In the first part of this series I explained the “Flying Buddha” candlestick pattern which can be used to trade Forex profitably. In this second part I will explain methods you can use to enhance the profitability of this entry method. I will also compare back test results with results of another similar entry strategy and we will see whether there is anything special about trading the “Flying Buddha” pattern.

Testing the “Flying Buddha” Pattern

Let’s start by taking a look at back test results. A back test was conducted from 2002 until the end of 2015, which is a total of 16 years covering many types of market conditions. The currency pairs examined were the seven major USD currency pairs. Hypothetical trades were taken following “Flying Buddha” candlesticks on the H4 London time chart only if the price was above its levels from 3 months and 6 months ago (for long trades), or below its levels from 3 months and 6 months ago (for short trades). Entries were placed 1 pip past the “Flying Buddha” candlestick, with stop losses placed just the other side of the candlestick, or if the previous candlestick extended beyond that, then just the other side of that previous candlestick.

When trading the “Flying Buddha” pattern, the entry candlestick was the final candlestick of the trading week, it was not taken and was excluded from the results. If a trade entry was not triggered during the very next candlestick following the “Flying Buddha” candlestick, then the trade was cancelled.

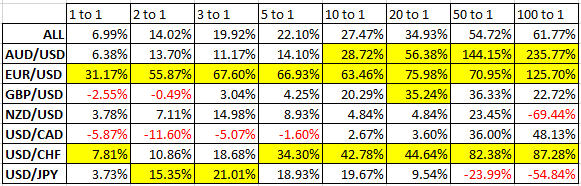

During the period covered by the back test there were 5,307 hypothetical trades. The hypothetical results are shown in the table below, in total and by currency pair, in the form of expectancy per trade at different reward to risk profit targets.

It is easy to see that the method had a positive expectancy that increases with the size of the profit target all the way up to a reward to risk ratio of 100 to 1!

Comparison of “Flying Buddha” Pattern Results with Rough Entry Results

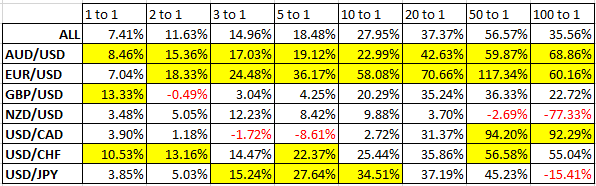

Let’s compare those results with the result of a back test covering the same currency pairs and time period, but using a different entry method: just using the next candle break of any candlestick that made a low beyond the previous four candlesticks in an upwards trend, or vice versa in a downwards trend. There were 6,482 hypothetical trades, i.e. about 20% more trades than there were in the “Flying Buddha” test. The results of this back test are shown below:

If we compare the headline results of all of the hypothetical trades taken trading the “Flying Buddha” pattern, we see that this entry method was a little superior to the less discriminating entry method, but there is not really a great deal in between the two methods. This is good news, as it shows you have two different entry methods that can be used to profitably exploit trends!

“Flying Buddha” Pattern by Time of Day

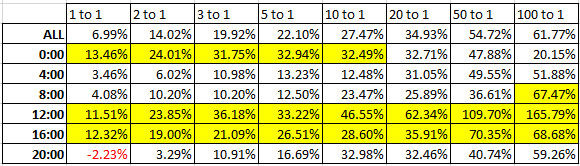

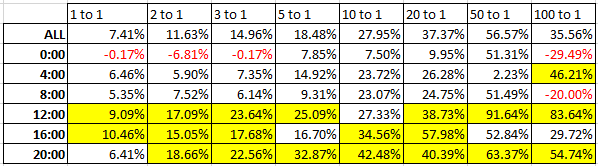

Now let's break these results down further. Is there a great difference between the “Flying Buddha” entries that appeared at different times of the day? The times shown in the table below are London times:

It is clear that the three best times to enter a trade are during the four hour periods that begin at midnight London time (which is also midnight UTC, or very close to it), and then later at noon and 4pm (which correspond to the first two-thirds of the New York business hours, including the London/New York overlap).

Before we try to draw any conclusions in trading the “Flying Buddha” pattern from this, let’s take a look at the back test results from the other entry method, also broken down by time periods:

We can see that noon and 4pm look like good times to enter trades here too. However midnight looks much worse and 8pm much better. This might be due to an effect caused by a very strong move taking place just before the New York close, which would be likely to produce a “Flying Buddha” candlestick ending at midnight London time. This effect might be producing a fast reversion to the mean.

Candlestick Range

Another filter that could be useful when trading the “Flying Buddha” pattern is time of day by currency pair. The tip here is first to avoid trading the USD/CAD pair between midnight and 8am. This really stands out as the biggest variance by time of all the currency pairs tested here. It makes sense as the Asian session is well outside the business hours of the U.S.A. or Canada.

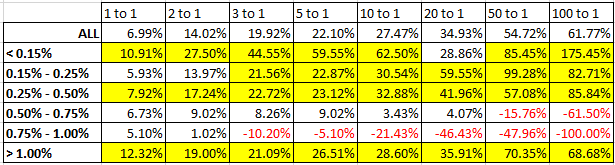

One final filter to consider is the size of the “Flying Buddha” candlestick itself, or more specifically, the range between the trade entry level and its stop loss. After all, as the profit targets are defined by reward to risk, a smaller candle that gives 200 pips maximum profit could be more profitable than a larger candle that gives 300 pips profit as using a constant risk per trade would produce different position sizes. Let’s look at profitability by the ranges of the entries for the “Flying Buddha” trades:

Looking at the stats, there's no question that the smaller candlesticks or two-candlestick combinations do produce more profitable results than the overall average where the range is less than 0.50% of the price of the currency pair. However, notice how the really huge candlesticks that represent more than 1% also tend to produce superior results, because such huge fast movements that have already snapped back towards the moving averages are likely to continue in that direction.

Conclusion

There is plenty of tried and tested material here in this article to build a complete, long-term trend trading strategy. Exact entry strategies are not so very important, what is more important instead is sticking to a plan for entry and taking every opportunity that comes along because in trend trading, it is important not to miss the big winners, even when the set-up does not seem to be of particularly high quality.

Remember that in Forex, it is quite possible to not get any long, strong moves for quite a while, so it is important to take profits here and there, regularly, because if you sit tight waiting for the huge 1,000 pip winners, they may not come for a year or so.