Editor’s Verdict

AMP Futures is a pure-play futures broker in the US offering 50+ trading platforms and four price feeds, promising the lowest commissions, or traders will receive 20 commission-free trades. Founded in 2004, AMP Futures only accepts US-resident traders, and I can recommend it as an execution-only broker for demanding futures traders. Learn what my AMP Futures review uncovered about this futures broker. Should you open an account with AMP Futures?

Overview

AMP Futures offers an excellent trading platform selection with ultra-low fees.

AMP Futures Five Core Takeaways:

- A balanced asset selection for a pure-play futures broker

- A choice of algorithmic trading platforms, including MT5

- A $100 minimum deposit requirement

- 24/5 customer support and trade desk

- No cryptocurrency trading

Headquarters | United States |

|---|---|

Regulators | CFTC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2004 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | Other, MetaTrader 5, Trading View |

Average Trading Cost EUR/USD | Undisclosed |

Average Trading Cost GBP/USD | Undisclosed |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Not applicable |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

AMP Futures Regulation & Security

Country of the Regulator | United States |

|---|---|

Name of the Regulator | CFTC |

Regulatory License Number | 0412490 |

Regulatory Tier | 1 |

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. AMP Futures has one regulated entity.

Is AMP Futures Legit and Safe?

My AMP Futures review found three regulatory actions by this broker, but they were minor offenses related to bookkeeping and one general misconduct fine. Therefore, I rate AMP Futures as a legitimate and safe broker.

AMP Futures regulation and security components:

- AMP Futures is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association

- Founded in 2004

- Segregation of client deposits from corporate funds

- No negative balance protection

What would I like AMP Futures to add?

AMP Futures has no investor protection features, which is typical for US-based brokers but does not make it right. I would appreciate it if tastytrade would offer third-party insurance. I am also missing details concerning the core management team.

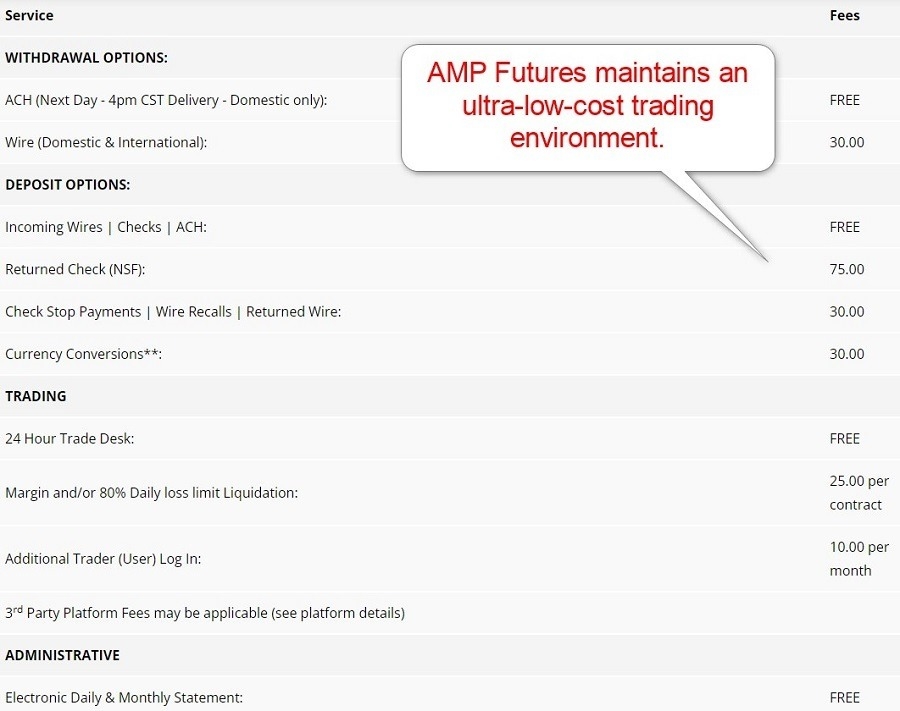

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. AMP Futures only notes that it provides the lowest trading commissions industry-wide and is willing to “match or beat any written commission quote,” or traders will receive 20 commission-free trades.

