Editor’s Verdict

Blueberry Markets, founded by a former Axi executive, is an Australian-headquartered broker that serves all non-Australian clients from its St. Vincent and Grenadines subsidiary. Traders get competitive trading fees, the MT4 and MT5 trading platforms, and a balanced asset selection with equities at its core. I decided to review this broker's St.Vincent and Grenadines subsidiary to evaluate whether Blueberry Markets is worth traders’ capital.

Overview

Blueberry Markets delivers tight spreads, high leverage, and a premium trader account.

I like the Premium Trader account at Blueberry Markets for active traders, as it lowers trading fees. Additionally, beginners get a quality educational package from a trusted broker with 24/7 customer support.

Headquarters | Australia, Saint Vincent and the Grenadines |

|---|---|

Regulators | ASIC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2016 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Average Trading Cost EUR/USD | $9.00 |

Average Trading Cost GBP/USD | $9.00 |

Average Trading Cost WTI Crude Oil | $0.037 |

Average Trading Cost Gold | $0.20 |

Average Trading Cost Bitcoin | $22.70 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Funding Methods | 12 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Blueberry Markets Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check a broker’s regulatory status by checking the provided license with the regulator’s database. Blueberry Markets has one regulated subsidiary with a clean track record.

Is Blueberry Markets legit and safe?

Blueberry Markets, founded in 2016, caters to its non-Australian clients through its unregulated but duly registered St. Vincent and Grenadines subsidiary. It acts as an introduction broker to ACY Capital Australia LLC, and all client deposits remain segregated from corporate funds while negative balance protection exists.

My review did not find any misconduct or malpractice by this broker. However, it needs more security features like an investor compensation fund from the Hong Kong-based Financial Commission, more clarity about the banks handling client deposits, and third-party audits. While Blueberry Markets operates as a regulated broker in Australia, it does not excuse the lack of protection for international traders.

Country of the Regulator | Australia |

|---|---|

Name of the Regulator | ASIC |

Regulatory License Number | 40 606 959 335 (ABN), 606 959 335 (ACN), no data on AFS |

Regulatory Tier | 1 |

Does Blueberry Markets accept US clients?

No, Blueberry Markets is ASIC-regulated and not authorized to offer services to U.S. residents. See the recommended US forex brokers licensed for US traders.

Fees

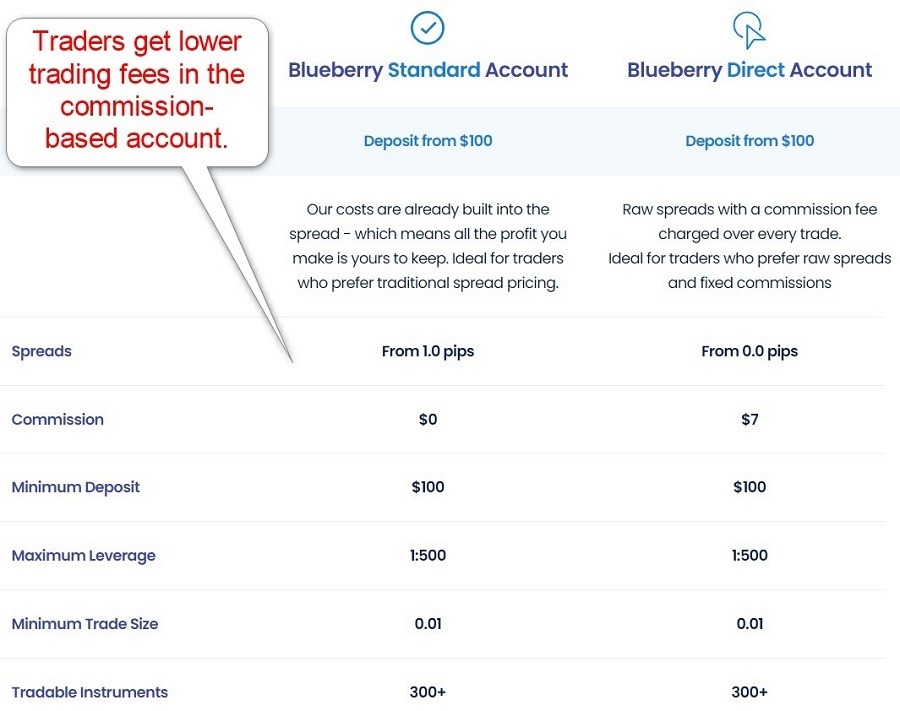

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. Blueberry Markets provides traders with one commission-free and one commission-based pricing environment. The minimum deposit requirement is $100 for both, and I recommend the cheaper commission-based offer. The commission-free Standard account has minimum Forex spreads of 1.0 pips, or $10.00 per 1.0 lot, versus 0.0 pips, and a $7.00 commission, or $7.00 per lot, for the commission-based Direct alternative. There is no inactivity fee, deposits are free, and internal withdrawal fees only apply to bank wires.

