Coinbase Editor’s Verdict

Coinbase is a digital currency exchange founded in 2012 in the US. In 2016, it rebranded the Coinbase Exchange to the Global Digital Asset Exchange (GDAX), its primary asset. It is one of the most recognized exchanges globally, facilitating cryptocurrency exchanges with fiat currencies in 32 countries. Its cryptocurrency wallet is available in 190 countries. Coinbase caters to over 35 million traders from over 100 countries, has trading volume in excess of $220 billion, and has over $7 billion of assets in storage. Coinbase has a global team consisting of over 1,000 employees; moreover, it has raised more than $500 million in funding from fifteen investors. The management team believes that cryptocurrencies are the future of money, and that it will create a more open, fair, and efficient financial system.

Overview

Coinbase is well-positioned to remain an essential part of the evolving cryptocurrency sector, particularly in the US.

United States 2012 Market Maker None Proprietary platform, Web-based 0.05% to 0.60%

Coinbase established itself as a primary player in the cryptocurrency sector in the US. The talented management team and board of directors continue to lead Coinbase and increase its US market share. It offers new traders an excellent start into cryptocurrency trading, but it is also one of the more expensive brokers to buy, sell, and hold digital assets. Its educational program awards new traders with a small number of cryptocurrencies after completing each lesson, making it an excellent tool that offers value and pays traders to learn. Advanced traders should consider Coinbase Pro, the digital asset exchange of Coinbase, where costs remain visibly lower but still ahead of international competitors. Coinbase also has numerous complaints from US-based customers concerning funds not available when promised. The US Internal Revenue Service (IRS) ordered Coinbase to report all users with more than $20,000 in annual transactions. It lists its two priorities as being the most trusted and the easiest to use and delivers on the latter without question.

Regulation and Security

Since Coinbase is neither a regular broker or financial company, the regulatory environment remains disjointed. In the US, this exchange maintains registration with FinCEN as a Money Services Business. Coinbase is not an SEC-registered broker nor is it regulated by the Commodity Futures Trading Commission (CFTC), or a member of the National Futures Association (NFA). Coinbase has an operating license from each US state which requires it; presently, that is 44 states plus the District of Columbia. Only 2% of assets remain online, and an insurance policy is in place which would cover any losses as a result of a breach of physical security or cybersecurity, or by employee theft at Coinbase.

A Coinbase user agreement for non-US traders, issued by its UK subsidiary, Coinbase UK LTD, is the only document available for international traders. In the US, Coinbase complies with the Bank Secrecy Act and the USA Patriot Act, and in the UK, Coinbase maintains only a business registration. Coinbase seeks to acquire an operating license in every jurisdiction where local law requires it; on a global level, it remains fully compliant with all applicable laws and regulations. In 2018, Coinbase acknowledged that some customers were overcharged for credit/debit card purchases; it is important to note that the fault was not with Coinbase itself, but with the banks, and occurred after they changed the merchant category code (MCC) for cryptocurrency purchases. Some issues with the availability of client funds emerged in 2018 in the US, per complaints filed against Coinbase with the Consumer Financial Protection Bureau. Overall, traders can trust the safety and security of Coinbase.

Coinbase complies with all applicable laws globally, but regulatory oversight, such as that for a traditional broker or exchange, does not apply.

Non-US traders have a user agreement with the UK subsidiary.

Coinbase Security

When it comes to security, Coinbase security delivers and grew into a highly secure broker and exchange. With 98% of all assets in offline cold storage, they are out of reach for hackers and theft. Coinbase keeps just 2% in hot storage online to cater to the day-to-day trading needs of clients. Coinbase splits the cold storage data with redundancy, encrypts it with AES-256, and stores FIPS-140 USB drives. It also keeps paper backups in case something happens to the USB drives. Enhancing security further, Coinbase stores the USB drives and paper codes in safe deposit boxes and vaults spread around the globe. Assets in hot storage also carry an insurance policy, covering traders against breach of security at Coinbase, employee theft, or compromise of the account. Coinbase pools cash balances of US clients together and keeps them in FDIC-insured banks. They remain protected up to $250,000 in case of default by the bank. Non-US clients have access to local alternatives, where the protection depends on domestic banking laws.

Coinbase security also implements 2-step verification on all accounts, requiring a mobile phone, together with the username and password to access the dashboard. The Coinbase website has SSL security, and wallets with private keys have AES-256 encryption. Completing the security protocols at Coinbase is database security, where it uses SQL injection filters to prevent CSRF attacks. They verify each request to post, put, or delete commands. Hash passwords use bcrypt with a cost factor of 12, and Coinbase keeps application credentials separate from the database and codebase. The Coinbase Bug Bounty Program engages the community to identify bugs and allows Coinbase to address them swiftly. From a security perspective, Coinbase does an excellent job. It ensures that assets and user data remains safe, protected, and insured, delivering ease of mind to traders and investors.

