Some weeks ago I wrote an article explaining about how an account of $10,000 could be grown into $1 million in the course of a few years of Forex trading. Many readers found it hard to believe that this could be a realistic target. It seems logical to believe that achieving such a feat would require either exceptional skill, exceptional luck, or a combination of the two.

In fact, becoming a profitable Forex trader by growing your trading account exponentially does not require exceptional skill in being “right”. It requires an understanding of statistical probabilities, iron discipline, and very steady nerves, as well as a willingness to accept risk and losing trades. The exact size of any exponential profit that can be achieved in the market is always down to luck, but you can choose whether or not to be exposed to it.

In this article I am going to reveal an exceptionally good trade entry method, and show how you can exploit it and give yourself a great chance of making a lot of profit. It is the best trade entry method I have ever seen, used, and tested.

...becoming a profitable Forex trader... requires...iron discipline... a willingness to accept...losing trades.

It is vital first of all to consider risk and how to prevent catastrophic losses, and to understand why trying to be “right” on trades will usually work to limit your profits instead of maximizing them.

Taking Risk and Being “Right”

Making winning trades can seem very difficult. A lot of Forex teaching counsels patience and extreme selectivity with trade entries. The trader is told to be very careful, to use a lot of analysis, and to be “right”, i.e. to anticipate the next move of the market through analysis. On top of all this, it is common to hear a risk of 2% of capital per trade presented as a risk management method and money management strategy.

Usually, this approach is a recipe for disaster. The trader is on edge, constantly watching the market for signs that the long-awaited special set up might be about to arrive. Suddenly it appears that it has come, at which point the trader risks a sizeable chunk of their capital on a single trade, and then watches the trade progress with a rapidly beating heart. If the trade goes into profit, the trader will usually itch to grab that profit far too early. If the trade stops out, the trader wants to hit his head against the wall, and runs back to second guess the “analysis” while experiencing a grinding insecurity.

A Better Approach to Risk

Much better results can be achieved more easily by taking a different approach which enables you to “let go”. This approach is to trade frequently, but in smaller sizes, and to forget about being “right” about the next 100 pip movement. Instead, focus on finding low-risk entries. Low risk entries are situations where a very tight stop loss can be used to capture the beginning of a reversal of the direction of the price. Neither a breakout, nor jumping on a bandwagon that has already covered a lot of distance. Those approaches can work, but in Forex, the best statistical chance you have over hundreds or thousands of trades is to get in just as the price is reversing.

Most of the time, the market ranges. This means that when the price moves up sharply, it is more likely to move down that it is to continue moving up. These short-term sharp movements happen all the time, and the good news is that not only are they easily identifiable, they also have positive statistical expectancies. You can exploit this by entering at these moments with small position sizes, taking partial profits when the trades go in your favor, and then leaving the rest of the trade to run. In this way, you can expose yourself to very large directional movements that can be closed out weeks or months later, while avoiding losing too much capital from your account in the meantime.

