Editor’s Verdict

Overview

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 5, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

UFX is a brokerage operational since 2010, is a broker that is fueled by its proprietary MassInsights Technology. All trades are reported to an EU verified trade register, resulting in 2.8 million unique trades submitted to the CME in 2018. A secure trading environment and reliable customer service are key offerings at UFX. The brokerage offers tradable assets across five categories. 68.34% of retail traders operate accounts at a loss, slightly better than the average, and a positive performance.

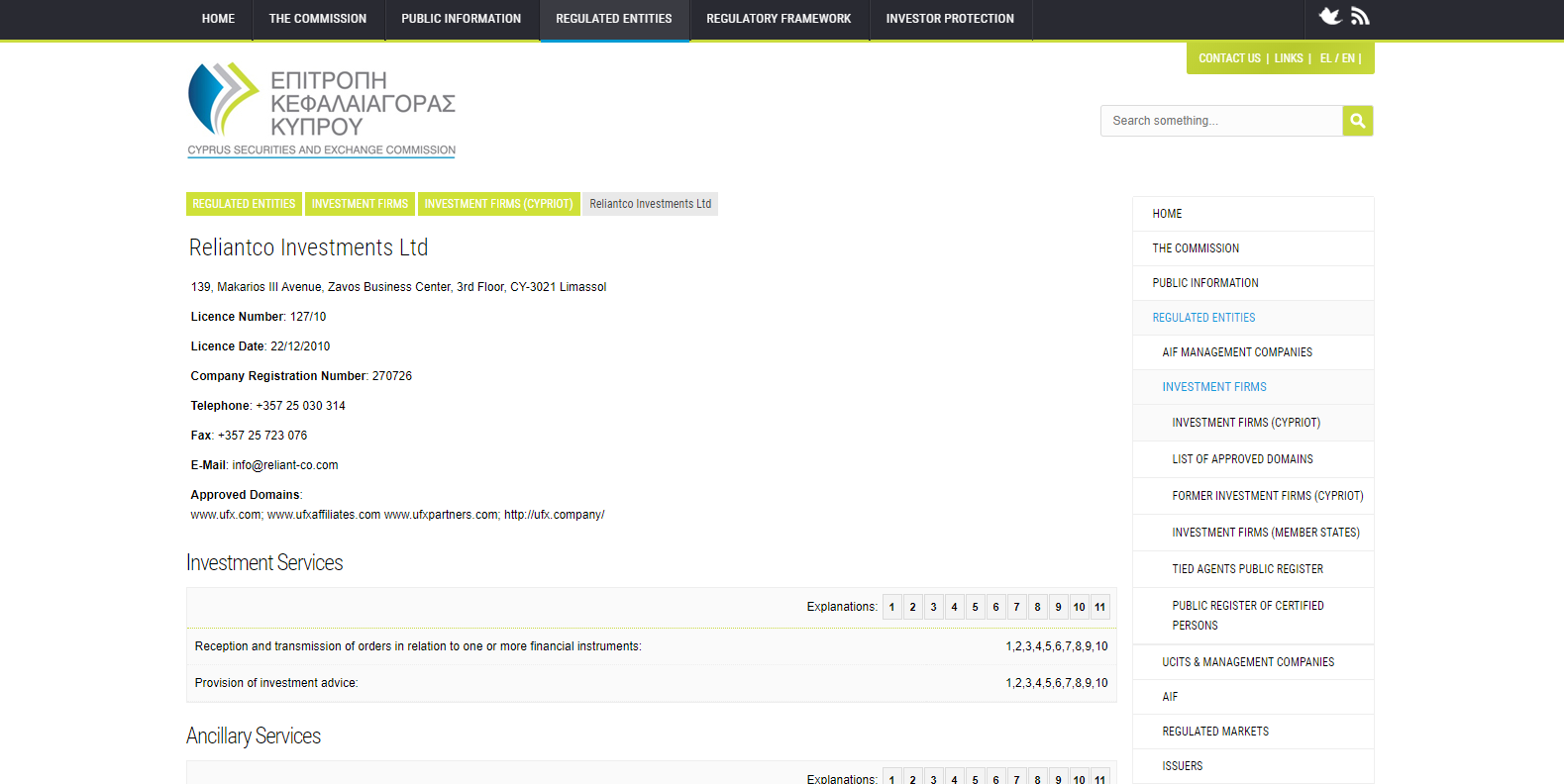

Regulation and Security

Reliantco Investments, the owner of UFX, is a Cyprus Investment Firm authorized and regulated by the Cyprus Securities Exchange Commission (CySEC), under license number 127/10, since December 22nd 2010. It operates under the Financial Instruments Directive 2014/65/EU or MiFID II and the EU’s 4th Anti-Money Laundering Directive. Per EU Directive 2014/49/EU, traders are protected by the Investor Compensation Fund (CIF) with maximum coverage of €20,000.