Fees

Average Trading Cost Bitcoin | 0.05% to 0.60% |

|---|

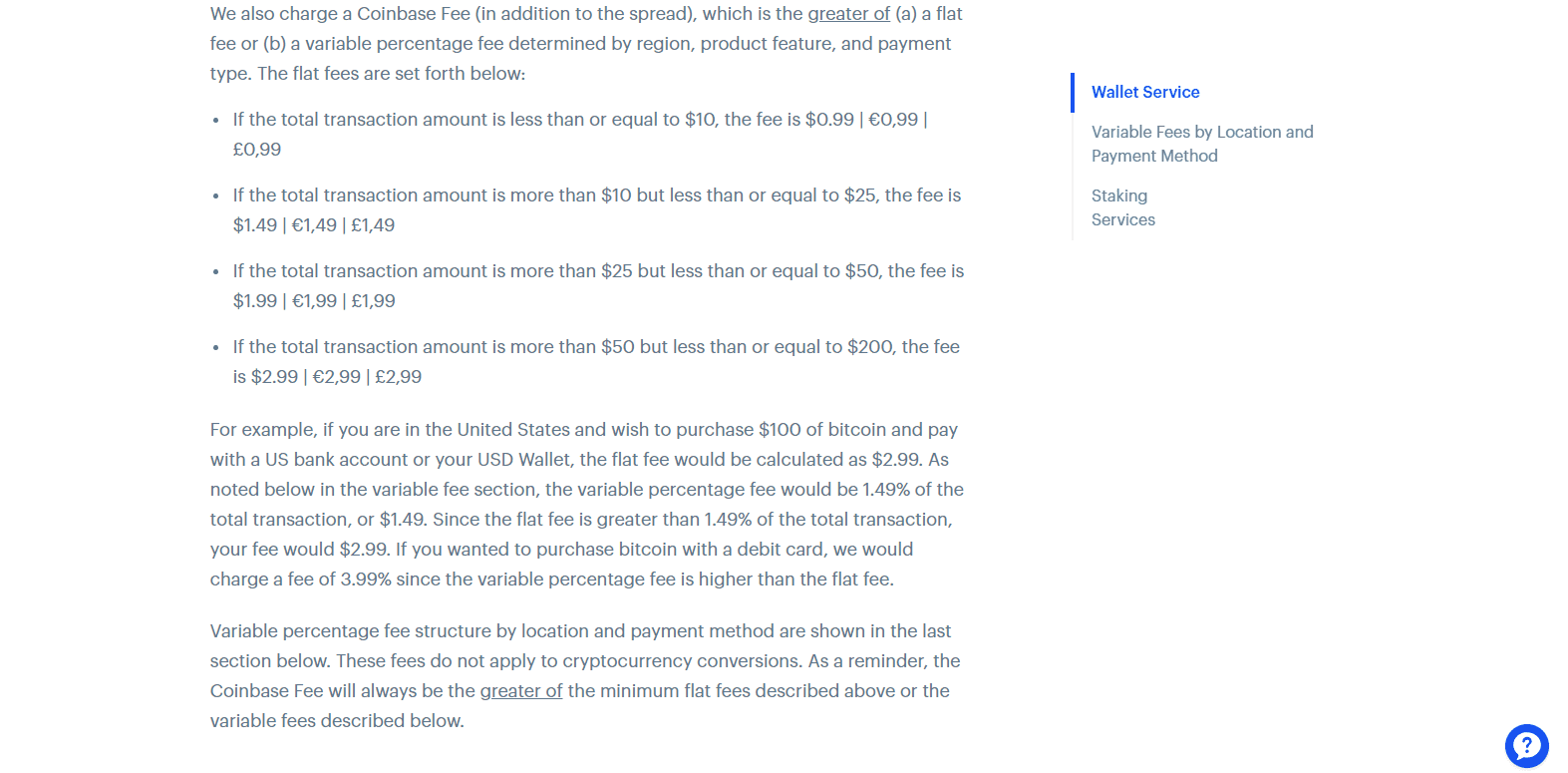

Coinbase earns the majority of its revenue from commissions charged with each fiat transaction. A four-tier flat fee structure exists, together with a variable percentage-based fee that is charged by the payment processor; in each instance, Coinbase will claim whichever fee is greater. Additionally, an 8% annualized interest rate for margin trading applies. Revenue estimates for 2019 were $520 million, of which approximately one-third came from the UK subsidiary.

The four tiers increase in somewhat small increments, as outlined below:

- Tier 1 is for transactions below $10.00, which incur a flat fee of $/€/£0.99.

- Tier 2 is for transactions between $10.01 and $25.00, which incur a flat fee of $/€/£1.49.

- Tier 3 is for transactions between $25.01 and $50.00, which incur a flat fee of $/€/£1.99.

- Tier 4 is for transactions between $50.01 and $200.00, which incur a flat fee of $/€/£2.99.

A four-tier flat fee structure for fiat transactions exist.

Network transaction fees, which vary on the blockchain where they occur, also apply. Traders should be aware that Coinbase charges an estimated blockchain fee, which may not be the actual amount charged.

Transactions on the proprietary trading platform, Coinbase Pro, also feature a mark-up on spreads (either a flat fee or a percentage of the transaction).

Cryptocurrency conversions face mark-ups as high as 2.00%.

