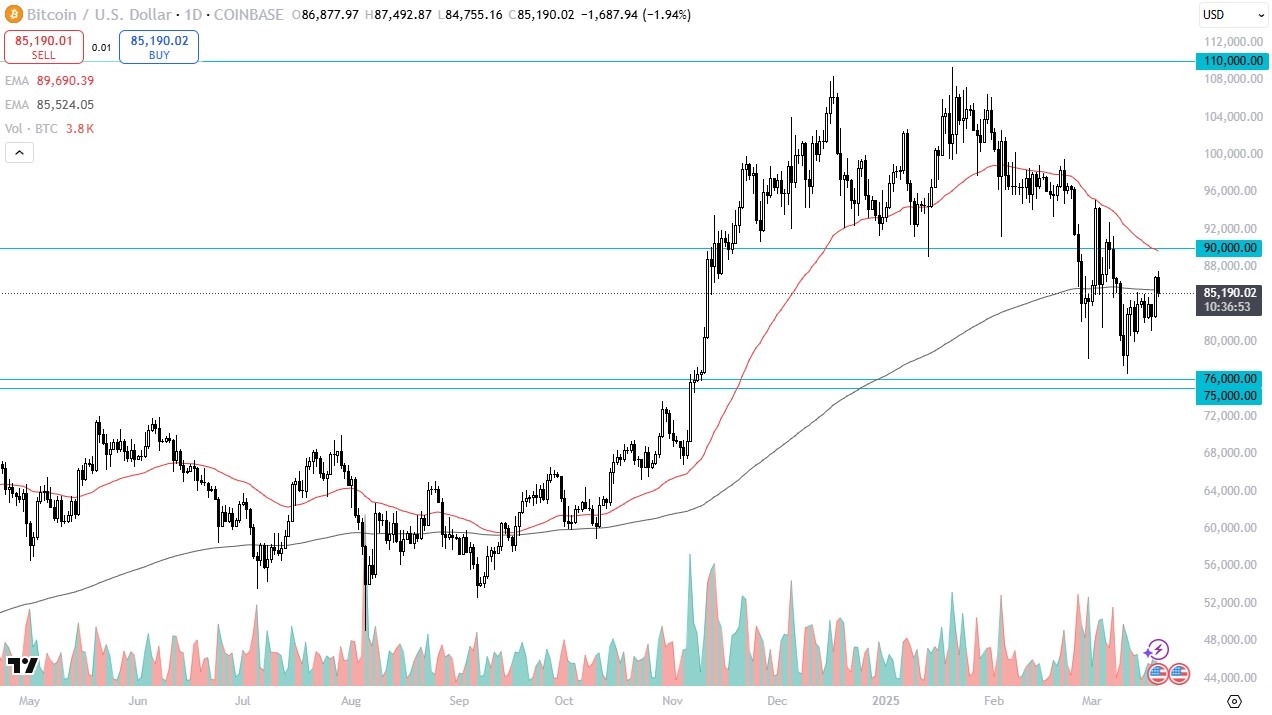

- The Bitcoin market has fallen a bit during the trading session on Thursday, as we are now below the 200 Day EMA indicator.

- The 200 Day EMA indicator is an indicator that a lot of people follow, so it would not surprise me at all to see this market react accordingly.

- All things being equal, I do believe that we are in a situation where we will see more sideways action than anything else, because Bitcoin has been beaten up pretty significantly. Because of this, I think you’ve got a situation where sooner or later, the selling stops.

Risk Appetite

Top Forex Brokers

The biggest problem Bitcoin faces at the moment is that risk appetite has been crushed. Risk appetite is necessary for Bitcoin to have any help whatsoever of rallying for a longer-term, and as long as the markets around the world are very volatile, Bitcoin will not perform very well. Keep in mind that Bitcoin is now essentially a New York ETF, so it will move back and forth with what’s going on with Wall Street. As things stand right now, we will probably have a few very bullish days here and there, but we need to build confidence, and it is probably worth noting that even more so than the stock market, Bitcoin desperately needs people to feel good about taking any type of risk in order to push price higher.

Most traders I know are simply buying little bits and pieces of Bitcoin along the way, in order to “dollar cost average” their way to a bigger position. This of course means that they believe in Bitcoin longer term, and it’s not necessarily a trade for them. However, if you are looking to trade in this market actively, I think at this point in time you have to look at it through the prism of a range bound market between the $75,000 level and the $90,000 level.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you