Fees

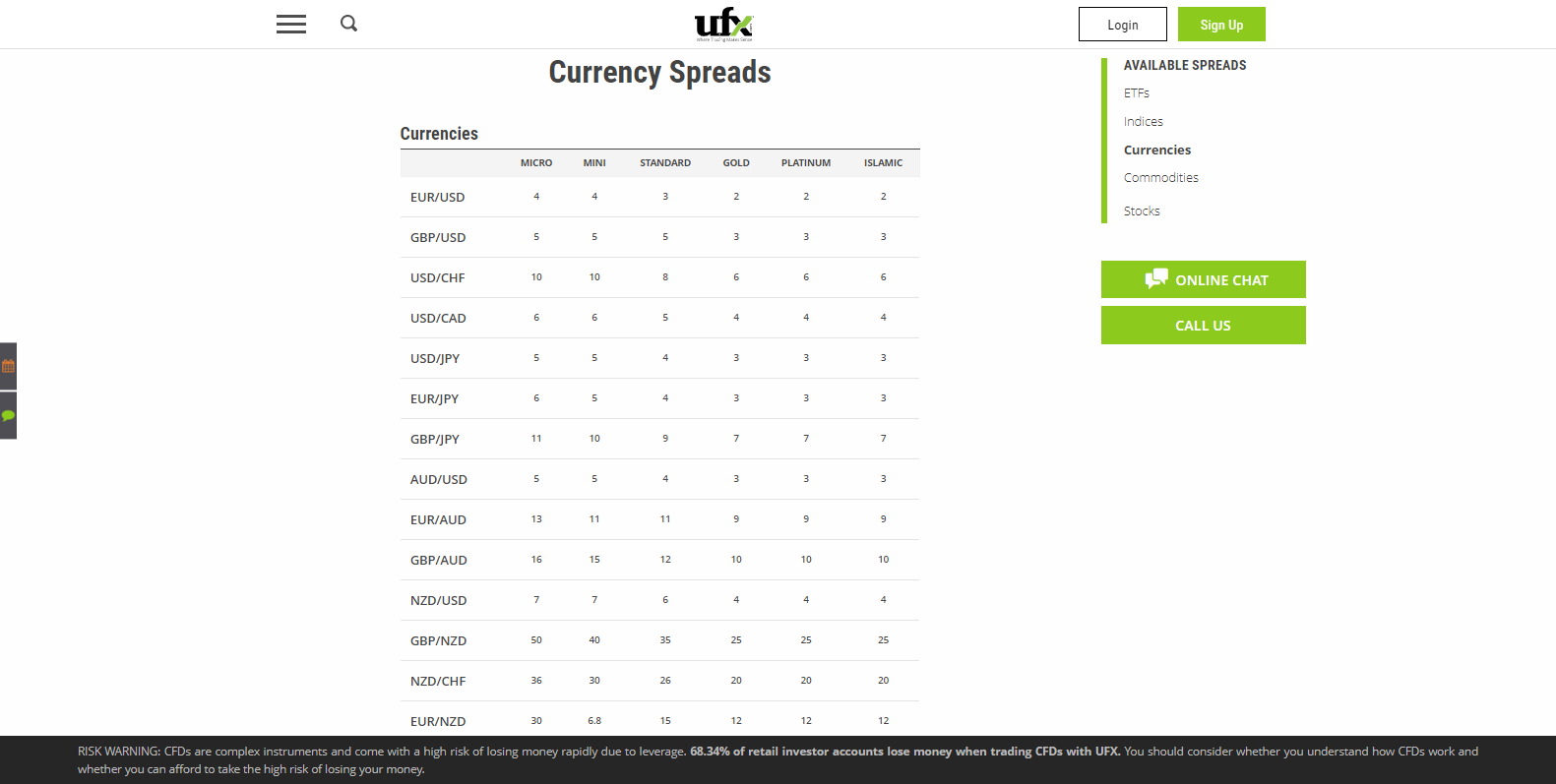

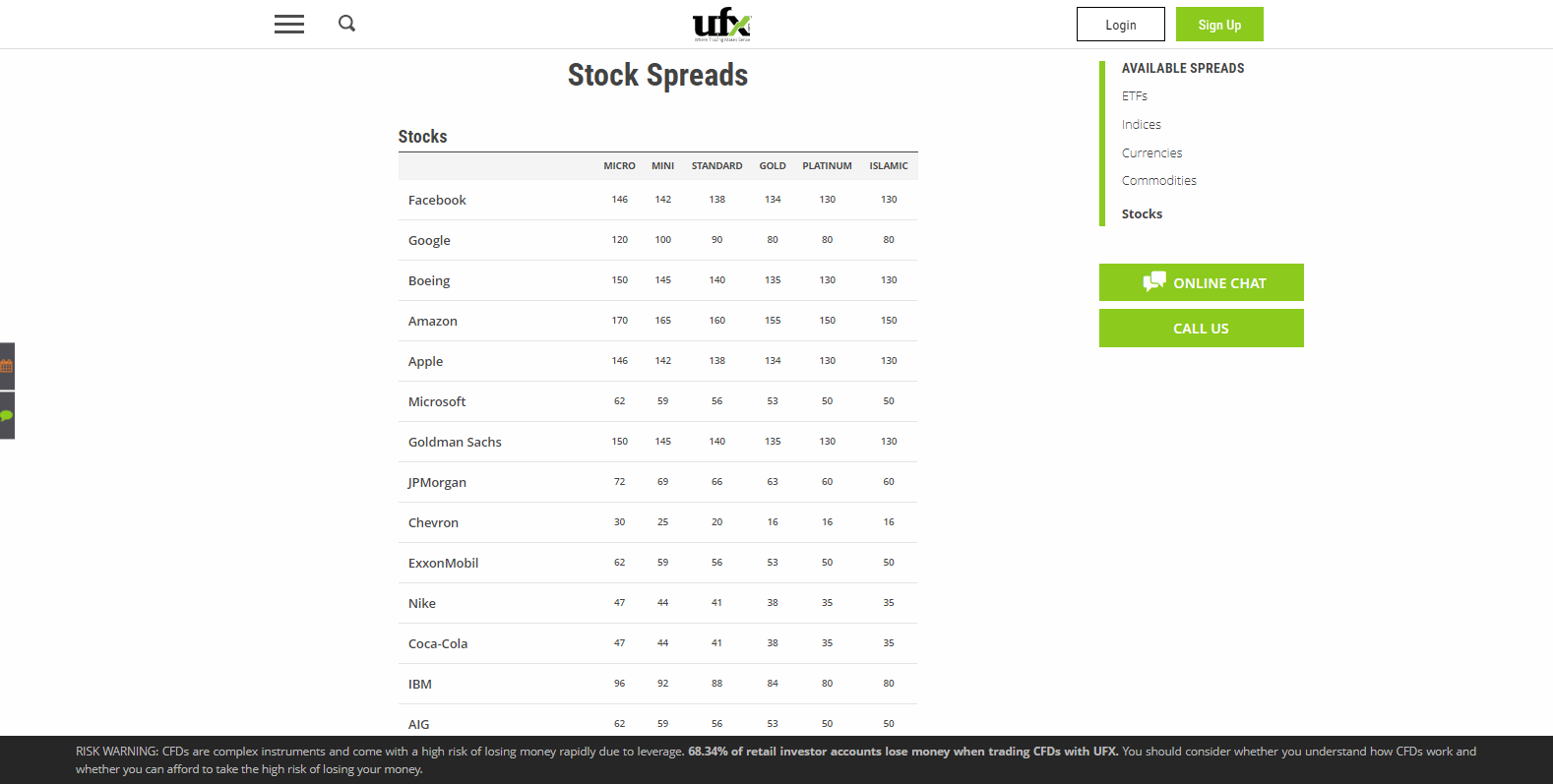

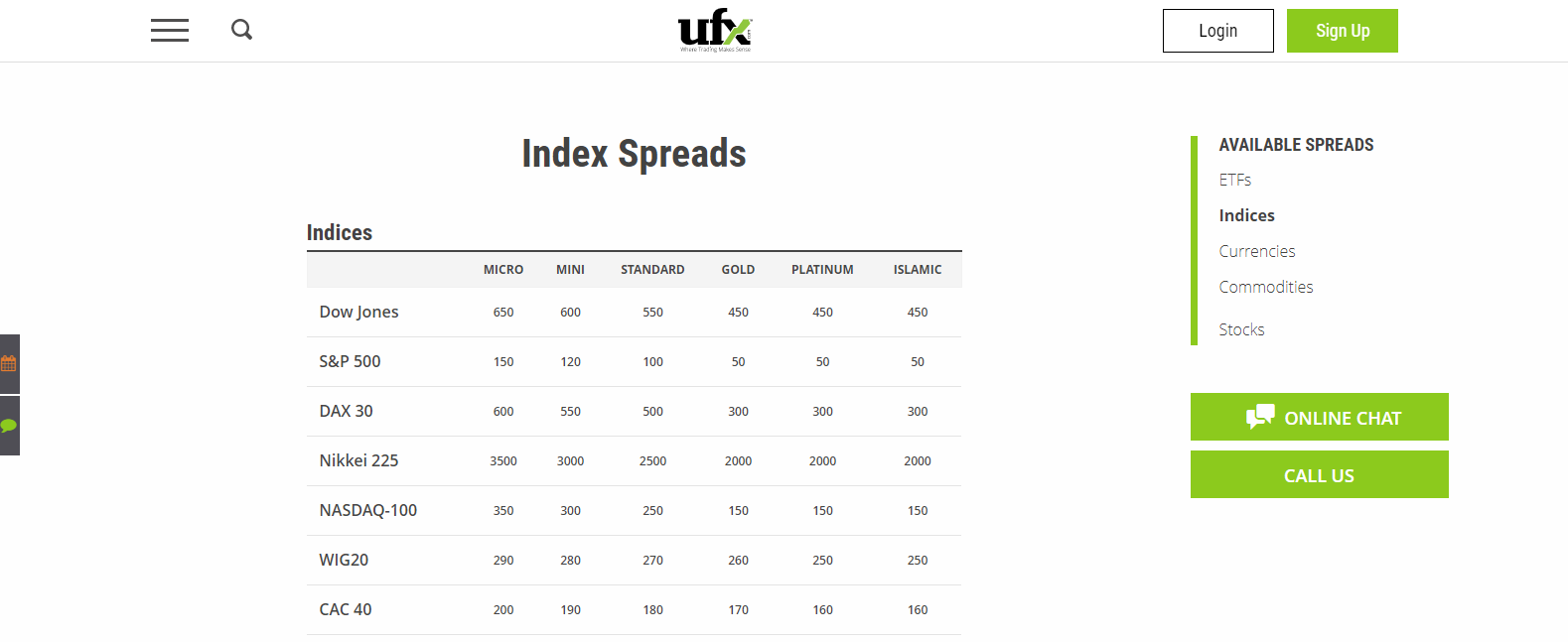

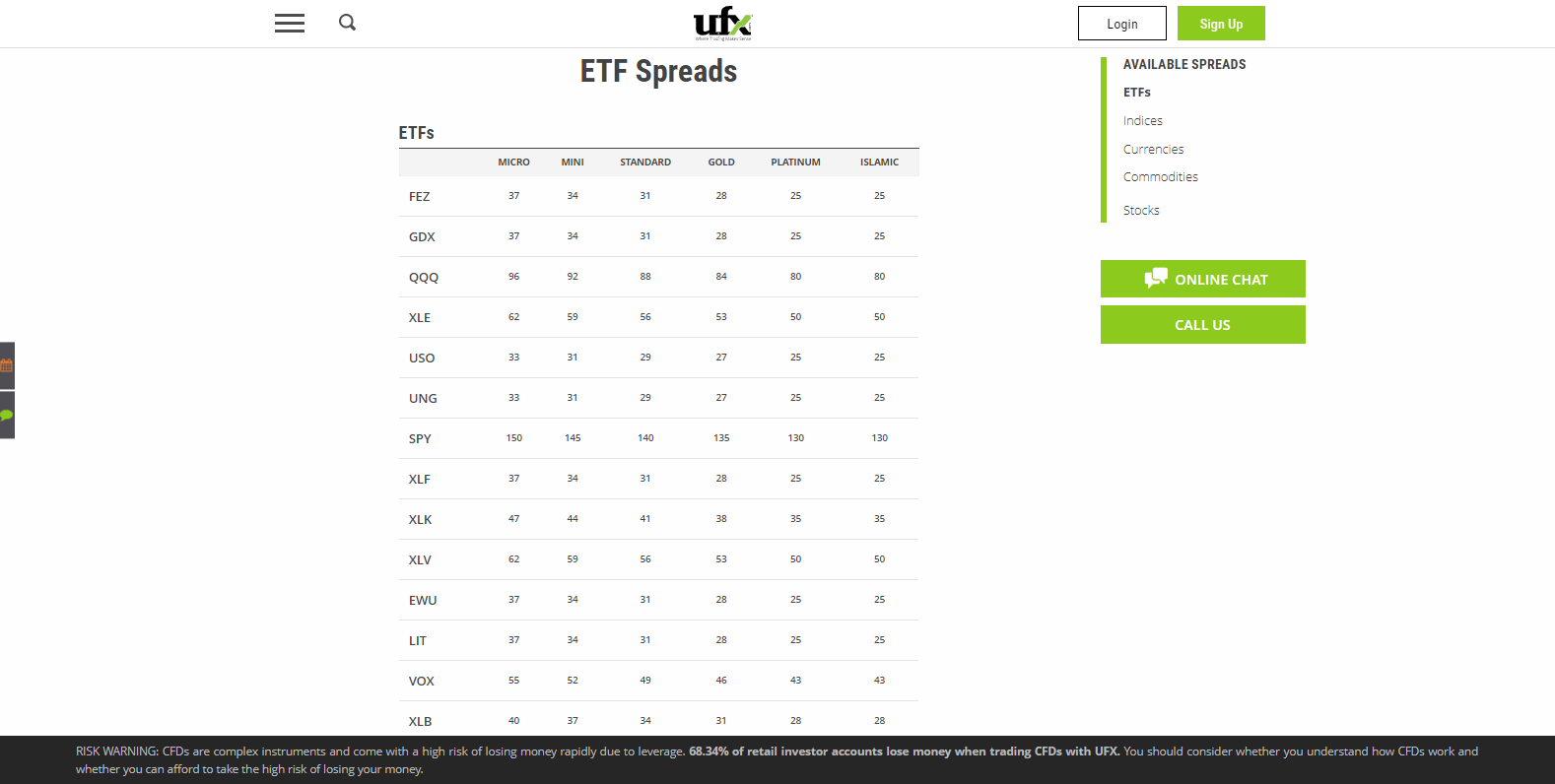

Trading costs at this market maker are on the high side, with spreads for the EUR/USD ranging between 2.0 and 4.0 pips. Swap rates on leveraged overnight positions apply. Details are listed on the company’s website, and the trading platform should provide precise trading costs. Since equity and index CFDs are offered, corporate actions like dividends and stock splits apply. Regrettably, UFX doesn't provide more detailed information. A $100 inactivity is charged every 45 days for accounts with no trading activity for 45 days, and a 0.1% hedging fee is also levied. Broadly speaking, the pricing environment is not as generous as those provided by other top brokers.