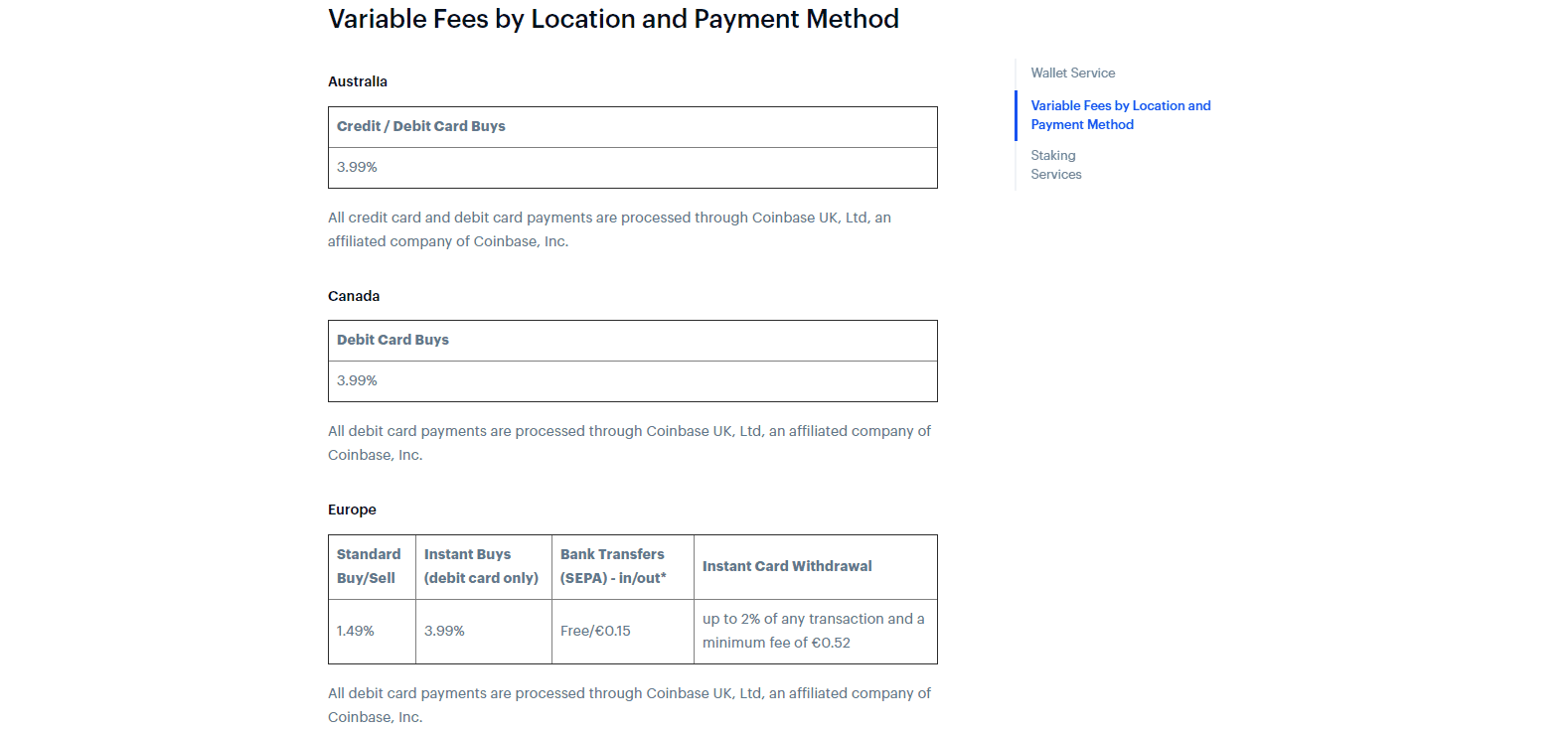

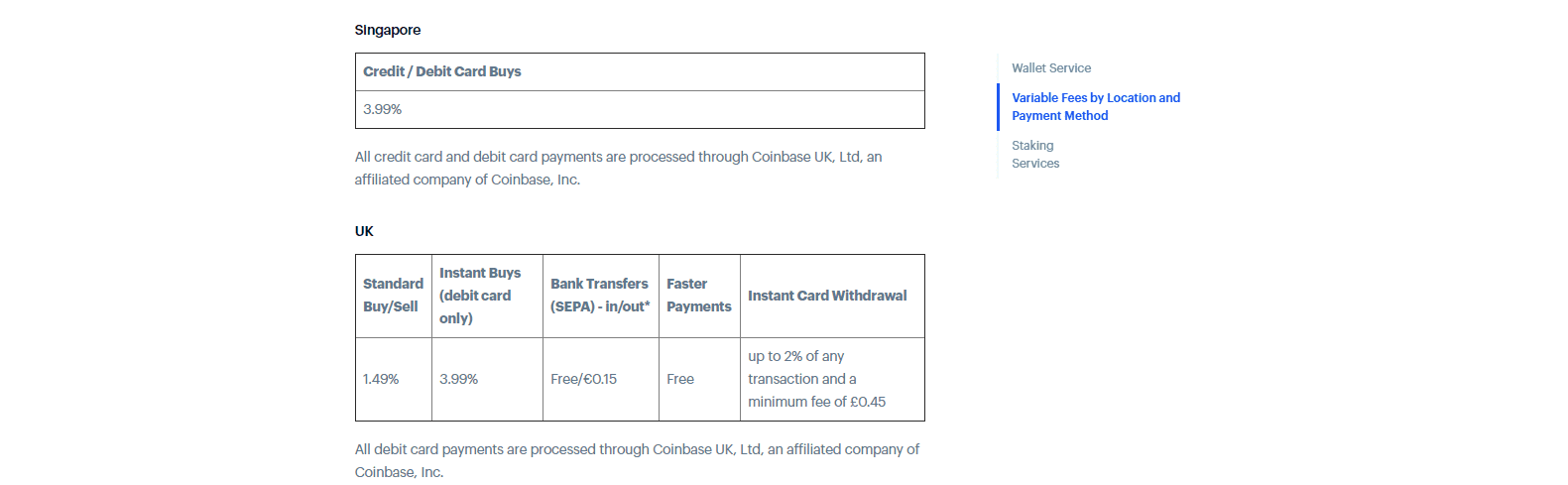

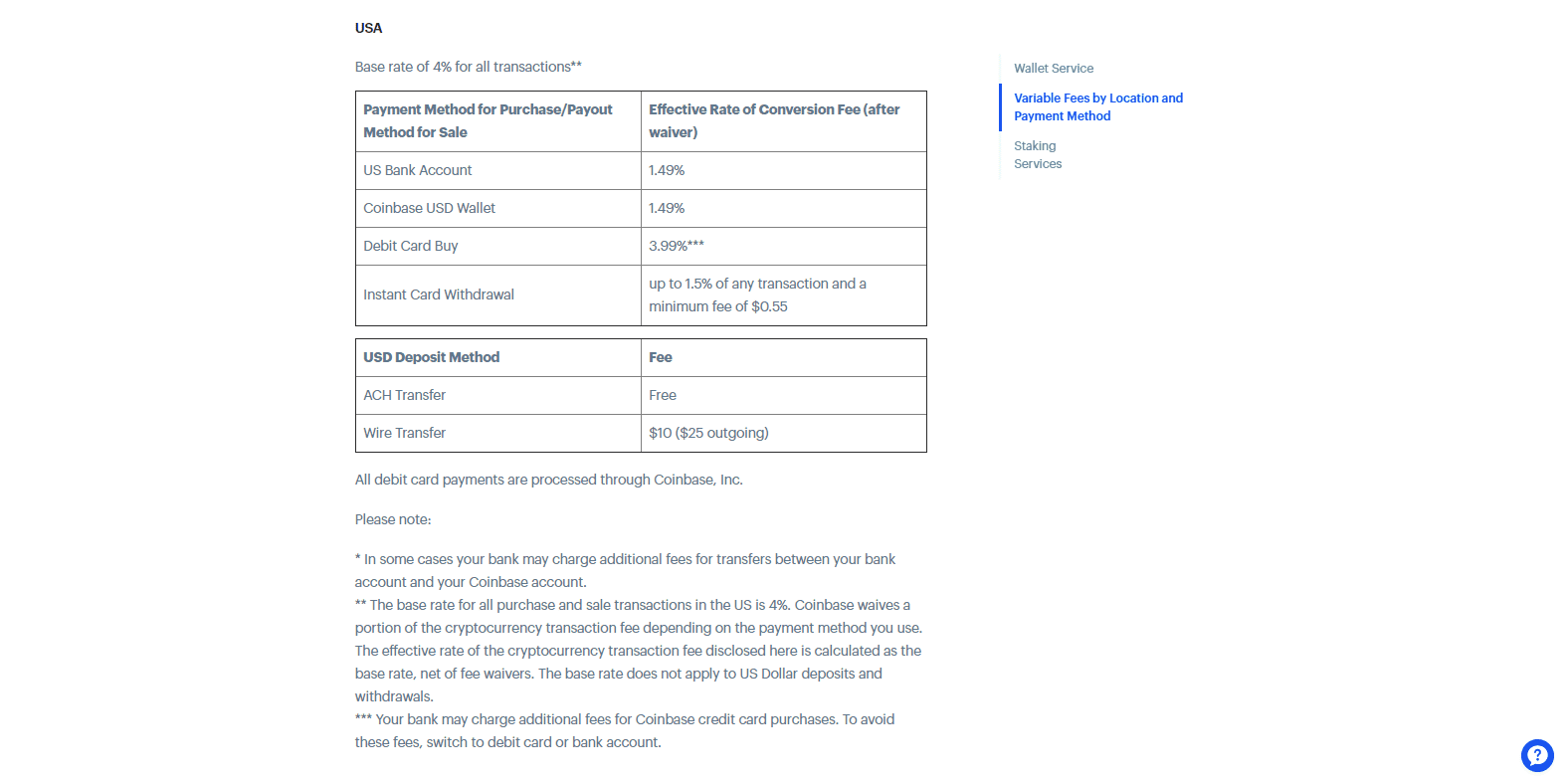

Various geographical locations feature different payment processor costs.

What Can I Trade

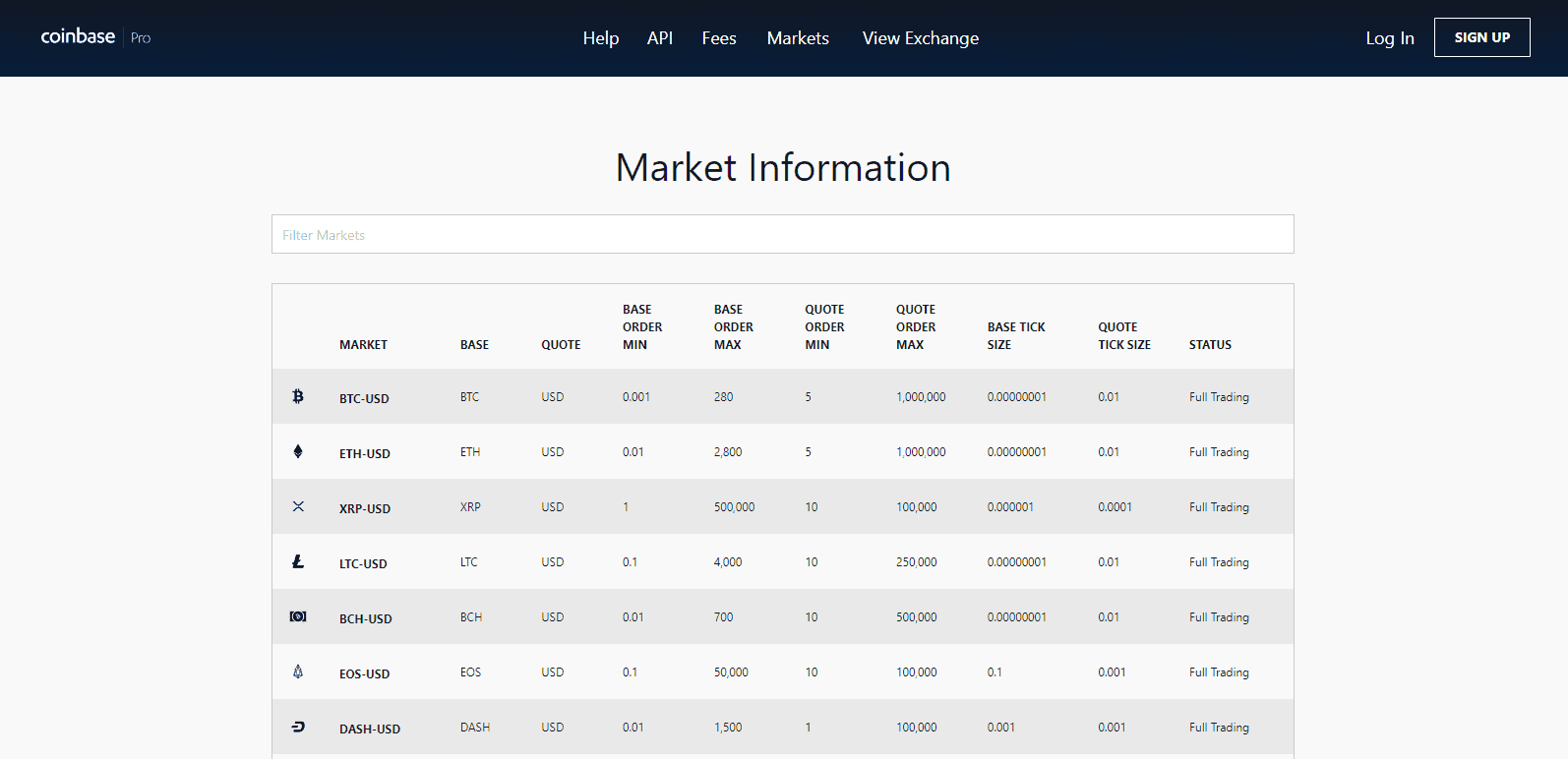

Coinbase maintains only 93 assets, a very disappointing number for any pure digital asset exchange, especially considering that there are almost 7,000 digital assets available globally. The market breadth at Coinbase, via its proprietary trading platform, Coinbase Pro, ranks as the most popular US-based exchange; even so, it remains significantly behind global competitors. Not all cryptocurrencies are available for full trading, as identified by the asset list on the website, further highlighting the market exposure. Nonetheless, Coinbase does serve most retail traders well, especially those who seek to transact on what is popular on social media. More sophisticated traders will likely make the determination that the asset choice as insufficient. Traders deserve more from an exchange with a market-leading position.

With only 93 assets, the choice is very disappointing at Coinbase.

Account Types

All retail traders will manage their cryptocurrency portfolio from the same account type, with a maximum transaction fee of 0.50%. While there is no minimum deposit, traders must have sufficient capital to meet the minimum transaction size, which is 0.001 BTC, 0.01 BCH, 0.01 ETH, or 0.1 LTC. Any orders placed below this limit will face automatic rejection. Maximum leverage of 1:3 applies but expires after 25 days. Coinbase will then sell crypto assets for US Dollars and renew the loan under identical conditions. Margin lending faces an 8% annualized interest payment, which is comparable to swap rates at Forex and CFD brokers.

