Editor’s Verdict

ACY Securities offers traders Capitalise AI, allowing traders to deploy algorithmic strategies in a code-free environment. The core MT4/MT5 trading platforms are available, and copy traders get Tradingcup. The commission-based trading accounts grant competitive trading fees, and this Australian-headquartered multi-asset broker supports 16 payment processors, including cryptocurrencies. I conducted an in-depth review of this broker to evaluate its competitive edge. Should you trade with ACY Securities?

Overview

ACY Securities maintains cutting-edge trading infrastructure and low fees for active traders.

Headquarters | Australia |

|---|---|

Regulators | ASIC |

Owned by Public Company? | |

Year Established | 2011 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $50 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

Average Trading Cost GBP/USD | 1.1 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.15 |

Average Trading Cost Bitcoin | $16.80 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 16 |

Islamic Account | |

US Persons Accepted? | |

Managed Accounts |

I like the trading tools at ACY Securities, creating a competitive edge where Capitalise AI stands out. It is also an excellent broker for copy traders, who get four providers to diversify their portfolios. Beginners get a broad-based educational offering, making it an ideal broker for clients across the trading spectrum.

ACY Securities Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. ACY Securities has one regulated subsidiary with a clean track record.

Is ACY Securities Legit and Safe?

ACY Securities, founded in 2011, is a well-trusted Australian-based broker. It segregates all client deposits from corporate funds held at Commonwealth Bank, and ACY Securities has professional indemnity insurance. Negative balance protection applies to all retail trading accounts. ACY Securities also operates an unregulated but duly registered subsidiary in St.Vincent and Grenadines, which counts Blueberry Markets as its introducing brokers.

My review did not find any misconduct or malpractice by this broker. I can confidently recommend ACY Securities, as it is a legitimate and safe broker with a clean record.

Country of the Regulator | Australia |

|---|---|

Name of the Regulator | ASIC |

Regulatory License Number | 403863 (AFSL) |

Regulatory Tier | 1 |

Fees

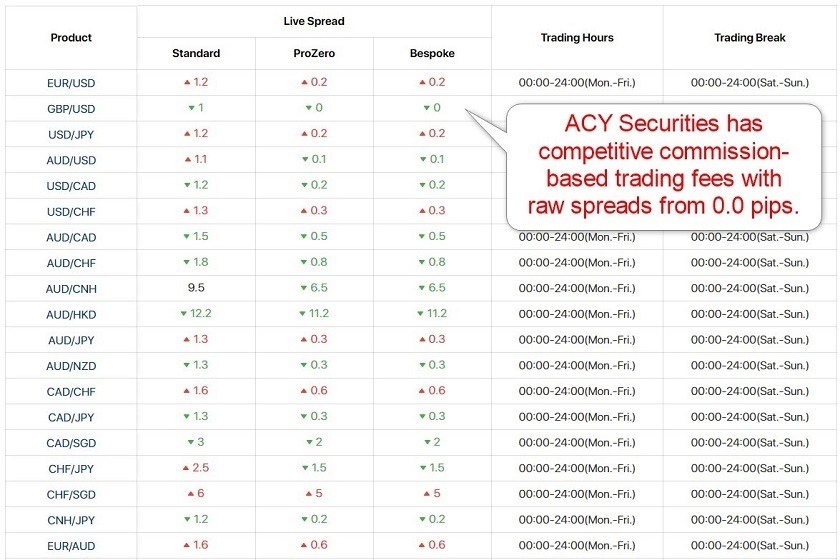

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Traders can choose between a commission-free cost structure and two competitively priced commission-based alternatives.

The commission-free Standard account has Forex spreads of 1.0 pips or $10.00 per 1.0 lot, with most ranging between 1.0 and 1.7 pips. The commission based ProZero and Bespoke alternatives have raw spreads from 0.0 pips for a commission of $6.00 and $5.00, respectively.

There is no inactivity fee, ACY Securities does not levy internal deposit costs, and traders get three free monthly withdrawals before a $25 charge applies.

The minimum trading costs for the EUR/USD at ACY Securities are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips (Standard) | $0.00 | $10.00 |

0.0 pips (ProZero) | $6.00 | $6.00 |

0.0 pips (Bespoke) | $5.00 | $5.00 |

Here is a snapshot of ACY Securities’ trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission based ProZero account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the ProZero account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $6.00 | -$6.01 | X | $14.01 |

0.2 pips | $6.00 | X | $3.87 | $4.13 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the ProZero account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $6.00 | -$42.07 | X | $50.07 |

0.2 pips | $6.00 | X | $27.09 | -$19.09 |

Noteworthy:

- ACY Securities offers positive swap rates on qualifying assets, allowing traders to earn money, like in the example above.

Average Trading Cost EUR/USD | 1.1 pips ($11.00) |

|---|---|

Average Trading Cost GBP/USD | 1.1 pips ($11.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.15 |

Average Trading Cost Bitcoin | $16.80 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

Range of Assets

ACY Securities maintains 2,200+ trading instruments covering Forex, cryptocurrencies, commodities, indices, equities listed in the US and Australia, and ETFs. Forex traders get 60+ currency pairs, while the 9 cryptocurrency CFDs, 17 commodity CFDs, and 21 index CFDs offer good diversification opportunities. The ETF selection consists of dozens of liquid ETFs. I like the overall range of assets at ACY Securities for its well-balanced approach.

