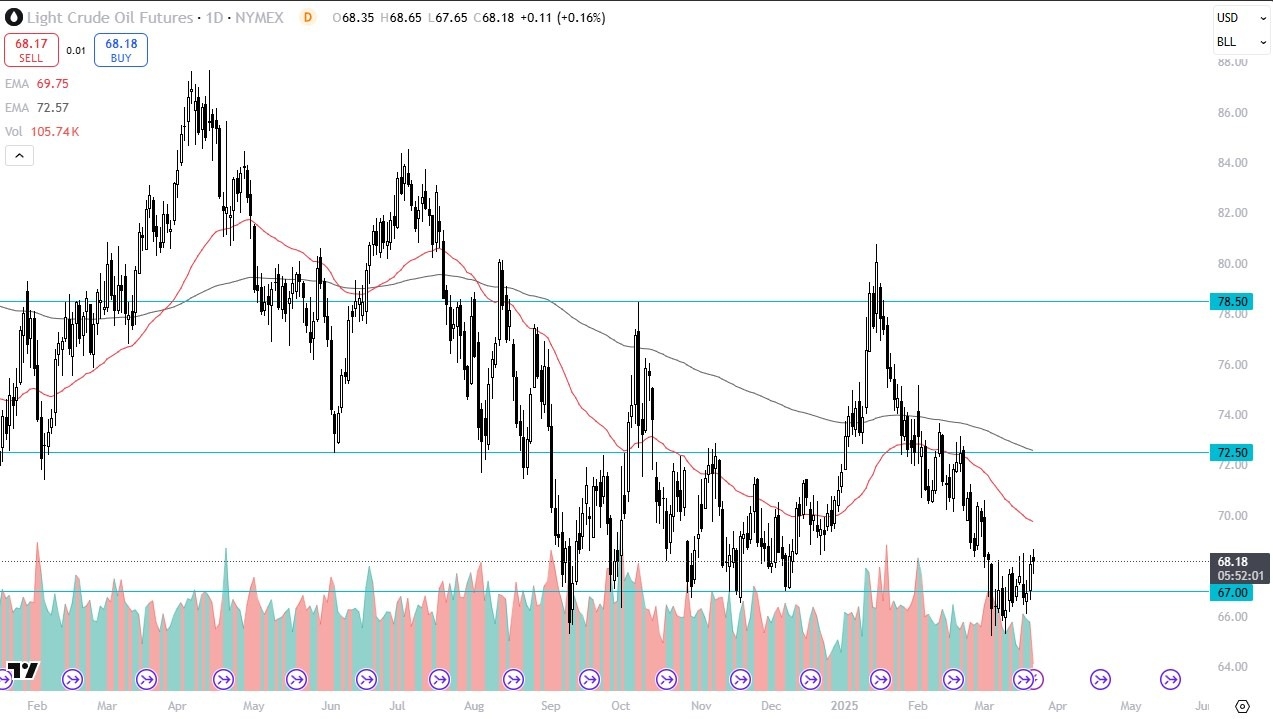

- The light sweet crude oil market has gone back and forth during the course of the trading session on Friday, as we continue to ask questions about whether or not this bottom is actually going to hold.

- The area that we are in, of course, is very interesting, as the $67 area all the way down to the $65 level has been massive support multiple times over the last three years.

We have rallied to make a fresh high, at least from this bottom perspective, but gave it back. Now we are starting to bounce again, and it suggests that there are buyers willing to come in and pick this market up on the dips. What I find more important is that every time we do pull back, it's a little bit shallower than the time before. So, it suggests that there are plenty of buyers. With that in mind, I am a little bit more bullish on crude oil than I was just a couple of days ago. But I also recognize that this is going to be a very noisy market on the way up. If it can rally from here, the market could go looking to the 50-day EMA, which sits just below the $70 level.

Top Forex Brokers

At the 50 Day EMA, Things Get Interesting

Breaking above that 50-day EMA opens up the possibility of a move to the $72.50 level. Short-term pullbacks, I think, continue to see plenty of support between here and $65. But if we were to break down below the $65 level, it could send this market much lower. Keep in mind, we are entering a time of year that is cyclically stronger than many others, so I think it all lines up for a bit of a bounce, but you're going to have to be very patient with this trade, as crude oil is very noisy.

Ready to trade Oil daily analysis and predictions? Here are the best Oil trading brokers to choose from.