Gold is one of the first and oldest assets, traded globally for millennia, and its popularity today is at its highest with ongoing demand from all sectors. Gold is a safe-haven asset, an inflation hedge, and a wealth symbol. It is also a highly liquid asset and part of every well-diversified portfolio. Gold prices reached record highs above $2,145 per ounce in December 2023, with predictions for double-digit gains in 2024, and today, we will look at how to trade gold on MT5.

Top Forex Brokers

How to Add XAU/USD on MT5 & MT4

Given its popularity, most brokers list the XAU/USD, the trading symbol on MT4/MT5, by default in the Market Watch tab on the left-hand side of the trading platform.

Here is how to add XAU/USD on MT4/MT5 if a broker does not list it by default:

- Open your MT4/MT5

- Right-click anywhere in the Market Watch tab and click "Symbols" or press CTRL + U.

- Locate gold in the list.

- Click “Show”

Noteworthy:

- Traders can also click the green “+” in the bottom-left corner of the Market Watch tab and type XAU/USD or gold.

- Right-clicking anywhere in the Market Watch tab and clicking “Show All” will show every asset the broker offers on the trading platform.

Understanding the XAU/USD Chart on MT4 & MT5

Before learning to trade gold on MT5, traders should understand the XAU/USD chart.

Core aspects of the XAU/USD Chart

- The X-axis represents time.

- The Y-axis represents the price.

- Traders can choose from various chart types, like bar, line, or candlestick.

- MT5 supports over a dozen time frames.

- One-click trading is available at the top-left corner of the chart.

- 1.0 standard lot in the XAU/USD equals 100 ounces of gold.

Pros & Cons of Trading Gold on MetaTrader

Part of understanding how to trade gold on MT5 includes knowing the pros and cons of gold trading on MetaTrader.

Pros of Trading Gold on MetaTrader

- Availability

- Algorithmic trading

- Copy trading

- Mobile trading

- Multiple gold crosses

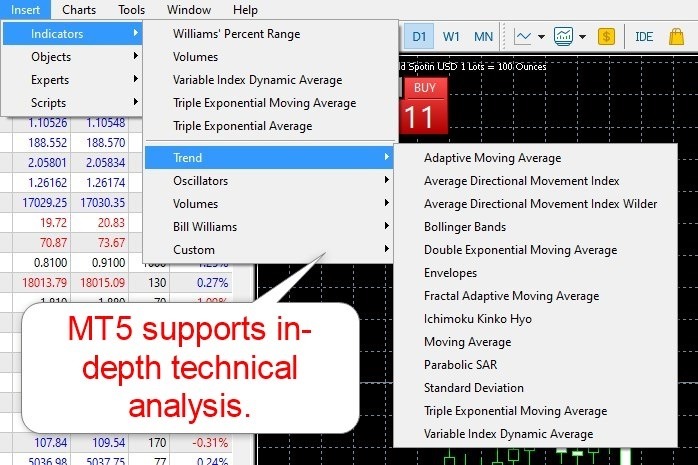

- In-depth technical analysis

Cons of Trading Gold on MetaTrader

- Traders need to educate themselves properly.

- Dated user interface.

How to Trade Gold on MT5

Every trader has preferences for analyzing gold trends and managing gold positions. Despite the differences, some similarities remain, as noted below.

Technical Analysis

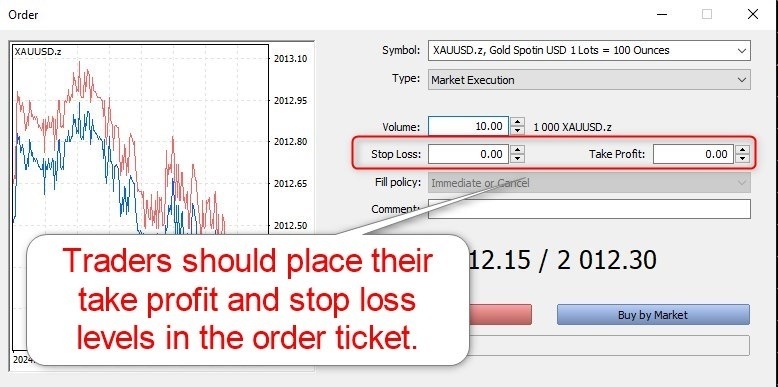

Stop Loss and Take Profit levels.

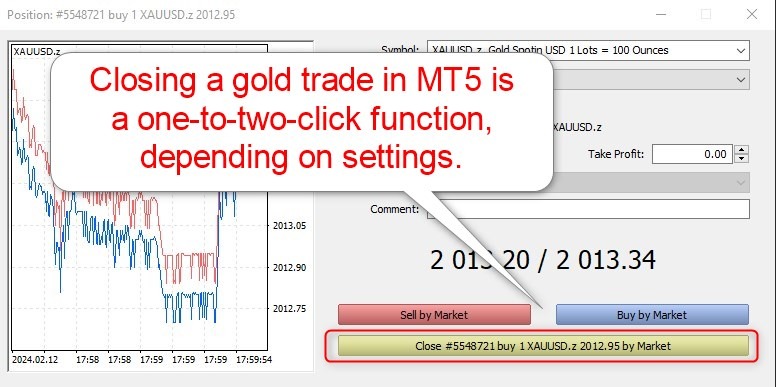

Closing Gold Positions

Maximizing Your Chances of Trading Gold Successfully

Learning how to trade gold on MT5 is simple but challenging. You can consider our tips below to maximize your gold trading success.

Tips on how to trade gold on MT5:

- Invest sufficient time into in-depth education.

- Know the factors that can move gold prices, including geopolitical uncertainty, interest rates, global economic data, and the US Dollar, which often positively correlates with gold prices.

- Understand the relationship between leverage and risk management

- Learn how to use entry, exit, take profit, and stop loss levels.

- Trade with sufficient capital and adjust your lot size accordingly.

Bottom Line

Trading gold on MT5 offers traders an excellent opportunity to hedge their portfolios, earn from price action, take advantage of deep liquidity, and take advantage of many short-term and long-term trading opportunities. Unlike most assets, gold prices can fluctuate due to many factors, making it more challenging to trade. Therefore, beginners must invest sufficient time in education before trading gold. MT5 is an excellent gold trading platform that supports in-depth technical analysis and algorithmic trading.