What Can I Trade

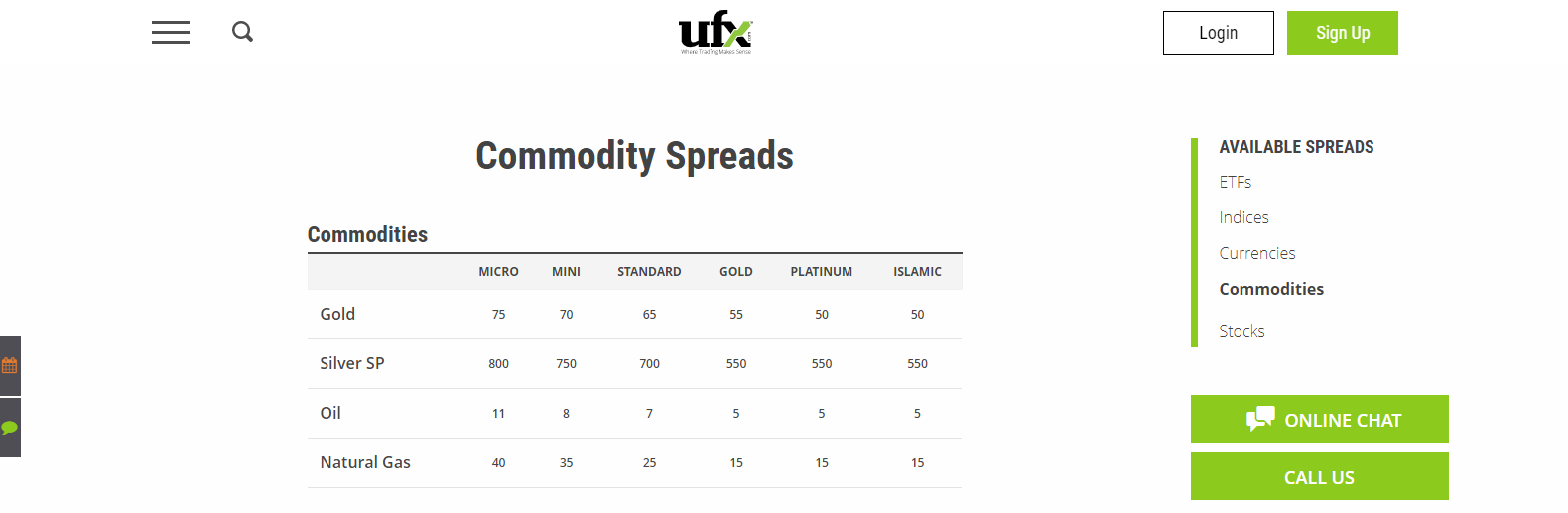

UFX provides assets across the Forex market, commodities, equities, indices and ETFs, plus Bitcoin. The overall asset selection is more than sufficient, allowing traders proper cross-asset diversification. Maximum leverage is capped at 1:30 due to the company’s compliance with strict CySEC regulation. Professional traders can apply for leverage of up to 1:400. Retail traders looking for higher leverage will have to look for a broker that is regulated outside of the European Union.

Four commodity CFDs leave this sector underrepresented.

Equity CFDs allow traders access to the most commercial names.

More index CFDs would be welcome, as the current selection is limited.

Adding diversity is a firm offering of ETF CFDs.

