Editor’s Verdict

Ally Invest is an online brokerage ideal for US-based investors seeking all their financial services from one company, since Ally Invest belongs to the US-publicly listed financial firm Ally Financial Inc. Clients get commission-free equity, ETF, and mutual fund trading. Ally Invest specializes in self-direct investing, automated investments via its robo portfolios, and traditional wealth management services. I reviewed this online brokerage to evaluate the commission-free trading environment. Should you manage a portfolio at Ally Invest?

Overview

A one-stop solution for all banking and investing requirements for retail investors.

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1919 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Undisclosed |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Undisclosed |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Ally Invest is an ideal choice for clients of Ally Bank, as it provides a seamless one-stop financial solution easily manageable via the user-friendly online banking suite or mobile app. The Ally Invest infrastructure suits long-term buy-and-hold investors and retirement planners but does not cater well to demanding traders.

Ally Invest Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Ally Invest presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | Securities and Exchange Commission | Undisclosed but verified |

Is Ally Invest Legit and Safe?

Ally Invest is a legit and safe online brokerage and a member of the Ally Financial family, established in 1919. As a publicly listed company in the US, the SEC is the ultimate regulator. Ally Invest is a trustworthy company, and depending on which services clients use, additional regulatory oversight is available via the NFA.

Ally Invest is a member of the Securities Investor Protection Corporation (SIPC), which covers customer claims up to $500,000, including cash claims up to $250,000. Additional client protection exists via coverage up to $37.5 million, including a maximum of $900,000 in cash with an aggregate cap of $150 million. The protection does not apply to Forex trading accounts.

Fees

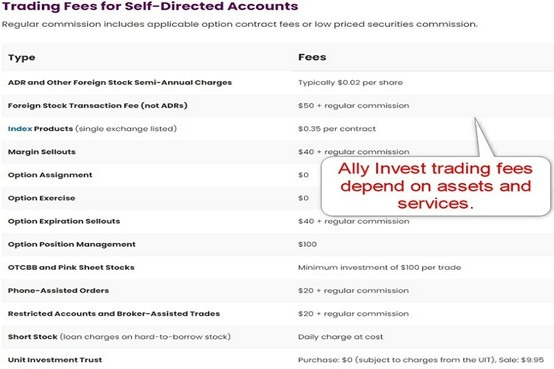

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Ally Invest provides commission-free equity, ETF, and mutual fund trading on US-listed assets. Stocks below $2.00 face a $4.95 commission plus $0.01 per share and a $100 minimum trade size. ADRs and foreign stocks cost $0.02 per share, index products $0.35 per contract, options $0.50 per contract, bonds $1 per bond with a $10 minimum and $250 maximum, robo portfolios have an annual advisory fee of 0.30%, and wealth management services cost 0.75% to 0.85% annually. Depending on individual client requirements, other costs may also apply.

Here is a snapshot of Ally Invest trading fees:

Minimum Raw Spreads | Undisclosed |

|---|---|

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Undisclosed |

Deposit Fee | |

Withdrawal Fee |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

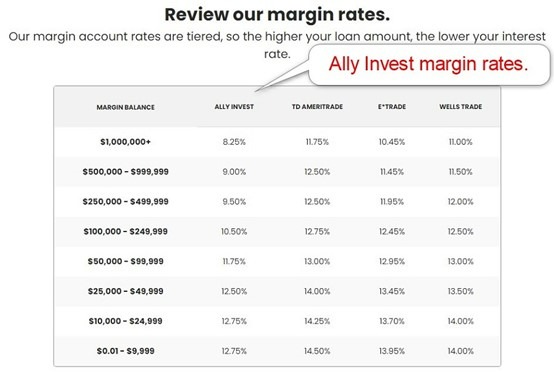

Here is a snapshot of Ally Invest margin fees:

Range of Assets

Ally Invest offers equities, ETFs, mutual funds, indices, options trading, certificate of deposits, and Forex trading as an introducing broker to Gain Capital. Ally Invest only offers equities listed on US exchanges and does not allow fractional share investments. Cryptocurrency trading is also missing, but crypto-specific assets exist, and Ally Invest does not mention commodity and metals availability.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Ally Invest Leverage

Ally Invest offers maximum leverage of 1:50 for Forex traders, while equity trading leverage depends on the asset. I urge traders to execute proper risk management to avoid magnified trading losses. Negative balance protection exists, meaning traders can never lose more than their deposits.

Ally Invest Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Undisclosed | Undisclosed |

Commodities | Not applicable | Not applicable |

European Equities | Not applicable | Not applicable |

US Equities | Undisclosed | Undisclosed |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, which essentially trades 24/5

Account Types

Ally Invest caters primarily to self-directed investors and does not ask for a minimum deposit. It also features a margin trading account which requires a $2,000 minimum deposit. Since Ally Invest is part of Ally Financial, clients can get an Ally savings account that pays interest on cash balances with instant transfers between savings and brokerage accounts up to $250,000 daily. IRA accounts are available, a dedicated Forex trading account exists, and Ally Invest offers robo portfolios and traditional wealth management services.

