Editor’s Verdict

Ardu Prime, founded in 1999 and headquartered in Athens, offers clients the core MT5 trading platform upgraded with the Trading Central plugin and STP/NDD order execution. It recently relaunched its website and corporate image, added a dedicated cryptocurrency service, and aims to expand its retail footprint. I reviewed Ardu Prime to evaluate its trading costs and determine if it provides traders with a competitive edge. Is Ardu Prime the right broker for you?

Overview

STP/NDD order execution in a commission-free Forex trading environment.

Headquarters | Greece |

|---|---|

Regulators | HCMC |

Year Established | 1999 |

Execution Type(s) | ECN/STP, No Dealing Desk |

Minimum Deposit | $/£/€ 250 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 5 |

Retail Loss Rate | 70.00% |

Minimum Raw Spreads | 0.8 pips |

Minimum Standard Spreads | 1.6 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 3 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like that Ardu Prime offers STP/NDD execution despite its commission-free Forex cost structure. Ardu Prime also launched a dedicated and regulated cryptocurrency service, Ardu Crypto, which includes custodial services. Therefore, it supports cryptocurrency deposits and withdrawals for Ardu Prime.

Ardu Prime Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Ardu Prime presents clients with one regulated entity and maintains a secure trading environment.

Name of the Regulator | HCMC |

|---|

Is Ardu Prime Legit and Safe?

Ardu Prime has regulatory oversight from the Hellenic Capital Market Commission in Greece, a lesser-known regulator operating within the European Union where the European Securities and Markets Authority (ESMA) is the super-regulator. Ardu Prime is also in the UK Temporary Permissions Regime (TPR) for EEA-based firms that previously passported into the UK (the Ardu Prime FCA reference number is 725166). Additionally, Ardu Prime remains authorized in Germany with BaFin (the Ardu Prime BaFin ID is 10146106).

The Ardu Crypto service provided by Ardu Prime operates under HCMC oversight, registered as a Virtual Asset Service Provider under HCMC for Crypto Exchange and Wallet Custodian Services.

With 20+ years of experience and a spotless regulatory track record, Ardu Prime is a legit and safe broker. It complies with the Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive, while the Greek Investment Guarantee Fund protects retail clients in case of an unlikely insolvency event.

Segregation of client deposits with tier-1 EU and UK banks and negative balance protection also exist.

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. While Ardu Prime offers commission-free Forex trading, spreads rank among the most expensive ones. The EUR/USD has a minimum markup of 1.6 pips or $16.00 per 1.0 standard lot. Traders with deposits above $25,000 can lower costs to $8.00. CFD commissions are $0.02 per share with a $10.00 minimum.

Given the low swap rates the Ardu Prime customer support quoted, traders who maintain leveraged positions for seven days or more can achieve highly competitive trading fees, while short-term traders pay high costs at Ardu Prime.

Minimum Raw Spreads | 0.8 pips |

|---|---|

Minimum Standard Spreads | 1.6 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | No |

The minimum trading costs for the EUR/USD at Ardu Prime are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.6 pips (Standard) | $0.00 | $16.00 |

0.8 pips (Premium) | $0.00 | $8.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Standard account.

Share Commissions

- Institutional and Standard Accounts are charged a commission of $0.02 per share traded, subject to a $10 minimum per trade.

- Premium Accounts are also charged $0.02 per share, but are subject to a $5 minimum per trade.

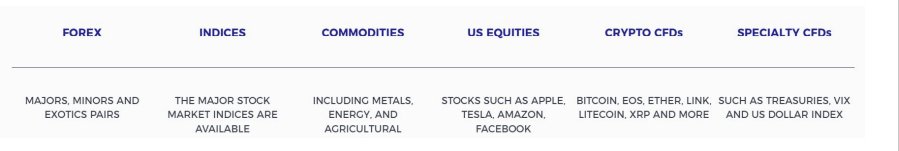

Range of Assets

Ardu Prime list 200+ assets, covering at least six sectors, giving traders a variety of CFDs to choose from and adding Ardu Prime to the list of well-balanced brokers. Ardu Prime is ideal for traders requiring fewer but highly liquid assets. Ardu Prime notes that it continuously expands its list of trading instruments but maintains enough choices for beginners to get acquainted with financial markets.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Bonds | |

ETFs |

Ardu Prime Leverage

As a broker operating under the ESMA framework, Ardu Prime offers retail traders maximum Forex leverage of 1:30. It does not list a professional account but features institutional services. Irrelevant to the amount of leverage, traders must use strict risk management protocols if they use it. Negative balance protection ensures traders cannot lose more than their deposits.

Ardu Prime Trading Hours (GMT +3)

Asset Class | From | To |

|---|

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

While Ardu Prime lists three account types, only the Standard one remains accessible to retail traders. It requires a minimum deposit of $250 or a currency equivalent. Supported account currencies are the US Dollar, the Euro, and the British Pound. The Premium account requires a minimum deposit of $25,000 and the Institutional account option is $100,000. All three account types have STP/NDD order processing, but traders should consider the trading fees.