ACY Securities Leverage

Maximum Retail Leverage | 1:500 |

|---|---|

Maximum Pro Leverage | 1:500 |

ACY Securities offers a maximum Forex leverage of 1:500 to non-Australian clients via its St.Vincent and Grenadines subsidiary versus 1:30 for the ASIC-regulated brokerage. Qualified traders can increase it to 1:500. Non-Forex assets have higher margin requirements, resulting in lower total leverage.

Negative balance protection ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

ACY Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Cryptocurrencies | Monday 00:05 | Friday 23:55 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:00 | Friday 24:00 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 16:30 | Friday 23:00 |

ETFs | Monday 16:30 | Friday 23:00 |

Account Types

Account types at ACY include the commission-free Standard account, which has a minimum deposit requirement of only $50. ACY Securities offers a competitive cost structure in its ProZero account, where traders get raw spreads for a commission of $6.00 per 1.0 standard round lot. The minimum deposit requirement is a very reasonable $200. Traders with $10,000+ can lower commissions to $5.00 per lot in the Bespoke account.

A swap-free Islamic account is available. However, ACY Securities replaces swap rates with flat-fee costs between $2.50 and $10.00 per lot.

ACY Securities Demo Account

ACY Securities offers demo accounts for MT4/MT5, which some sources claim expires in 30 days. Still, traders can ask customer support for a non-expiry option. The default demo balance of $100,000 is excessive, but MT4/MT5 have fully customizable options. I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

ACY Securities offers traders MT4/MT5 as a desktop client, a web-based alternative, and a mobile app. Both platforms support algorithmic trading, where MT4 remains the industry leader, and the MT4/MT5 trading platforms have embedded copy trading services.

Capitalise AI, enabling algorithmic trading in a code-free environment, provides an incredible service and a notable competitive edge. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs or 5,000+ for MT5. Please note that quality upgrades or functioning EAs cost money. ACY Securities provides 15 quality upgrades with well-explained videos.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Scalping | |

Hedging | |

One-Click Trading |

Unique Features

Besides Capitalise AI and the 15 MT4/MT5 plugins, ACY Markets offers Tradingcup for copy trading, enabling traders to diversify their portfolios passively. VPS hosting for algorithmic trades requiring low-latency 24/5 market access is available for $35 monthly, which becomes free of charge for traders who transact at least 20 lots monthly. Another unique feature of ACY Securities is the 46 liquidity providers it uses.

Research & Education

Six analysts provide research at ACY Securities, where I can recommend the one-hour-plus videos discussing key levels on dozens of assets. It is an excellent research and educational service for beginners. The Market Analysis presents a well-structured and thought-out service, placing ACY Markets among the best brokers offering in-house research.

ACY Securities features an excellent educational section consisting of well-written content, video trading courses, e-books, webinars, and seminars. I highly recommend it to beginners, and the research posted as videos adds tremendous educational value. The content for beginner traders at ACY Securities is among the best I have reviewed. It shows the care the team put into creating a valuable service rather than having some content for the sake of having it like most brokers have.

Therefore, beginners should take advantage of the educational content at ACY Securities. I also recommend additional in-depth education covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

ACY Securities offers 24/5 customer support but explains its products and services well, minimizing the need to contact a support representative. Traders can e-mail or call, but I recommend live chat, as the response time is reasonable and provides correct answers rather than push for an account opening.

Phone support exists, but I need a direct line to the finance department, where most issues can arise. The FAQ section answers many questions. Traders can search for answers before seeking additional help.

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |                 |

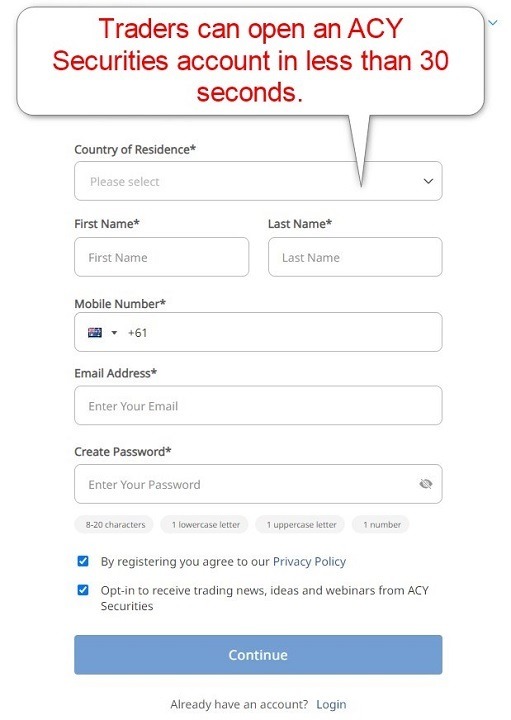

Opening an Account

The online application form onboards new clients, following well-established industry practices. New clients must provide their country of residence, name, e-mail, phone number, and desired password. It will grant access to the back office.

