Editor’s Verdict

CAPEX, founded in 2016, is a pan-European broker offering 2,100+ CFDs. It also presents five trading tools to clients, available from its proprietary CAPEX WebTrader. It promises a customer-centered and education-oriented business philosophy backed by powerful technology. I reviewed this broker to evaluate its trading conditions. Is CAPEX the right broker for you?

Overview

A pan-European broker with a balanced asset selection and quality trading tools.

Review

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2016 |

Execution Type(s) | Market Maker |

Minimum Deposit | $100 |

Trading Platform(s) | MetaTrader 5, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the balanced asset selection and trading tools at CAPEX, but the absence of MT4 is unfortunate. While traders get MT5, it lacks the abilities of MT4. The IPO section is a nice touch, but retail traders should remain cautious. CAPEX maintains a well-structured educational offering, and I recommend new traders take their time learning and understanding the lessons.

Retail Loss Rate | 69.69% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 1.0 pips |

Cashback Rebates | No |

Minimum Deposit | $100 |

Inactivity Fee | $25 monthly after twelve months |

Deposit Fee | Third-Party |

Withdrawal Fee | 20 USD/EUR/GBP |

Funding Methods | 5 |

CAPEX Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. CAPEX presents EU clients with one well-regulated entity and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | 292/16 |

Is CAPEX Legit and Safe?

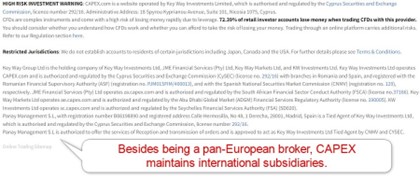

CAPEX is a pan-European broker with its headquarters in Cyprus. It has one branch registered, in Romania. Being an EU-based broker, CAPEX remains registered in all member countries. It complies with the Financial Instruments Directive 2014/65/EU or MiFID II and the EU 5th Anti-Money Laundering Directive. An investor compensation fund, per EU Directive 2014/49/EU, protects 90% of client deposits up to a limit of €20,000.

All client deposits remain segregated from corporate funds, and negative balance protection exists. It operates three domains, www.capex.com, www.keywayinvestments.com, and www.keywayinvestments.ro. CAPEX has a clean regulatory record and maintains a legit and safe trading environment.

Please note:

- CAPEX maintains international subsidiaries, but our review focuses exclusively on the CySEC- regulated unit for EEA traders

Fees

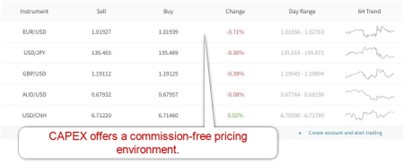

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact revenue. CAPEX offers traders low-commission trading with higher spreads to compensate for the lack of commissions.

CAPEX offers a low-commission cost structure. I received a quote with a 1.2 pip spread for the EUR/USD, the most liquid currency pair, which equals $12.00 per standard lot, during the most liquid trading period. This can make CAPEX most suitable for longer-term traders.

Here is a screenshot of CAPEX quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD at CAPEX in the low-commission trading account:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.2 pips | $0.00 | $12.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission-free account.

Taking a 1.0 standard lot buy/sell position, in EUR/USD, at the average spread and holding it for one night will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.2 pips | $0.00 | -$13.4244 | X | $25.4244 |

1.2 pips | $0.00 | X | -$3.5595 | $15.5595 |

Taking a 1.0 standard lot buy/sell position, in EUR/USD, at the average spread and holding it for seven nights will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

|---|---|---|---|---|

1.2 pips | $0.00 | -$93.9708 | X | $105.9708 |

1.2 pips | $0.00 | X | -$24.9165 | $36.9165 |

Range of Assets

CAPEX lists 2,100+ trading instruments focused on equity markets in the US and Europe, with an overall balanced mix serving retail traders well. It also features unleveraged share dealing, ideal for dividend income portfolios and long-term trading strategies. While Forex traders get a selection of 50+ currency pairs. The other sectors offered provide sufficient assets for retail traders for cross-asset exposure, including Index CFDs, cryptocurrencies, and bonds.

