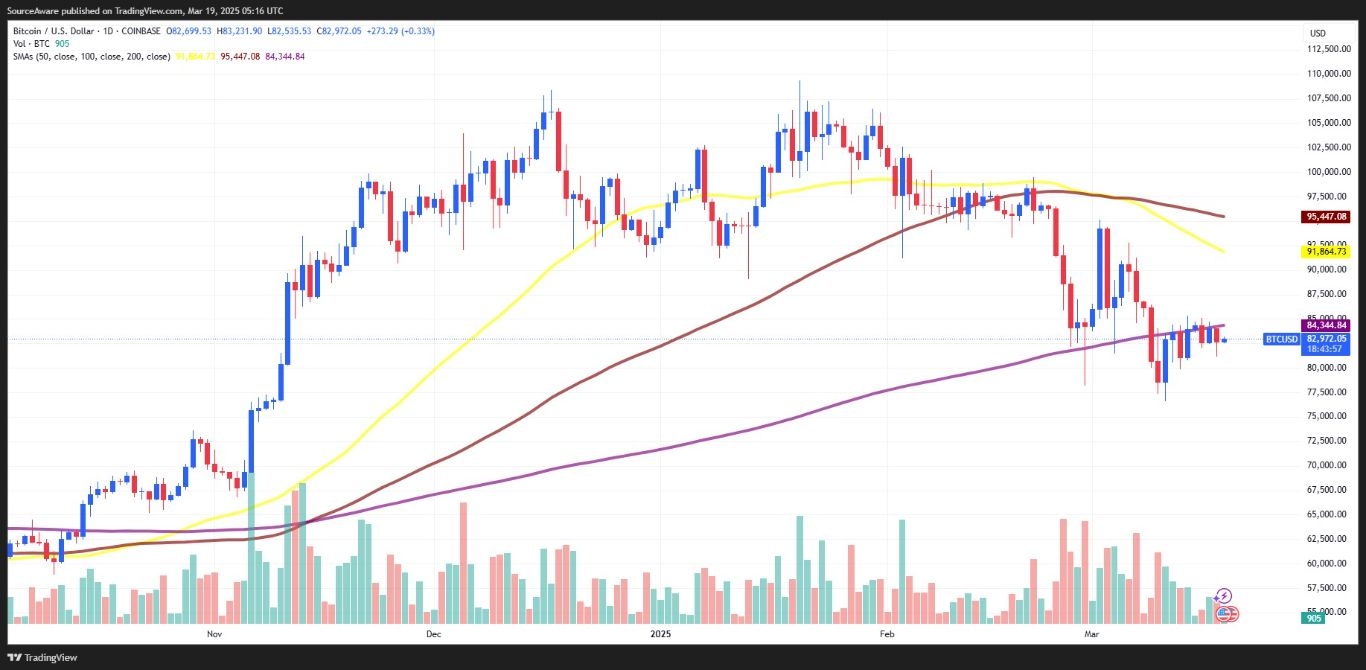

After hitting a low near $76,550 last Tuesday, Bitcoin (BTC) rallied to a high of $85,330 on Friday before entering consolidation near $83,000.

BTC/USD 1-day chart. Source: TradingView

King Crypto now trades below the 200-day moving average, with analysts saying bulls need to flip the $85,000 resistance level into support if they want to target higher highs at $90,000.

Market watchers are now awaiting Wednesday’s conclusion of the FOMC meeting and press conference, though it’s widely expected that interest rates will go unchanged – with the CME Group’s FedWatch tool indicating a 99% probability that the Fed will maintain rates at 4.25%–4.50%.

Silent Dogecoin Accumulation

One asset that has largely mirrored the performance of Bitcoin is Dogecoin (DOGE), the first memecoin and the largest by market cap.

As shown on the chart below, the latest peak in DOGE happened in early February, when the token hit $0.484 around the same time as Bitcoin was pushing to break above $100,000.

DOGE/USD 1-day chart. Source: TradingView

After pulling back to $0.32 heading into the New Year, Dogecoin spiked to $0.434 on Jan. 18, just days before BTC hit its new all-time high of $109,452.

Since then, both assets have declined, but DOGE’s ascent downward has been steeper, due in part to the mid-February “Libragate” fiasco, which embroiled Argentina’s President Javier Milei in a pump-and-dump scheme involving alleged insider trading, price manipulation, and a direct link to the President’s inner circle.

The scandal hit the entire memecoin sector hard, and Dogecoin wasn’t immune to the troubles. Its price has now fallen more than 70% from the December high – but while many are predicting a further decline and the return of crypto winter, DOGE whales have been silently accumulating amid the pullback, suggesting they see a potential rebound in the coming weeks.

According to data provided by Santiment, wallets holding at least 1 million DOGE coin have increased by 1.24% since early February as its price slid lower.

?? Dogecoin, like most meme coins, have been hammered during the 2-month crypto-wide retrace. However, we recommend keeping an eye on the rising level of wallets holding at least 1M $DOGE, which has recovered during the price dump. Active addresses are also at 4-month highs. pic.twitter.com/v4Vx5ifmQv

— Santiment (@santimentfeed) March 17, 2025

Also encouraging are the stats on active addresses, which have surged to a four-month high, pointing to rising network activity.

#Dogecoin $DOGE on fire! On-chain data from @santimentfeed shows that active addresses skyrocketed 400% to nearly 395,000. pic.twitter.com/NzLYBLZmRS

— Aqua Nova (@aquanovaaa) March 15, 2025

Typically, when sentiment is low and fears of a crypto winter are rising, large holders sell en masse, and the price declines that result push retail traders out of the market. However, when whales accumulate amid price declines, that’s a signal they see the asset as undervalued and expect it to recover – and the increased purchases position them to capture the upside of a rebound. The fact that active addresses increased also suggests growing retail interest. While the 70% pullback since the December high would suggest the top is in, a follow-up rally is not unheard of ,as the memecoin showed a similar pattern ahead of DOGE’s 200%-plus price rally in November.

#Dogecoin is gaining support from the mid-band of the Gaussian Channel ?

— Trader Tardigrade (@TATrader_Alan) November 17, 2024

This is the third time in history this price action has occurred.

After this price action, $DOGE will experience an incredible PUMP ? pic.twitter.com/02njMzdex3

Dogecoin’s correlation with Bitcoin was noted by pseudonymous market analyst ANBESSA, who said, “The $0.16 support aligns with BTC's pullback toward $75k. The projection remains valid as long as we reclaim and maintain above the $0.27 area. For renewed bullish momentum, DOGE needs to reclaim and sustain above the fib 0.618 resistance level at $0.27. Only then would the original bullish projection be fully back on track.”