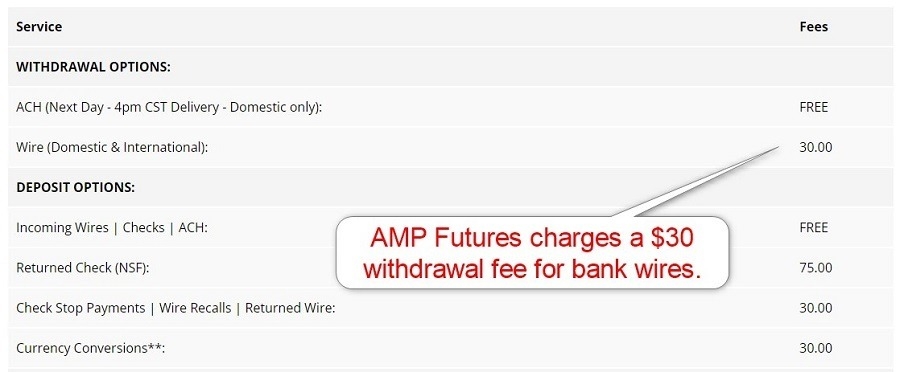

An inactivity fee does not exist, while a $30 currency conversion fee exists. AMP Futures does not charge deposit fees but applies a $30 withdrawal fee. AMP Futures also levies a $30.00 per contract forced liquidation fee.

Average Trading Cost EUR/USD | Undisclosed |

|---|---|

Average Trading Cost GBP/USD | Undisclosed |

Average Trading Cost WTI Crude Oil | Undisclosed |

Average Trading Cost Gold | Undisclosed |

Average Trading Cost Bitcoin | Not applicable |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Range of Assets

AMP Futures is a pure-play futures broker with a balanced asset selection that supports many trading strategies and medium cross-asset diversification opportunities.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

AMP Futures offers the following sectors:

- Micro E-mini futures (US indices)

- Equity index futures (global selection)

- Forex futures (including micro futures)

- Energy futures

- Metal futures

- Grain futures

- Soft commodity futures

- Meat futures

- Financial futures

AMP Futures Leverage

AMP Futures does not list margin requirements as a ratio but provides a detailed list of day trading and maintenance margins per contract, which does not change based on the price of the futures contract. Therefore, the margin ratio varies between contracts.

What should traders know about AMP Futures’s leverage?

- The minimum day trading margin depends on the asset and is as low as $27.50 and as high as $12,650 per contract

- The minimum maintenance margin depends on the asset and is as low as $110 and as high as $12,650 per contract

- Negative balance protection does not exist

- AMP Futures starts forced liquidation if account equity drops below 80%

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses

Account Types

AMP Futures offers one account type to all traders. Other choices are for specific purposes. While the equal treatment of traders is noble, I am missing volume-based discounts.

Therefore, high-volume and high-frequency traders should consider all trading fees and evaluate if AMP Futures maintains a pricing advantage.

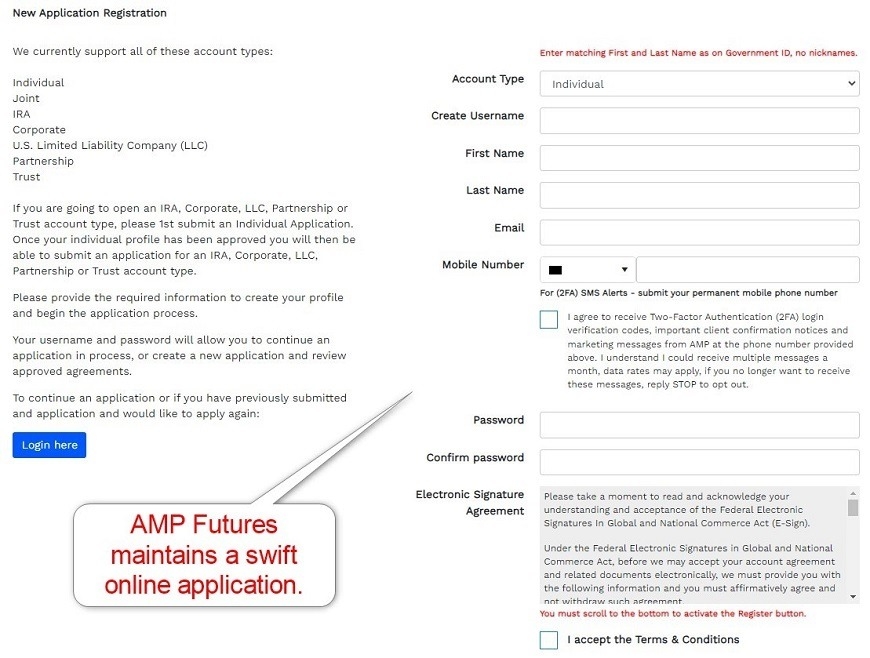

AMP Futures offers the following account types:

- Individual

- Joint

- IRA

- Corporate

- US Limited Liability Company (LLC)

- Partnership

- Trust

My observations concerning the AMP Futures account type are:

- A $100 minimum deposit requirement

- No volume-based rebates

- No monthly volume requirements

- No inactivity fee

- S&P500 e-Mini margins of $40 per contract

AMP Futures Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the AMP Futures demo account?

