It took me many years into my trading career to understand that market sentiment is decisive in producing orders that drive price moves.

However, this knowledge alone is not enough. To use market sentiment effectively, we need to understand the concept in-depth and gain familiarity with the necessary tools. In this article, we will do exactly that.

What is Forex Market Sentiment?

Market sentiment is the combined sum of all the individual views in the market.

Every market participant, from the smallest retail trader to a professional fund manager, will arrive at a bullish, bearish, or neutral view of the market. Market sentiment is the combined sum of all those individual views. I like to think of Market Sentiment as the “tip of the spear”— the result of all the information, from news announcements and economic data to chart patterns, swirling around and going through the brains of all the traders and ultimately giving price an overall direction.

Of course, not all views are equal: a small trader with a thousand dollars will not affect the market as an asset manager with a billion dollars. Market sentiment must weigh views accordingly.

As traders, it’s our job to gauge the overall market sentiment to have a bias on how the market may move.

Market Sentiment Indicators

Indicators under the “Market Sentiment" category track how market participants have positioned themselves. Let’s spotlight some of them.

Commitment Of Traders (COT) Report

This is probably the most famous Market Sentiment report. The COT report informs the public of the big positions in the market. Knowing what the big players are doing can help us find a market at the beginning of a trend. “The trend is your friend,” and trading is easier knowing the direction of the trend.

- The COT report is a weekly report released by the CFTC every Friday at 3:30 p.m. ET. It shows the open interest in several markets from the previous Tuesday. (Open interest is the total number of contracts market participants hold.) The report breaks down the net longs and net shorts.

- There are several sections in the reports: Commercials, Non-Commercials, and Unreportable.

- Commercials are businesses that use futures to hedge price activity for their operations, such as an airline needing to hedge jet fuel price, i.e., do not have speculative goals.

- Non-commercials: banks and funds. They want to make a profit from price movements.

- Non-reportable are small speculators with positions small enough not to require reporting.

- Commercials and non-commercials have reporting requirements when they trade a minimum number of contracts.

- Commercials and Non-Commercials COT data often move in opposite directions because Commercials want to hedge and are countertrend, and Non-commercials want to make money in the direction of the trend.

- The COT report titled “Trades in Financial Futures” contains data on currency futures, which is the most relevant for Forex Market Sentiment.

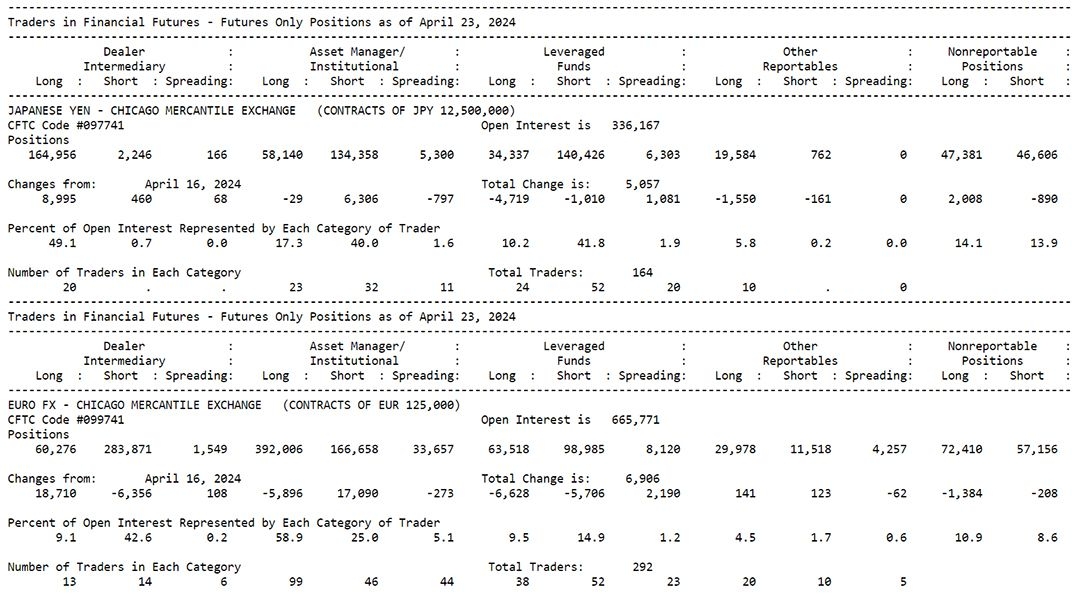

Anyone can download the COT report from the CFTC.gov site, and it is simply raw data like this section containing Japanese Yen and Euro futures data:

