Editor’s Verdict

Alpaca Trading is a unique broker without a trading platform but with extensive API support, allowing the trading community to develop custom trading solutions that connect to the Alpaca Trading infrastructure. It also connects accounts to TradingView, allowing traders to trade directly from the charts. I conducted an in-depth review to determine if this broker offers its clients a competitive edge. Is Alpaca Trading the right broker for you?

Overview

A leading API broker for traders deploying custom algorithmic trading solutions.

Headquarters | United States |

|---|---|

Regulators | SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2015 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $0 |

Trading Platform(s) | Proprietary platform, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Not applicable |

Funding Methods | 1 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like Alpaca Trading for US-based traders with custom algorithmic trading solutions. This broker also connects to TradingView, allowing traders without access to API trading to manage their portfolios directly from advanced trading charts with an active trading community.

Alpaca Trading Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Alpaca Trading presents clients with one regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

US | SEC | Undisclosed but verified |

Is Alpaca Trading Legit and Safe?

Alpaca Trading, founded in 2015, is a legit and safe US-based online brokerage, compliant with the SEC, and a SIPC member. It covers customer claims up to $500,000, including cash claims up to $250,000. Alpaca Trading is also a FINRA member, and my review did not uncover any malpractice or misconduct. Therefore, I can recommend Alpaca Trading as a trustworthy broker.

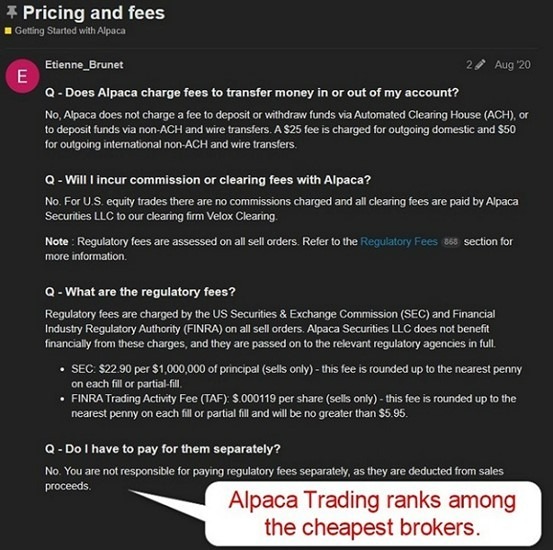

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Alpaca Trading offers commission-free trading for all its assets. Traders must pay the SEC fee of $22.90 per $1,000,000 of principal on sell orders (rounded to the nearest penny) and the FINRA Trading Activity Fee (TAF) of $0.000119 per share on sell orders. Alpaca Trading does not list spreads, but it ranks among the cheapest US brokers, including swap rates on leveraged overnight transactions.

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee |

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Here is a snapshot of Alpaca Trading margin fees:

Range of Assets

Alpaca Trading only offers US-listed equities, ETFs, and cryptocurrencies. It states 8,000 equities and ETFs, 20+ crypto coins for spot trading, and 48 crypto-to-crypto pairs. While the asset selection suffices for traders managing US equity portfolios, I am missing diversification opportunities via international equities and other asset classes.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Alpaca Trading Leverage

Alpaca Trading limits maximum leverage to 1:2 and raises it to 1:4 for clients who fulfill the pattern day trader (PDT) requirements. I urge traders to execute proper risk management to avoid magnified trading losses. Please note that negative balance protection does not exist, meaning traders can lose more than their deposits.

Alpaca Trading Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Undisclosed | Undisclosed |

Forex | Not applicable | Not applicable |

Commodities | Not applicable | Not applicable |

European Equities | Not applicable | Not applicable |

US Equities | Undisclosed | Undisclosed |

Noteworthy:

- Equity markets open and close each trading session, unlike cryptocurrencies, which essentially trade 24/7

Account Types

All clients at Alpaca Trading can choose an equity trading account (non-retirement), a cryptocurrency account (available in 23 states), and a margin account. The former two have no minimum deposit requirement, while the latter requires $2,000. I like that Alpaca Trading keeps it simple and fair. Corporate accounts are also available.

Alpaca Trading Demo Account

Alpaca Trading offers unrestricted demo accounts with a default balance of $100,000, which users can modify. Since Alpaca Trading is an API brokerage, and developers can require demo accounts to test and bug-fix their solutions, Alpaca Trading ensures they have the necessary tools. I appreciate that Alpaca Trading dedicated a section explaining the rules and assumptions of its demo account.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations.

Trading Platforms

Alpaca Trading does not offer a trading platform but APIs that allow developers and its growing community to create custom trading solutions for equity and cryptocurrency trading that connect to the Alpaca Trading infrastructure. Alpaca Trading routes orders to its liquidity providers Jane Street, Citadel, and Virtu for equity / ETF orders and ErisX or Genesis for cryptocurrency orders.

