For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

ADSS offers traders its proprietary ADSS trading platform alongside MT4. Unlike most brokers, ADSS is a financial service firm operating out of the UAE. ADSS is the biggest Forex trader in the GCC/MENA region and maintains a commission-free cost structure. I reviewed ADSS thoroughly to evaluate the competitiveness of its trading environment. Is ADSS the right broker for you?

Overview

Good pricing transparency from the leading Forex broker in the Middle East / MENA.

Headquarters | United Arab Emirates |

|---|---|

Regulators | SCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2010 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4 |

Average Trading Cost EUR/USD | $9.00 |

Average Trading Cost GBP/USD | $16.00 |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | 0.05% - 0.75% |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the transparency on trading fees at ADSS. The balanced asset selection and educational content for beginners are good, and I like the familiarity of MT4. This detailed ADSS review includes all the relevant information you need to know to find out whether the broker will suit you.

ADSS Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. ADSS presents clients with a well-regulated entity and maintains a secure trading environment.

Country of the Regulator | United Arab Emirates |

|---|---|

Name of the Regulator | SCA |

Is ADSS Legit and Safe?

ADSS is a dominant financial services firm in the Middle East, the leading Forex trader in the GCC and the MENA region, complies with its regulator where it maintains a spotless record, and has an operational history spanning 10+ years. The management team is skilled and knowledgeable, it segregates client deposits from corporate funds.

ADSS has earned a trustworthy reputation, catering to high-net-worth clients, central banks, asset managers, brokerage firms, and hedge funds. ADSS also provides Forex commentary on CNBC, Bloomberg, and CNBC Arabiya. Therefore, I rate ADSS as a legit, safe broker, that features well in any MENA broker review. Which MENA broker is perfect for you will depend on your client needs, so read on to find out more.

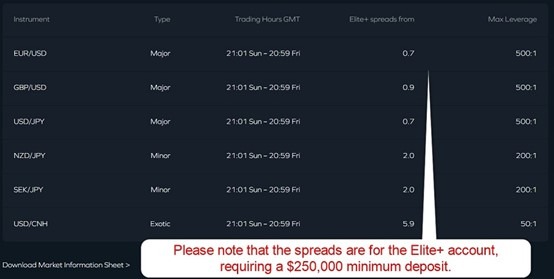

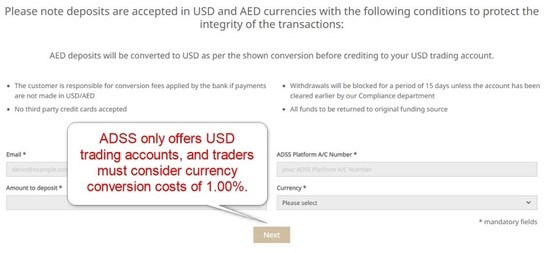

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Forex trading at ADSS is commission-free for retail traders, where minimum spreads start from 1.2 pips or $16.00 per 1.0 standard round lot. Traders with deposits exceeding $250,000 get a cost structure starting at 0.7 pips. Equity CFD commissions are 0.20%, and swap rates are reasonable. Additionally, traders should be aware of the 1.00% currency conversion fee and the $5 minimum withdrawal charge.

Average Trading Cost EUR/USD | $9.00 |

|---|---|

Average Trading Cost GBP/USD | $16.00 |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.38 |

Average Trading Cost Bitcoin | 0.05% - 0.75% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.7 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

The minimum trading costs for the EUR/USD currency pair at ADSS are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.2 pips (Classic) | $0.00 | $16.00 |

0.9 pips (Elite) | $0.00 | $11.00 |

0.7 pips (Elite+) | $0.00 | $7.00 |

Here is a snapshot of ADSS trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Classic account.

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.7 pips | $0.00 | -$8.60 | X | $15.10 |

0.7 pips | $0.00 | X | $3.40 | $3.70 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD, at the minimum spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.7 pips | $0.00 | -$56.70 | X | $63.70 |

0.7 pips | $0.00 | X | $23.10 | -$16.10 |

Noteworthy:

- ADSS offers positive swap rates in qualifying assets, meaning traders can get paid for holding leveraged overnight positions, like in the example above on EUR/USD short positions.

- ADSS CFD broker services offer clients access to CFD markets on a broad range of underlying assets.

