Editor’s Verdict

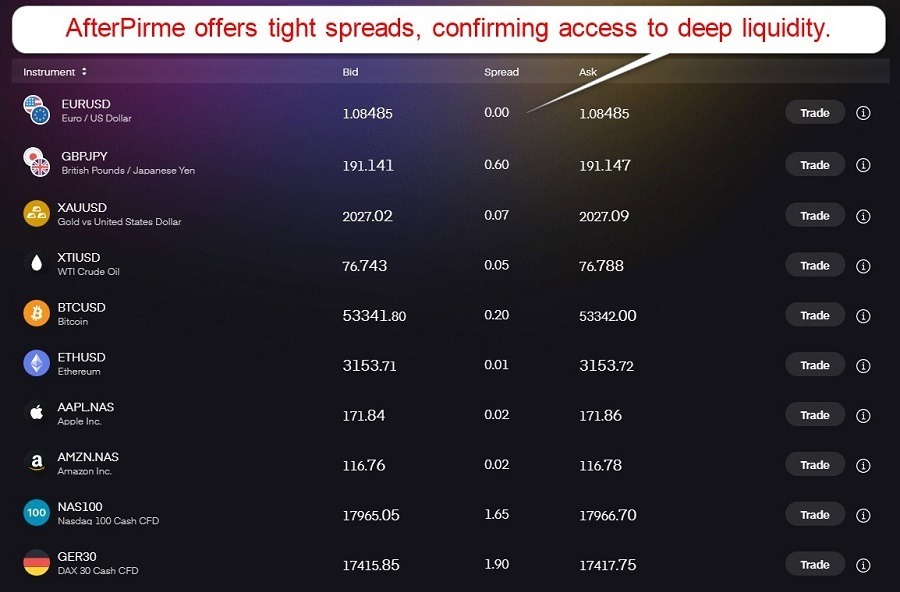

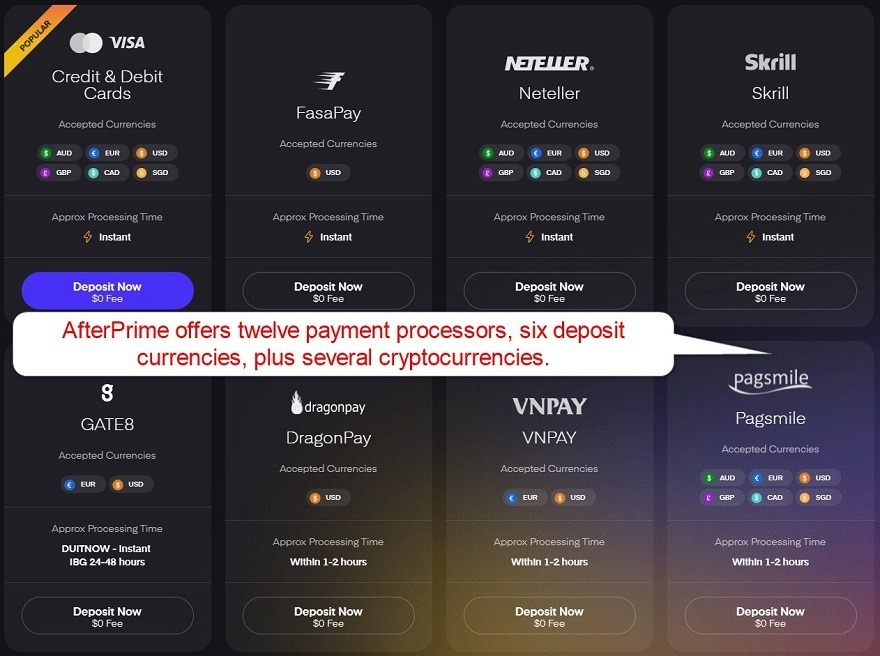

AfterPrime offers traders low trading fees, a balanced asset selection, and a choice of cutting-edge trading platforms. It features twelve payment processors, supporting cryptocurrency, outstanding transparency, and deep liquidity. Its AI-boosted liquidity engine, Bid Offer Optimized Spread Technology (BOOST), makes AfterPrime an excellent choice for demanding algorithmic traders and scalpers. My in-depth AfterPrime review has evaluated the trading environment to determine how traders can benefit. Read on to see whether AfterPrime is the right broker to meet your trading requirements.

Overview

AfterPrime offers cutting-edge trading platforms and competitive trading fees.

