Alvexo Editor’s Verdict

Alvexo, founded in 2014, is a fairly new Forex broker. Since then, this broker claims to have over 650,000 registrations, a rather impressive accomplishment, but one that we could not verify during this Alvexo review. Alvexo offers CFD trading in over 450 assets across five categories and claims that technology fulfills a vital role in its trading environment. This broker has a research department, hosts annual events, and provides traders with the MT4 trading platform on top of its proprietary WebTrader. Education is also highlighted in Alvexo’s approach to achieve long-term trading satisfaction. An unusual fact remains that this broker opted for an office in Paris, France, besides its headquarters in Limassol, Cyprus.

Overview

What stands out is that over 79% of traders operate portfolios at a loss with Alvexo; this is at the upper-end of the spectrum, though not all brokers publish this information.

Seychelles CySEC, FSA 2014 Market Maker $500 MetaTrader 4, Proprietary platform, Web-based 1.4 pips ($14.00) 2.4 pips ($24.00) $0.03 $0.50 $423.09

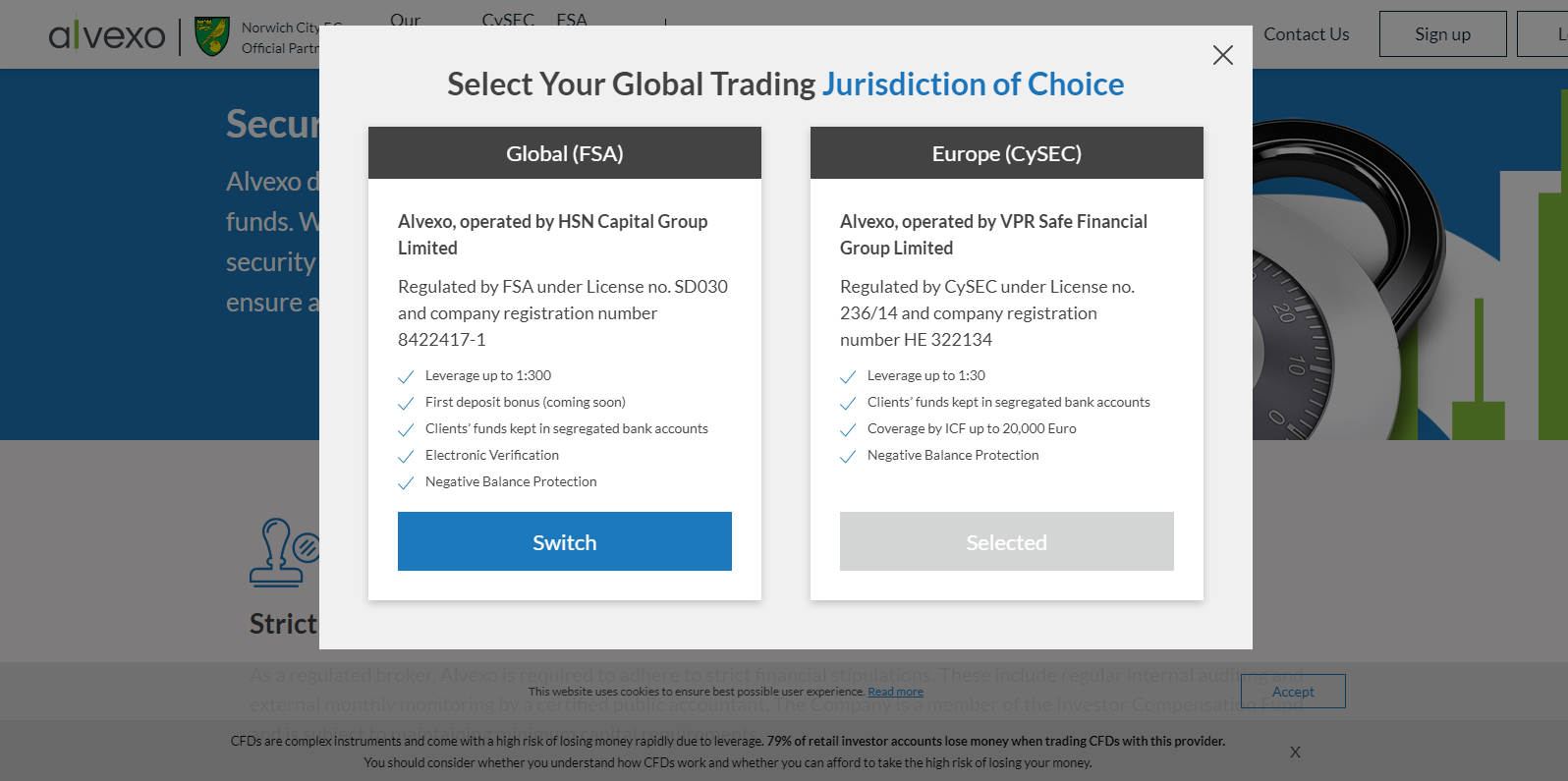

Regulation and Security

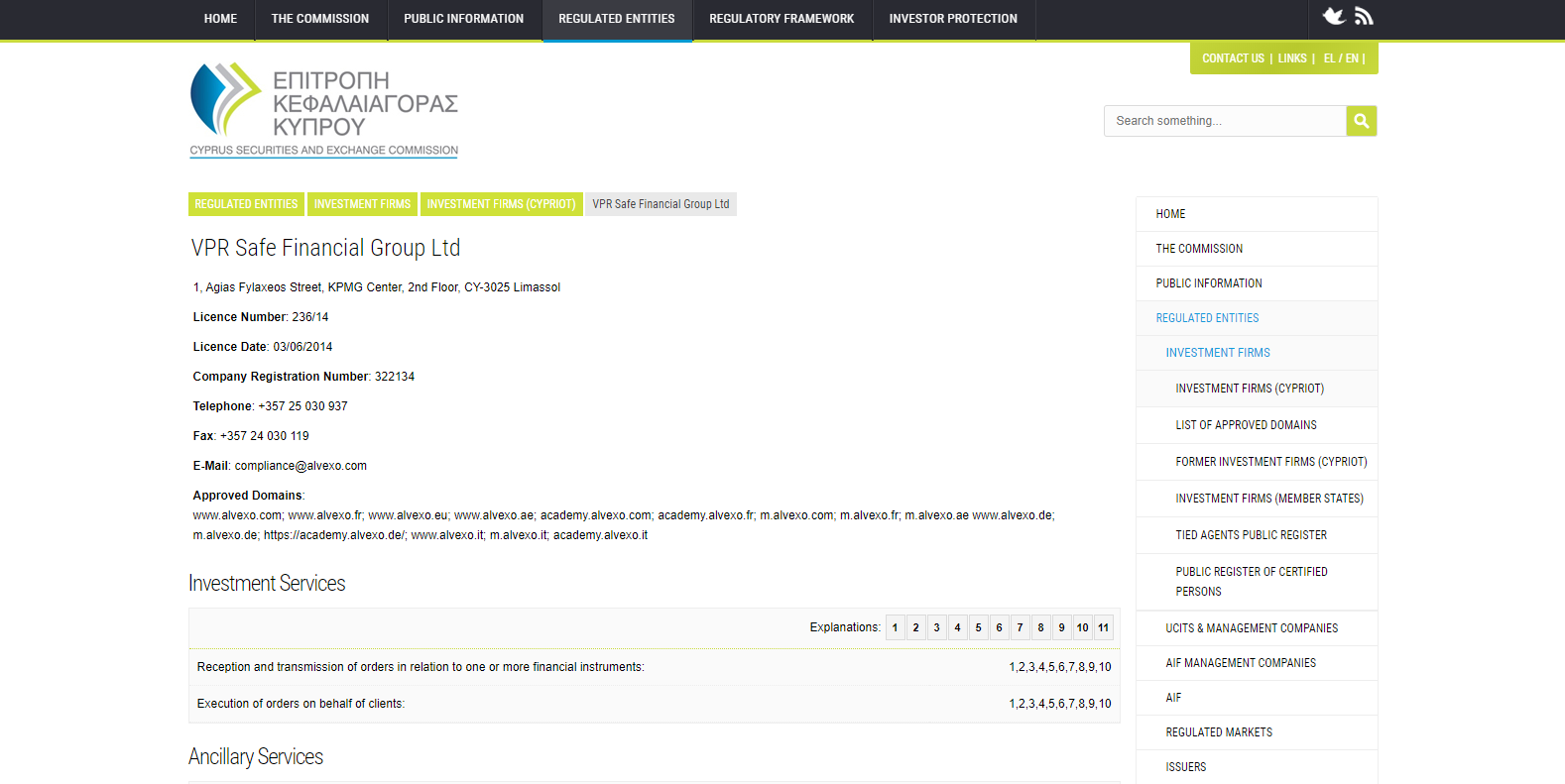

Alvexo is owned and operated by VPR Safe Financial Group LTD, a Cypriot Investment Firm. The company registration number is HE 322134. It is supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 236/14; the license was approved on March 6, 2014. As an EU member, cross-border regulation applies, and Alvexo is compliant with the Markets in Financial Instruments Directive 2014/65/EU, or MiFID II, and with the EU’s 4th Anti-Money Laundering Directive; all legal documents are published.

As mandated by the EU Directive 2014/49/EU, this broker participates in the Investor Compensation Fund (CIF) that covers clients in the event of default by Alvexo up to the maximum amount of €20,000. Client deposits are maintained in segregated bank accounts per regulatory requirements. Negative balance protection is available.

