When we first start trading Forex, we most often play what is known as a “market order” to get involved. You simply click the button to buy or sell and get involved. The market order tells the broker that you want to get involved to the best price possible, or what is known as the “market price.” There is no guarantee that you will get the price that you see on the chart or order window, but as Forex is extraordinarily liquid, most of the time it works out.

Pending orders

Pending orders in Forex, or any other market for that matter are a set of instructions that you give your broker on entering or exiting a position. Sometimes with more complex platforms, you can have multiple actions in the same order. At its most basic level, you are looking at a scenario where you are telling the market you wish to get in or out of a position at a specific price. If the market does not reach that price, then nothing happens. There are multiple types of orders but will take a look at the most basic ones that you are most likely to find.

Buy stops

A buy stop simply tells the broker that you want to buy a currency pair at a specific price. For example, if you are short of the USD/CAD pair at 1.31, but you recognize that you are wrong in your position if the market reaches 1.3180 level, you place a buy stop at that level to protect your account. This means that as soon as the market hits 1.3180, you buy back the position to close out the trade and live to fight another day.

Sell stops

Sell stops of course are the exact opposite. If a price is touched, you wish to sell the market, normally to close out a position. Using an example of the GBP/USD pair, let’s say that you are long at 1.30, and price has traveled all the way to the 1.33 handle. You wish to lock in some profits, so you decide to place a sell stop at 1.3270 just below. If the market travels back to the 1.3270 level, you sell your position and flatten out the account, at least as far as that trade is concerned.

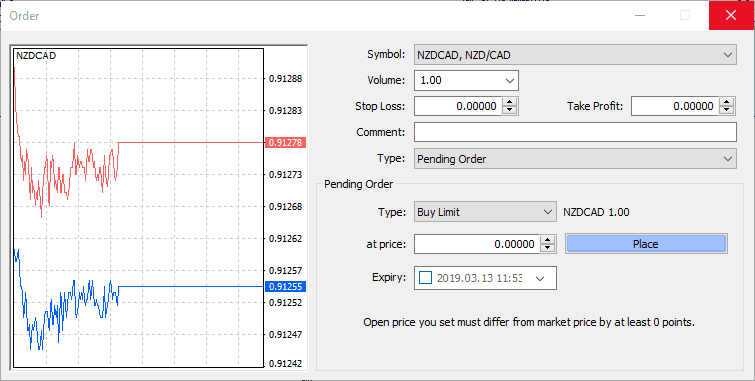

Buy limit

A buy limit is an order that says you are willing to buy a currency pair at a specific price or better. An example might be that you are looking to buy the USD/JPY pair at ¥111.05 which is currently lower than the market. As market drops down to the ¥111.05 level, you are only willing to buy it at that specific price, or better. It is possible to get filled at a lower price since it is considered to be “better”, but that rarely happens, and almost always in a situation where there is a lot of slippage during the news event. If your price doesn’t get hit, then nothing happens. You will either pay ¥111.05 or less for the position.

Sell limit

Obviously, this is the exact opposite of a buy limit order, as you are setting a specific price that you are looking to sell this currency pair. For example, the EUR/USD pair is currently trading at the 1.1358 level, and you recognize that the 1.12 level above is an area of resistance. You are wanting to short the market if it gets up in that area, and you are only willing to pay that price. You put in a sell limit at that level, and you either get your trade filled at that price or higher to take advantage of the “better” part of the trade.

You should never use market orders if you can avoid it

Granted, we are all guilty of this but you should never use market orders if you can avoid it. This invites slippage which can cause major issues. Under most circumstances it’s not a serious concern, but it can happen. And beyond that, if you do get slipped, there’s no recourse. You cannot call up your broker and complain about slippage and expect to get a favorable reaction. With a limit order, then you have something to discuss.

FAQ

How do I make a pending order?

A pending order is any order which is not a market order. Pending orders are limit or stop orders. Most trading platforms make it very simple and intuitive to enter a pending order.

What is pending order in stock market?

In the stock market, a pending order is any order which is not a market order. An order to buy or sell at a better price than the market price is a limit order, while an order to buy or sell at a worse price than the market price is a stop order.

What is a buy limit on MT4?

A buy limit on mt4 is an order that can be placed with the MetaTrader 4 trading platform to buy something at a lower (better) price than the current market price.

What is a buy stop in forex?

A buy stop order in Forex is an order to buy something at a higher price than the current market price, which is triggered when the price reaches the level at which the buy stop order was set for.