A Great Trade Entry Method

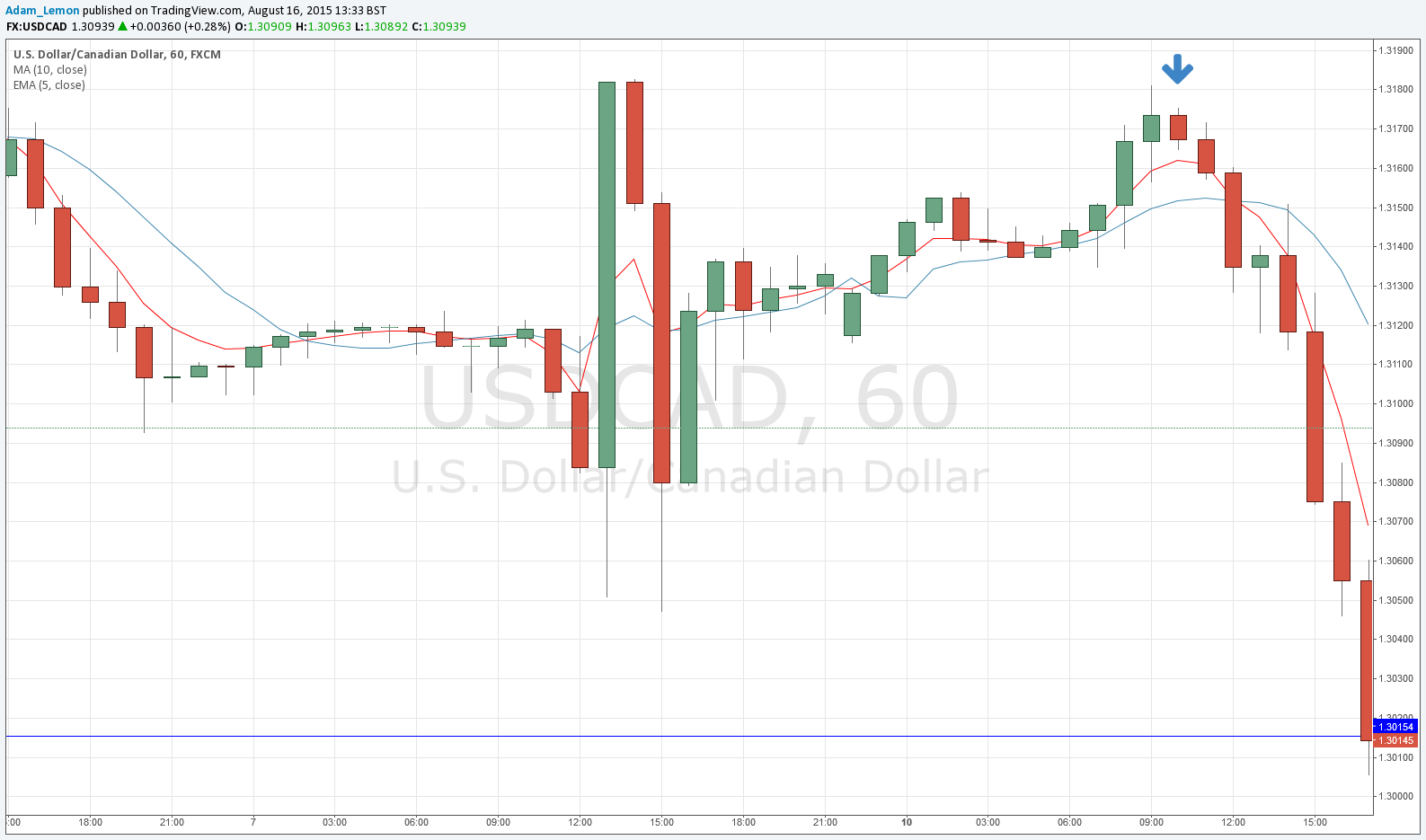

On an hourly candlestick trading chart, add two indicators: a 5 period exponential moving average and a 10 period simple moving average, both set to close.

Watch out for one of two situations to arise:

When the 5 period EMA is above the 10 period SMA, and a candlestick closes whose range is entirely above the 5 period EMA. Here you have a possible short trade

When the 5 period EMA is below the 10 period SMA, and a candlestick closes whose range is entirely below the 5 period EMA. Here you have a possible long trade.

The next thing to do is to be quick and place an entry order one tick above (for a long trade) or below (for a short trade) the range of the closed candle. The stop loss should be 1 pip past the other side of the closed candle (but see my note below). If before hitting the trade entry price, the price instead goes the other way and breaches the other side of the candle, do not take the trade. Of course, this next candle might go on to become an entry candle in its own right, if its range never touches the moving averages and if the two moving averages remain in the correct order.

An expert advisor could be programmed to do this job, if you are using Metatrader.

There is another situation to watch out for: when there is a long trade entry candle that has an immediately preceding candle with a lower low, or in the case of a short trade entry candle, a higher high. In these cases, you should place the stop loss 1 pip beyond that previous candle’s lower low or higher high.

Back Test Results

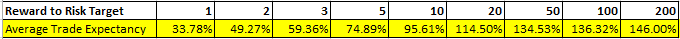

To show just how good and frequent an entry method this can be, here are the results of back testing this entry strategy on just a single major pair, the GBP/USD currency pair, from April 2001 until the end of 2014.

There were a total of 11,112 trade entries. The results allow for a spread of 1.5 pips, no slippage, and no overnight interest charges.

At the reward to risk target of 1 – that is to say, if the risk to the stop loss was 20 pips, the trade exit would be at +20 pips – the worst peak to trough drawdown over this 15 years plus period was only -14 units of risk.

This means that replicating this back test with a starting cash balance of $10,000 and risking only $10 per trade, would have seen a closing balance at the end of the test of $385,500 with a maximum draw down of $140.

This is a good example of how it could be possible to turn $10,000 into $1 million over a few years, if you had been able to achieve a similar result trading multiple currency pairs. In Part 3, I will outline some other crucial elements you should know about before you undertake this kind of trading strategy, such as controlling risk, how to determine which currency pairs to trade, and more advanced ways to plan for exiting trades.