Editor’s Verdict

Apex Trader Funding, a US-based retail prop trading firm founded in 2021, offers a wealth of trading tools for aspiring prop traders, who can choose from seven funded account options. Apex Trader Funding offers Rithmic and Tradovate accounts and charges a monthly fee based on the account size. The minimum funded account is $50,000, and the maximum payout ratio is 90%. I conducted a comprehensive Apex Trader Funding review to determine the trading conditions and environment. Is Apex Trader Funding the best choice for your trading skills?

The Pros and Cons of Apex Trader Funding

Traders should consider the pros and cons of prop trading with the prop firm Apex Trader Funding. I have summarized the ones that stood out most during my Apex Trader Funding review.

Overview

Apex Trader Funding offers a wealth of trading tools and supports algorithmic trading.

I like the flexibility Apex Trader Funding allows in achieving the profit target, as traders must trade seven days but can spread them out as they see fit. Prop traders can use copy trading software to manage up to 20 accounts. Prop traders keep 100% of the first $25,000 they earn before a 90% profit share applies, placing it at the top of the range in this category.

Apex Trader Funding Trustworthiness and Reputation

Trading with a prop firm, an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts and that the prop firm maintains an excellent reputation among its prop traders.

Is Apex Trader Funding Legit and Safe?

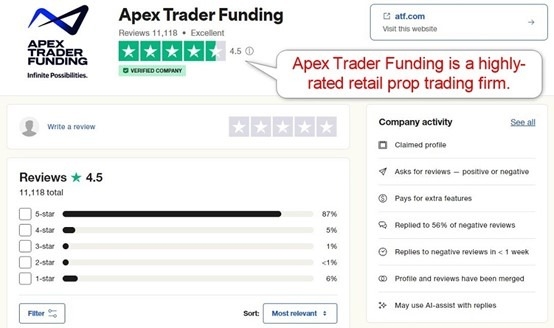

Apex Trader Funding, founded in 2021, lacks operational history. It has a 4.5 out of 5.0 rating on Trustpilot based on 11,112 reviews.

My Apex Trader Funding review found several negative reviews, primarily from non-US prop traders, concerning payouts and constant rule changes to negate withdrawal requests. Another issue was the slow response time from the Apex Trader Funding customer support team. I advise traders to consider the negative comments skeptically, as they could come from traders who have failed the evaluation or violated trading rules. Therefore, I cautiously rate them as a prop trading firm interested traders could try to establish a rapport with.

Apex Trader Funding Features

Apex Trader Funding follows best practices established across the expanding prop firm industry.

The most notable features of Apex Trader Funding are:

- One-step evaluation

- No time limits during the evaluation process

- A minimum of seven trading days to reach the profit target

- No daily drawdown

- No scaling

- A monthly fee, which includes trading platform and data fees

- Rithmic and Tradovate accounts

- 90% profit share, but prop traders keep 100% of their first $25,000

- A series of consistency rules exist, primarily a 30% P&L and 30% single trading profit restriction

- Traders can use algorithmic trading solutions supported in NinjaTrader

- Traders may trade seven days per week, 23 hours per day

- Traders can use copy trading software to copy their traders across multiple accounts

Evaluation Fees & Profit-Share

Apex Trader Funding levies a monthly fee, which includes the trading platform and live data fees. Prop traders can choose from seven evaluation accounts costing between $167 and $657 monthly. Please note that traders cannot change the account value once approved, meaning if they qualify on a $50,000 account, they will manage a $50,000 portfolio. A $100,000 static account is available for a monthly fee of $137, but I cannot recommend it for active prop traders.

The profit share at Apex Trader Funding starts at 100% for the first $25,000 in profits and adjusts to 90%, allowing traders to earn the industry maximum.

The minimum evaluation fee at Apex Trader Funding for a $50,000 account is:

Type of fee | Fee (without discounts) |

One-time evaluation fee | $0 |

Monthly evaluation fee | $167 |

Hold-over-the-weekend | $0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry | Not applicable |

Total fees for a $50,000 account | $167 |

Account Types

Apex Trader Funding has seven account types with a one-step evaluation. The funded account types are $50,000, $75,000, $100,000, $150,000, $250,000, $300,000, and a $100,000 static account alternative. Prop traders can have up to 20 funded accounts.

All accounts are with Rithmic or Tradovate and use the NinjaTrader trading platform.

What Are the Trading Rules at Apex Trader Funding?

The Apex Trader Funding evaluation begins after prospective prop traders choose their preferred evaluation account and pay the monthly fee. There is no time limit, and the profit target depends on the account size, starting with $3,000 on a $50,000 account and a $2,500 trailing threshold.

Violating the maximum overall loss rule results in a hard breach and cancellation of the evaluation. Potential prop traders can restart by paying a $80 reset fee, and there are no limits on how often traders reset their evaluation account.

