Becoming a successful Forex trader is about more than just learning how to identify good trades and entering them correctly. Without knowing how to manage your trades after entry –when to adjust the stop loss or take profit level, when to add or take off from the trade, and when to exit – you will find achieving profitability in Forex almost impossible. Join me while I teach you the Forex trade management skills you need to know below.

The 4 Stages of a Trade

It is important to distinguish the four main phases of a Forex trade – this way, you can test your skills on each phase and understand what needs more work and what does not. The 4 phases are:

- Trade identification: your setup conditions.

- Trade execution: your entry trigger.

- Trade management: what you do when your trade is “live”. Having a plan that considers the various scenarios that can materialise once your trade is live is essential to maintain a sense of control over your trading. It also allows you to respond to the various curve balls the market will throw at you. I will cover several plan components within the remainder of this article. At a very basic level, Forex trade management must give you the answers to the following questions:

1. What do I do if the trade reaches my profit objective quickly?

2. What do I do in case of reversal right after entry?

3. What do I do in case of an intra-trade drawdown?

4. What do I do in case the trade moves steadily in my favour (but without reaching the target) and then reverses?

5. What do I do if the market posts a reversal pattern?

- Trade Exit: the decision to completely close the trade and wait for the next opportunity.

Why is Forex Trade Management Important?

Trade Management is essential to your survival as a trader. To explain why, consider the most important equation you will ever see in your trading career:

Expectancy = Average Win * Win% - Average Loss * Loss%

Average Win and Average Loss are calculated in “R-terms”, meaning units of return by risk. For example, if your stop loss is 50 pips from your entry, and you exit with 50 pips of profit, you made a profit of 1R (50 pips of profit / 50 pips of risk).

To understand what the “R” of a trade is, simply divide your profit by your risk per trade. Since trading is all about being a good risk manager, and delivering superior risk-adjusted rewards, you should now understand why thinking about trade results in “R-terms” is better than thinking in money terms.

Going back to the expectancy equation, reaching the objective of a consistently positive expectancy is challenging, but the formula tells you exactly what you need to do:

- Keep the Average Win/Average Loss Ratio as high as possible (you are doing well if your average win is at least twice the size as your average loss)

- Keep the Win Percentage as high as possible (but over time, this will probably average close to 50%, which means that the key to profitability is averaging losses that are much smaller than your average win)

Trade management is essential because without having a clear plan, you will be more prone to making hasty, emotional decisions. If you do not average at least 1R on your winning trades, you will probably lose money over time.

Another thing to consider is that, by keeping your losses small compared to your wins, you will be in a much more relaxed place because the minimum win rate to ensure you do not lose money will become smaller. Here is the supporting math:

Minimum Win Rate = 1/ (1 + Avg. Reward-to-Risk)

Which means that to be profitable:

An average return of 1R requires the win rate to be higher than 50%.

An average return of 2R requires the win rate to be higher than 33%.

An average return of 3R requires the win rate to be higher than 25%.

This hopefully sounds quite straightforward. However, there is something which complicates this calculation, and takes us back to the importance of trade management: risk and reward are not static, and both change during a trade’s life cycle.

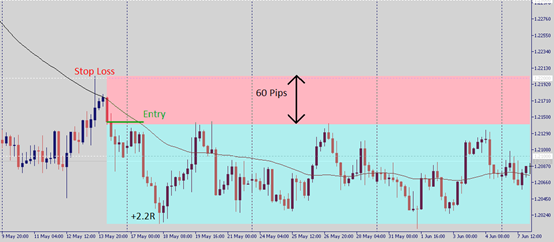

USD/CAD Short Trade Maximum Reward to Risk

For example, in the price chart above, you can see a potential trade on USD/CAD from the beginning of May. The stop loss distance from the hypothetical entry is 60 pips. The farthest the trade went in our favour (also called mean favourable excursion or MFE) was 2.2R (60*2.2 = 132 pips).

When the trade is up 1R, your actual risk is no longer 60pips. It’s 120 pips (1R stop loss + 1R paper profit). So, you are risking 2R at that point. When the trade is up 2R, your total risk is now 3R, and so on and so forth.

Make sure you make the most of those paper profits (via trade management) and do not let the market eat them back up and stop you out. Do not forget that you are risking paper profits when you have them in addition to the initial risk of the trade.

Simple Forex Trade Management Principles

Whether you are a mean-reversion (range) trader or a trend trader, the principles of the trade management equation apply equally because:

- A mean reversion trader will have a higher win rate but smaller average wins, so their challenge is to trail stops on a part of the trade,

- A trend trader will have large gains but smaller win rates, so the key for them is to try and bank some profit initially, while avoiding full stop-outs.

Forex Trade Management Strategy

The trade management vehicle we will look at today combines:

- An initial momentum-maximising period: once you enter the trade, scale out exit of 1/3 position on either: a reversal price action signal shortly after entry, or a divergence in momentum,

- A trailing stop on the remainder of the position, below swing lows (in an uptrend) or above swing highs (in a downtrend);

- Timeframe clarity: you will always manage your trade based on the timeframe in which you executed your trade entry.