Headquarters | Seychelles |

|---|---|

Regulators | CySEC, FSA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 4, MetaTrader 5, Proprietary platform, Trading View |

Average Trading Cost EUR/USD | 0.0 pips + $7 commission ($7.00) |

Average Trading Cost GBP/USD | 0.0 pips + $7 commission ($7.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | 0.02 + $7 commission ($7.20) |

Average Trading Cost Bitcoin | $0.90 + 0.05% commission |

Retail Loss Rate | 74% - 89% |

Minimum Raw Spreads | 0.0 pips |

Minimum Commission for Forex | $7.00 per round lot |

Funding Methods | 12 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

AfterPrime Five Core Takeaways

- Competitive commission-based trading fees.

- Cutting-edge trading platforms.

- VPS hosting and API trading for advanced algorithmic traders.

- Balanced asset selection.

- Twelve payment processors, including cryptocurrencies.

AfterPrime Regulation & Security

I always recommend that traders check for regulations and verify them with the regulator by double-checking the provided license with their database. AfterPrime has two regulated subsidiaries with a clean track record.

Country of the Regulator | Cyprus, Seychelles |

|---|---|

Name of the Regulator | CySEC, FSA |

Regulatory License Number | SD057, 368/18 |

Regulatory Tier | 4, 1 |

Is AfterPrime Legit and Safe?

Although it only has five years of operational history, my AfterPrime review found no misconduct or malpractice by this broker. Therefore, I see AfterPrime as a legitimate and safe brokerage, as this broker will extend its operational achievements.

AfterPrime regulation and security components:

- Regulated by the Seychelles Financial Services Authority and the Cyprus Securities and Exchange Commission.

- AfterPrime claims ASIC regulation in Australia, but my AfterPrime review could not confirm it.

- They were founded in 2018.

- Segregated client deposits from corporate funds.

- Negative balance protection.

What Would I Like AfterPrime to Add?

AfterPrime could consider membership with the Hong Kong-based Financial Commission, as it provides independent audits and a €20,000 compensation fund per claim. AfterPrime could further enhance protection via a third-party insurance package.

Fees

AfterPrime offers traders a competitive pricing environment. Raw spreads start at 0.0 pips, and the commission is $7.00 per 1.0 standard round lot. The same commission applies to metals, but commodity, index, and bond traders get commission-free trading.

Equity traders pay $0.02 per share, and cryptocurrency traders pay 0.05% of the deal value, which ranks among the cheapest cryptocurrency trading fees I have ever reviewed.

Deposit and withdrawals fees are nonexistent at AfterPrime, but third-party payment processing costs or currency conversion fees could apply.

Average Trading Cost EUR/USD | 0.0 pips + $7 commission ($7.00) |

|---|---|

Average Trading Cost GBP/USD | 0.0 pips + $7 commission ($7.00) |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | 0.02 + $7 commission ($7.20) |

Average Trading Cost Bitcoin | $0.90 + 0.05% commission |

Minimum Raw Spreads | 0.0 pips |

Minimum Commission for Forex | $7.00 per round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Minimum Trading Costs for the EUR/USD at AfterPrime

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.0 pips | $7.00 | $7.00 |

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

How MT4 Traders Can Access Swap Rates

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling EUR/USD, holding the trade for one night and seven nights in a commission-based AfterPrime account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $7.00 | $7.23 | X | -$14.23 |

0.0 pips | $7.00 | X | -$2.54 | -$4.46 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.0 pips | $7.00 | $50.61 | X | -$57.61 |

0.0 pips | $7.00 | X | -$17.78 | $10.78 |

Noteworthy:

- AfterPrime offers positive swap rates on qualifying assets, allowing traders to earn money, as in the example above.

AfterPrime Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:01 | Friday 23:57 |

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Commodities | Monday 01:00 | Friday 24:00 |

Crude Oil | Monday 01:00 | Friday 24:00 |

Gold | Monday 01:02 | Friday 23:57 |

Metals | Monday 01:00 | Friday 24:00 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 16:32 | Friday 23:00 |

Bonds | Monday 01:00 | Friday 24:00 |

Range of Assets

AfterPrime maintains a balanced asset selection consisting of liquid trading instruments. I like the overall choice, but during my AfterPrime review, the absence of ETFs was notable. Forex and cryptocurrency traders get the broadest sector coverage, but AfterPrime only provides blue-chip stocks listed on the NASDAQ and NYSE. I like the asset selection for traders requiring fewer but active trading instruments, like scalper and algorithmic traders. In addition, the choice of cryptocurrency CFDs caters well to copy traders.

AfterPrime offers the following assets:

- 66 currency pairs

- 56 cryptocurrency pairs

- 23 commodities

- 16 indices

- 3 bonds

- 74 equity CFDs

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

AfterPrime Leverage

Maximum Retail Leverage | 1:200 |

|---|---|

Maximum Pro Leverage | 1:200 |

What should traders know about leverage at AfterPrime?

