Accuindex Editor’s Verdict

Accuindex describes itself as a young force in the Forex and CFD markets, committed to delivering a powerful, accessible, and fair trading experience. It offers out-of-the-box MT4/MT5 trading platforms and a balanced asset selection with reasonable trading fees. The recently added Accuindex Academy presents high-quality research and education for beginners. I conducted an in-depth review of this broker to evaluate its trading conditions. Should you consider Accuindex as your next broker?

Overview

A high-quality educational and research service from a balanced Forex broker.

Mauritius CySEC, FSC Mauritius 2017 ECN/STP, Market Maker $100 MetaTrader 4, MetaTrader 5 71.92% 0.0 pips 0.8 pips $5.00 per 1.0 standard round lot) 8

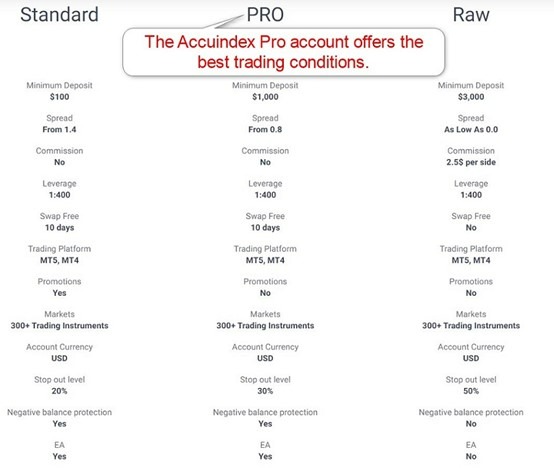

I prefer the trading conditions in the Accuindex Pro account, which requires a minimum deposit of $1,000, as the cheaper Raw alternative does not support algorithmic trading and lacks negative balance protection. With 70+ currency pairs, Accuindex maintains competitive sector coverage, while beginners benefit from high-quality education and research.

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Accuindex presents clients with two regulated entities and maintains a secure trading environment.

Name of the Regulator | CySEC, FSC Mauritius |

|---|

Is Accuindex Legit and Safe?

Accuindex lacks operational longevity but maintains a spotless regulatory record with two recognized regulators. Therefore, I believe it will continue to provide a legit and safe trading environment for clients. It segregates client deposits from corporate funds and offers negative balance protection. Accuindex also operates an unregulated but duly registered subsidiary in St. Vincent and the Grenadines, registration number 23639 IBC 2016.

Fees

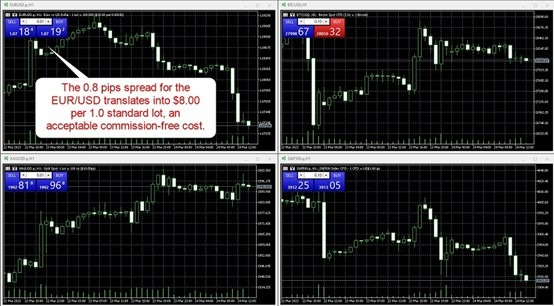

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Traders may choose between two commission-free and one commission-based cost structure. The Standard account commences with a pricing environment with minimum spreads of 1.4 pips or $14.00 per 1.0 standard round lot. Accuindex trading fees decrease to a minimum of 0.8 pips or $8.00 per lot in the Pro account, while the commission-based Raw option features raw spreads from 0.0 pips for a commission of $5.00 per round lot.

Since the Raw account does not support algorithmic trading and lacks negative balance protection, I see the Pro account as a good option, as it delivers the best overall trading conditions.

Minimum Raw Spreads | 0.0 pips |

|---|---|

Minimum Standard Spreads | 0.8 pips |

Minimum Commission for Forex | $5.00 per 1.0 standard round lot) |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at Accuindex are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.4 pips (Standard) | $0.00 | $14.00 |

0.8 pips (Pro) | $0.00 | $8.00 |

0.0 pips (Raw) | $5.00 | $5.00 |

Here is a screenshot of Accuindex fees during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Noteworthy:

- Accuindex fails to list swap rates in their trading platform.