The minimum trading costs for EUR/USD at Blueberry Markets are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.0 pips (Standard) | $0.00 | $10.00 |

0.0 pips (Direct) | $7.00 | $7.00 |

Here is a snapshot of Blueberry Markets’ trading fees:

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4/MT5 traders can access swap rates from their platform by following these steps:

- Right-click the desired symbol in the Market Watch window and select Specification.

- Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling EUR/USD, holding the trade for one night and seven nights in the commission-based Premium account.

Taking a 1.0 standard lot buy/sell position in EUR/USD at the average spread and holding it for one night in the Direct account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $7.00 | -$10.6385 | X | $19.6385 |

0.2 pips | $7.00 | X | $7.3548 | $1.6452 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD at the average spread and holding it for seven nights in the Direct account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

0.2 pips | $7.00 | -$74.4695 | X | $83.4695 |

0.2 pips | $7.00 | X | $51.4836 | -$42.4836 |

Noteworthy:

- Blueberry Markets offers positive swap rates on qualifying assets, allowing traders to earn money, as shown in the above example.

- A monthly fee of A$28 applies to trade ASX200 single-stocks on MT5 plus a 0.10% commission of the notional value traded (Blueberry Markets waives this fee if traders exceed A$28 in monthly commissions on ASX200 single-stock trades)

Average Trading Cost EUR/USD | $9.00 |

|---|---|

Average Trading Cost GBP/USD | $9.00 |

Average Trading Cost WTI Crude Oil | $0.037 |

Average Trading Cost Gold | $0.20 |

Average Trading Cost Bitcoin | $22.70 |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | 1.0 pips |

Minimum Commission for Forex | $7.00 per 1.0 standard round lot |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

Range of Assets

Blueberry Markets offers currency pairs, cryptocurrencies, commodities, indices, and equity CFDs. The choice of non-equity CFDs still needs to be improved, but traders get 2,000+ US and Australian listed equities. I like the range of assets outside of equities for scalpers requiring fewer but highly liquid trading instruments.

Blueberry Markets Leverage

Blueberry Markets offers a maximum Forex leverage of 1:500, which decreases to 1:5 for equity CFDs and 1:2 for cryptocurrencies. Forex leverage follows other well-established offshore brokers, but equity and cryptocurrency leverage remain restrictive, especially since Blueberry Markets offers highly liquid assets.

Negative balance protection ensures traders cannot lose more than their deposits. Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Blueberry Markets Trading Hours (GMT+1)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:02 | Friday 23:58 |

Cryptocurrencies | Monday 00:00 | Friday 24:00 |

Commodities | Monday 03:00 | Friday 23:59 |

Crude Oil | Monday 03:00 | Friday 23:59 |

Gold | Monday 01:01 | Friday 23:58 |

Metals | Monday 01:01 | Friday 23:58 |

Equity Indices | Monday 01:01 | Friday 23:58 |

Stocks | Monday 16:35 | Friday 22:55 |

Account Types

Traders can choose between the commission-free Standard account or the commission-based Direct alternative. The premium account upgrade for qualifying traders lowers trading fees further. The minimum deposit is $100 for both, and the minimum trade size is 0.01 lots. Blueberry Markets only offers US Dollar accounts but accepts AUD, USD, CAD, GBP, NZD, EUR, and SGD as deposit currencies. A swap-free Islamic account does not exist, and my review found no restrictions on trading strategies.

Blueberry Markets Demo Account

Blueberry Markets offers demo accounts, which have no expiry, for clients with live portfolios. The default demo balance of $100,000 is excessive, but MT4 and MT5 have fully customizable options. Therefore, I advise traders to select parameters similar to planned live portfolios for a more realistic demo trading experience.