ACY Securities complies with global AML/KYC requirements. Therefore, account verification is mandatory. Uploading a copy of their government-issued ID and one proof of residency document allows most traders to pass account verification. ACY Securities may ask for additional information on a case-by-case basis.

Minimum Deposit

The ACY Securities minimum deposit is $50.

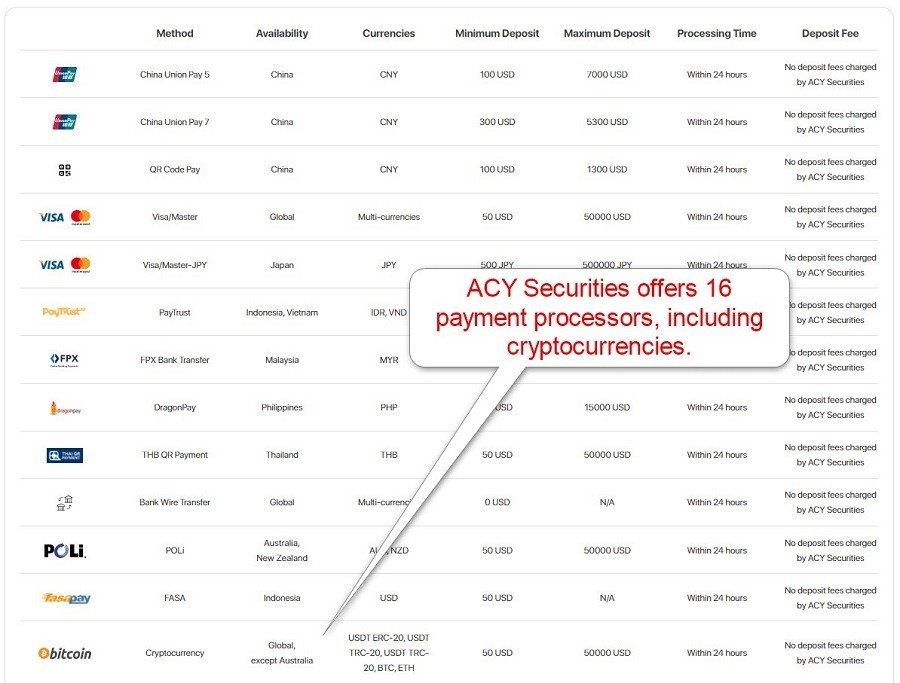

Payment Methods

ACY Securities payment methods are bank wires, credit/debit cards, China Union Pay, QR Code Pay, PayTrust, FPX Bank Transfer, Dragonpay, THB QR Payment, POLi, FasaPay, cryptocurrencies (USDT ERC-20, USDT TRC-20, USDT TRC-20, BTC, ETH), Skrill, Perfect Money, Neteller, and SticPay.

Withdrawal options |         |

|---|---|

Deposit options |         |

Accepted Countries

ACY Securities accepts clients from many countries and does not publish a list of restricted countries. The FAQ section explicitly states that US-based traders cannot open an account.

Deposits and Withdrawals

The secure ACY Securities back office handles all financial transactions for verified clients.

The minimum and maximum deposit amounts depend on the payment processors, which start from $50. ACY Securities does not levy internal deposit fees, while third-party payment processing costs may apply. ACY Securities supports 16+ currencies, and traders should consider currency conversion fees. The deposit processing time is within 24 hours, but most e-wallets have instant to near-instant deposits.

ACY Securities offers clients three free withdrawals monthly, which more than suffices, and levies a $25 withdrawal fee for additional transactions. Traders who send their withdrawal request before 16:00 AEST benefit from same-day processing.

The name on the payment processor and ACY Securities trading account must match in compliance with AML regulations.

Is ACY Securities a good broker?

I like the trading environment at ACY Securities for its trading tools, low trading fees, and cutting-edge infrastructure, including fast order execution under 30ms and 46 liquidity providers. Traders get the MT4/MT5 trading platforms, Capitalise AI, Signal Start, SoFinX, VPS hosting, and 15 high-quality MT4/MT5 plugins.

ACY Securities supports 16 payment processors in 16+ currencies that include several cryptocurrencies. It offers high-quality research and educational content to beginners. Passive income seekers get a high-paying partnership program, and the 24/5 customer support ranks among the best industry-wide due to its fast response times and quality answers. I highly recommend ACY Securities and rate it among the leading multi-asset brokers without restrictions on trading strategies. Yes, a demo account is available at ACY Securities, and clients can request a non-expiry demo account ideal for testing algorithmic trading solutions, signal providers, and new strategies. ACY Securities has 12+ years of operational experience under ASIC supervision with a clean track record. It established itself among the most trusted brokers in the industry. The ACY Securities minimum deposit starts from $50. ACY Securities ranks among the best brokers due to its cutting-edge trading infrastructure, low trading fees, excellent trading tools, superb customer support, and quality research and education for beginners.FAQs

Does ACY Securities offer a demo account?

Is ACY Securities trustworthy?

What is the ACY Securities minimum deposit?

Is ACY Securities a good broker?