Ally Invest Demo Account

Ally Invest offers a 30-day $50,000 demo account. The time restriction and high demo balance create an unrealistic demo trading experience and insufficient time for beginners and seasoned traders alike to cater to their demo trading needs. Ally Invest appears to misunderstand demo trading requirements.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations.

Trading Platforms

Ally Invest offers its web-based trading platform and mobile app, which cater well to buy-and-hold investors. Regrettably, Ally Invest fails to introduce them properly. My review confirms a user-friendly interface with a well-designed platform for investors. It only supports manual trading via basic features and lacks advanced trading tools. I can recommend it to buy-and-hold investors but not advanced traders.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

I highlight the robo portfolios Ally Invest offers, which provide a low-cost alternative for most retail traders. I also like the availability of savings accounts and banking services, making Ally Invest and Ally Bank a one-stop financial institution for investors.

Research & Education

Ally Invest does not publish in-house research, but the investment platform features third-party providers which provide market commentary and trading ideas. Actionable trading recommendations are unavailable, but I do not consider it a negative, given the abundance of available research online. Ally Invest relies on its wealth management unit to assist clients, and offering free research is counterproductive to its services portfolio.

The “Money & Milestones” offers valuable educational content, and Ally Invest features an educational section, where its game-like approach under Fintropolis stands out as an interactive and fun approach to teaching the basics. I also recommend beginners obtain high-quality third-party education available for free and avoid paid-for courses. I advise beginners to start with lessons covering psychology and risk management.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Ally Invest offers high-rated customer support 24/7 via e-mail, phone, and live chat. The help center provides answers to basic questions, and Ally Invest explains its products and services well. Phone support exists, but I am missing a direct phone line to the finance department, where most issues can arise.

Bonuses and Promotions

At the time this review was written, Ally Invest neither offered bonuses nor promotions.

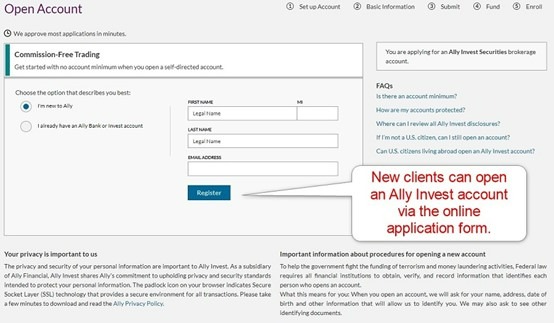

Opening an Account

Account verification is mandatory, in line with global AML/KYC stipulations enforced by regulators. Most clients will pass it by uploading a copy of their driver’s license and one proof of residency document. Foreign citizens with a US social security card and US residence may also open an Ally Invest account.

Minimum Deposit

Ally Invest does not have a minimum deposit requirement for its self-directed investment account, but clients seeking a margin account must deposit a minimum of $2,000.

Payment Methods

Ally Invest supports bank wires and cheques.

Accepted Countries

Ally Invest only caters to US residents.

Deposits and Withdrawals

The secure Ally Invest client portal handles all financial transactions for verified clients.

Ally Invest only offers bank wires and cheques as payment methods, which is highly restrictive even by US standards. Ally Invest does not list a minimum withdrawal amount, but a bank wire fee of $30 applies, while a cheque costs $5. Clients who request a cheque via overnight mail must pay a fee of $50. Wealth management clients who withdraw 20%+ from their portfolio must call Ally Invest.

Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the Ally Invest account name. Ally Invest does not list internal processing times, but a funds availability schedule per the Check and Electronic Funds Transfer Clearing Schedule applies.

Is Ally Invest a good broker?

Ally Invest is a good choice for buy-and-hold investors due to low trading fees and commission-free trading for US equities, ETFs, and mutual funds. Options and index costs are also cheap, but Ally Invest does not cater well to traders and those transacting in penny stocks priced below $2.00 per share.

The web-based Ally Invest platform is ideal for low-frequency manual traders and offers the basics but fails to provide demanding traders with the necessary tools. Ally Invest shines with its robo portfolios and wealth management service, added by the availability of banking services for a one-stop financial solution with excellent management. Traders will fare better at tech-centered competitors with custom-tailored solutions and cutting-edge trading tools. Ally Invest and Ally Bank are not the same but belong to the same corporate owner and have interconnected services. Ally Invest offers commission-free investments on qualifying assets. Ally Invest makes money from spreads, commissions, and a host of other trading and non-trading fees. Clients can withdraw all their funds from Ally Invest. The corporate owner of Ally Invest is a publicly listed US company, and Ally has an excellent reputation and trust score. Yes, clients can withdraw from Ally Invest, which is a trusted online brokerage. Ally Bank is a well-trusted financial institution owned by a publicly listed company without any visible downsides, except for the lack of brick-and-mortar banks and in-person consultations. Ally Invest has no minimum deposit except for margin accounts, which require $2,000.FAQs

Is Ally Invest the same as Ally Bank?

Is Ally Invest commission-free?

How does Ally Invest make money?

How much can I withdraw from Ally Invest?

Can I trust Ally?

Can I withdraw from my Ally Invest account?

What is the downside of Ally Bank?

What is the minimum deposit for Ally Invest?