Why Traders Don’t Consider Pair Selection Carefully

Most traders are eager to start making lots of money. The way to make lots of money quickly, so they are told, is to trade using smaller timeframes – this is at least theoretically true. Traders notice that some currency pairs have lower spreads (such as EUR/USD) and think they should pick such low-spread pairs to trade to save costs. Another common reasoning is that it makes sense to trade those currencies which are most active during the trader’s preferred hours of operation. A further argument says that each currency pair has its own “personality” and you should get a lot of experience trading a few pairs so you can get to know their personalities well, and in this way, trade them more successfully.

These considerations are both rational and truthful, at least to some extent. The problem is, that they are very far from being the most important consideration that should influence which currency pairs you trade. I learned this myself the hard way some years ago when I decided that I would day trade, the EUR/USD and GBP/USD currency pairs full time. Over several months, these two pairs barely moved, while USD/JPY took off like a rocket and provided easy money to anyone trading it. Sure, I knew the personalities of EUR/USD and GBP/USD very well, had a great strategy which had worked extremely well on these pairs for years, and their hours of greatest activity fitted the time zone of my geographical location precisely. Despite all this, my linear thinking caused me to miss out on the only real trading opportunities of 2012, which came in the JPY pairs and crosses.

The #1 Factor to Use in Deciding Which are the Best Currencies to Trade

So, how should you decide which are the best currencies to trade? I’ll use an analogy to the world of gambling to simplify the issue: Let’s say you go into a casino to play a game where you need other players to risk money on the table to give you a chance to make profit, i.e. your winnings will come from their losses. This is a good comparison to the Forex market, which works the same way. So, which table would you go to? The busiest one, with the most players and most money on the table, or a quiet one in the corner with just a couple of players there? Obviously, it would make sense to choose the busiest table. So why should Forex trading be any different? You want to be trading the “busiest” currencies at any given time, you want to be where the action is. Are there any ways to determine that? Well, you could try reading the Forex news to spot the biggest things that are happening in the market now. There’s a place for that, but there are easier ways that can tell you where to begin to focus your search. Although Forex is “over the counter”, there are reliable statistics which tell us which currencies are traded the most, i.e. which currencies are exchanged in the largest volumes. The takeaway headline is that today, about 70% of all Forex trading is between the U.S. Dollar, the Euro, and the Japanese Yen only. The British Pound and Australian Dollar account for another 10%. The U.S. Dollar is by far the most dominant of all these currencies, so it makes sense to focus on each of the other currencies against the U.S. Dollar. You don’t need to open your trading platform and worry about 80 pairs and crosses or wonder whether the Canadian Dollar / Swiss Franc cross is what you should be trading today. It almost certainly isn’t, and if you ever hear anyone telling you about a support or resistance level in a currency cross like that, please ignore them – nobody is watching this cross or its levels!

Narrowing Down the Field

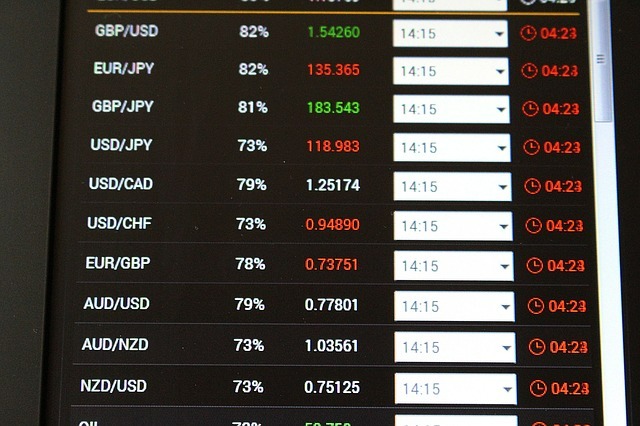

Now you know that it is only worth watching a few currency pairs, you will find it much easier to know which one or ones to be trading any day. The method to use to answer this question in detail, is which of these currency pairs are likely to have the most volatility? You need volatility, because if the price does not move, how are you going to make any money? You need to buy and sell at the widest price differentials you can possibly find, to make the greatest possible profit. There are a few ways to forecast where market volatility is likely to be, and if you apply the methods I outline below, you should get some good answers.

The first thing to know is that statistically, in markets, volatility “clusters”. Suppose the average daily range of a currency pair is a movement of 1% of its value, taken over several days. Suddenly, one day it moves by 3% of its value. Volatility clustering research conducted by data scientists such as Benoit Mandelbrot tell us that this pair is more likely to move by something more than 1% tomorrow, quite possibly actually by an amount closer to 3%. So, when you see a currency pair move by more than its average volatility, that high volatility is more likely to continue than reverse over the short term. Another approach could be to calculate the average true range (ATR) of the past 5 or 10 days for EUR/USD, GBP/USD, and USD/JPY, and calculate these values as percentages of each pair’s price from the start of the period. Whichever has the largest value, is probably the pair it makes sense to focus on tomorrow.

Another crucial factor is trend, or momentum (they are essentially the same thing). The major currencies such as the U.S. Dollar, Euro and Japanese Yen, have, in recent years, shown a greater probability to move in the direction of their long-term trends. One good rule of thumb in trading major currency pairs is asking yourself, is the price higher or lower than it was 3 and 6 months ago, and trading mostly or entirely in the same direction as any long-term movement, if it exists.

If you are trading only during Asian business hours, you will probably find that your best opportunities will involve Asian currencies such as the Japanese Yen and Australian Dollar. I urge you to consider whether you can develop a method to trade longer time horizons, as otherwise you could be missing other opportunities while you are asleep, the same way I missed out on USD/JPY opportunities in 2012. If I had the wisdom to trade daily charts back then, I could have profited from that big movement in the Yen very easily, even at night while I was asleep, with traders in Tokyo doing the heavy lifting for me!

Finally, if you watch an economic calendar to see when the major central bank or most important economic data releases are scheduled for the major currencies, you can see that if you are in a trade before those releases, those releases might provide you with the volatility you need to turn your trade into a big winner, or at least show you where some volatility is likely to appear.

So, narrow your focus to the major pairs, and trade the currencies showing the highest volatility, and watch where the bigger long-term trends are. This should give you the best chance of success in Forex trading.

FAQs

What are the best currency pairs to trade?

The best currency pairs to trade are the ones which are trending most strongly over the long term. In trendless environments, it is better to trade the currency pairs which have shown the highest volatility over recent days.

What is the easiest Forex pair to trade?

EUR/USD is the easiest Forex pair to trade because it trends very reliably, is extremely liquid, and has the lowest spread so can be traded relatively cheaply.

What are the top 10 traded currencies?

In order, the top traded currencies by value are the U.S. Dollar, the Euro, the Japanese Yen, the British Pound, the Australian Dollar, the Canadian Dollar, the Swiss Franc, the Chinese Renminbi, the Hong Kong Dollar, and the New Zealand Dollar.

Which Forex pairs pay the most?

The Forex pairs paying the most are those with the largest long-term directional movement. The biggest mover of any widely traded Forex pair in 2020 was the AUD/USD, which rose in value by more than 37% in only ten months.