Range of Assets

The ADSS asset selection covers Forex, commodities, indices, bonds, futures, and equity CFDs listed across Europe, the US, Asia, and the Middle East. I discovered 54 currency pairs and 2 commodities listed in its daily financing sheet. The market information sheet showed 8 more commodities, 6 bonds, 17 indices, and 10 futures contracts. Retail traders will have sufficient assets, and I like the availability of Saudi Arabian equity CFDs, but ADSS would do well to increase its transparency about its range of assets.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

ADSS Leverage

Forex traders get maximum leverage between 1:50 and 1:500, dependent on the liquidity of the currency pairs, which is highly competitive, and I appreciate the risk-adjusted flexibility. Commodity traders max out between 1:20 and 1:200, and equity traders receive 1:20. The ADSS leverage ensures a competitive trading environment, but traders should deploy proper risk management to avoid magnified trading losses.Our UAE broker review finds ADSS compares favorably to other regional players.

ADSS Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 21:05 | Friday 21:00 |

Cryptocurrencies | Sunday 22:00 | Friday 20:59 |

Commodities | Sunday 22:00 | Friday 21:00 |

Crude Oil | Sunday 22:00 | Friday 21:00 |

Gold | Sunday 22:00 | Friday 21:00 |

Metals | Sunday 22:00 | Friday 21:00 |

Equity Indices | Sunday 22:00 | Friday 21:00 |

Stocks | Monday 13:30 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which trade 24/5

Account Types

ADSS has three account types, but only Classic is for retail traders. It has a minimum deposit requirement of $100, with all accounts denominated in US Dollars. The Elite and Elite+ accounts, which require deposits of $100,000 and $250,000, respectively, have lower fees and multi-currency accounts. It lists 400+ institutional clients, 8 liquidity providers, and prime brokerage services, confirming its focus on the high-end market. Swap-free accounts are also available.

ADSS Demo Account

The ADSS MT4 demo account registration on its website does not allow traders to customize the demo account, which is standardized. After ADSS sends an e-mail with the login details, traders can use the MT4 demo registration to open a customized demo account. The default expiration of the ADSS demo account is 60 days. I recommend traders choose demo account settings similar to their planned live deposit to create the most realistic demo trading experience.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to a full range of trading psychology and can create unrealistic trading expectations.Though our ADSS review finds the demo platform performs well, traders should not mistake demo performance for a real trading record.

Trading Platforms

The proprietary ADSS Platform, also available as a mobile app, offers a user-friendly and modern interface. Besides one-click charting features, it has an advanced drop-down deal ticket for precision order entries, and the intuitive trading interface is fully customizable. It also supports seamless switching between devices.

MT4 is the industry leader in algorithmic trading solutions and has an embedded copy trading service. It is also the most versatile trading platform, with 25,000+ custom indicators, plugins, and EAs. The MT4 MAM module is available for asset managers.

I recommend manual traders give the ADSS Platform a try. More demanding traders will probably do better with MT4.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The ADSS trading platform mobile app is available in Arabic, with the Arabic desktop version coming soon.

Unique Features

While ADSS does not offer especially unique features, I want to note that ADSS is the only broker in the GCC/MENA region that offers clients dedicated Sales Traders. Clients can be confident they are dealing with a leading financial institution.

Awards

ADSS received several awards for various aspects of its trading environment.

Among the most recent ones are:

- Best Forex Trading Innovation - Global Forex Trading 2021

- Best Forex Broker Middle East - Forex Expo Dubai 2022

- Most Trusted Forex Broker - Fazzaco Expo Dubai 2022

- Best Forex Broker Middle East - Forex Traders Summit Dubai 2022

- Decade of Excellence in Forex Brokerage – Forex Expo Dubai 2023

- Best Trading App 2024 – Forex Expo Dubai 2024

Research & Education

ADSS offers daily market commentary and articles from the Dow Jones News Service on the website while extensive news providers on the platform. Traders can receive technical analysis and actionable trading recommendations from ADSS Trading Services. I like the economic calendar, which offers a modern twist with its visualization, and includes sentiment indicators and average pip movements after the event for the most impacted assets. I highly recommend the economic calendar, which is available to everyone.

I like the 10-article written introduction on trading at ADSS, where beginners get quality, well-written content. I recommend first-time traders start there and then move on to the 10-video course. ADSS also published eleven platform guides, and it maintains an overall good educational section.