I want to caution beginner traders against using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Traders get the core MT4 and MT5 trading platforms as a desktop client, a web-based alternative, and a mobile app. Both support algorithmic and copy trading, where MT4 is the leading platform. Regrettably, Blueberry Markets does not offer any third-party tools or plugins. Therefore, traders must source them from the 25,000+ custom indicators, templates, and EAs available for MT4 or the 5,000+ for MT5. Please note that quality upgrades or functioning EAs cost money.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Scalping | |

Hedging | |

One-Click Trading |

Unique Features

Blueberry Markets provides copy traders with DupliTrade, allowing them to diversify their portfolios from the embedded MT4/MT5 copy trading service. Algorithmic traders get VPS hosting if they exceed monthly trading volumes of 10.0 lots, a reasonable offer. Managed account services via MAM or PAMM accounts are available for money managers.

Research and Education

Traders get frequent market content and trading ideas from Blueberry Markets but no actionable trading ideas. The Week Ahead videos feature charts explaining what to look for without buy-or-sell recommendations. Blueberry Markets distinguishes between providing research and not violating rules and regulations in tier-1 jurisdictions.

Blueberry Markets has three trading programs: Beginner, Intermediate, and Advanced. They are a good introduction with quality content but need more depth to elevate beginner traders to the level they require to start trading. I recommend the video tutorials, which add more short-form educational content ideal for beginners to understand what they should focus on.

Therefore, beginners should get an idea of the content at Blueberry Markets and then consult free online educational resources. I recommend they begin with in-depth content covering trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

Customer Support

Blueberry Markets customer support is available 24/7 via e-mail, phone, and live chat. I highly recommend live chat due to the fast response time and friendly, knowledgeable customer support representatives. Phone support exists, but Blueberry Markets needs a direct line to the finance department, where most issues can arise. The FAQ section answers many questions, and the broker explains its products and services well.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |     |

Bonuses and Promotions

Blueberry Markets neither provides bonuses nor offers promotions. However, passive income opportunities exist via an affiliate program and a $100 refer-a-friend campaign. Terms and conditions apply, and I recommend traders read and understand them.

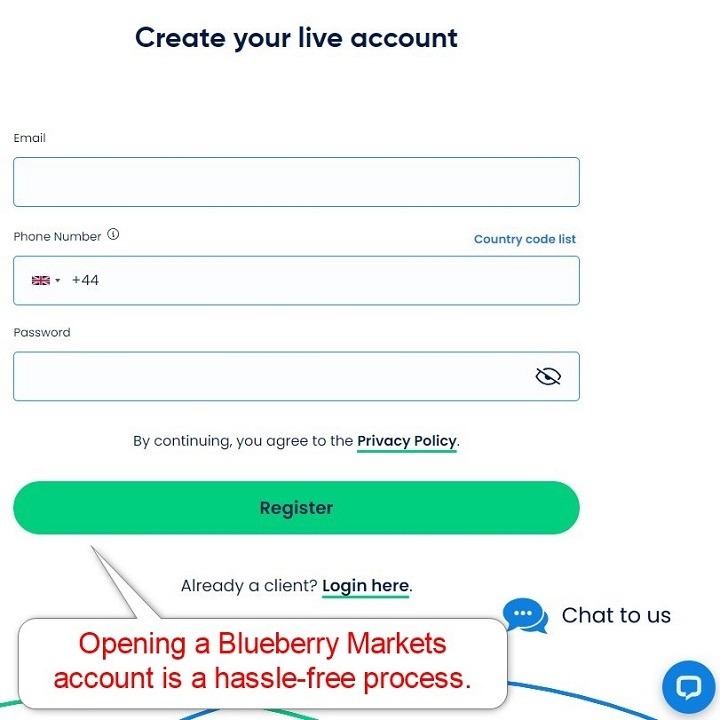

Opening an Account

Traders can open a Blueberry Markets account via a brief online application form without unnecessary data collection. New clients must provide their e-mail, phone number, and desired password to get started.

Account verification at Blueberry Markets is mandatory, as this broker fully complies with global AML/KYC requirements. Most traders will satisfy it by uploading a copy of their government-issued ID and one proof of residency document. Blueberry Markets may ask for additional information on a case-by-case basis.

Minimum Deposit

The Blueberry Markets minimum deposit is $100.