Here are a couple of recent real trades taken by a student of mine, illustrating these trade management components in practice.

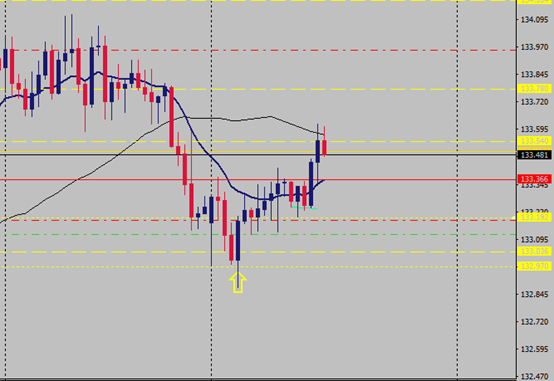

Partial TP and Moving Up Stop Loss EUR/JPY Trade

In the trade shown above, my student entered long on June 7th at 133.11 with a stop loss at 132.85 (26 pips) and an initial resistance area identified at 133.36 (25 pips). The trade was intended to be able to deliver at least 1R.

Since there were no divergences in momentum and no reversal price action on the H1 chart, the student kept his trade live and scaled out 1/3 when 133.36 was reached. He then trailed his stop below the most recent swing low on the 1H chart, which was the execution timeframe.

Next comes the trailing stop phase, where the student attempts to let his winner run. My student had marked 134.00 as his final take profit, but as you can see on this H4 price chart below, the market started to post bearish action off a previously identified resistance level at 133.60.

Trailing Stop Loss EUR/JPY Trade

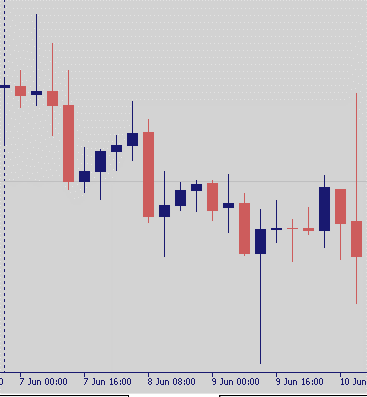

The trade was subsequently closed on the breach of the higher hourly swing low as highlighted in the chart below.

Trailing Stop Loss Triggered on Swing Low Breach

The total profit achieved by this trade was +1.11R which is nothing spectacular, but still respectable as it is more than 1R. Not every trade will be a multiple-R winner.

Now for another trade example, this time on USD/CHF. This trade is an example of one possible action to take, if the market is not granting immediate gratification and posts a reversal candle or shows contrary intent, almost immediately after entry.

Trade Management: Entry Before Immediate Reversal

Trade entry was at 0.8962 with a stop loss at 0.8925. Disregarding the rationale for entry, we should focus on what the market did after entry, and the trader’s response.

Trade Management: Entry Before Immediate Reversal

Shortly into the trade, the market posted a bearish reversal candle. The trader promptly closed his position with a loss of 14 pips (-0.38R). Independently from what happens after the trader exits the position, they are doing a great job as a risk manager:

- Kept their loss from the trade to less than 1R,

- Acted based on factual evidence (the bearish intent),

- Did not rely on wishful thinking (hoping the market would reverse),

- Freed up capital that could be deployed into another trade opportunity (efficiency).

Adjust Expectations to Market Type

One final point to discuss: whether the market is in a range or in a trend. The exact trade management strategy you adopt, and your expectations for the trade, should be anchored in a well-grounded understanding of market types: are we in a rangebound market or a trending market?

In a range-bound market, you cannot really expect trades to last long because the range barriers will likely attract contrary action.

Vice-versa, in a trending market you can expect your trade to have a longer life, trying to roll it over and let it mature with trailing stops.

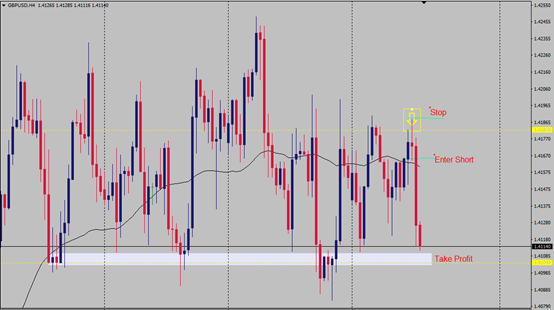

Here is another trade example from my student in GBP/USD. “Cable” is clearly in a rangebound environment and in this case, the student was prepared to make a full trade exit at the previous support zone.

Trade Management: Exit in Rangebound Environment

Once again: a profitable trade, managed in a logical manner. Entry at 1.4165, stop loss at 1.4190, and exit at 1.4105 for a 2.4R profit.

Bottom Line

Trade management is the third essential component of a sound trading model. To develop the best trade management strategy for your own trading model, here are some principles to adopt:

- Trade management should be used on the same timeframe you used to enter your trade,

- Time availability: if you are trading around a day job, consider executing and managing from a 4H timeframe at the very shortest,

- Adapt trading strategy to market condition: if you are trading mean-reversion, maximise momentum on the initial 2/3 of the position but try to run the last 1/3 with a trailing stop; if you are trading trends, consider maximising momentum on 1/3 of the position, and trailing the stop on 2/3 so long as the trend lasts,

- Either way: minimise losses by never allowing a winner to transform into a large loss. Try to keep your average loss much smaller than your average winner in absolute terms.

