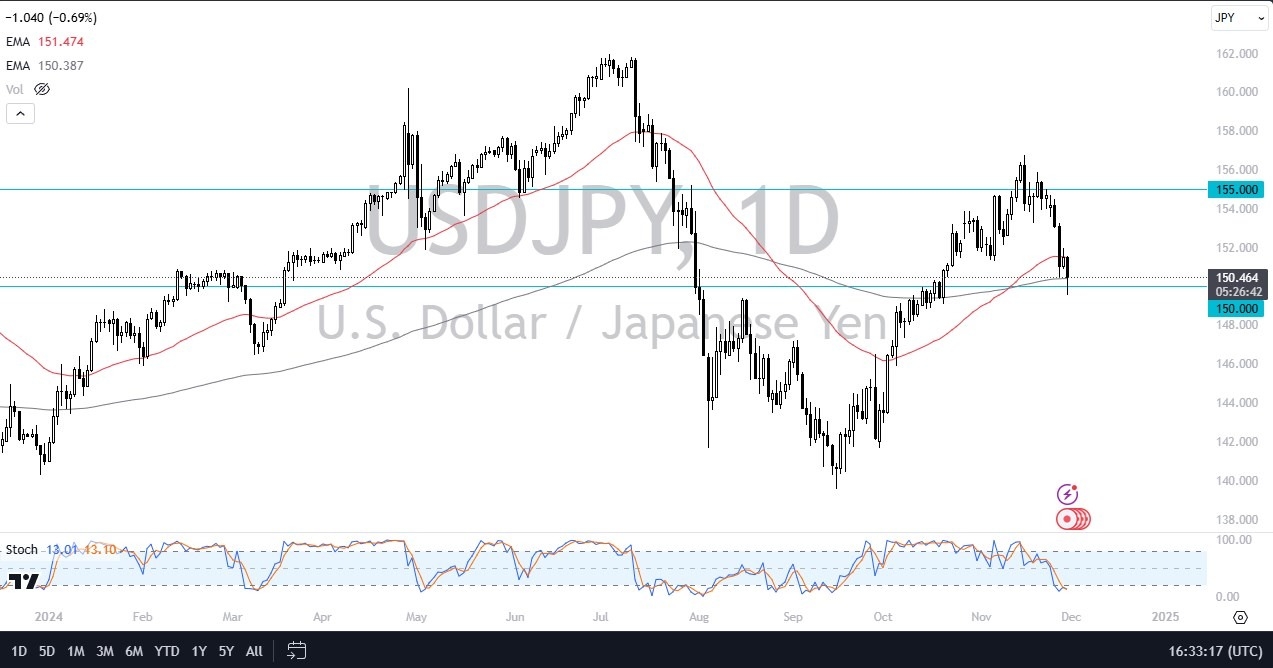

- The US dollar has plunged against the Japanese yen during the trading session on Friday to dip below the 150 yen level.

- But this is an area that I think will continue to be crucial, so it'll be interesting to see how this plays out.

- I like the idea of buying on a dip that then finds itself bouncing, and I think that's what we're watching right now to see whether or not it happens.

We are right around the 200 day EMA, so I would anticipate a certain amount of technical trading in this area regardless. The fact that the 150 yen level is a large round psychologically significant figure is probably something worth paying attention to anyways. Ultimately, I think this is a situation where if we can break above the top of the candlestick for the Friday session, then we could really start to take off towards the 155 yen level.

Top Forex Brokers

On the other hand, if we break down below the bottom of the candlestick for the USD/JPY trading session on Friday, then we could go down to the 148 in level, possibly even 146 yen. There is an interest rate differential that you need to pay close attention to. With that being said, I think you've got to look at this as a scenario where traders will probably continue to find one way or the other to take advantage of this interest rate differential.

If things settle down. When you look at the pullback that we've seen from the bounce, we're only at about the 38.2% Fibonacci retracement level. So really, it is still technically bullish. It's just been tough to be bullish over the last four or five sessions. A bounce from here though, would solidify the idea of people taking advantage of the carry trade. So, we'll have to wait and see how that plays out.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.