Coinbase grants one account type to all retail traders.

Maximum leverage of 1:3 exists.

An 8% annualized interest payment applies.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

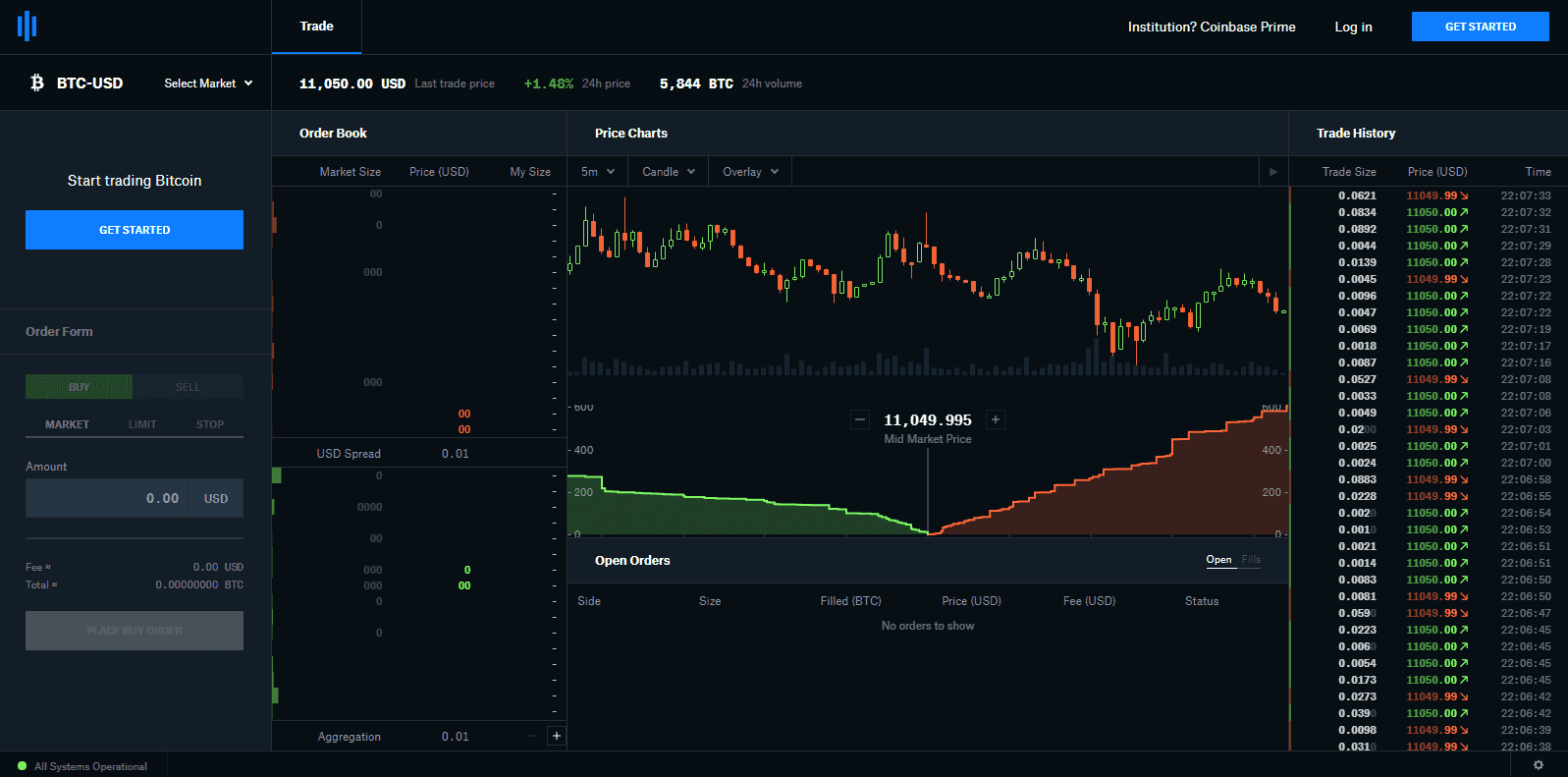

Coinbase Pro is the proprietary webtrader, a depressingly limited trading terminal without proper research tools. An order book and trade history is available to the left and right of the chart, with the ability to overlay two moving averages as the only technical indicators. A simple order form processes trade management, but the overall presentation of Coinbase Pro is inadequate. It is suitable as an execution-only platform, adding to disappointments in the core product and services portfolio of this digital currency exchange.

Coinbase Pro is an execution-only terminal, lacking essential analytics tools.