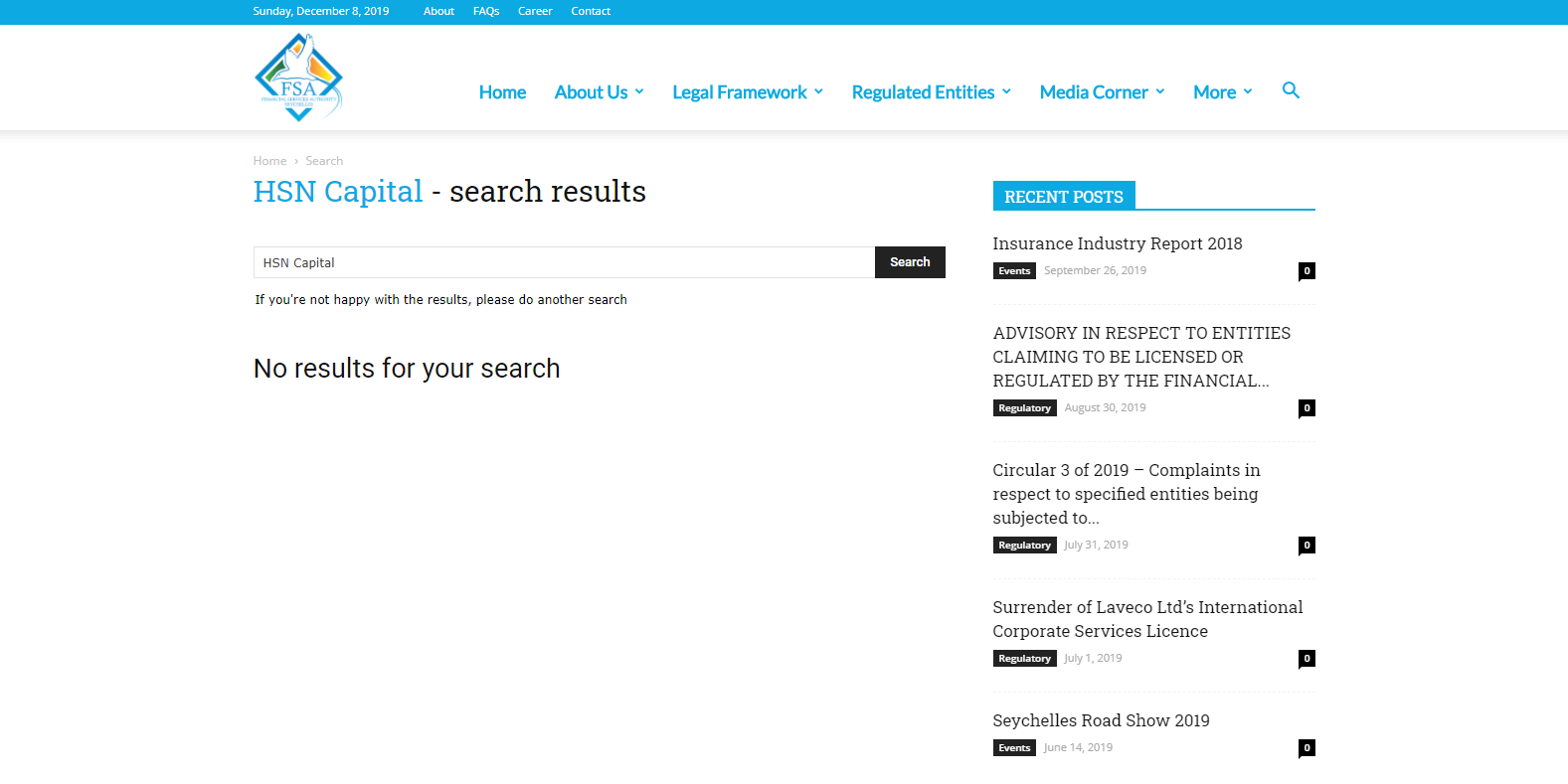

Alvexo states that through HSN Capital Group LTD, it offers services authorized and regulated by the Financial Services Authority (FSA) of Seychelles under registration number 8422417-1. A search at the FSA for HSN Capital returned no matches. Interestingly enough, Alvexo provided a link to its registration with CySEC but failed to do the same for the claimed FSA regulated entity.

CySEC regulation is confirmed, and Alvexo provided the link to the regulation.

FSA regulation appears to be incorrect, as no matches were found.

Fees

Average Trading Cost EUR/USD | 1.4 pips ($14.00) |

|---|---|

Average Trading Cost GBP/USD | 2.4 pips ($24.00) |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.50 |

Average Trading Cost Bitcoin | $423.09 |

Alvexo collects its fees from spreads and commissions charges across all available assets. The EUR/USD is listed with a spread of 3.3 pips in the Classic account; this is reduced to 1.4 in its ECN account, but a commission between $13 and $18 applies. These fees are considered extremely high in the Forex industry. Commission charges for equity CFDs range between $0.025 and $0.015 per share, and certain assets are priced as high as $50 per lot. This broker is a market maker and also profits from traders’ losses where it acts as the count-party to the positions taken.

Swap rates on overnight positions apply, but Alvexo fails to mention them (or, at least, we saw no reference to the spreads during our Alvexo review). Corporate actions are also not mentioned in detail but appear to be applicable to equity and index CFDs. The lack of transparency to critical charges remains a disappointment.

