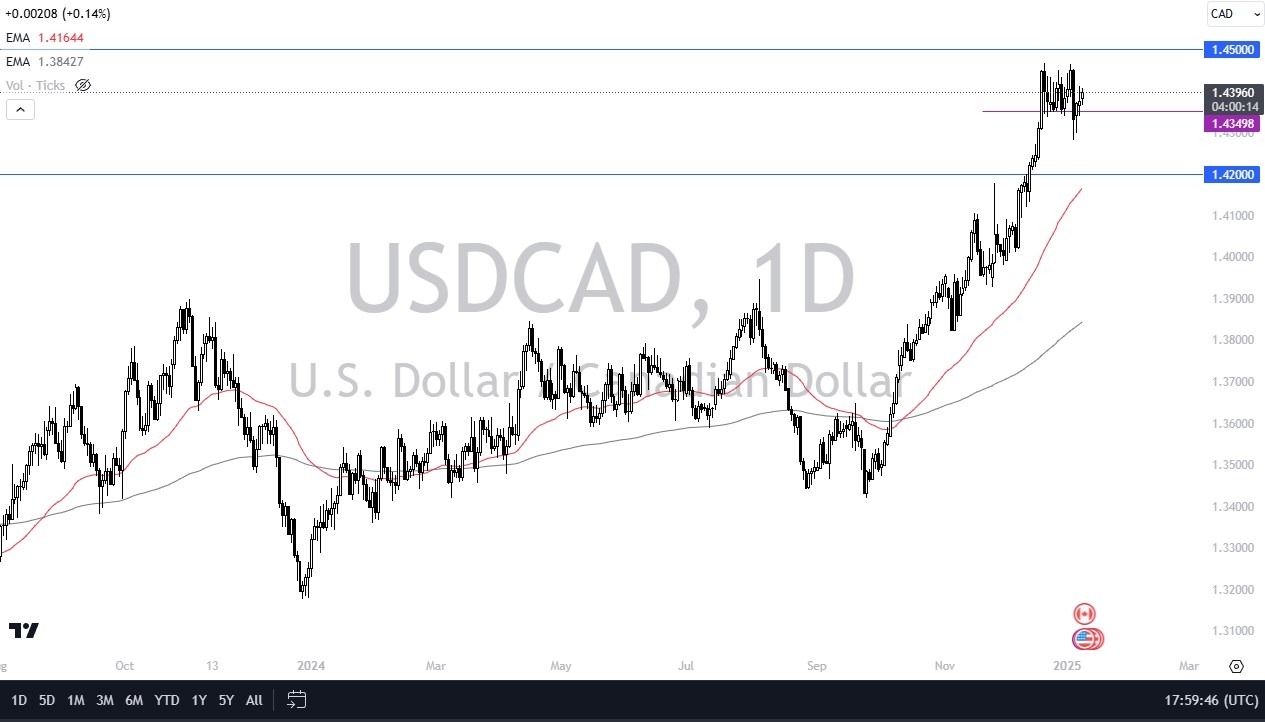

- U.S. dollar continues the rally against the sad and lonely Canadian dollar.

- The U.S. dollar has been a little bit stronger during the trading session on Thursday against the Canadian dollar despite the fact that it was a National Day of Mourning in the United States for former President Jimmy Carter.

- This means Wall Street traders for the most part weren't at work and therefore liquidity could have been an issue.

But at the end of the day this is just a continuation of what we've seen despite the fact that it wasn't over. But what I'm paying the most attention to on Friday is the fact that this might be the epicenter of FX trading. After all, we get the non-farm payroll announcement coming out of the United States as well as the employment numbers coming out of Canada, so a lot of volatility just waiting to happen.

Top Forex Brokers

Friday Close Could Be Important

In this environment, I suspect that the daily close will tell us most of what we need to know. For example, if we close above the 1.45 level at the end of the Friday session, that is an extraordinarily bullish sign. If we close below the 1.4350 level, then maybe we have to revisit the 1.42 level where I would expect to see buyers as well.

I don't want to buy the Canadian dollar. We aren't at a spot where I think things change. Yes, we are at an extremely high level right now, but the reality is that the Canadian parliamentary situation is just too messy to be bothered with. Furthermore, the Canadian economy isn't exactly humming along. While at the same time, the U S economy is probably too hot. So unless we get some type of massive switch during the Friday session, as far as the economic outlook is concerned, I anticipate that any pullback at this point in time will be thought of as a buying opportunity, just as a daily close above the 1.45 level would be an extraordinarily bullish sign.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.