- A $50,000 demo account

- Real-time quotes for select GLOBEX, e-CBOT, and single stock futures contracts

- Delayed quotes for pit-traded CBOT, CME, EUREX, COMEX, and NYMEX contracts

- A demo account requires registration but no account verification

Trading Hours

Asset Class | From | To |

|---|---|---|

Futures | Sunday 17:00 | Friday 16:00 |

Trading Platforms

The trading platform selection at AMP Futures is superb, granting traders 50+ choices, including the algorithmic trading platform MT5, the full version of QuanTower, and TradingView for social traders. AMP Futures offers price feeds from CQG, TT, Rithmic, and Teton. Please note that exchange data fees may apply, depending on what traders require.

I appreciate the wealth of trading platform choices, as it allows traders to trade futures in the way that suits them best. AMP Futures is the best broker globally in this category.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

AMP Futures’ unique features are the ultra-low pricing guarantee and the choice of trading platforms. It places AMP Futures at the top of the list among US futures brokers.

Research & Education

AMP Futures neither provides in-house research nor sources third-party research, as it is an execution-only futures broker for DIY traders.

What about education at AMP Futures?

AMP Futures maintains a YouTube channel with 500+ videos but lacks a dedicated beginners section, which is not its target market.

My conclusion:

- First-time traders can browse YouTube videos for valuable lessons

- I strongly recommend that beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management

- Avoid paid-for courses and mentors

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Sunday 17:00 through Friday 17:00 |

Website Languages |  |

Traders receive 24/5 multi-lingual customer support and 24/5 trade desk support. Traders can contact customer support via e-mail, phone, live chat, and remote desktop. AMP Futures describes its products and services well, and I had no reason to contact customer support during my AMP Futures review. The AMP support forums answer many questions and allow traders to interact, and I recommend it before contacting customer support.

Noteworthy:

- AMP Futures offers phone support, but I miss a direct line to the finance department, where most issues can arise

Bonuses and Promotions

During my AMP Futures review, neither bonuses nor promotions existed.

Opening an Account

The AMP Futures online application asks for the account type, desired username, the trader’s name, e-mail address, and mobile phone number.

What should traders know about the AMP Futures account opening process?

- AMP Futures complies with global AML/KYC requirements

- Account verification is mandatory

- Most traders pass verification by uploading a copy of a government-issued ID and a proof of residency document issued within the past six months

- AMP Futures may ask for additional information on a case-by-case basis

Minimum Deposit

The minimum deposit requirement is $100.

Payment Methods

Withdrawal options |   |

|---|---|

Deposit options |   |

AMP Futures supports bank wires and checks.

Accepted Countries

AMP Futures only accepts US-resident traders but has an international subsidiary that accepts most non-US residents.

Deposits and Withdrawals

The secure AMP Futures back office handles all financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at AMP Futures?

- The minimum deposit is $100

- AMP Futures charges a $30 withdrawal fee

- Stopped checks or wire recalls incur a $30 fee, while a returned check faces a $75 fee

- Currency conversions cost $30

- External processing times and fees depend on the bank

- In compliance with AML regulations, the name of the trading account and payment processor must be identical

Is AMP Futures a good broker?

I like the trading environment at AMP Futures for its ultra-low commission pledge and choice of trading platforms, with a focus on algorithmic trading. While several free trading platforms are available, data fees may apply. The asset selection is well-balanced for a pure-play futures broker, but AMP Futures is not a beginner-friendly broker. Traders receive free 24/5 trading desk support from a well-trusted broker with 20+ years of experience. Therefore, I recommend AMP Futures for demanding traders who can overlook the absence of a volume-based rebate program. AMP Futures has a $100 minimum deposit requirement. AMP Futures has been in business since 2004. AMP Futures deposits funds within 24 hours, but it depends on the payment processor. The CFTC/NFA regulates AMP Futures.FAQs

What is the minimum balance for AMP Futures?

How long has AMP Futures been in business?

How long do AMP Futures deposits take?

Is AMP Futures a regulated broker?