I recommend beginners start with the ADSS lessons before financing an ADSS account. I also urge beginners to seek in-depth education from third parties on trading psychology to deepen their foundation and avoid paid-for courses.

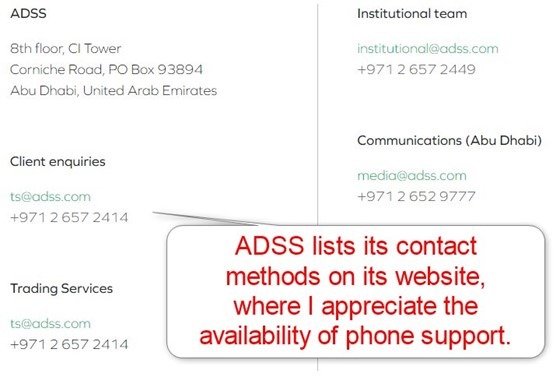

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |   |

ADSS offers 24/5 support via e-mail and phone. Aside from general customer support, ADSS’ Sales Traders offer technical and market analysis and more. I appreciate the latter for urgent matters. I did not find a live chat function, and the FAQ section provides limited answers.

Bonuses and Promotions

ADSS offers referrals and high-volume rebates.

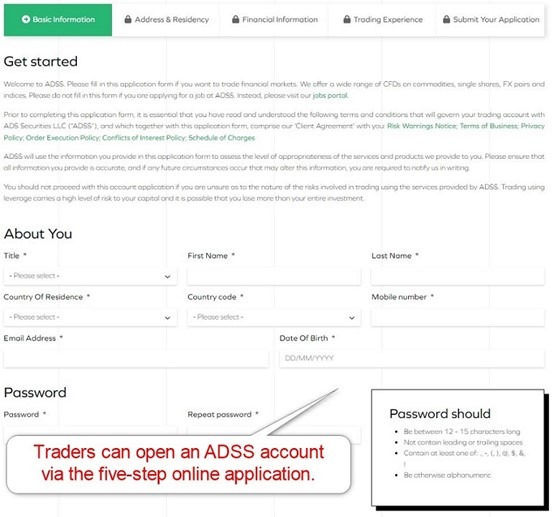

Opening an Account

ADSS uses a five-step online application which collects information about traders concerning their finances and trading experience. The initial step follows well-established industry standards.

Traders must verify their trading account, a mandatory step for regulated brokers to comply with strict AML/KYC requirements. Uploading a government-issued ID and one proof of residency document satisfies account verification for most traders. ADSS might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at ADSS is $100 for Classic, $100,000 for Elite, and $250,000 for Elite+.

Payment Methods

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

ADSS accepts trader’s residency in most countries and does not publish a restricted country list. It only notes that its services are not “intended for distribution to, or use by, any person in any country where the distribution or use is contrary to local law or regulation.”

Deposits and Withdrawals

The secure ADSS client portal handles all financial transactions for verified clients.

Deposits are free of internal charges, but ADSS levies a minimum withdrawal fee of $5. No information concerning processing times or minimum deposit and withdrawal amounts is published.

All non-USD or AED deposits face an internal 1.00 currency conversion fee. Traders should also consider potential third-party payment processing costs.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the ADSS account name. All withdrawals must follow the deposit path.

Is ADSS a good broker?

I like the trading environment at ADSS for beginner traders, as they offer the use of MT4 or their modern proprietary ADSS trading platform for manual strategies, an excellent economic calendar, and good educational content. Based in the UAE, ADSS is the leading Forex trader in the GCC and the MENA region. The ADSS minimum deposit is $100. ADSS is regulated by the Securities and Commodities Authority in the UAE (license number 20200000152). ADSS offers Contracts for Difference (“CFDs”) on a wide range of underlying financial instruments including Forex, equities, indices, government bonds, commodities, and cryptocurrencies. ADSS products are offered to ordinary and professional investors and counterparties. ADSS acts as the counterparty to all CFD trades with clients, providing an execution-only service through its online platforms. Yes, ADSS has a good track record spanning 10+ years and complies with regulators in the UAE. It established a trustworthy relationship and became the leading Forex trader in the GCC and the MENA region.FAQs

What is the minimum deposit at ADSS?

Who is ADSS regulated by?

What type of broker is ADSS?

Is ADSS trusted?