Ardu Prime Demo Account

Traders can get an Ardu Prime demo account by downloading the MT5 trading platform and registering from within. It requires verification of an e-mail and mobile phone number, which is excessive for demo account registrations. Ardu Prime restricts demo accounts after 30 days of inactivity, making them useful to new traders and experienced who wish to familiarize themselves with the MT5 trading platform.

I recommend traders use similar deposit balances and leverage settings as their planned live account. I also want to caution beginner traders when using demo trading as an educational tool, as they should consider the limitations, like the absence of exposure to trading psychology. It can create unrealistic trading expectations.

Trading Platforms

Ardu Prime offers the MT5 trading platform, but many clients with existing trading solutions will miss the versatile MT4. It is available as a desktop client, lightweight web trader, and mobile app. Traders can use algorithmic trading via EAs, and copy traders have an integrated service. Ardu Prime upgrades MT5 with services by Trading Central, but traders must deposit a minimum of $25,000 for full access. Institutional clients get direct liquidity access and API trading, where Ardu Prime offers a tailored account structure.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

The two unique features of Ardu Prime are its dedicated and regulated cryptocurrency service, including its mobile app, Ardu Crypto, and its multi-currency account and prepaid debit card services operated under Ardu Pay. While neither impacts trading services directly at Ardu Prime, both contribute to managing portfolios via convenient deposit and withdrawal methods from a trusted source.

Research and Education

Ardu Prime outsourced research to Trading Central, which includes actionable trading signals, and does not publish in-house content. It allows Ardu Prime to focus on its core business. I find it an acceptable solution, since Ardu Prime provides weekly market insights and an A-Z glossary of terms which their clients can benefit from. Traders can always source research from third parties if they require it or rely on available services within the MT5 trading community.

Beginner traders can take advantage of the educational resources that are being offered by Ardu Prime. In addition to the above, traders can use the economic calendar to keep on track with companies’ and market updates, which is available through the MT5. My recommendation to traders that seek more information is to look at online trusted sources as well, which are available for free. They will provide an in-depth knowledge base, and beginners should avoid paid-for courses.

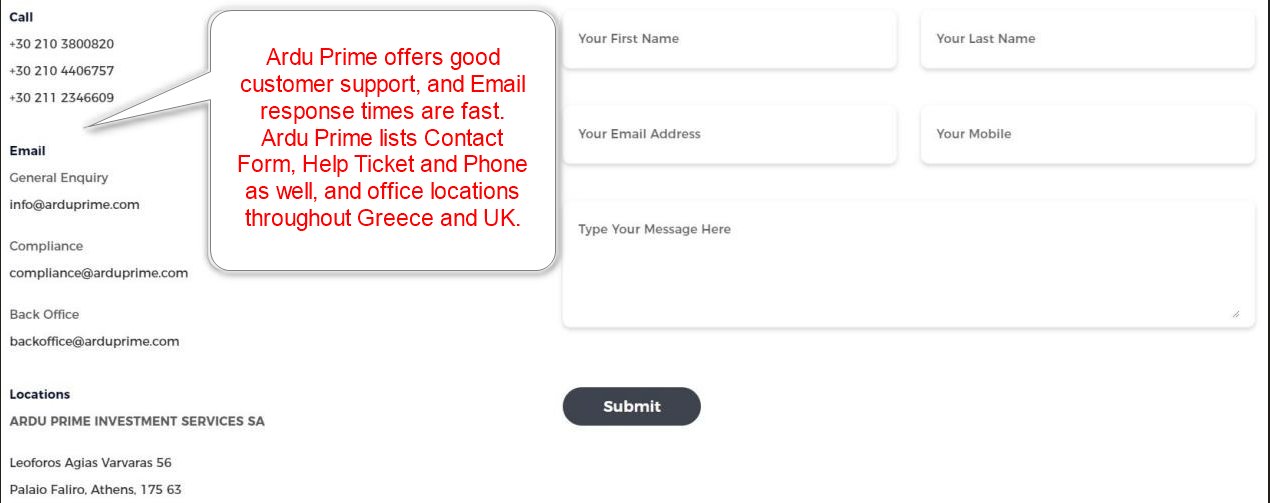

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |   |

Customer service at Ardu Prime is available 7 days a week. Clients may contact Ardu Prime via Email, Contact Form and Support Ticket from Monday to Sunday, from 09:00 am to 22:00 pm GMT +2. I recommend traders read through the FAQ section before contacting a customer support representative. Email is ideal for both non urgent matters and pressing issues.

Bonuses and Promotions

Ardu Prime neither offers bonuses nor promotions, which the ESMA prohibits.

Awards

Ardu Prime has has received six awards in 2022 since rebranding its corporate image. They are a statement of the ongoing efforts by Ardu Prime to maintain a competitive edge for its clients.