Alternatively, traders can connect their Alpaca Trading accounts to TradingView and trade directly from advanced charts. This is ideal for beginners who lack experience with API trading solutions or wish for an out-of-the-box approach to trading and investing.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

The absence of a trading platform for a broker is unique, but it works for Alpaca Trading. Clients can also get up to seven years of historical data and a maximum of 10,000 API calls per minute. Individual traders get the Algo Trader Plus API for $99 per month. It is an ultra-cheap service for accurate data, a necessity for algorithmic trading solutions.

I also like that Alpaca Trading offers extended-hour trading, allowing clients to transact Monday through Friday from 4 a.m. to 8 p.m. EST.

Research & Education

Alpaca Trading is an API broker and does not offer research, which I find acceptable given its core trader base primarily relies on algorithmic trading and has no use for research.

Beginner traders are not the core market for Alpaca Trading, which does not offer education. Social trading is available via TradingView, where beginners can get valuable content.

I recommend beginners obtain high-quality third-party education available for free and avoid paid-for courses, where they should start with lessons covering psychology and risk management.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Alpaca Trading disappoints with customer support, as only e-mail support is available. While traders get plenty of documentation and how-to articles, it does not excuse the hands-off approach to catering to customers. Alpaca Trading relies on Forums, GitHub, and Slack to offer support via the community.

Bonuses and Promotions

During my review, Alpaca Trading neither offered bonuses nor promotions.

Opening an Account

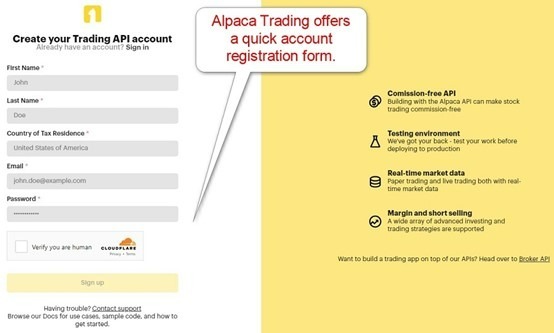

Traders can open an Alpaca Trading account via a quick online application form which asks for a name, country of tax residence, e-mail, and desired password.

Alpaca Trading requires account verification, as any regulated broker in compliance with global AML/KYC stipulations enforced by regulators. Most clients will satisfy it by uploading a copy of their driver’s license and one proof of residency document.

Minimum Deposit

Alpaca Trading does not have a minimum deposit requirement for individual traders, but the margin account requires $2,000. Alpaca Trading launched a beta program for international business clients with a minimum deposit requirement of $30,000.

Payment Methods

Alpaca Trading only supports bank wires.

Accepted Countries

Alpaca Trading caters only to US residents but launched a beta program for international business clients.

Deposits and Withdrawals

The secure Alpaca Trading dashboard manages all financial transactions for verified clients.

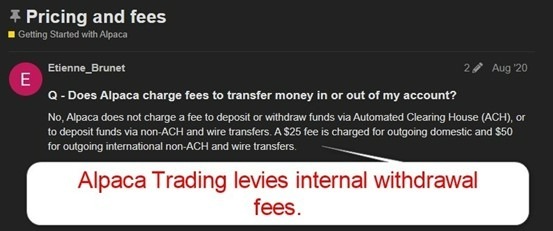

Alpaca Trading only supports bank wires, which is unfortunate and inadequate even by dated US standards. Alpaca Trading provides few details about its deposit and withdrawal process but notes a $25 withdrawal fee for domestic transactions and $50 for international ones.

Per regulatory requirements, only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the Alpaca Trading account name.

Is Alpaca Trading a good broker?

Alpaca Trading is an excellent choice for API and algorithmic traders. It provides a genuine commission-free cost structure and competitive margin financing rates. Alpaca Trading also connects accounts to the TradingView community, where 50M+ traders socialize, share, and discuss trading ideas. There is no Alpaca Trading minimum deposit for individual traders unless they seek a margin account, which requires $2,000.

The asset selection remains limited to US equities, ETFs, and cryptocurrencies. The biggest disappointment is the hands-off approach to customer service and bank wires as the sole methods to deposit and withdraw. Overall, I rate Alpaca Trading as the best choice among US brokers for API and algorithmic trading with advanced trading requirements. I also like the $99 monthly plan for market data. Alpaca Trading only supports bank wires. Alpaca Trading does not charge clients for deposits. Alpaca Trading levies a withdrawal fee of $25 for domestic and $50 for international bank wires. Alpaca Trading has its headquarters in the USA. Yes, Alpaca Trading is a commission-free broker, where traders pay spreads, financing, and regulatory fees. Alpaca Trading is an excellent and cost-effective choice for API and algorithmic traders.FAQs

How do I withdraw money from Alpaca?

How much is the Alpaca deposit fee?

How much is the withdrawal fee from Alpaca markets?

Where is Alpaca Trading based?

Is Alpaca really commission-free?

Is Alpaca Trading worth it?