- Maximum retail Forex, commodities, index, and bond leverage is 1:200.

- Equity traders trade with 1:20 leverage.

- Cryptocurrency traders receive a restrictive maximum of 1:3.

- Negative balance protection exists.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Account Types

I like that AfterPrime offers one commission-based trading account type with competitive trading conditions. It keeps everything fair, but I still need volume-based rebates for active, high-volume traders. During my AfterPrime review, a swap-free Islamic account was unavailable.

The account types at AfterPrime feature:

- There is no minimum deposit requirement.

- USD, EUR, GBP, AUD, CAD, SGD, and cryptocurrencies as deposit currencies.

- Maximum leverage of 1:100.

- Margin call at 120%.

- Automatic stop-out level at 100%.

- 0.01 lot minimum order size.

- 5-decimal quotes.

- Deep liquidity with transparent order execution.

- Order execution speed below 0.01 seconds.

AfterPrime Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the AfterPrime demo account?

- Traders get a $5,000 demo account.

- AfterPrime features demo trading competitions with real money awards.

Trading Platforms

Traders are offered a choice of the MT4 or MT5 trading platforms, the industry leaders for algorithmic trading, which also have embedded copy trading services. Each is available as a powerful desktop client, a lightweight web-based alternative, and a popular mobile app. Traders can customize and upgrade it via 25,000+ custom indicators, templates, and EAs. Please note that the quality ones do cost money. AfterPrime also offers TraderEvolution, a cutting-edge trading platform for ECN brokers, banks, hedge funds, and high-frequency trading firms. It supports algorithmic trading, comes with the AfterPrime AI-boosted liquidity engine Bid Offer Optimized Spread Technology (BOOST), and allows dark pool trading. Full integration with TradingView ensures a seamless cross-platform experience. Social traders can connect their AfterPrime account to TradingView, where 50M+ traders share and discuss trading ideas.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my AfterPrime review, the ultra-fast order execution of less than 0.01 seconds and the deep liquidity stood out. AfterPrime also supports API trading, allowing advanced algorithmic trading solutions to connect to the cutting-edge trading infrastructure at AfterPrime via the FIX API. It requires a minimum deposit of $25,000 and monthly commissions of $2,000.VPS hosting ensures low-latency 24/5 Forex trading, and I also appreciate the Trade Receipts with each transaction. They prove that AfterPrime is a genuine ECN broker, as they list the liquidity provider that filled the order. AfterPrime's transparency separates this broker from most competitors.

Research & Education

AfterPrime is an ECN broker that does not target beginners. It focuses on its cutting-edge trading infrastructure and does not provide research. Given the abundance of free and paid-for research, I do not consider its absence a negative for the AfterPrime trading environment and appreciate that it caters flawlessly to its core market.

What about Education at AfterPrime?

AfterPrime does not offer education, as beginners are not its target market.

My conclusion

- I recommend beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

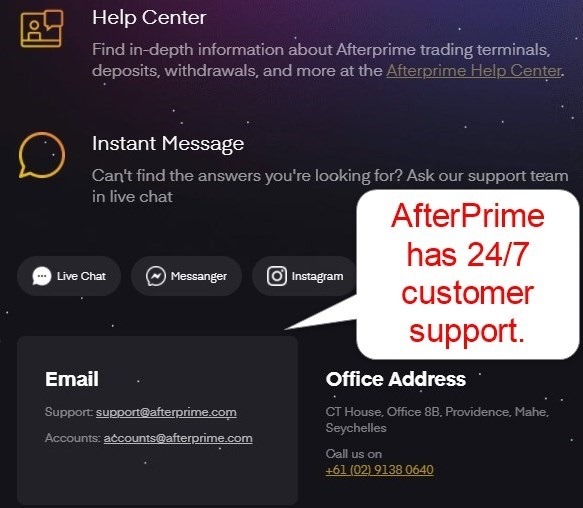

Customer Support

AfterPrime maintains 24/7 customer support with fast response times, available through live chat, e-mail, or phone. AfterPrime explains its products and services well, and while conducting my AfterPrime review, I did not require customer support assistance. I recommend traders browse the Help Center before contacting customer support.

Bonuses and Promotions

During my AfterPrime review, traders could participate in demo trading competitions that award cash prizes. This is the only negative aspect of AfterPrime, as demo trading competitions can promote a false trading mentality and cater to beginners who don’t know how to approach them.

Terms and conditions apply; you should read and understand them before participating in trading contests or accepting bonuses.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Opening an Account

Traders can open an account by providing their e-mail address, desired password, and country of residence, which determines which subsidiary will onboard them. I like the fast registration process, which is free of data mining.

What should traders know about the AfterPrime account opening process?

- AfterPrime complies with global AML/KYC requirements.