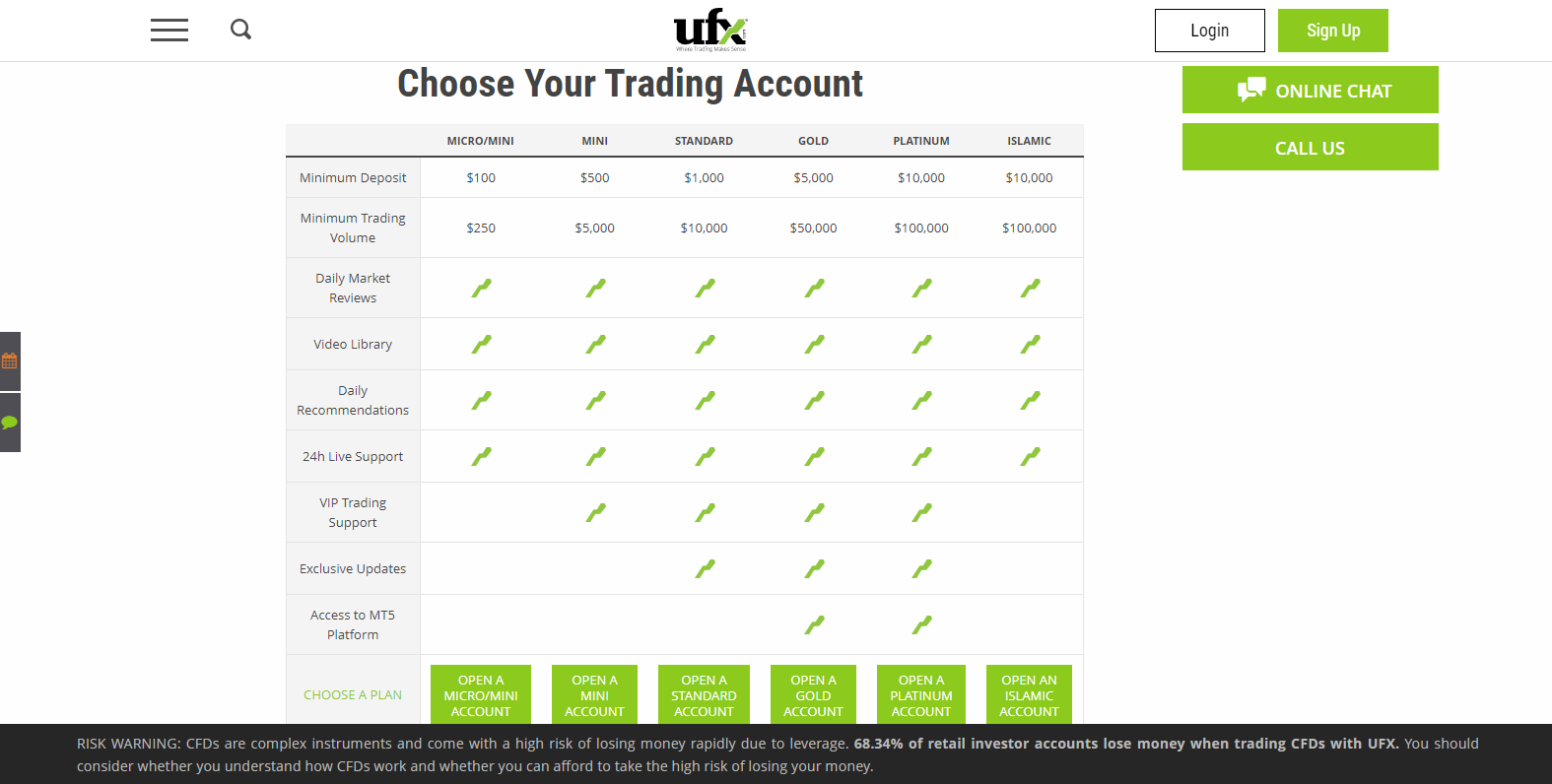

Account Types

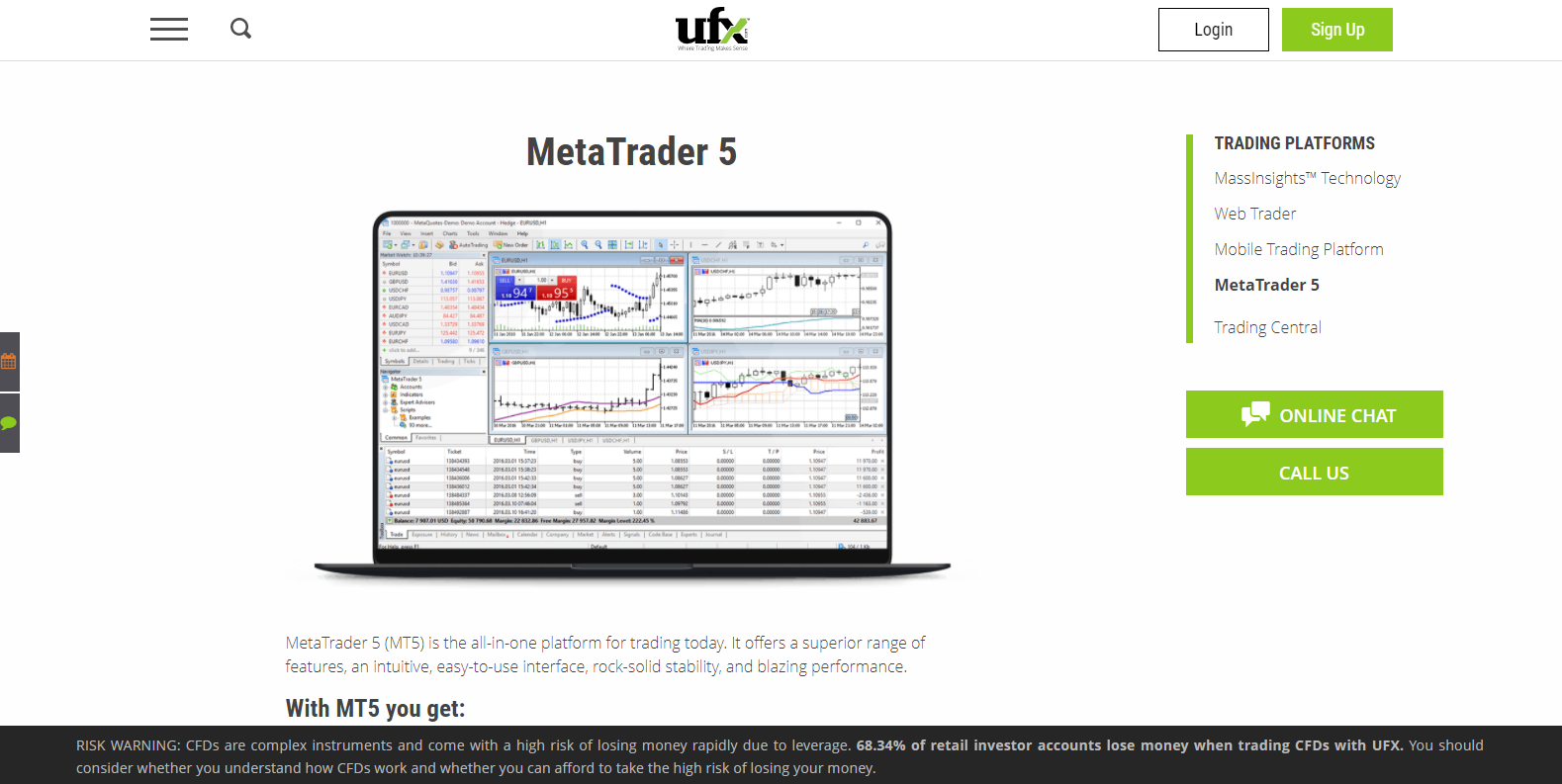

Six distinct account types are available, but none provides traders with a great choice. To get access to the MT5 trading platform, UFX asks for a minimum deposit of $5,000, while other brokers offer this platform for a much lower minimum deposit. Islamic accounts require a $10,000 deposit, the same as for the Platinum account. MT5 access does not seem to be available in the Islamic account despite the high minimum deposit.

UFX provides six unacceptable account options for traders to consider.