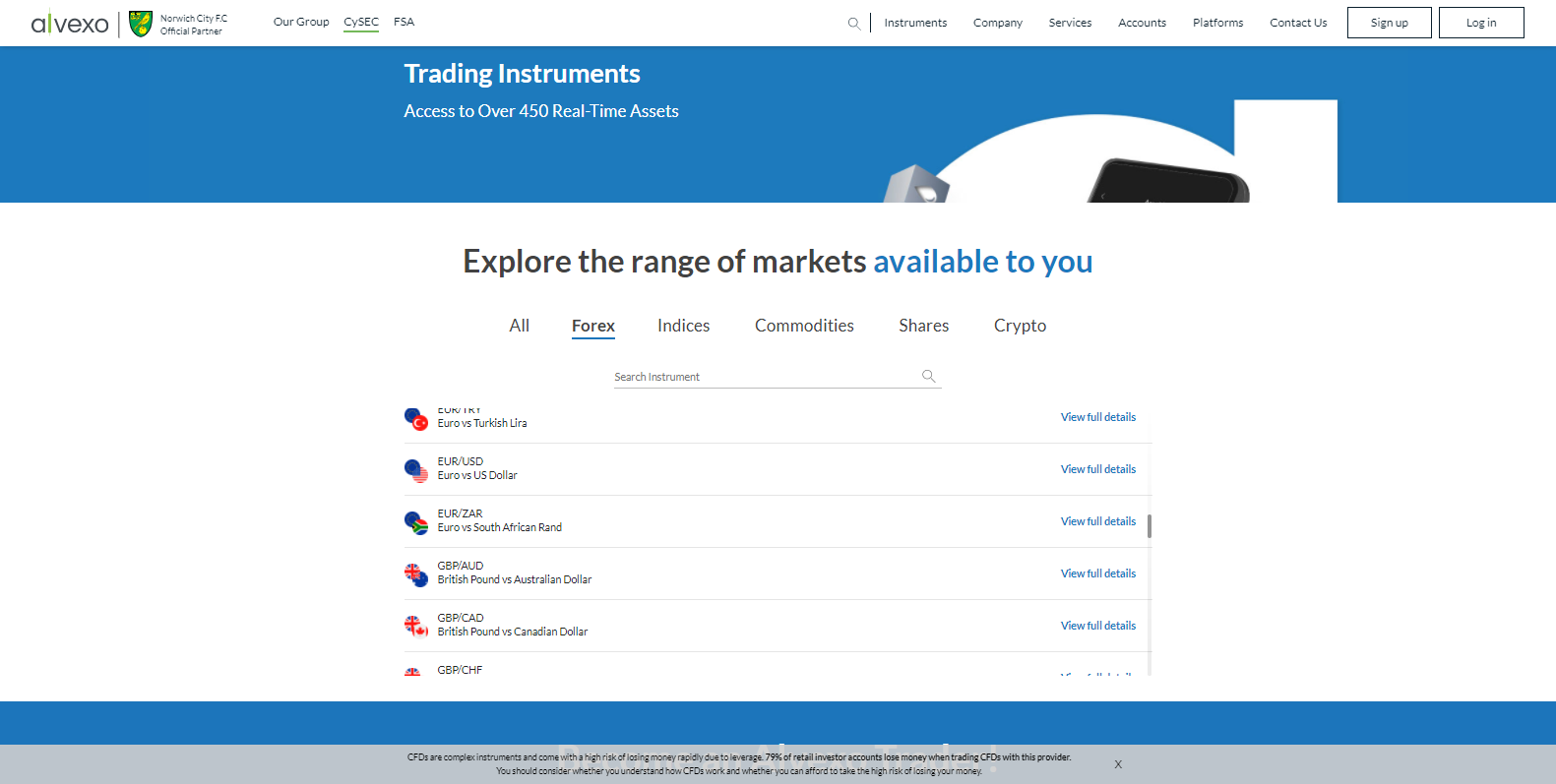

What Can I Trade

Over 450 assets including Forex, indices, commodities, equities, and cryptocurrencies are available at Alvexo. The overall solid asset selection allows most retail traders to adequately diversify their portfolios, but the drawback to the asset selection is unacceptable spreads and commissions. Alvexo additionally executed a terrible task on listing available assets. While they are arranged by asset class, and a search function is present, the list only includes five assets, and traders need to scroll through a sometimes extensive list. Clicking on “View full details” opens a new tab and displays swap rates for the asset.

Clicking on “View full details” opens a new tab with more details about the asset.