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Asset List Overview

Currency Pairs | Yes |

|---|---|

Cryptocurrency Pairs | Yes |

Commodities and Metals | Yes |

Index CFDs | Yes |

Equity CFDs / DMA Shares | Yes |

Bonds | Yes |

ETFs | Yes |

Options, Futures, and Synthetics | Yes |

Maximum Retail Leverage | 1:30 |

Maximum Pro Leverage | 1:30 |

CAPEX Leverage

Due to ESMA restrictions in force since 2018, maximum Forex leverage is 1:30. Commodities and indices get no more than 1:20, with most limited to 1:10. Shares, ETFs, and bonds max out at 1:5, and cryptocurrencies at 1:2.

Negative balance protection ensures traders cannot lose more than their deposits.

CAPEX Trading Hours (GMT -2)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 21:00 | Friday 20:55 |

Forex | Sunday 22:05 | Friday 21:55 |

Commodities | Sunday 23:01 | Friday 21:55 |

European Equities | Monday 7:05 | Friday 15:25 |

US Equities | Monday 14:35 | Friday 21:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex and commodities, which essentially trade 24/5

- CAPEX does not offer 24/7 cryptocurrency trading

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

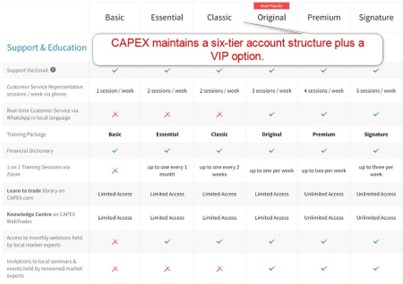

CAPEX deploys an account structure consisting of six tiers plus one VIP option. The minimum deposits range from $100 to $25,000. CAPEX clientsmay enjoy additional conditions in higer tiers.

Trading costs appear fair and equal for all traders. Therefore, traders who require an execution-only broker get the same core trading environment for $100 that they would receive for $25,000, making CAPEX a broker to consider for EEA-based traders who do not require value-added services.

CAPEX Demo Account

CAPEX offers demo accounts, ideal for testing strategies and algorithmic trading solutions, and I did not find a time limit on them. Since MT5 is available, I recommend opening a demo account from within the trading platform.

I recommend a demo account balance is chosen similar to the amount of the planned live deposit. I also want to caution beginner traders against using a demo account as an educational tool. It can create unrealistic trading expectations, as the psychology is different when real money is at stake.

Trading Platforms

CAPEX.com deploys its proprietary CAPEX WebTrader alongside MT5, while MT4 is not offered. The CAPEX WebTrader offers manual traders a clean user interface and modern design, equipped with six trading tools, including Trading Central, Insiders’ Hot Stocks, Daily Analyst Ratings, Bloggers Opinions, Hedge Funds Activity, and News Sentiment.

The MT5 trading platform supports automated trading solutions and features an integrated copy trading service. Both trading platforms are also available as mobile apps. Please note that multi-account management requires a minimum deposit of $5,000, while the complete Trading Central suite is available for $10,000+ accounts.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Unique Features

The Daily Analyst Ratings provided by TipRanks offer quality information, while Bloggers Opinions source data from over 50,000 providers but require a minimum deposit of $2,500. CAPEX also added services provided by TradingView, which requires a $10,000 capital commitment. Overall, CAPEX.com offers high-quality value-added services, but traders should check the requirements for access.

Research and Education

The bulk of research at CAPEX comes from its third-party services, which I find a good solution. One analyst provides market commentary throughout the week. Five trading tools are available to all clients using the proprietary CAPEX WebTrader. I recommend traders who are interested in services by Trading Central, TipRanks, and TradingView check the minimum deposit requirements.