Unique Features

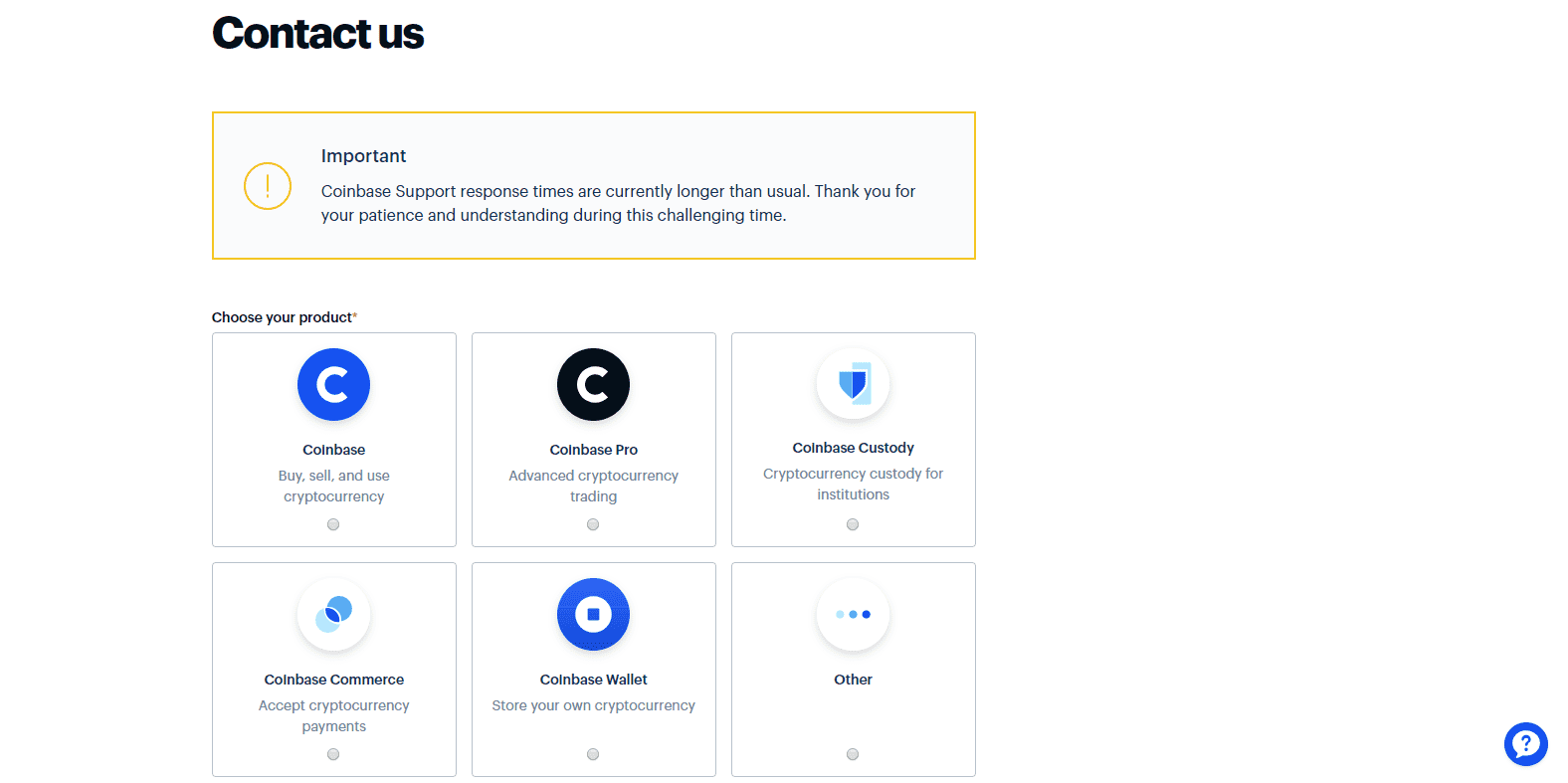

While Coinbase has several services geared towards institutional clients, such as Coinbase Prime, Coinbase Commerce, Coinbase Custody, and Coinbase Ventures, retail traders do not have access to any unique features. Most of the raised capital flowed towards developing enterprise solutions, with a distinct neglect for retail-focused products and services. One fact to note is that 98% of deposits are in secure offline storage with excellent security features; as such, traders can rest assured their funds are well-protected.

Coinbase ensures the safety of client deposits through enhanced security features.

Research and Education

This digital currency exchange does not provide any research or market commentary, which is not unusual. Coinbase is not a broker, but an exchange, which usually does not expand into market analytics. It does provide industry-related information and opinion pieces in its blog under the Around the Block segment. More live streaming news should be sourced for traders, similar to well-established exchanges, as the current product remains significantly behind that of competitors.

Around the Block grants industry-related content, but falls well short of granting traders even the most elemental news flow.

Where Coinbase fails in the market commentary, it shines with education. Though more than twelve years have elapsed since the first Bitcoin (BTC) was mined, and despite the seemingly limitless media hype surrounding the expanding cryptocurrency sector, the majority of traders remain misinformed. Coinbase created an excellent educational program which features eleven courses to introduce the most popular cryptocurrency assets to traders. The program consists of videos, followed by a quiz. After successful completion, new traders will receive a cryptocurrency reward, denominated in the cryptocurrency that is covered in each lesson. Completion of the course allows new traders to put their knowledge to the test. Essentially, rather than requiring payment for the education, Coinbase instead offers up to $115 worth of assets to all traders who are willing to educate themselves—clearly, the most exceptional feature at this digital exchange.

Coinbase offers an excellent educational section that pays new traders up to $115 to get educated and allows them to start a diversified cryptocurrency portfolio.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |                |