- The Seychelles subsidiary does not use data mining, but the CySEC unit does, per ESMA rules.

- Account verification is mandatory.

- Most traders complete account verification by uploading a copy of a government-issued ID and one proof of residency document.

- AfterPrime may ask for additional information on a case-by-case basis.

Minimum Deposit

AfterPrime has no minimum deposit requirement but recommends $200.

Payment Methods

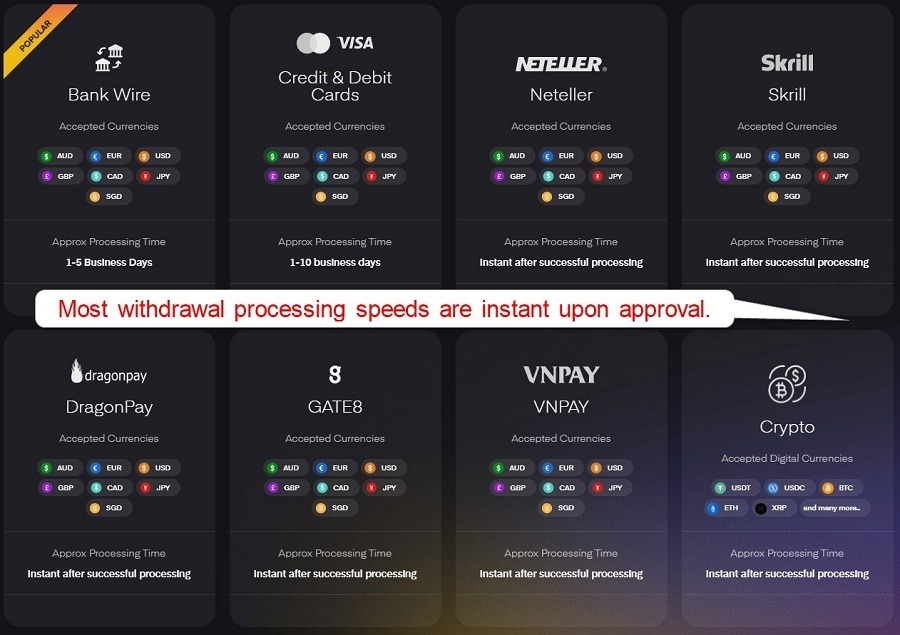

AfterPrime accepts bank wires, credit/debit cards, Skrill, Neteller, FasaPay, Gate8, Dragon Pay, VNPAY, Pagsmile, Perfect Money, Interac, and cryptocurrencies.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

AfterPrime accepts traders residing in most countries but lists Australia, the United States, China, New Zealand, and Japan as banned countries. It further notes that its products and services are "not intended for... any country or jurisdiction where such distribution or use would be contrary to local law or regulation."

Deposits and Withdrawals

The secure AfterPrime back office handles financial transactions for verified clients.

Key Takeaways from the AfterPrime Deposit and Withdrawal Process

- AfterPrime does not levy internal deposit or withdrawal fees.

- No minimum deposit or withdrawal amounts exist.

- A currency conversion fee of 2% applies.

- Traders may face third-party payment processing charges.

- Cryptocurrency transactions incur blockchain fees.

- Deposit processing times are instant to near-instant for most payment processors.

- Bank wire deposits may take up to five business days.

- Withdrawals are instant upon approval except for bank wires and credit/debit cards, which can take up to five and ten days, respectively.

- The finance department processes withdrawal requests the same day if traders submit requests before 10 AM AEST/11 AM AEDT (00:00 GMT).

- The availability of payment processors may depend on the geographic location of traders.

- The name on the payment processor and AfterPrime trading account must match and comply with AML regulations.

Is AfterPrime a good broker?

I like the trading environment at AfterPrime for its competitive trading fees, deep liquidity, trade receipts that confirm a genuine ECN trade execution with NDD, and trading platform choice. The clean regulatory track record spans five years, and AfterPrime offers twelve payment processors with six deposit currencies and several cryptocurrencies. In my AfterPrime review, the only component missing, from an active trader’s perspective, was a volume-based rebate program. The Seychelles FSA and Cyprus CySEC regulate AfterPrime. Most withdrawals are processed instantly once AfterPrime approves them, which takes less than 24 hours. AfterPrime is reliable and regulated by the Seychelles FSA and Cyprus CySEC and has a clean track record. AfterPrime has no minimum deposit requirement but recommends a deposit of at least $200. AfterPrime is a genuine ECN broker with one commission-based account type.FAQs

Is AfterPrime regulated?

How long does AfterPrime withdrawal take?

Is AfterPrime reliable?

What is the minimum deposit for AfterPrime?

What type of account is AfterPrime?