- In a world where the US dollar is by far the strongest asset that I follow in general, it’s a bit surprising to see that the Philippine peso is a little bit of an outlier, in the sense that it is fighting back against the US dollar.

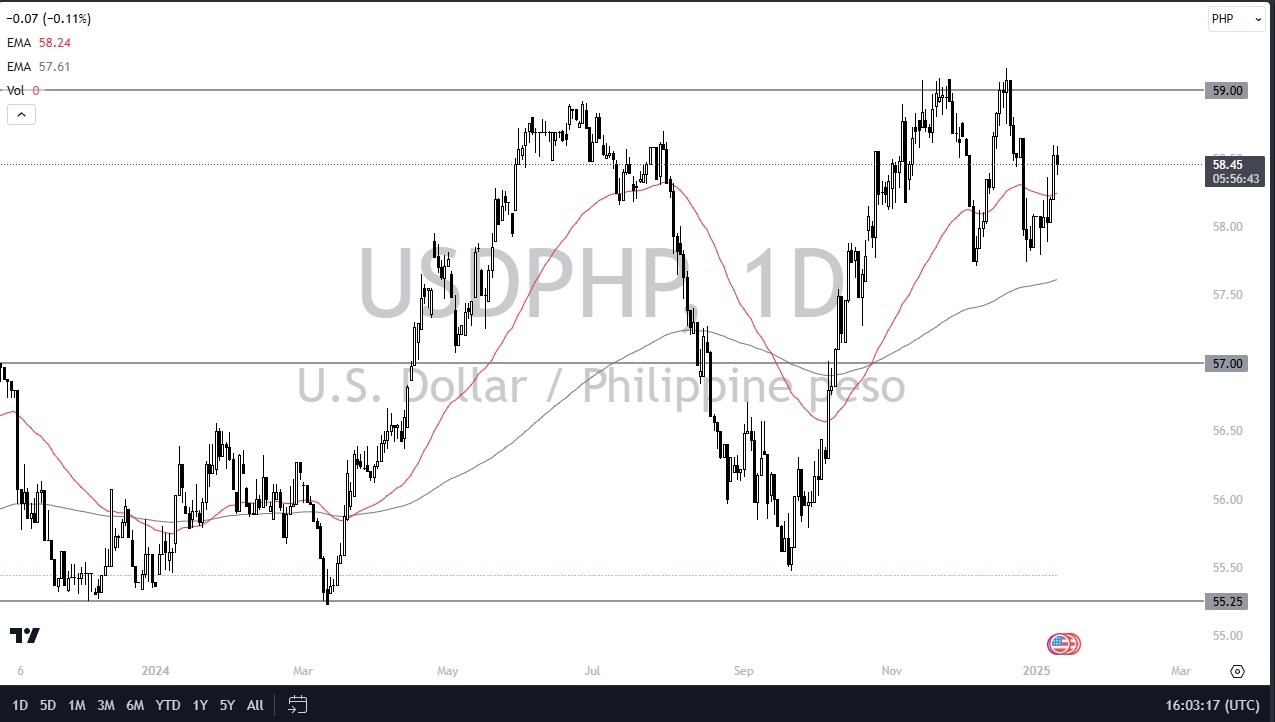

- That being said, it’s probably worth noting that the technical analysis for this pair is somewhat neutral but bullish over the longer term as the USD/PHP pair had been as low as 55.25 PHP just a couple of months ago.

- Currently, we are right around the 58.45 PHP level.

Non-Farm Payrolls

Keep in mind that the Non-Farm Payrolls announcement comes out during the trading session on Friday in the United States, so between now and then, this pair might be a little bit sluggish, but after that announcement I would expect to see a lot of volatility when it comes to the US dollar against just about everything, this pair being yet another place you will see that come to fruition. Because of this, I think you have to be very cautious about getting overly exposed to the US dollar ahead of time, because we might get a situation where there’s a little bit of a “knee-jerk reaction” to that announcement.

Top Forex Brokers

Technical Analysis

The technical analysis for this pair is somewhat flat at the moment with the 50 Day EMA hanging around the 58.20 PHP level, as it is relatively flat. You can also make an argument that we have been consolidating between the 57.75 PHP level on the bottom, and the 59 PHP level on the top. Just below that support level at the 57.75 PHP level, we have the 200 Day EMA, hanging about the 57.60 PHP level. If we can break above the 59.10 PHP level, then it would be a very strong signal that perhaps the US dollar is truly going to start taking off. Furthermore, you can make an argument for a little bit of a “W pattern” being broken to the upside. On a move to the downside, if we were to break down below the 200 Day EMA, it could open up a move down to the 57 PHP level.

Ready to trade the daily forex forecast? Here are the forex trading platforms in Philippines to choose from.