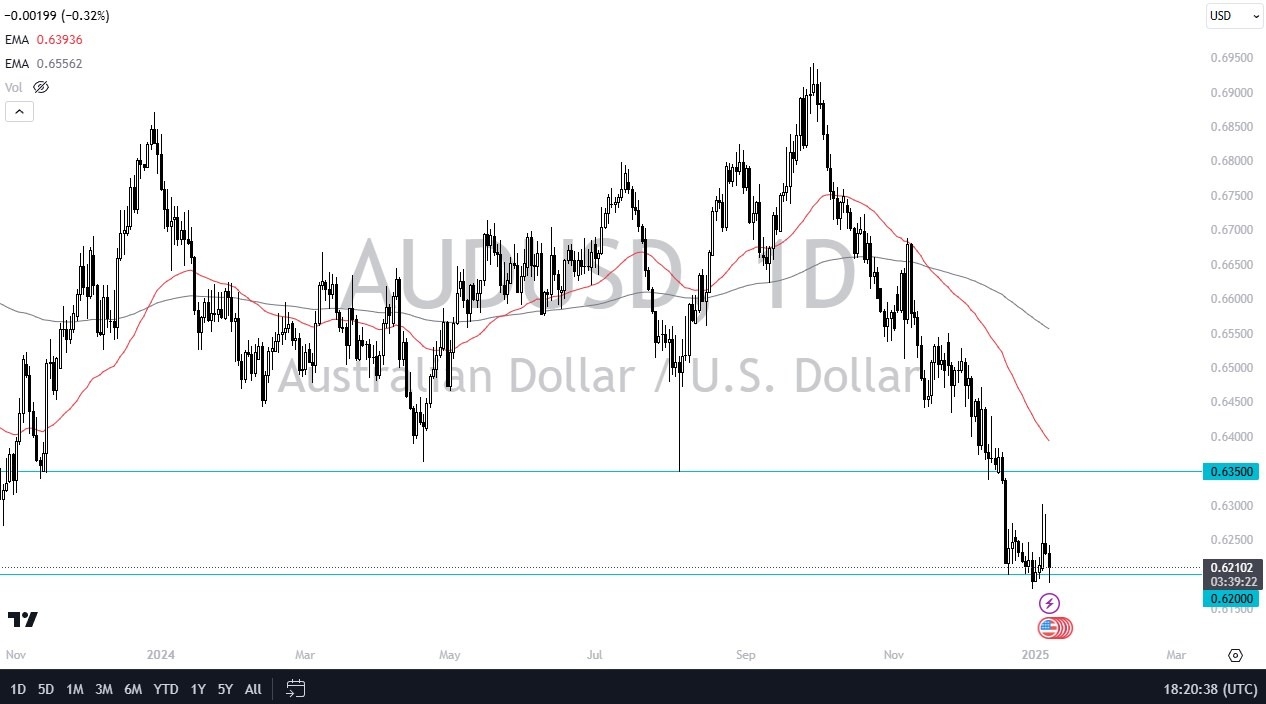

- The Australian dollar plunged during the early hours on Wednesday as we have pierced the 0.62 level.

- With that being the case, the 0.62 level has attracted a lot of attention.

- This is an area that we have seen offer that noise more than once.

The fact that we have turned around from there and shown signs of life should not be a huge surprise considering that we had seen the 10-year yield in America finally relax a bit, which is something that was desperately needed in order to get positive on anything other than the US dollar. So having said that, I think you've got a situation where the market continues to be very noisy and bumps along the bottom here, which does make sense considering that you are comparing two currencies at very opposite ends of the spectrum.

Top Forex Brokers

For example, the US dollar is strong based on uncertainty, economic growth in the United States, and interest rates in America. On the other side of the equation, you have the Australian dollar. The Australian dollar is highly anchored to China, which has been struggling for a while now, and I think you have to look at this as a potential way to play China.

Interest Rates Matter

As interest rates in China have plummeted, it shows a real lack of strength. Perhaps people are out there betting on a slowdown in China. Short-term rallies continue to be selling opportunities in this market as they have been for some time. It's really not until we break above the 0.6350 level that we can even remotely begin to consider the idea of buying Aussie dollars. The 0.60 level underneath should be a rather hard floor for this market, but if we were to break out and down below that level, all hell could break out and break loose in this AUD/USD pair.

Ready to trade our AUD/USD daily analysis and predictions? Here are the best currency trading platforms Australia to choose from.