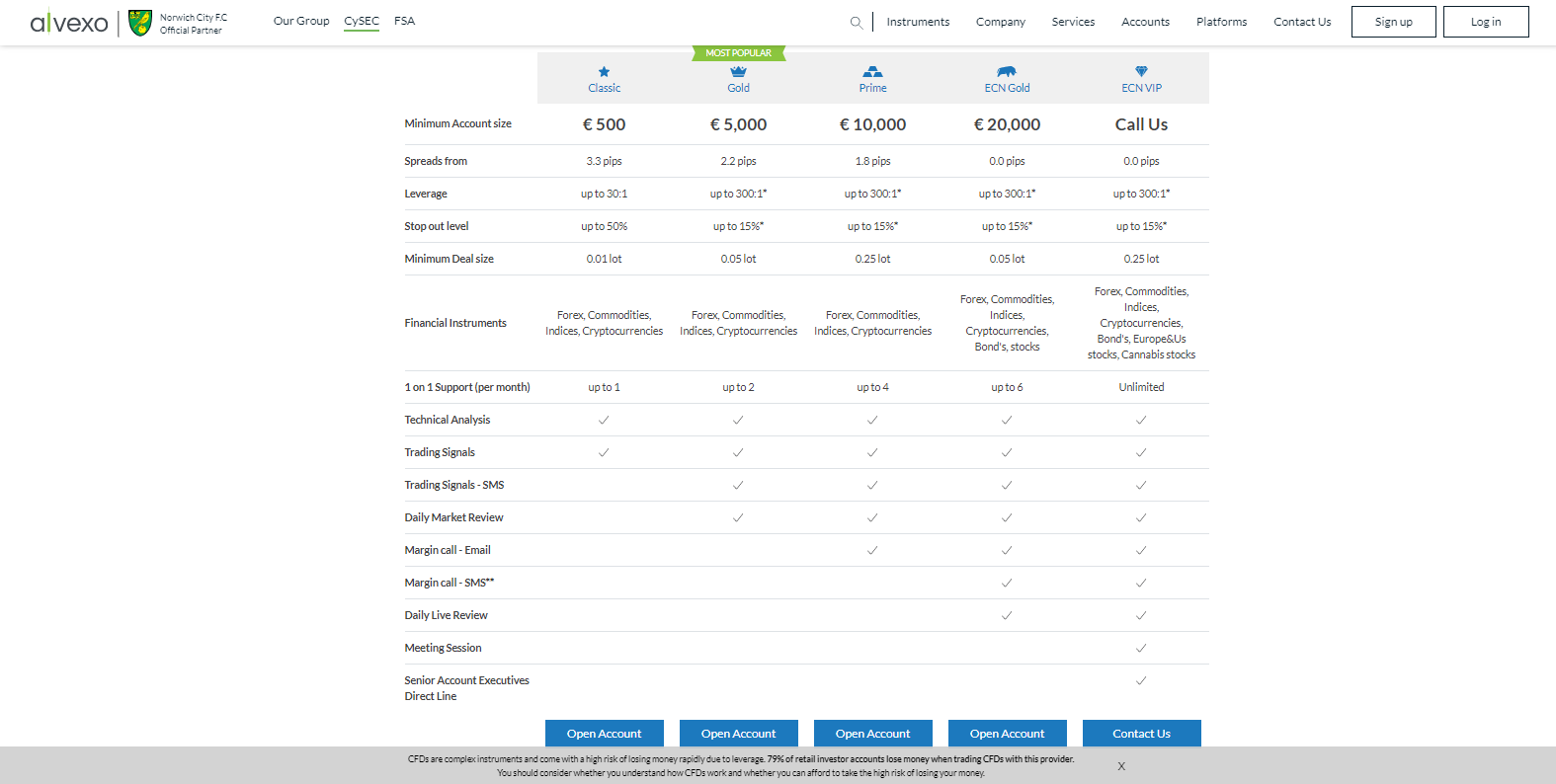

Account Types

Alvexo offers five distinct account types, all of which has less-than-ideal trading conditions. The Classic account requires a minimum deposit of €500 and spreads start from 3.3 pips. Only Forex, commodity, index, and cryptocurrency CFDs are granted in this account type. Therefore, the asset selection is severely reduced from the advertised 450+ assets. This broker labels its Gold account as the “Most Popular”, but it requires a €5,000 minimum deposit. The only significant change remains a reduction in the minimum spread to 2.2 pips. Equity CFDs remain missing, the minimum trade size has been increased from 0.01 lots to 0.05 lots, and the stop-out level is reduced from 50% to 15%.

The Prime account requires a €10,000 minimum deposit to receive a reduction in the minimum spread to 1.8 pips. All other trading conditions remain the same, except for an increase in the minimum lot size to 0.25 lots. The ECN Gold account is the first account where some equity CFDs are tradeable, but for a minimum deposit of €20,000. Spreads are listed as 0.0 pips on the account page, though information in other places on the site seem to contradict this information. The EUR/USD carries at 1.4 pips with a commission of $18 per lot with a minimum lot size of 0.05 lots. The ECN VIP account represents the sole account where all assets are available. The minimum deposit size is available on request only, but given the structure implemented, it is likely above €50,000 as the minimum lots size is increased to 0.25 lots.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

The MT4 trading platform is offered by Alvexo, but it lacks many of the add-ons offered by other brokers that can turn this platform into a true powerhouse. MT4 fully supports automated trading and remains the most popular choice among retail traders. Alvexo also offers a proprietary WebTrader that is also available as a mobile version.

Limited information is published about WebTrader, but the features listed comparable to those offered by the myriad of MT4 plugins that Alvexo doesn’t currently offer. While a proprietary platform shows dedication to provide a better trading environment for clients, it needs to surpass what is available to offer a competitive edge, not simply equal what is offered elsewhere.

Alvexo offers the MT4 trading platform without any third-party plugins.

A look at Alvexo’s WebTrader:

Unique Features

The best features offered by Alvexo are the its learning offerings, but those must be picked through carefully to find the right ones. Regrettably, there were no real unique features discovered during our Alvexo review. Spreads and commissions are extremely high, neither trading platform provided-as-is grants traders the required edge in today's markets, and transparency regarding key costs are absent.

Research and Education

Alvexo does offer research and education to traders. Research is broken down into market updates, trading signals, an economic calendar, trading calculators, and a blog. The educational division features articles and tutorials, a glossary, and an FAQ section. This broker additionally conducts events multiple times per year, to meet clients and present the latest market trends.