The six Ardu Prime awards are:

- Trading House of the Year (Greece) - Pan Finance Awards 2022

- Best Investment Services Provider (Greece) - Pan Finance Awards 2022

- Most Reliable FX & CFD Broker (Greece) - Pan Finance Awards 2022

- Best Trading Conditions – 2022 UF Awards

- Most Innovative Broker – 2022 UF Awards

- Most Trusted Broker Europe – 2022 UF awards

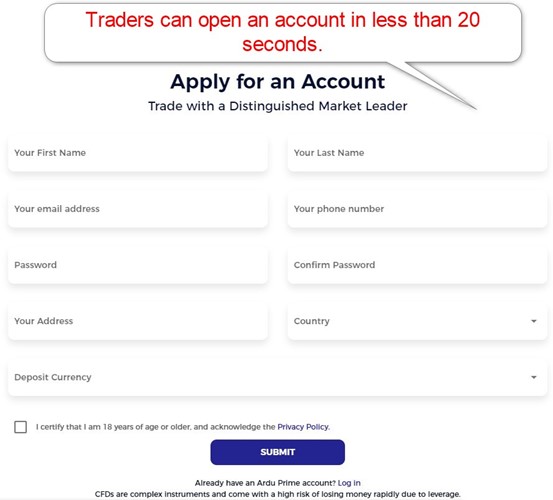

Opening an Account

The Ardu Prime online account application takes less than 20 seconds to complete. Traders must submit their name, e-mail, phone number, desired password, address, country, and deposit currency.

Account verification at Ardu Prime is mandatory. After sending a copy of their ID and one proof of residency document, most traders will pass regulatory stipulated verification. Traders must also verify their registered e-mail address and mobile phone number. Ardu Prime might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at Ardu Prime is between $250 or a currency equivalent for the Standard account, $25,000 for Premium, and $100,000 for Institutional.

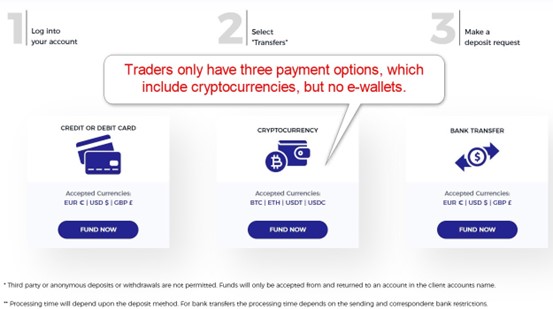

Payment Methods

Ardu Prime supports bank wires, credit/debit cards, and cryptocurrencies.

Withdrawal options |     |

|---|---|

Deposit options |     |

Accepted Countries

Ardu Prime accepts traders from most countries but notes the US, Syria, Iran, North Korea, Russia, and Belarus as restricted countries. Other restrictions may apply, so it is always best to contact the broker’s customer support for specifics.

Deposits and Withdrawals

The secure Ardu Prime back office handles all financial transactions for verified clients.

The deposit and withdrawal options at Ardu Prime are limited to bank wires, credit/debit cards, and cryptocurrencies, preferably via its in-house Ardu Crypto service. Traders may deposit in US Dollars, Euros, British Pounds, Bitcoin, Ethereum, Tether, and USD Coin. Processing times depend on the payment processor. Ardu Prime levies deposit fees of 1% for deposits by credit or debit card, and 4% for Neteller deposits. Third-party payment processor costs may apply.

Is Ardu Prime a good broker?

I like the trading environment at Ardu Prime as it offers STP/NDD order processing despite a commission-free cost structure. The Ardu Crypto and Ardu Pay subsidiaries are excellent value-added services. The asset selection is generous , suitable for traders requiring fewer but highly liquid assets. Traders must consider the high trading fees at Ardu Prime, which upgrades the MT4 trading platform, which fully supports algorithmic and copy trading, with services by Trading Central. The 2022 rebranding of its corporate image makes Ardu Prime a Greek-based broker worth monitoring as it seeks to expand its services and market share.

It’s worth mentioning that in October 2022, Ardu Prime announced a new partnership with EuroLeague becoming a Premium Partner of two top Pan-European basketball club competitions; the Turkish Airlines EuroLeague and 7DAYS EuroCup. This high profile partnership will continue until 2024. Ardu Prime is not a scam, but a legit broker with 20+ years of experience, headquartered and regulated in Greece. Ardu Prime is a Greek-based and regulated multi-asset CFD broker with an expanding footprint in the cryptocurrency sector, primarily via its regulated Ardu Crypto unit. Ardu Prime offers a wide range of CFDs in Forex, Cryptocurrencies, Specialties and more. It is considered to be a trusted broker with 20+ years of experience who offers some of the best trading conditions in the industry. The broker is ideal for both novice and experienced traders with 3 different account types that cover the needs of every individual.FAQs

Is Ardu Prime a scam?

What is Ardu Prime?

Should Ardu Prime Be Your Forex Broker?