CAPEX promises an education-oriented business philosophy and delivers a well-structured trading academy. I highly recommend less experienced traders make it their first step at CAPEX, as the quality written content will ensure first-time traders build a solid educational foundation. Webinars are also available in Spanish. A financial dictionary also exists, covering many terms in short format.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Undisclosed |

Website Languages |         |

CAPEX transparently lists all contact methods on its website, but the support hours are unavailable, suggesting regular business hours in Europe apply. I like that CAPEX maintains a trading desk for phone-assisted trades. Since CAPEX describes its products and services well, I doubt many clients will require further assistance. I recommend live chat for non-urgent matters and phone support for emergencies

Bonuses and Promotions

CAPEX neither offers bonuses nor hosts promotions, as these cannot be offered within the EU due to the ESMA regulatory framework. CAPEX maintains a high-paying partnership program ideal for passive income generation.

Awards

CAPEX has received five industry awards from well-respected sources. They are a statement of the ongoing efforts by CAPEX to maintain a competitive edge for its clients.

The five CAPEX awards are:

- Fastest Growing Provider - Forex Awards 2018

- Best Dealing Room - Forex Awards 2019

- Best New Forex Broker Middle East - Global Banking & Finance Review 2020

- Best Trading Tools - Brokercheck 2020

- Best Forex Educational Broker - Forex Expo 2020

The award for best dealing room stands out, as it belongs to the CAPEX core offering to traders.

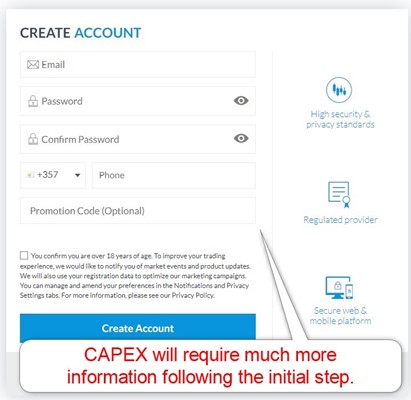

Opening an Account

While the application merely asks for an e-mail, password, and valid phone number, CAPEX is also required to ask traders to complete an appropriateness test. This can make the account opening process a bit longer on average compared to brokers outside the EU, but this is a relatively trivial matter and the difference is not great.

Account verification remains a necessary final step, usually satisfied by sending a copy of your ID and one proof of residency document.

Minimum Deposit

The minimum deposit at CAPEX is between $100 and $25,000, depending upon the account type chosen.

Payment Methods

CAPEX accepts:

- Credit/debit card

- Fast online banking

- Skrill

- Neteller

- PayPal ‘

- ApplePay

- GooglePay

- iDeal

- Giropay

- Paysafecard

This review focused on the CySEC-regulated subsidiary, catering to EEA clients. CAPEX caters to most international traders via its global subsidiaries, except residents of the USA, Canada, and Japan.

Deposits & Withdrawal

The secure CAPEX back office handles all financial transactions for verified clients. CAPEX charges a fee of 20 USD/EUR/GBP for withdrawals , and also charges currency conversion fees where applicable. Traders may face third-party payment processor charges, especially with bank wires. CAPEX advertises payment processing times of one business day by its finance department, and its FAQ section reveals an additional three to seven business days until clients receive their funds, dependent on the payment processor.

Is CAPEX a good broker?

I like the trading environment at CAPEX for its integrated trading tools, which are available in the proprietary CAPEX WebTrader. Equity traders get a balanced choice of trading instruments, including direct share dealing, ETFs. I also like the educational section at CAPEX, and I highly recommend traders take advantage of the quality content. Overall, CAPEX offers less experienced traders and equity traders in the EEA a trustworthy broker and reliable choice. CAPEX processes withdrawals within one business day, but it may take three to seven days for clients to receive their funds. CAPEX offers an adeuate execution-only service to EEA-based Forex traders. The minimum deposit at CAPEX is $100. CAPEX offers clients a choice between its proprietary CAPEX WebTrader and the MT5 trading platform. CAPEX is not a scam. It operates under the supervision of the CySEC, where it maintains a clean track record.FAQs

How long does it take to withdraw from CAPEX?

Is CAPEX a good Forex broker?

What is the minimum deposit at CAPEX?

Which trading platforms are available at CAPEX?

Is CAPEX a scam?