- During the trading session on Monday, USD initially tried to rally a bit against the backdrop of a major holiday in the United States but then gave back its strength and dropped against the Swiss franc.

- We've seen the US dollar drop in general, but that's not a huge surprise because quite frankly, there isn't a lot of business going on in America during the session.

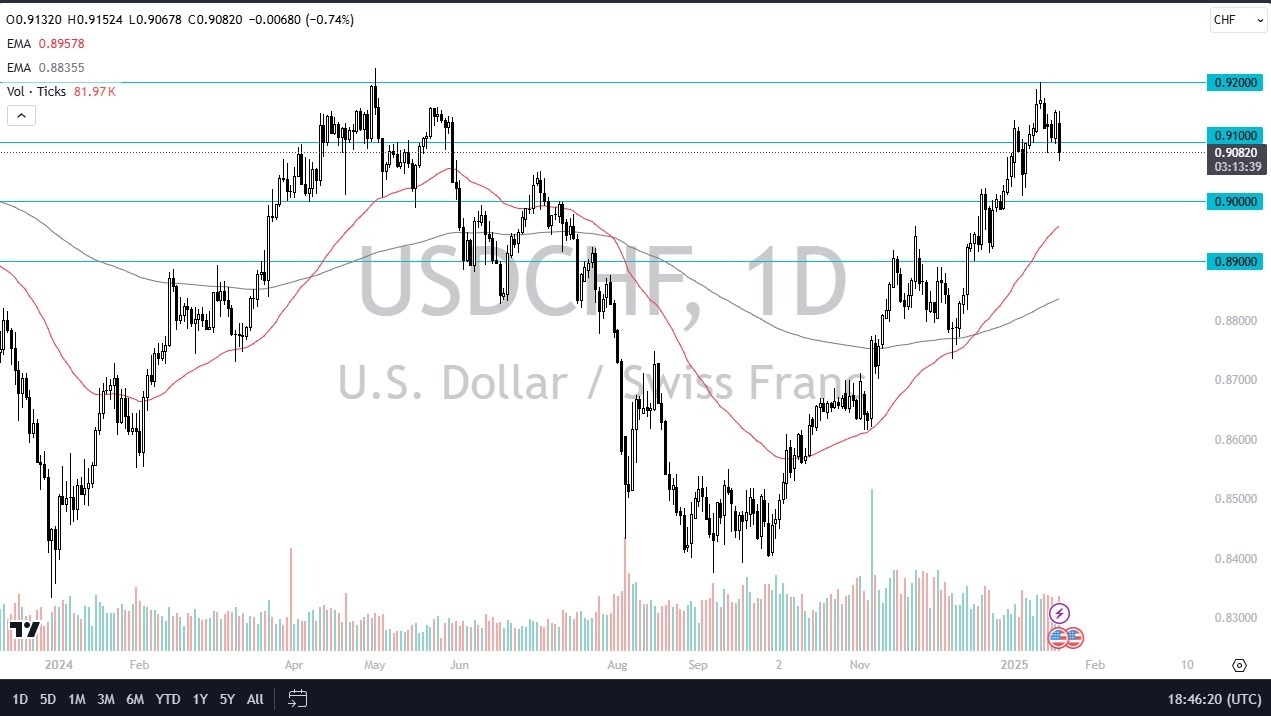

So, with that being said, I don't necessarily think that we have a situation where you would anticipate that the market would simply take off from here. Yet, we are getting close to a major barrier in the form of 0.92, and I will be watching that very closely. Where do we go from here? Well, I mean, we could turn around and consolidate further, which would be a very bullish case.

Drift Lower? Probably. For Now.

But more likely than not, I think we may drift a little bit lower. The 0.90 level underneath should be supported, not only because it has a lot of market memory built into it, and is a large round psychologically significant figure, but because it also features the 50-day EMA racing towards it at the same time. On the other hand, if we do rally from here and break above the 0.92 level, I will get long of this pair, and I will get aggressively long because that more likely than not will open up a move all the way back to parity.

When you zoom out on the charts, you can see that we are in the midst of forming a massive bottoming pattern, but that doesn't mean that we're ready to break out now. In fact, it would make a lot of sense if we just churned a bit. So, I look at this, more or less, as a buy-on-the-dip type of scenario, but I also recognize that we have been turning things around and you have to look at the fundamentals. We have a Federal Reserve that is light years away from being able to start aggressively cutting rates, but at the same time, we have the Swiss National Bank who recently cut interest rates by 50 basis points in a bit of a panic move. That right there tells you most of what you need to know.Top Forex Brokers

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from