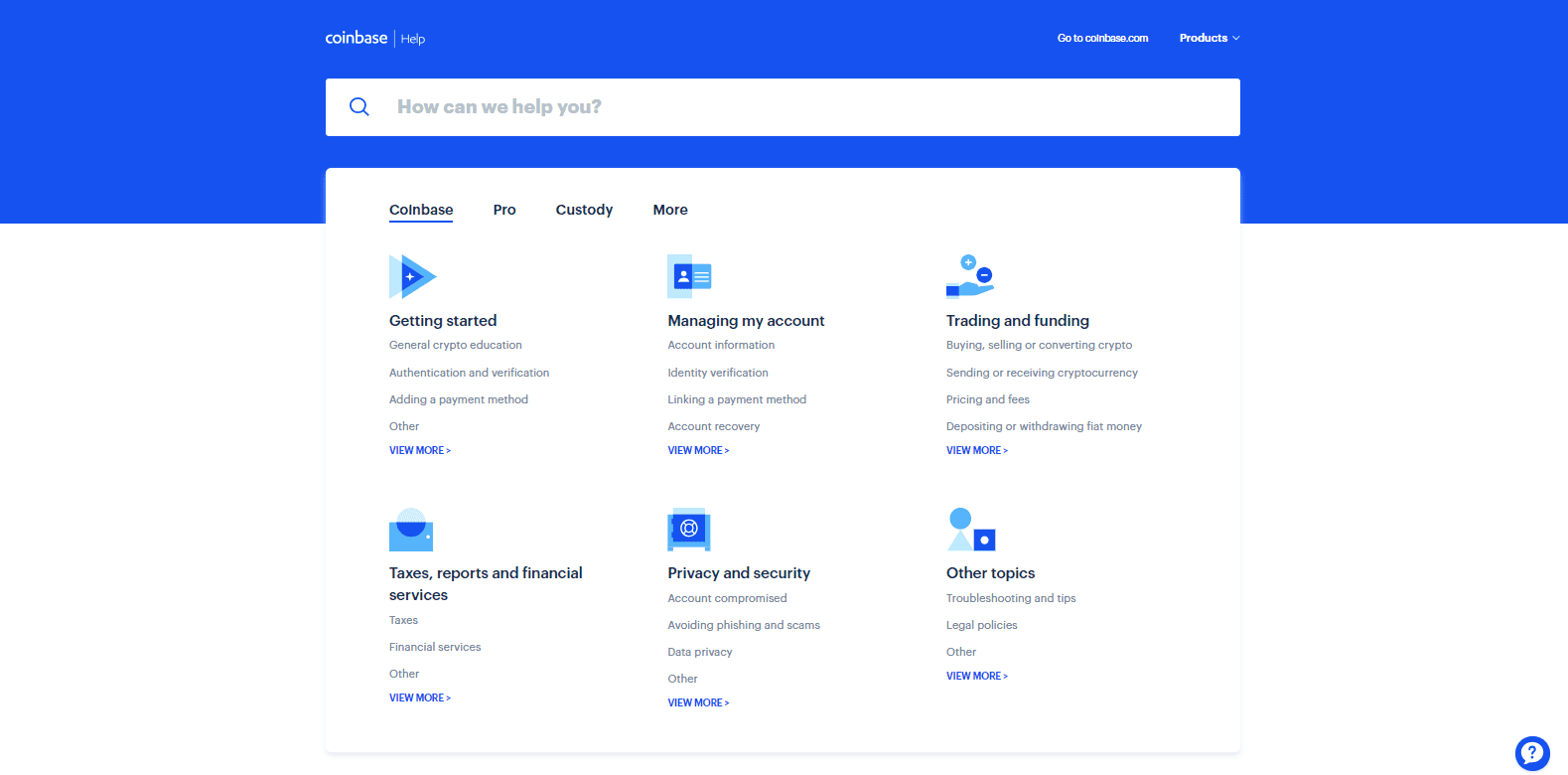

The primary support channel is the FAQ section, which attempts to answer the most common questions, together with a support bot. A second layer of support is granted via a web form, while account assistance is accessible via phone. Most traders will find the answers on the well-explained website.

The FAQ section answers the majority of questions.

A second support layer exists via the web form.

How to use Coinbase

Coinbase offers a user-friendly gateway to get involved in cryptocurrency trading and digital assets. The first step for new traders consists of opening an account. New traders will complete the first step with their name, e-mail, and by choosing a password. Account verification is a mandatory second step, as Coinbase complies with AML/KYC requirements. While most new traders will rush to the dashboard to link their bank account or credit card to Coinbase to make a deposit, we strongly recommend taking advantage of the educational program at Coinbase. It does not only provide quality information on seventeen cryptocurrencies, but it also pays traders to complete them. Education remains paramount to the success of traders, and Coinbase created a market-leading approach. Once traders mastered the lessons and took advantage of other free online courses to learn the basics, the next step is depositing in fiat currency. Regrettably, Coinbase only supports bank wires and credit/debit cards and fails to offer low-cost online payment processors. It added PayPal but remains well behind what established and trusted international competitors provide.

Following a deposit, traders can buy cryptocurrencies on Coinbase. It provides brokerage services but charges excessive fees. Trading directly on the exchange at Coinbase Pro offers cost savings. New traders may want to get acquainted with the dashboard and trading process at Coinbase before opting for more advanced features. Coinbase provides a wallet for hot storage, but investors who wish to hold, or hodl as the cryptocurrency crowd refers to it, should consider buying a device for cold storage. Traders will keep their assets in the Coinbase wallet for swift access to take advantage of trading opportunities. Where traders source their information and trading strategy depends on them but following popular social media themes leaves them two steps behind the curve.

Bonuses and Promotions

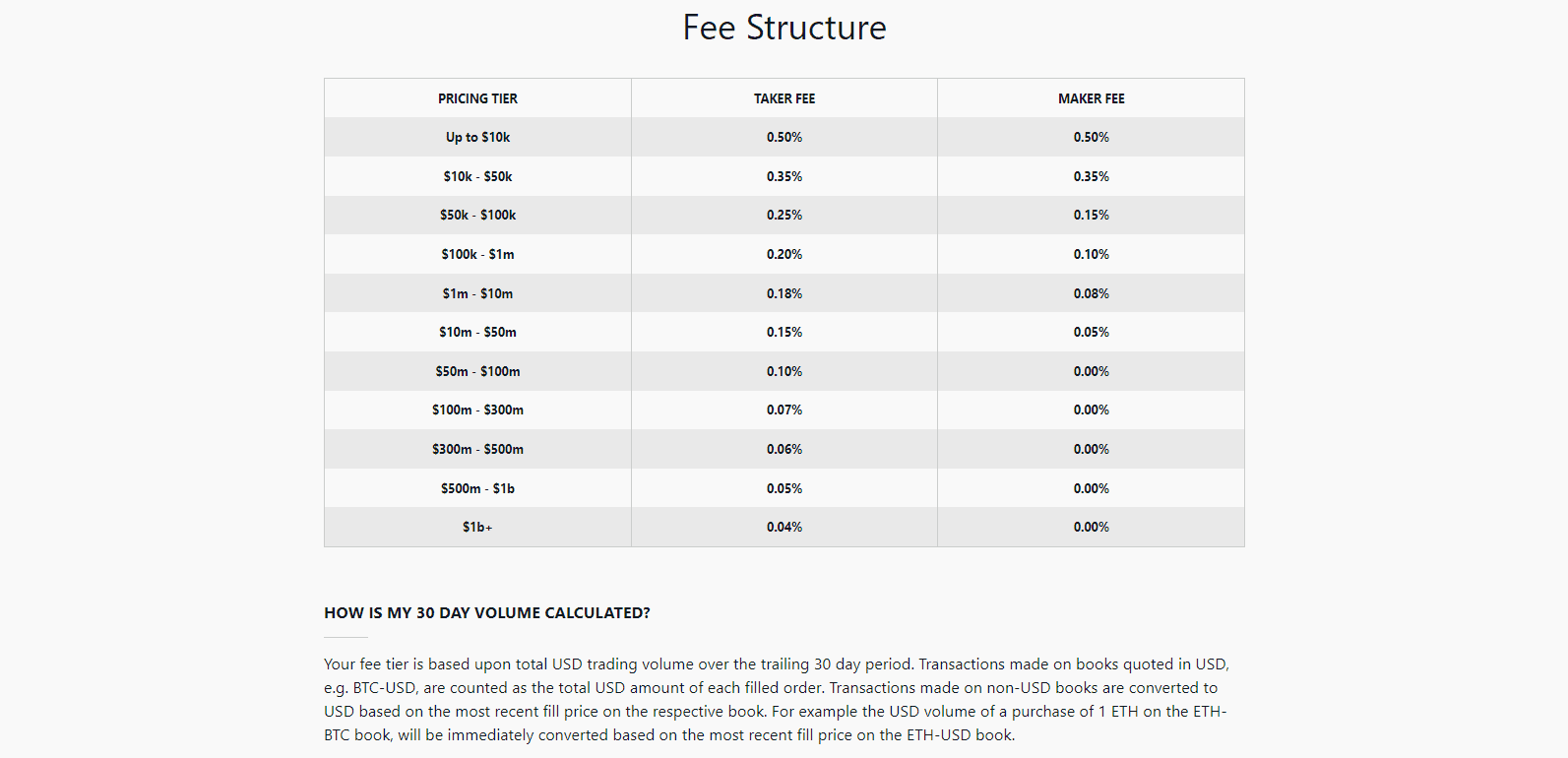

Coinbase offers a volume-based discount on fees. Eleven tiers exist, calculated through cumulative volume over a 30-day period. The costs for what Coinbase refers to as “takers and makers” varies; the lowest available charge is 0.04% and 0.00%, respectively, while the initial one is 0.50% for both.

