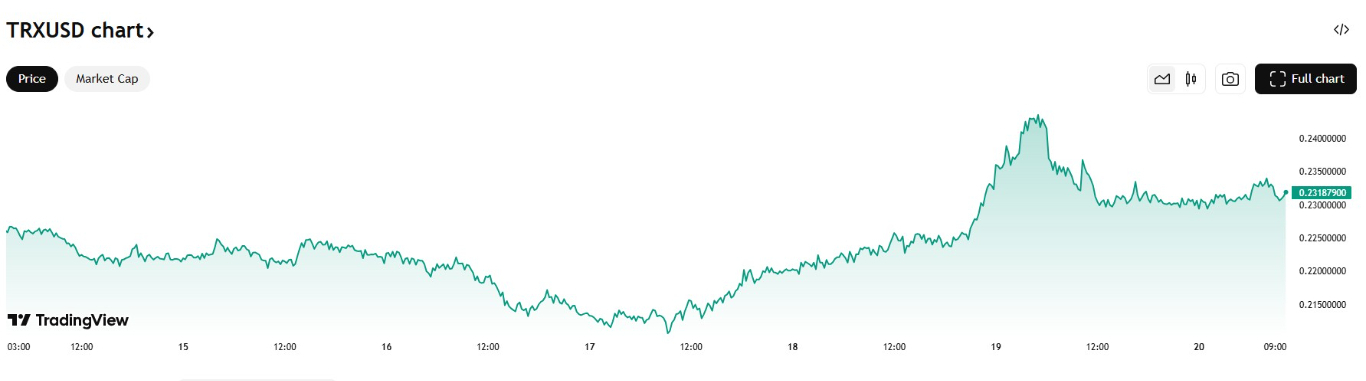

TRON (TRX) is trading near $0.231, up 3% this week, which reflects cautious optimism following its recovery from recent lows around $0.212.

TRX Faces Significant Resistance

TRON has had considerable resistance around the critical $0.235 threshold, an area that has repeatedly limited TRX's upward progress this month.

Tron Price Chart | Source: Trading View

Recent attempts to break above this price have stalled, reinforcing its significance as a key short-term barrier. If TRX breaks above $0.235, the next resistance lies at the $0.245–$0.256 range, closely aligned with the 50% Fibonacci retracement.

Meanwhile, momentum indicators provide mixed signals for TRX. The Relative Strength Index (RSI), currently neutral in the mid-50s, suggests balanced buying and selling pressure.

With RSI neither overbought nor oversold, the price is positioned for potential consolidation in the short term. Notably, the recent RSI recovery from near-oversold levels (~30) to the current mid-range (~55–59) highlights alleviated selling pressure without clear bullish dominance.

The Moving Average Convergence Divergence (MACD) paints a slightly more optimistic picture. The MACD line is close to achieving a bullish crossover above the signal line, which indicates a possible shift to positive momentum.

This pending crossover is key; confirmation would significantly enhance bullish sentiment. Conversely, if the MACD line fails to cross positively, TRX may face renewed selling pressure and lead to extended consolidation or downside risk.

Short-term Moving Averages Continue to Cap Price Surges

The immediate short-term outlook for TRX is complicated by its position below crucial moving averages. Specifically, TRX remains beneath both the 30-day SMA ($0.231) and the 60-day SMA ($0.243).

These moving averages have tilted downward, emphasizing the bearish sentiment resulting from the recent market pullback. For bulls to reclaim control confidently, a decisive breakout above these levels, particularly the 50-day SMA (~$0.235), is essential.

Moreover, the convergence of the 50-day and 200-day SMAs near $0.23 marks a pivotal technical crossroads. This alignment indicates a neutral market state, highlighting uncertainty and suggesting potential extended consolidation.

A move above these averages could reinforce bullish momentum, whereas failure to do so would emphasize bearish pressure.

Fibonacci Levels Highlight Crucial Price Zones

TRX is confronting critical Fibonacci retracement resistance levels at $0.235 (38.2%) and potentially $0.246–$0.247 (61.8%). A successful break and sustained close above $0.235 could pave the way for a rally toward higher targets, such as $0.256 (50% Fibonacci level).

On the other hand, failing at the current retracement levels could return TRX towards immediate Fibonacci supports at $0.225 and further down near $0.180, which reflects deep retracement support zones.

These Fibonacci levels are significant because they align closely with historical price action. Hence, they serve as psychological and technical reference points.

For instance, the crucial support around $0.18 marks both a historical breakout level and a deep Fibonacci retracement, highlighting it as a robust long-term support region.

Immediate Support Zones Provide Stability Amidst Volatility

Support levels remain clearly defined for TRX, with bulls recently showing strength around the $0.218–$0.215 range. A breakdown below this immediate support would introduce $0.200 as the next critical psychological threshold.

Further weakness below $0.200 would place the altcoin near robust structural support at $0.190, a previous consolidation point.