Let’s take a look at some of the features Alvexo does offer:

Research

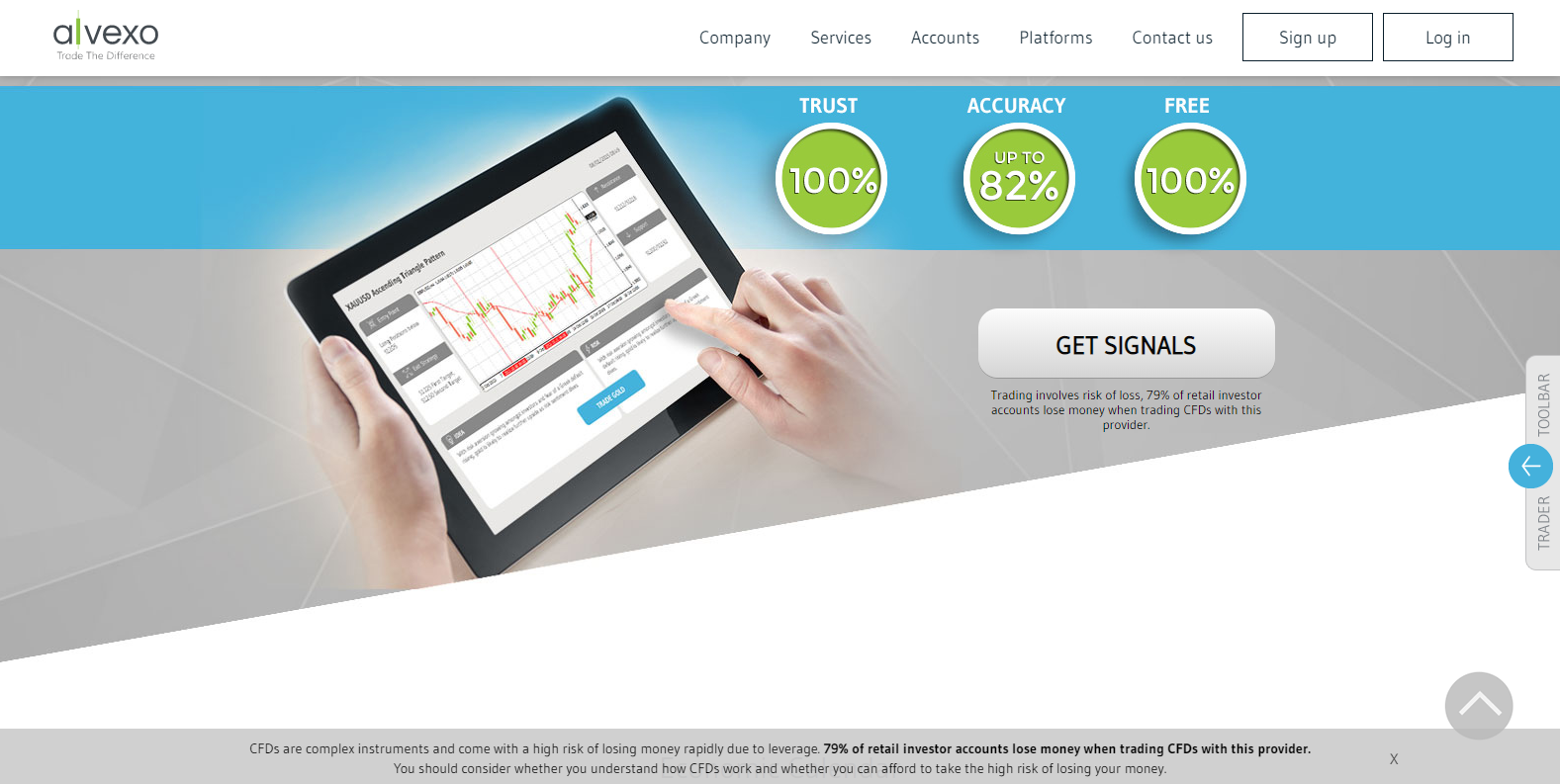

Market updates consist of market trends published once per week, a daily analysis, and a weekly report. The content remains brief but is on topic, the presentation is clean, and the outcome is acceptable. Trading signals are provided free of charge and advertised with an accuracy rate of 82%. One could suggest that if more of Alvexo’s traders used the brokerage’s trading signals, their overall client loss rate wouldn’t be sitting at 79 percent.

The economic calendar returned a blank section, while the four trading calculators are better presented as an MT4 plugin for a proper deal ticket. The blog offers good topics which can be useful to traders. Still, the mix of different font sizes, colors, and overall design created an interrupted read, as did endless adds for Alvexo products.

The brief market updates represent a solid service provided by Alvexo.

Alvexo does offer free signals, a service that not every broker offers.

The economic calendar remained blank.

The Alvexo blog covers interesting topics and is worth a read.

Education

The Trading Academy is truly the best feature Alvexo offers. There is an abundance of written content and videos available, and much of it is good quality. Clicking on “Start Learning!” opens a new tab populated with articles and video tutorials, the content is solid but again littered with marketing material from this broker. This may help explain why the education provided appears to disconnect with traders, the academic atmosphere is not provided, and a marketing-focused presentation is dominant. Five banners are embedded with each educational article, and therefore the Trading Academy is a bit distracting when it should be designed for ease of use.

The Trading Academy is an excellent idea, and marks the prime service offered.