Trading Platforms

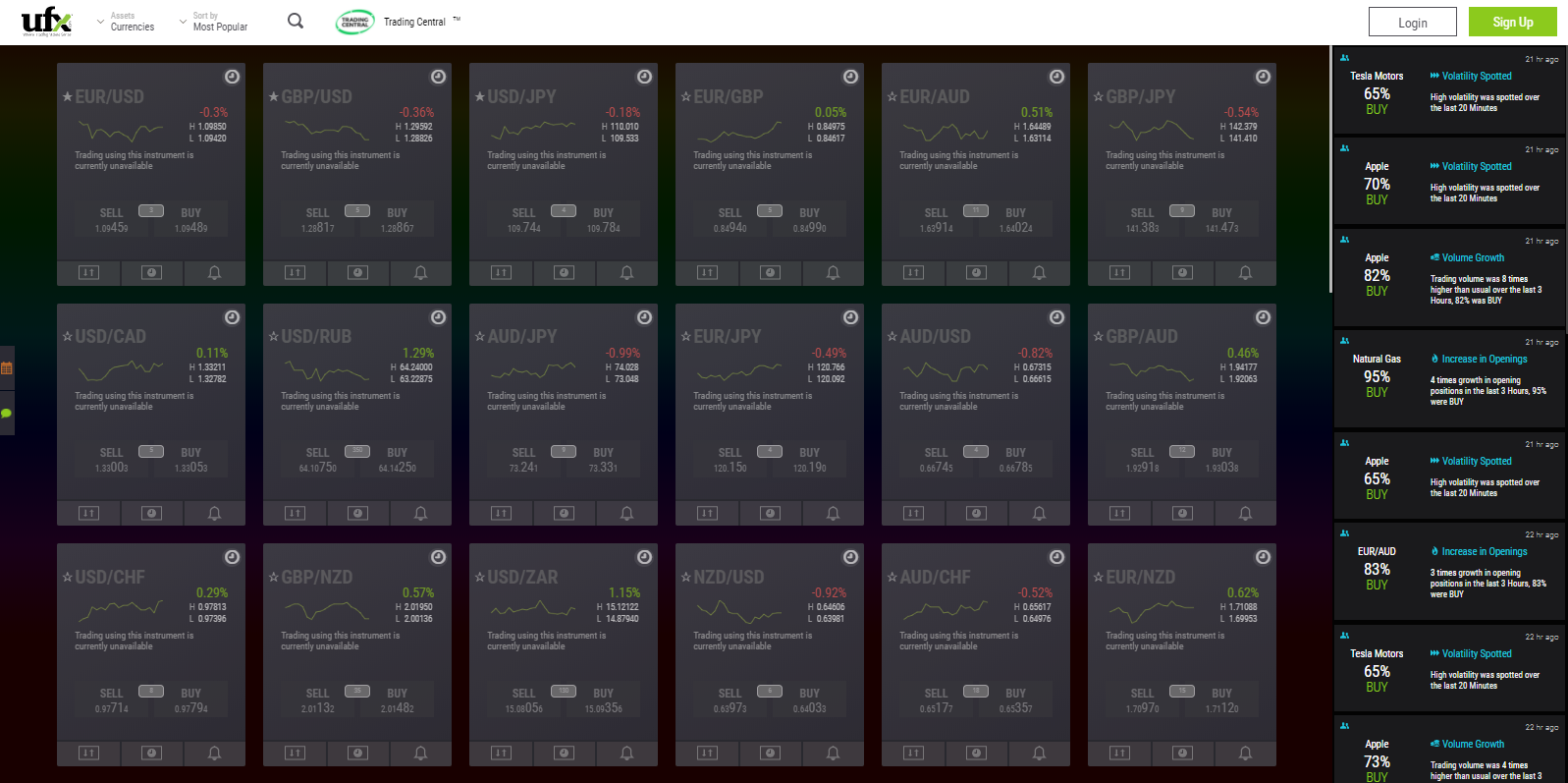

The UFX webtrader is built around this broker’s proprietary MassInsights Technology, providing a live stream of market events on top of aggregated trader behavior based on its clients. With a user-friendly interface, simple trade placement, and seven unique sentiment-based alerts, it creates an excellent environment for new traders. Unfortunately, the MT4 trading platform is unavailable, while the MT5 requires a $5,000 deposit. During our UFX review we could not find support for autotrading services, making this a less-than-ideal option for more advanced traders.

MassInsights Technology represents the biggest asset UFX has to offer.

The MT5 trading platform is only available in the Gold and Platinum account types.

Unique Features

There are no distinctly unique features at UFX besides the MassInsights service which was previously mentioned. This service may be useful for some traders, specifically those who are relatively new to trading. The absence of the MT4 trading platform and lack of support for automated trading solutions represent a critical oversight. Excessive trading fees and an unusual approach to account specification stand out as significant errors by the management team.

Research and Education

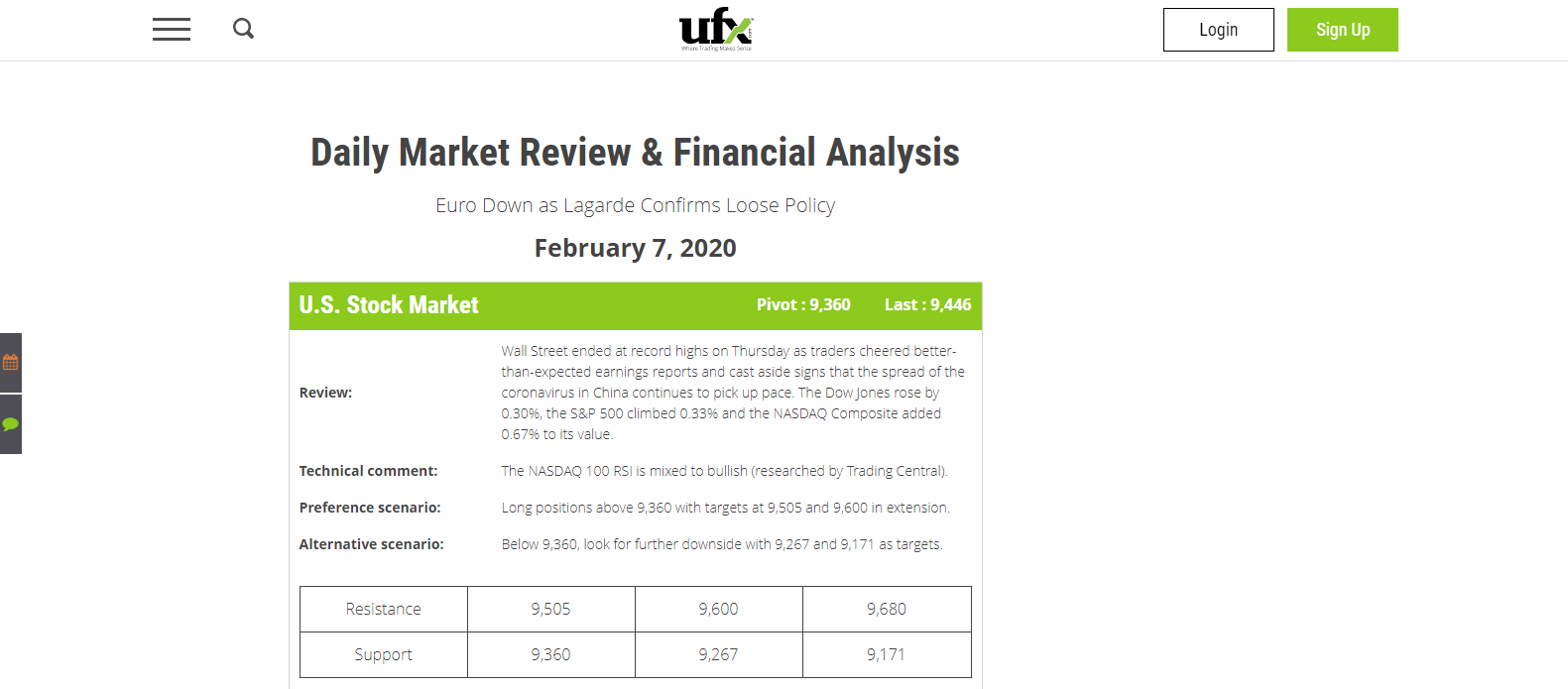

Research is exclusively provided in partnership with Trading Central, a leader in independent third-party research, but it is solely available to traders with a minimum deposit of $1,000 and above. Unfortunately, UFX uses this promise of research to lure new accounts with more substantial deposits. The Daily Market Review features daily trading recommendations, based on Trading Central research. An economic calendar is available. Education is not offered by UFX, another critical error by this market-maker focused on the retail sector.