- Traders must consider swap rates unless they close trades before the cut-off time, usually 17:00 EST.

Range of Assets

Forex traders get 70+ currency pairs at Accuindex, making it a good choice due to its above-average sector coverage. Commodity traders get a selection of five assets plus associated futures contracts. Equity traders can diversify via 180+ liquid blue chip CFDs listed in the UK, Germany, France, Spain, the US, and Hong Kong, plus eleven index CFDs and associated futures contracts. The cryptocurrency selection lists only a selection of 4 crypto CFDs. I conclude that Accuindex caters overall well to Forex traders and those requiring fewer but highly liquid assets in other asset classes.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Accuindex Leverage

The Accuindex leverage depends on the operating subsidiary and asset class. Forex traders get a maximum of 1:400, but only at the Mauritius and St. Vincent and Grenadines subsidiaries. Commodity CFDs max out at 1:200, index CFDs at 1:100, equity CFDs at 1:20, and cryptocurrencies at 1:400. Traders with the Cyprus subsidiary get maximum leverage of 1:30, mandated by local regulatory requirements.

I like the tiered margin, where Accuindex lowers the maximum leverage in a four-tier system based on the number of open lots to improve risk management for traders and itself. Traders should ensure they execute risk management to avoid magnified losses. Accuindex offers negative balance protection, except in the commission-based Raw account, meaning traders can never lose more than their deposits.

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, cryptocurrencies, and commodities, which essentially trade 24/5

- Accuindex does not offer 24/7 cryptocurrency trading.

Account Types

Accuindex offers two commission-free and one commission-based account type. Trading conditions in the Standard and Pro accounts are nearly identical, with the most significant difference in trading fees. The former has minimum spreads of 1.4 pips or $14.00 per 1.0 standard round lot versus 0.8 pips or $8.00 in the latter. The minimum deposit requirements are $100 and $1,000, respectively. The Pro account does not qualify for bonuses, and the automatic stop-out level is 30% versus 20% in Standard.

The commission-based Raw account has the lowest fees, with raw spreads from 0.0 pips for a commission of $5.00 per 1.0 standard round lot. Accuindex disables algorithmic trading and negative balance protection for this account type. The minimum deposit requirement is $3,000, and the automatic stop-out level is 50%. Accuindex offers the US Dollar as the account base currency on all account types.

Accuindex Demo Account

Accuindex offers demo accounts, which traders can easily add and manage from the secure back office. They are fully flexible, and I recommend traders use settings similar to their planned live deposits to get the most realistic demo trading experience. Accuindex does not list a limit on how many demo accounts one client can open, and there is no noted time limit. This shows Accuindex understands the needs and necessities of demo traders.

I want to caution beginner traders intending to use demo trading as a dull simulation tool to consider the inherent limitations of demo accounts. Demo trading does not offer full exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders can use the out-of-the-box MT4/MT5 trading platforms. They are available as powerful desktop clients, lightweight web-based alternatives, and user-friendly mobile apps. Both fully support algorithmic trading and have embedded copy trading services. MT4 remains the most versatile trading platform with 25,000+ EAs, custom indicators, and templates. Accuindex provides MT4 for Windows devices, while MT5 is available on Windows and MacOS. Traders can use the mobile apps for both trading platforms on Android and iOS devices.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

Accuindex is a newer broker focused on providing a competitive core trading environment. My review found no unique features for seasoned traders but good trading conditions in the Pro account, which offers Accuindex a foundation for growth and revenue generation, allowing it to add value-added features as this broker grows and matures. I like to point out the recently launched Accuindex Academy to beginners seeking a well-structured educational offering and actionable trading signals.

Research and Education

Traders get market research under the Accuindex Insights section, while the Accuindex Academy features actionable trading recommendations. The Daily News section combines short videos with market-moving headlines and written technical trading recommendations. The content remains well-written and easy to follow for beginners.

The Accuindex Academy provides quality education via three courses, Beginner, Intermediate, and Advanced. Beginners will also get plenty of educational content in the Accuindex Insights section, which is available to everyone. The video lessons available in the courses are short but ensure beginners leave with a basic understanding. The format is ideal for Millennial and GenZ traders while lacking in-depth coverage of topics.