Whatever you do, make sure your Forex trade management model is a process, otherwise you will likely suffer from emotional decision-making instead of reacting logically to what the market is telling you.

FAQs

What is Forex money management?

Forex money management is the strategy traders apply to decide how much money to risk on a particular trade or series of trades. The optimal risk per trade can be determined mathematically by the Kelly Criteria if there is an anticipated positive expectancy determined for the trade. Beginner traders will be wise to risk no more than 0.25% of their trading account on a single trade.

How do I manage risks in Forex trading?

- Trade only with a reputable, well-regulated broker. Consider opening separate accounts with two or more brokerages.

- Always use hard stop losses when trading.

- Never risk more than a small percentage of your account size on a single trade.

- Use no leverage or low leverage. Consider the fact that businesses typically aim to be leveraged by a factor no greater than 1.3 to 1.

What is the average income of a Forex trader?

According to brokerage reports under ESMA regulations, almost 80% of Forex traders lose money. Therefore, the average income of a Forex trader is sadly likely to be negative. To be a profitable Forex trader and make any income at all, you must trade better than 80% of those who attempt Forex trading.

How can I get 50 pips in a day?

The best way to get 50 pips in a day is by swing trading Forex and only entering trades when you see a valid set up. The best trading opportunities for swing trading in recent years have come from pullbacks in strong directional trends made by the EUR/USD and USD/JPY currency pairs.

What are the types of trade in management?

There are various trade types which depend on the timeframe they originate and are managed from: scalping (with an intraday and short-term duration, originating on the 5 to 15min timeframe), swing trading (with a duration going from hours to days, with trades originating on the 1H to Daily timeframe), position trading (duration going from days to weeks, with trades originating on the Daily or Weekly charts).

What are the four types of trades?

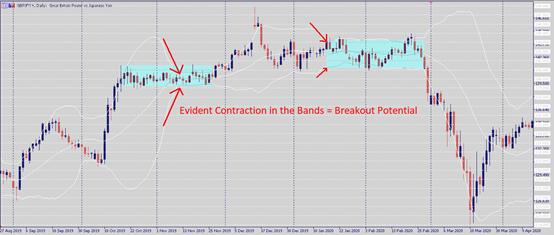

1. Breakout Trades: when prices post a range expansion and “break out” of a low volatility consolidation.

Trade Type: Breakout

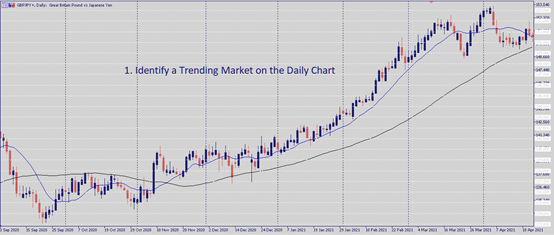

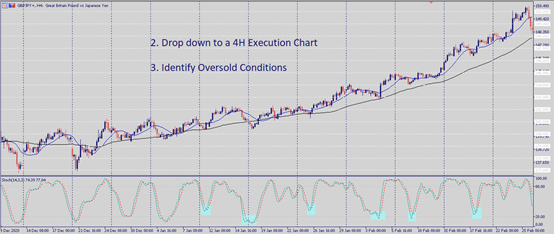

2. Retracement Trades: identifying a pullback in the context of a trending market.

Trade Type: Bearish Pullback Higher Timeframe

Trade Type: Bearish Pullback Lower Timeframe

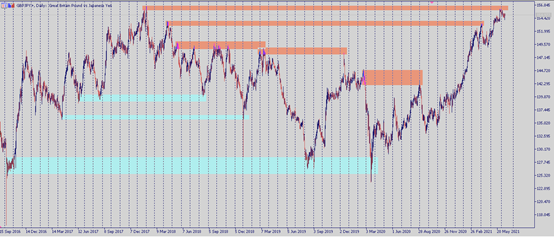

3. Reversal Trades: identifying a market that has been going in 1 direction for an extended period and is now reacting/reversing from zones of prior demand or supply.

Trade Type: Reversal Trade

4. Rangebound Trading: identifying a consolidating market with clear support and resistance boundaries, such as the GBP/USD example from above.

What do traders do?

Traders perfect market timing skills (their edge) and use these skills to identify and exploit situations that provide high reward-to-risk opportunities. In simple terms, a trader’s job is to deliver strong risk-adjusted rewards which are frequently measured via the Sharpe Ratio and Calmar Ratio.

Which trade is best for beginners?

Beginners should always be focused on perfecting their skills and being as systematic as possible with their decision making. Higher timeframes (4H, Daily, Weekly) are best to focus on (not only for beginners!) because they tend to generate more reliable trade signals and do not require hours of screen time to ensure effective trade management.