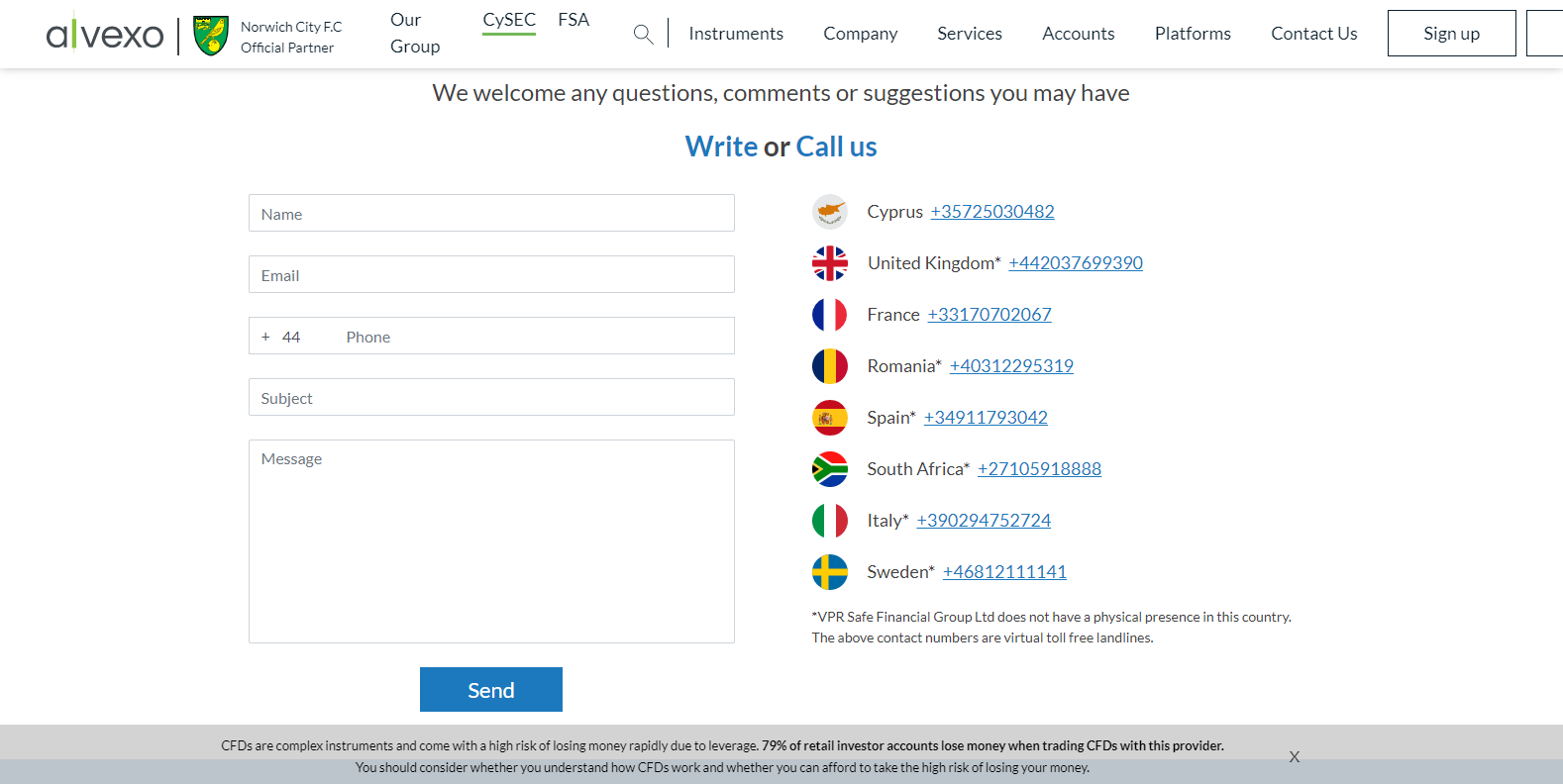

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |      |

Customer service information remains scarce, and operating hours are not mentioned. Traders may call one of the toll-free numbers provided or use the webform to send a message. At a well-managed brokerage, most traders will never require assistance. The opportunity to offer TeamViewer support could be interesting if serious assistance is needed, though traders would be rightfully skeptical about the security implications of sharing screens in this way.

Bonuses and Promotions

Traders were not offered any bonuses or promotions at the time of this Alvexo review, most likely because regulation does not allow these offerings.