I recommend beginners start with the Accuindex Academy to acquire the core knowledge and then complement their education via third-party sources for in-depth content before funding an Accuindex trading account. I urge beginners to master trading psychology and avoid paid-for courses.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |        |

Accuindex provides 24/5 customer support, but during my review, I could only interact with their chatbot during regular business hours. Therefore, I recommend e-mail support for non-urgent matters, and I appreciate the availability of phone support for urgent questions. The FAQ section offers limited answers to common issues.

Bonuses and Promotions

Accuindex offers a 50% deposit bonus of up to $25,000 for new and existing clients. Terms and conditions apply, and I recommend traders read and understand them before accepting any monetary incentive. I like that the bonus is withdrawable, making it an ideal portfolio boost for high-volume and high-frequency traders. Those committed to growing their portfolio via generic income generation and follow-on deposits before considering withdrawals will also benefit from the bonus.

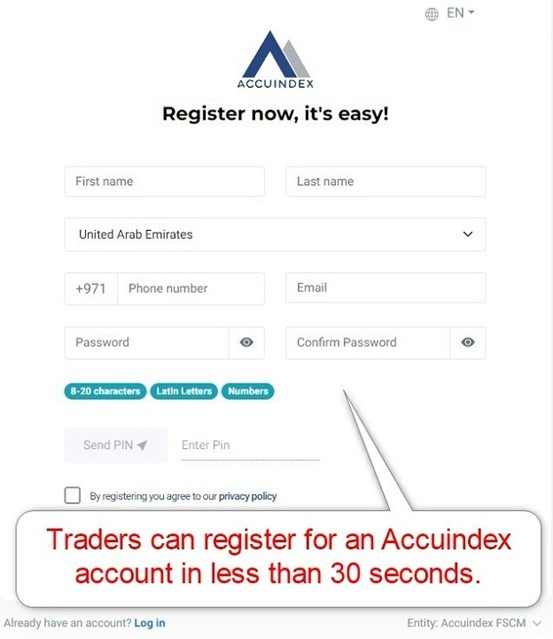

Opening an Account

The online application to open an Accuindex account follows well-established industry standards. Traders must provide their name, country of residence, phone number, e-mail, and desired password. Accuindex will send a confirmation pin, which completes the account registration process.

Account verification is mandatory, as Accuindex complies with two regulators and follows AML/KYC rules. Uploading a copy of their ID and one proof of residency document allows most traders to become verified. Accuindex might ask for additional information on a case-by-case basis.

Minimum Deposit

The Accuindex minimum deposit is between $100 and $3,000, dependent on the account type.