A $1,000 minimum deposit is necessary to receive access to proper research at UFX.

This broker provides limited free research daily, inspired by marketing needs.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |

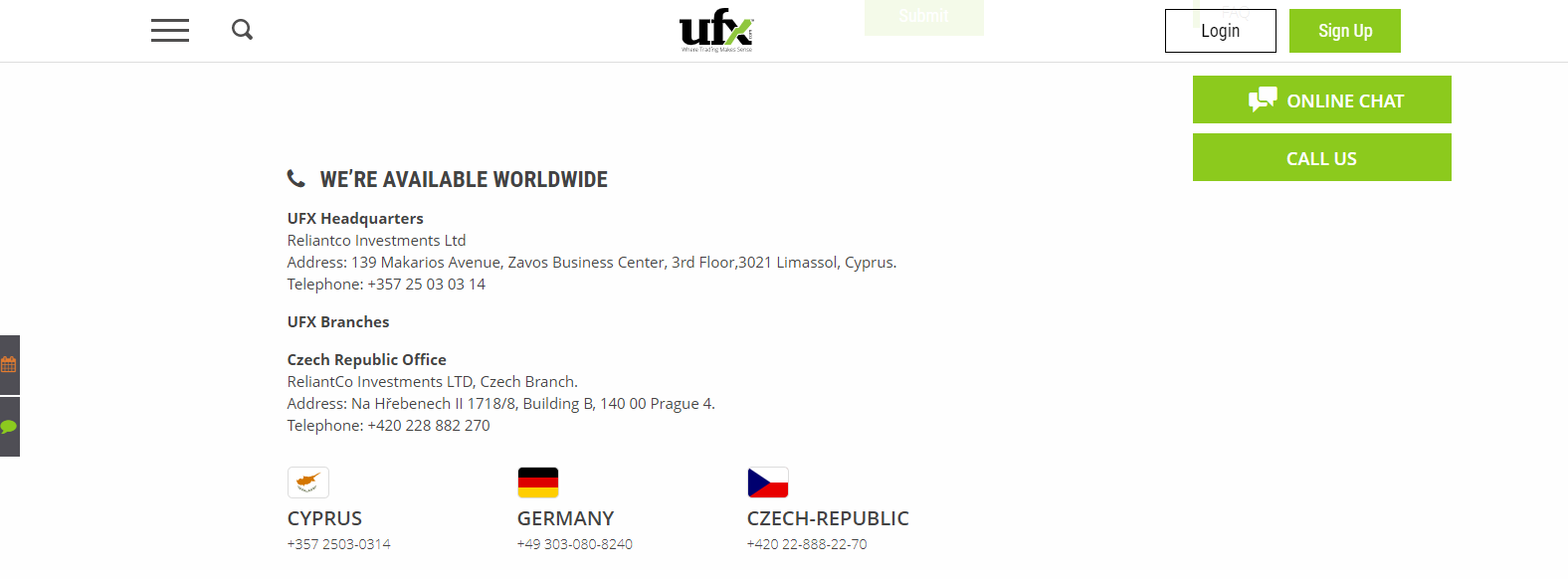

Traders have access to UFX customer support 24/5. The UFX European customer support center is regulated by the German Financial Supervisory Authority (BaFin) under license number 80164620. Support may be reached via the webform, by calling or utilizing the live chat option.

Bonuses and Promotions

At the time of this UFX review, there were no bonuses or promotions available, in compliance with EU law.

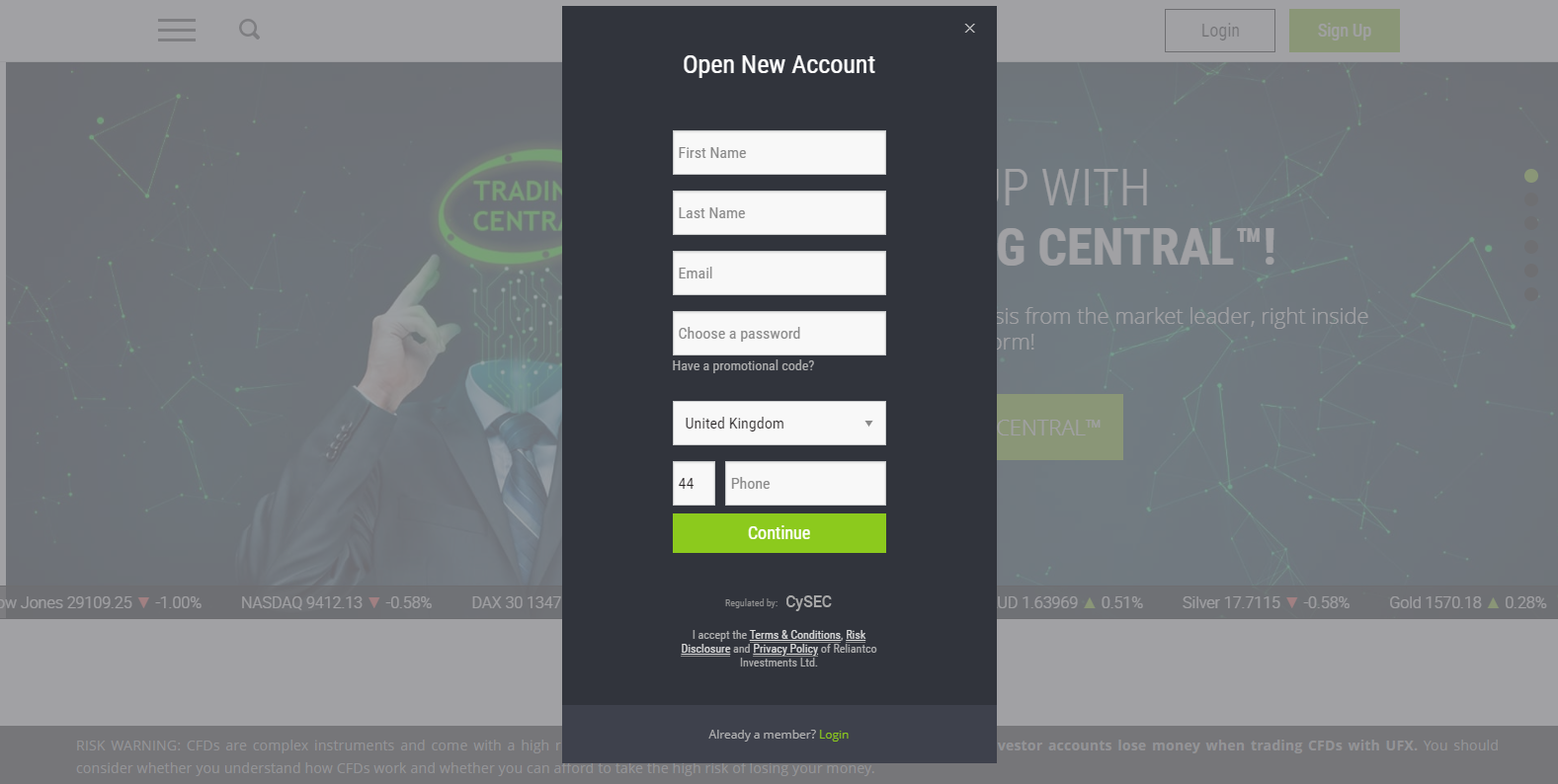

Opening an Account

Accounts are swiftly opened via an online application, the standard operating procedure. This grants new traders access to the back-office. As a CySEC regulated brokerage, UFX adheres to a strict KYC/AML policy. New accounts require verification via a copy of the trader’s ID and one proof of residency document.