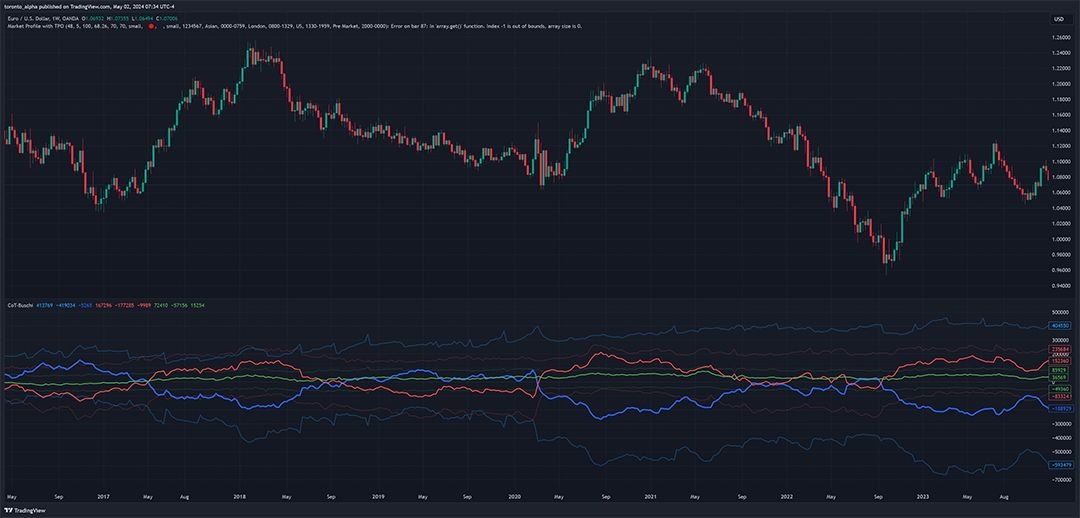

The COT report is not user-friendly—imagine having the OHLC prices written out for Forex pairs instead of candlestick charts! The best way to use COT data is when it is charted. Traders and third-party programmers have written COT indicators and even a COT Index that works like an oscillator with a 0-100 scale to interpret COT data. Here’s a COT indicator written by a third party on TradingView:

The different lines show the Commercials, Non-Commercials and Non-reportable longs and shorts.

Entire books have been written about how to trade the COT report, but here are some key ideas:

- At the beginning of uptrends, Non-commercials typically increase longs and reduce shorts.

- At the beginning of downtrends, Non-commercials typically increase shorts and reduce longs.

- When net longs and net shorts increase simultaneously, especially after a trend, it signals an accumulation or distribution phase, i.e., a reversal setting up a new trend.

- When Non-commercials move from Net Long to Net Short, look for the price to decrease, or when moving from Net Short to Net Long, look for the price to increase.

The Above Concepts Should Not Be Used in Isolation

Changes in COT data should be taken as a bias and then confirmed with additional tools such as technical patterns.

COT Is Not a Timing Signal. It’s Used to Find Long-Term Trends

The COT report is weekly and is a tool for helping to spot long-term trends rather than lower timeframe market timing.

Whenever I read these types of articles, I ask if there are traders who have used the techniques successfully. An example of success using COT is Maxim Schutz, a German trader and multiple award winner of the World Cup of Futures Trading. He ranked in the top 5 of various trading competitions in 2017, 2019, and 2020 using Commitment Of Traders reports.

Brokers' Position Summaries

Many Forex brokers publish the aggregate percentage of traders or trades currently long or short in different Forex pairs. Remember, this is the data from the brokers’ client, not the entire market. The larger the broker, i.e., the larger the sample size, the more reliable the position summaries. It’s also good to check multiple brokers to develop a consensus.

When multiple brokers show extreme readings, there is a higher chance of a reversal.

Futures Open Interest

Open interest is the number of contracts that are not settled and remain open. Futures Open Interest is more accurate than spot Forex data because it is from centralized exchanges rather than individual brokers, which may or may not accurately represent the marketplace.

Yet, traders can use Futures Open Interest data to help analyze spot Forex moves because the two are highly correlated.

Here’s a quick cheat sheet to interpret open interest:

- Rising futures price with rising open interest: strong/strengthening trend

- Rising futures price with falling open interest: weakening trend

- Falling futures price with rising open interest: weak or weakening trend

- Rising futures price with rising open interest: strengthening trend

As an example, if we see the British Pound futures price (known as “6B” on the Chicago Mercantile Exchange) rising along with rising open interest, I would be bulling on GBPUSD in spot Forex.

Open interest data is available on charting platforms, such as TradingView or directly from the exchanges.

Examine Reactions to News for Sentiment Trading

This is the most subjective area of sentiment analysis and has no traditional indicators to support it. It often also means knowing a little about the economic calendar or fundamental news announcements. But I’ve experienced consistent success when I spot these trades, and I think this is one of the purest and best ways to take advantage of market sentiment.

Look for Price Movement in the Opposite Direction of News

For example, if there is a stronger-than-expected GDP data release but the Forex pair falls on the news, then I would take that as a very bearish signal. I can also apply this to other markets, such as stocks: e.g. if earnings are more bullish or bearish than expected, but the price moves in the opposite direction to the bullishness or bearishness, then I would take that as a huge sign.

How to Develop a Market Sentiment-Based Trading Approach

- Decide what sentiment data you wish to use. Remember, COT data is weekly and gives longer-term bias. Open interest data can be available daily giving it more precision or helping with shorter-term trades.

- Like any trading approach, develop the concept into a strategy with entry, take profit and stop-loss rules. The strategy does not have to be purely mechanical, but at the very least, there should be criteria for when to get in and out of a trade. This article's COT and Open Interest sections contain some key ideas on how to use the data to make trading decisions.

- Continually practice, learn, and test. This article is a starting point. There are successful traders incorporating market sentiment data that teach their methods.

Pros & Cons of Trading Using Sentiment Indicators

Pros

- All the information in the market ultimately creates market sentiment, so tracking it reveals how the market is currently positioned.

- Market sentiment indicators can reveal turning points before the price reverses.

- Very often, public sentiment is opposite to institutional sentiment. Market sentiment indicators help you track institutions which move prices rather than getting trapped in public sentiment, which is often wrong at key turning points.

Cons

- Market sentiment indicators and concepts are subjective and can be open to interpretation.

- COT data, in particular, is only useful for long-term trends and reversals.

- It takes a lot of time and practice to apply market sentiment indicators profitably.

Bottom Line

Market sentiment is decisive in producing orders that drive price moves. Indicators like the Commitment Of Traders report and Futures Open Interest help track market sentiment in Forex and other markets. Traders can also look at how the price reacts following news events to track sentiment. Using these tools can reveal sentiment in a way that is not visible on the price chart, but it is subjective and takes practice.