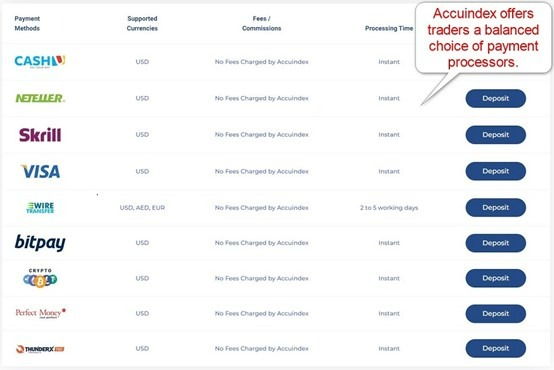

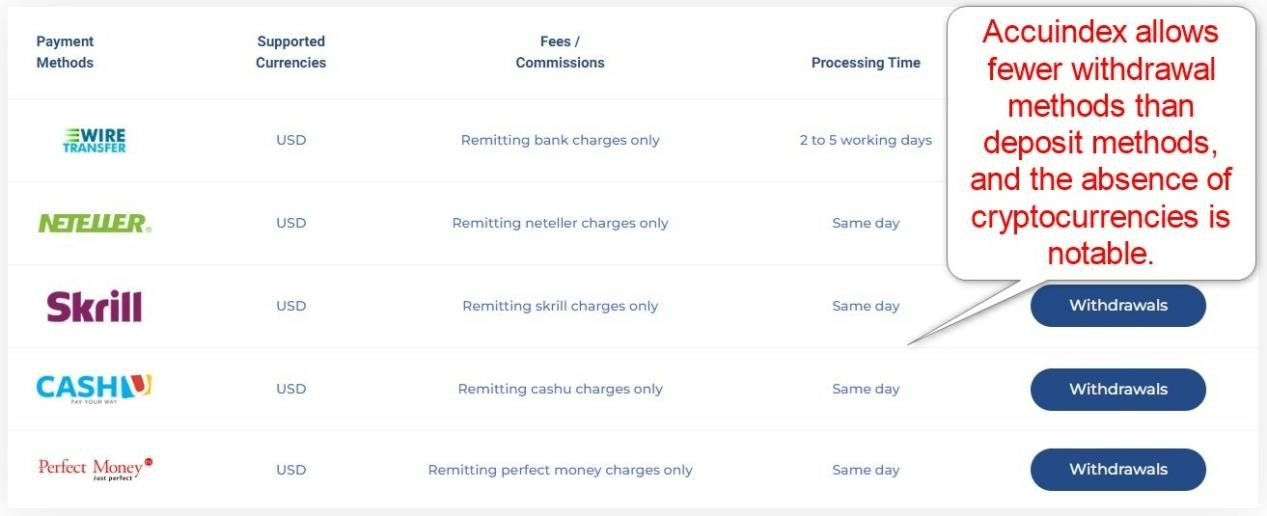

Payment Methods

Accuindex supports bank wires, credit/debit cards, Skrill, Neteller, Perfect Money, CASHU, ThunderXpay, and cryptocurrencies.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

Accuindex accepts traders resident in many countries except the US, Canada, Israel, Japan, North Korea, Belgium, and UN/EU-sanctioned countries.

Deposits and Withdrawals

The secure Accuindex back office handles all financial transactions for verified clients.

The Accuindex minimum deposit ranges between $100 and $3,000, dependent on the account type, and Accuindex does not list a minimum withdrawal amount. There are no internal processing fees, but traders should consider third-party payment processing costs and currency conversion fees.

Internal processing times are instant for deposits, except for bank wires, which take two to five business days. Accuindex processes withdrawal requests the same day, and bank wires take two to five business days. External processing times depend on the geographic location of traders and their chosen payment processors. Some payment processors have geographic restrictions, but the Accuindex back office will only list the ones available to traders.

Accuindex only allows US Dollar deposits and withdrawals, except for bank wire deposits, which are available in Euros and United Arab Emirates Dirhams. Withdrawal options are fewer than deposit methods, and traders should carefully consider the differences. The name on the payment processor must match the Accuindex account name.

Is Accuindex a good broker?

I like the trading environment at Accuindex in the Pro account for its acceptable trading fees. The Raw alternative has lower costs but does not support algorithmic trading and lacks negative balance protection. While the minimum deposit of $1,000 is notably higher than the $100 for the Standard options, the sharp decrease in trading costs makes it worth the higher capital requirement. I also like the research and education for beginners, while the withdrawable bonus provides committed traders with a valuable tool to grow their portfolios.

Accuindex is a comparatively young broker, but it possesses a sound foundation from which it can grow its market share, which should lead to an increase in value-added services, and, hopefully, a decrease in trading fees. I would welcome a volume-based rebate program, but I rate Accuindex as a trustworthy broker with untapped potential.

Yes, Accuindex is a good Forex broker due to competitive trading costs and 70+ currency pairs. The Pro account offers Forex traders the best trading conditions, including negative balance protection and algorithmic trading. No, Accuindex is not a scam but a regulated multi-asset CFD broker with a spotless regulatory track record. The Accuindex minimum deposit is $100 for the Standard account, $1,000 for Pro, and $3,000 for Raw. Accuindex is a safe broker with regulatory oversight in two jurisdictions, where it has a clean operational track record since 2017, the year of its foundation.FAQs

Is Accuindex a good Forex broker?

Is Accuindex a scam?

What is the Accuindex minimum deposit?

Is Accuindex safe?