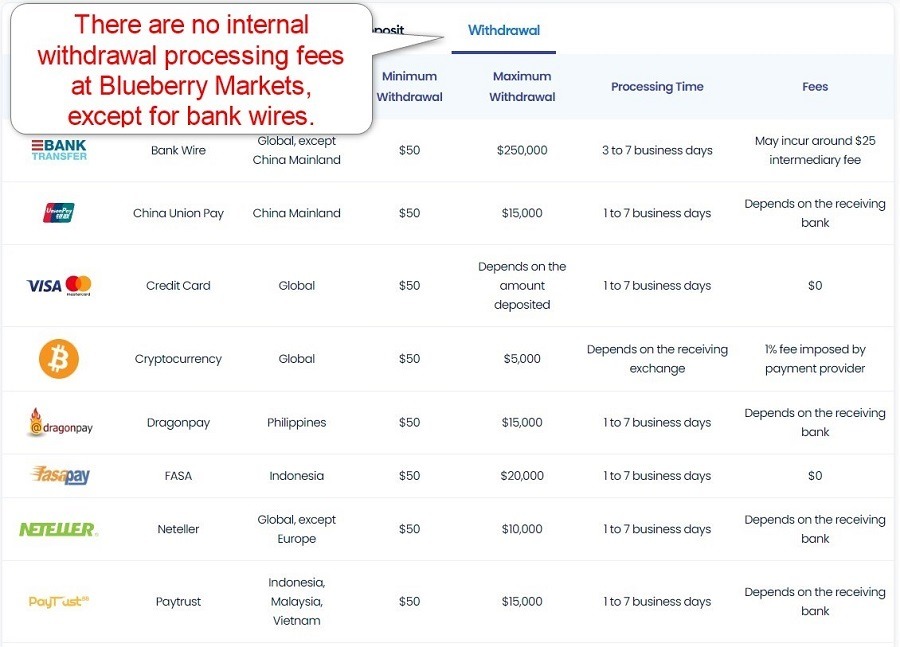

Payment Methods

Blueberry Markets payment methods are bank wire, credit/debit card, China Union Pay, cryptocurrencies, Dragonpay, Fasa Pay, Neteller, Paytrust, Perfect Money, Skrill, STICPAY, and THB QR Payment.

Accepted Countries

Blueberry Markets accepts resident of most countries except American Samoa, the Central African Republic, the Democratic People's Republic of Korea (DPRK), the Democratic Republic of Congo (formerly Zaire), Guam, Guinea-Bissau, Iran, Iraq, Japan, Lebanon, Libya, Mali, New Zealand, the Northern Mariana Islands, Puerto Rico, Saipan, Somalia, South Sudan, the United States, the US Virgin Islands, Vanuatu, and Yemen.

Deposits and Withdrawals

The secure Blueberry Markets back office handles all financial transactions for verified clients.

Blueberry Markets offers twelve payment processors, including cryptocurrency transactions. The minimum deposit is $100, except for China Union Pay, where it increases to $300. The maximum deposit amount depends on the payment processor, while the transaction time is within 24 hours, except for Dragonpay, which averages five to six hours. There are no deposit fees at Blueberry Markets.

The minimum withdrawal amount is $50, and the processing times range from one to seven business days. Blueberry Markets levies a $25 bank wire fee, but all other payment processors are free. Traders may pay third-party costs, currency conversion fees, and follow-on transaction charges.

The name on the payment processor and Blueberry Markets trading account must match in compliance with AML regulations.

Withdrawal options |         |

|---|---|

Deposit options |         |

Is Blueberry Markets a Good Broker?

I like the trading environment at Blueberry Markets for its Premium Trader account, as it allows active high-volume clients to achieve competitive trading fees. I also recommend this broker for equity traders and scalpers requiring fewer but highly liquid assets. Blueberry Markets offers something for everyone, like DupliTrade for copy traders, VPS hosting for algorithmic traders, or MAM/PAMM accounts for money managers. It does not set itself apart from most competitors, except for its outstanding customer support, which ranks among the best I have interacted with during my reviews. Yes, cryptocurrency CFD trading is available at Blueberry Markets. The average withdrawal time from Blueberry Markets is between one and seven business days. The minimum deposit at Blueberry Markets is $100. The maximum trade size at Blueberry Markets is 40 lots. The maximum Forex leverage at Blueberry Markets is 1:500. The St. Vincent and the Grenadines subsidiary, on which this review focused, is an introducing broker to ACY Capital Australia LLC. Yes, Blueberry Markets is available in the UK. Blueberry Markets is a private company headquartered in Australia, with Dean Hyde as its managing director. Yes, Blueberry Markets is a legitimate company registered in St. Vincent and the Grenadines.FAQs

Can you trade crypto on Blueberry Markets?

How long does it take to withdraw from Blueberry Markets?

What is the minimum deposit for Blueberry Markets?

What is the maximum lot size in Blueberry Markets?

What is Blueberry Markets’ leverage?

Is Blueberry Markets a broker?

Can I use Blueberry Markets in the UK?

Who owns Blueberry Markets?

Is Blueberry Markets legit?