Deposits and Withdrawals

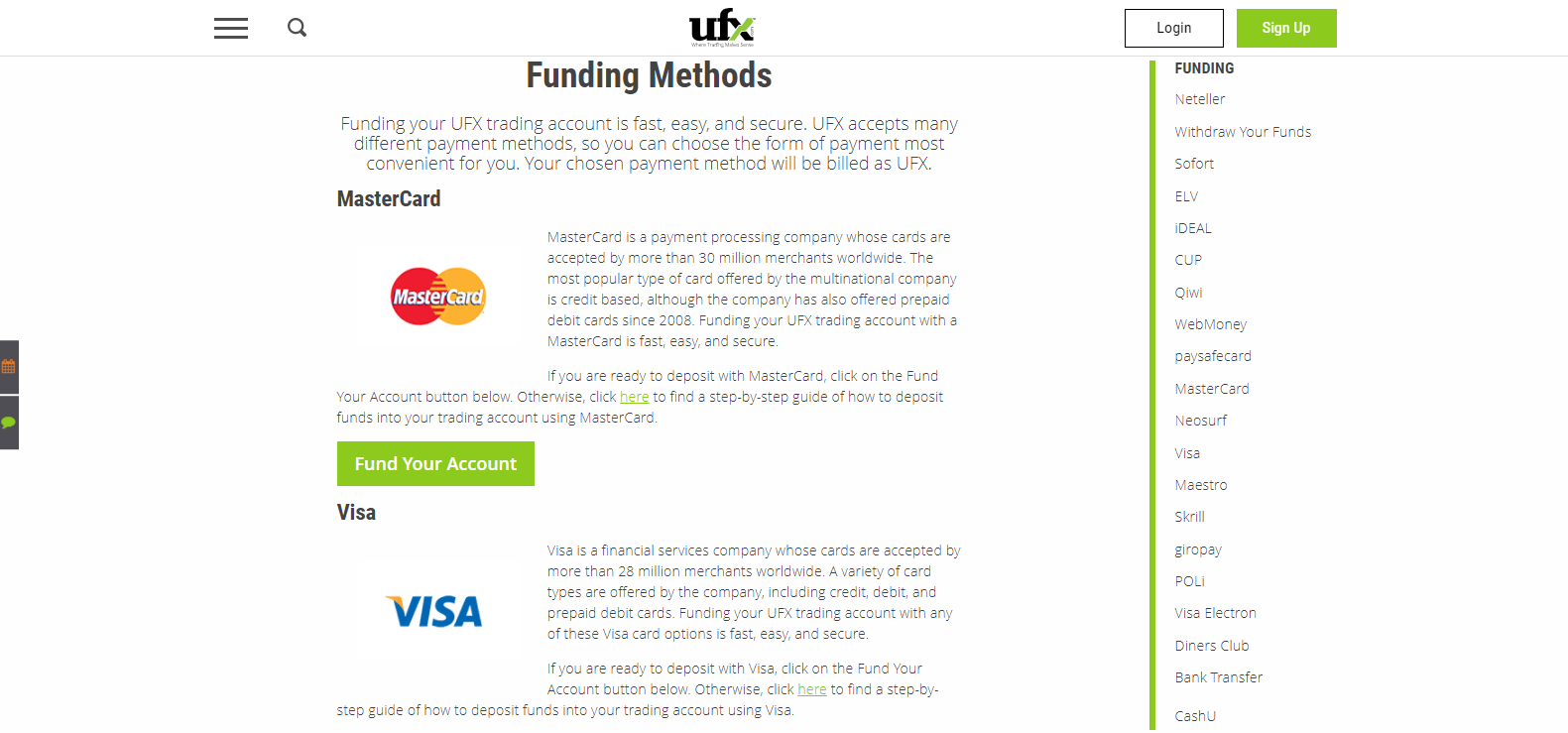

UFX provides traders plenty of choices when it comes to payment processors. Traders may select between bank wires, credit/debit cards, Skrill, Neteller, SOFORT, ELV, giropay, iDEAL, Neosurf, China UnionPay, CashU, Qiwi, WebMoney, POLi, and paysafecard. This broker provides comprehensive information about each service but fails to not associated fees and processing times. Per AML stipulations, the UFX account name and the payment processor must be identical.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Summary

UFX is a solid, albeit overpriced broker operating out of Cyprus. While the asset selection is adequate for retail traders and most advanced traders alike, the trading conditions provided are unacceptable. An educational section is absent. Proper research requires a $1,000 minimum deposit, and an Islamic account is only granted above $10,000. The MT4 trading platform was not supported at the time of this UFX review, and traders who wish to use the MT5 version are asked to deposit $5,000. This broker developed its services around its proprietary MassInsights Technology, featuring attractive tools for traders, but it doesn’t justify the non-competitive trading conditions. UFX shows a lot of promise, but there are certainly aspects that deserve to be addressed to make the broker a more attractive option, especially for more established traders. UFX is regulated by CySEC and follows strict security protocols. It deploys two layers of firewalls to safeguard the information of its clients. Reliantco Investments, the owner of UFX, is a Cyprus Investment Firm authorized and regulated by the Cyprus Securities Exchange Commission (CySEC), under license number 127/10, since December 22nd 2010. Traders may select between bank wires, credit/debit cards, Skrill, Neteller, SOFORT, ELV, giropay, iDEAL, Neosurf, China UnionPay, CashU, Qiwi, WebMoney, POLi, and paysafecard. UFX is a market-maker, charging excessive fees via spreads. The EUR/USD, the most liquid currency pair, ranges between 2.0 pips and 4.0 pips. A $100 inactivity is charged every 45 days for accounts with no trading activity for 45 days, and a 0.1% hedging fee is additionally levied. UFX is a legit brokerage, in full compliance with its European regulator.FAQs

Is UFX trading safe?

Is UFX regulated?

How do I withdraw money from UFX?

What are the UFX trading fees?

Is UFX a scam?