The trading rules for the Apex Trader Funding evaluation are:

- A trailing P&L cannot exceed 30% of the trade value

- No single trade can exceed 30% of profits

- A minimum of seven trading days

Noteworthy:

- Apex Trader Funding will grant access to live trading accounts after traders pass the evaluation

Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping |

Apex Trader Funding offers the NinjaTrader trading platform with Rithmic or Tradovate. During my Apex Trader Funding review, the maximum leverage was 1:1, meaning prop traders can only trade the funded account size. Since Apex Trader Funding offers live trading accounts, this restriction makes sense from a risk management perspective.

Please note that trading commissions for Rithmic range between $0.84 and $5.58 and between $0.60 and $4.64 for Tradovate.

Education

Apex Trader Funding does not offer education, and beginners should never consider prop trading. Prop traders get a range of trading tools and explanatory content covering select topics, including an offer for 1-on-1 coaching.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

My Apex Trader Funding review found numerous complaints about customer support response times. The Help Center answers many questions before traders sign up for a funded account, and e-mail support is available. Apex Trader Funding also offers phone support Monday through Friday from 9 a.m. to 5 p.m. I am missing a direct line to the finance department, where most issues could arise, and where I came across many complaints. Customer support is an area where Apex Trader Funding must improve.

How to Get Started with Apex Trader Funding

Interested prop traders can start the evaluation after selecting their desired package and paying the monthly fee.

Minimum Evaluation Fee

The minimum monthly fee at Apex Trader Funding is $167 for the $50,000 funded account (a $100,000 static account is available for $137, which I cannot recommend due to the trading conditions).

Payment Methods

Withdrawal options |    |

|---|---|

Deposit options |   |

Apex Trader Funding relies primarily on credit/debit cards for transactions.

Accepted Countries

Apex Trader Funding accepts traders from 100+ countries.

Here is the latest restricted country list, as discovered during my Apex Trader Funding review:

Afghanistan | Kazakhstan | Republic of the Congo | Algeria | Kenya | Reunion |

Azerbaijan | Kosovo | Russia | Bahrain | Kuwait | Rwanda |

Bangladesh | Latvia | Saint Pierre and Miquelon | Belarus | Lebanon | Saudi Arabia |

Benin | Lesotho | Senegal | Brunei | Madagascar | Serbia |

Burkina Faso | Maldives | Somalia | Cameroon | Mauritania | South Africa |

Central African Republic | Mauritius | Sri Lanka | Chad | Mongolia | Tanzania |

China | Morocco | Togo | Congo | Mozambique | Trinidad and Tobago |

Côte D'Ivoire | Namibia | Tunisia | Cuba | Nepal | Turkey |

Curaçao | New Caledonia | Uganda | Cyprus | Nicaragua | Ukraine |

Egypt | Niger | Uzbekistan | Gabon | Nigeria | Venezuela |

Grenada | Oman | Vietnam | Haiti | Occupied Palestinian Territory | Western Sahara |

Iran | Pakistan | Yemen | Iraq | Qatar | Zambia |

Jersey | Republic of Moldova | Zimbabwe | Jordan |

How to Pay the Evaluation Fee

Prop traders can pay their evaluation fee via credit/debit cards. Please note, AMEX cards are not accepted.

The Bottom Line - Is Apex Trader Funding a Good Prop Firm?

I like Apex Trader Funding for its flexibility in reaching the profit target, algorithmic trading via NinjaTrader, and the option to use a trade copier to manage up to 20 accounts. Traders can choose from seven funded accounts and keep 100% of profits from their first $25,000 before an industry-leading profit share of 90% applies. Prop traders must pay a monthly fee, and Apex Trader Funding grants access to live accounts without trading leverage. My Apex Trader Funding review found the usual complaints about prop trading firms, but non-US traders appear to have more issues than US-based traders. I can cautiously recommend Apex Trader Funding to retail prop traders in the US if they accept the consistency rules and limitations. Apex Trader Funding offers funded accounts for a monthly fee. After traders pass the one-step evaluation in a demo account, Apex Trader Funding offers live accounts without leverage, keeping a 10% fee from profits. Still, prop traders will keep 100% of their first $25,000. Darrell Martin founded Apex Trader Funding and remains the majority owner. No single trade can exceed a 30% profit or loss based on the position size. While Apex Trader Funding states that the 30% rule is a soft breach, prop traders have reported it as a hard breach preventing the reception of payouts. Apex Trader Funding states that prop traders can request a payout every eight trading days, and that it manually approves payout requests within two business days.FAQs

How does Apex Trader Funding work?

Who owns Apex Trader Funding?

What is the 30% rule in Apex Trader?

Does Apex Trader Funding pay out?