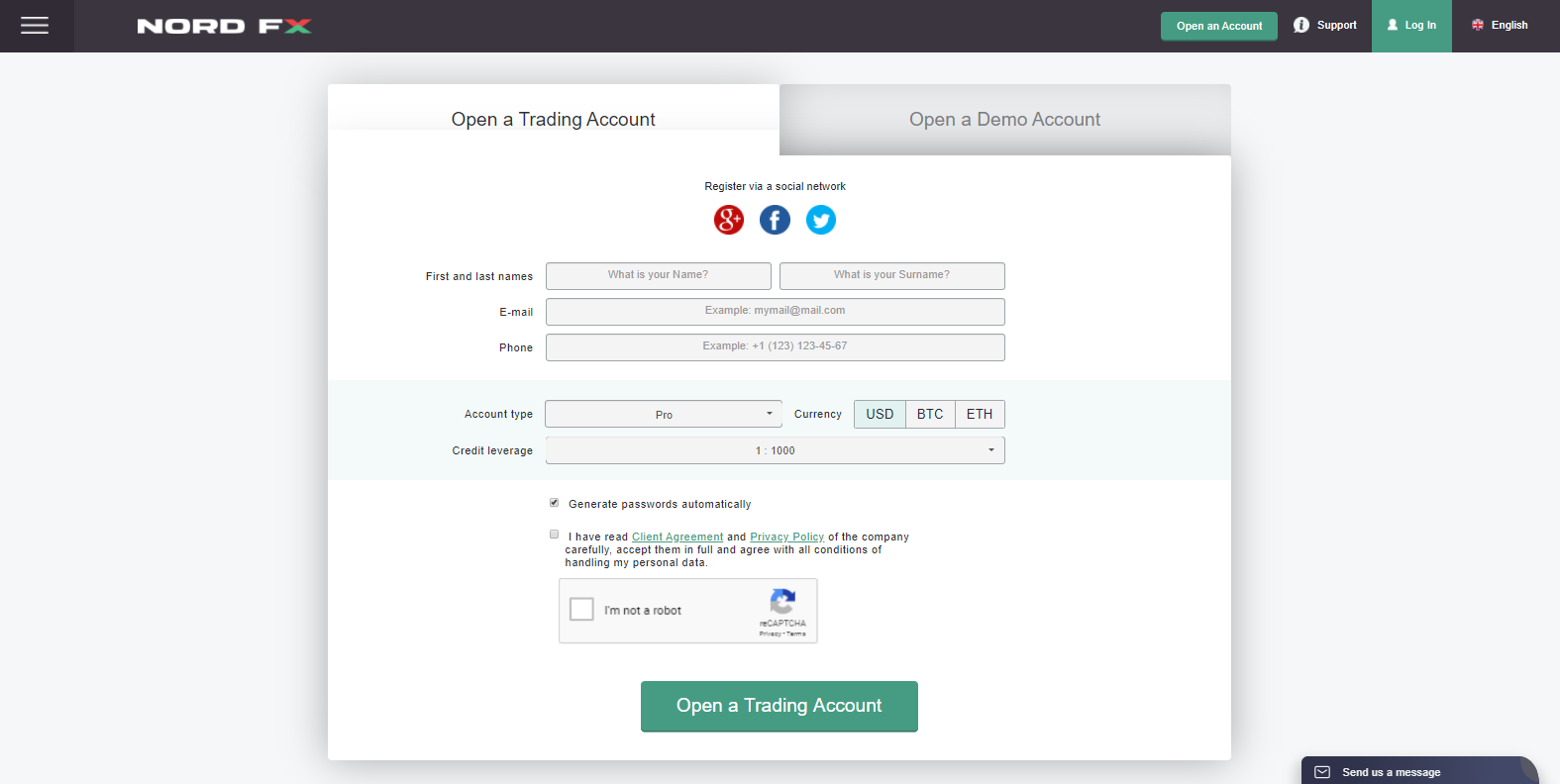

Opening an Account

Accounts are opened through an online application, as is the standard operating procedure across the brokerage industry. The quick form should grant access to the back-office, from where accounts need to be verified per regulatory requirements; a copy of the ID and a proof of residence document concludes the verification process.

Deposits and Withdrawals

Alvexo provides no information regarding deposits and withdrawals on their website which is highly unusual. The absence of this critical component presented the final piece to conclude that this broker operates a trading environment that should be avoided.

Summary

Alvexo provides traders with expensive trading conditions in an uncompetitive trading environment; they may be the highest across the brokerage industry. Alvexo claims over 650,000 registrations, though this information could not be confirmed. Information provided regarding costs contradicts itself on their website, and CySEC regulation does little to install confidence in Alvexo.

The best offerings by Alvexo are its daily market news, signals and trading academy, all of which are worth checking out. That being said, the company’s proprietary platform is lacking extra features that make it stand out, and the lack of plugins for MT4 is unfortunate.

The educational section is filled with ads but does provide valuable information if traders can prevent themselves from getting distracted. Trading signals are provided free of charge and marketed with an accuracy rate of 82%, though we didn’t test them ourselves. We can say that Alvexo seems to have the makings of a good broker, but at the end of this review, we are left feeling disappointed that the execution of the broker did not live up to the hype. Alvexo is headquartered in Limassol, Cyprus. Alvexo collects its fees from spreads, commissions, and client losses where it acts as a direct counter-party; this broker is a market maker. Alvexo provides no information regarding deposits and withdrawals. The minimum trading size is listed as 0.01 lots, but dependent on account type; it is increased to as high as 0.25 lots. Alvexo initiates a stop-out at a 50% equity-margin ratio in its Classic account, all other account types face a stop-out at a 50% equity-margin ratio. Alvexo is owned and operated by VPR Safe Financial Group LTD, a Cypriot Investment Firm; the company registration number is HE 322134. It is supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 236/14; the license was approved on March 6th 2014. The maximum leverage is 1:30. Alvexo has an online application form, which is the standard operating procedure. Alvexo offers the MT4 trading platform, as well as its WebTrader platform.FAQs

Where is Alvexo based?

How does Alvexo make money?

How can I deposit into an Alvexo account?

What is the minimum lot size at Alvexo?

When does a stop-out take place at Alvexo?

Is Alvexo regulated?

What is the maximum leverage offered by Alvexo?

How do I open an account with Alvexo?

Does Alvexo offer the MetaTrader Trading Platform?