Fee Structure for “Takers and Makers”

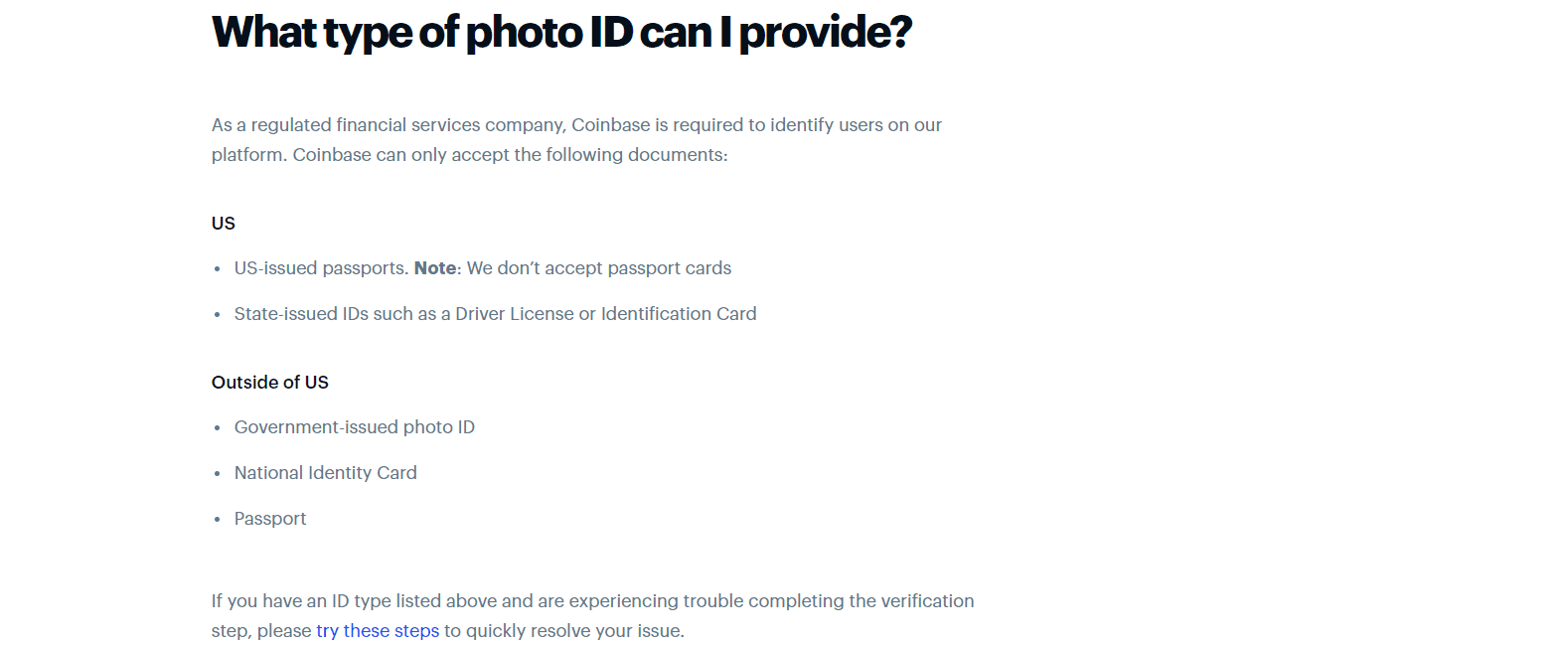

Opening an Account

A name, e-mail, and password complete the first step of the online account opening process. While Coinbase does not operate under any regulatory framework, it complies with AML/KYC requirements. The main difference is that a copy of the trader's ID satisfies the account verification procedure, without any proof of residency document. Coinbase has a mobile app to complete this process, allowing new traders swift completion.

Traders can open a new account in a matter of seconds.

Account verification via a copy of the trader's ID is mandatory.

Deposits and Withdrawals

Coinbase Withdrawal Fee

Coinbase does not charge an internal withdrawal fee for most transactions, but traders still face costs. For example, a deposit in fiat currency followed by a withdrawal request incurs bank or credit card provider levies. They vary based on location and payment options. Many credit/debit cards show a 3.99% fee, SWIFT transactions face a €5.00 cost, and traders requesting a US bank wire withdrawal will pay $25. Instant card withdrawals can result in up to 2.00% in additional charges. Traders must consider two types of costs, first for placing trades on Coinbase. A trader who wants to withdraw from Coinbase but only has cryptocurrencies must first convert it by placing a sell order. Any amount above $200 faces a 1.49% charge. Below $200, a fixed commission between $0.99 and $2.99 or a currency equivalent. It is a high cost, especially for frequent traders, and it stacks up over time.

Another cost is the network transaction fee, depending on how busy the network is. Traders report an average levy for Bitcoin between $1.00 and $5.00, less for other cryptocurrencies. Network fees can spike north of $40.00, but it is an anomaly. Traders must also consider the mark-up Coinbase adds on cryptocurrencies. While it is not a direct withdrawal cost, it will lower the overall amount traders will receive. It can be up to 2.00%, depending on trading volume and other factors. In other words, a $1,000 transaction can face an extra $20.00. It applies when buying and selling, adding $40.00 in costs plus $14.99 in commission each way for a total of $69.98. Payment processor fees for the deposit and withdrawal as high as 3.99% each way, adding another $79.98, plus a network fee, can result in total costs for one round trip of almost $155.00 on a $1,000 transaction.

Coinbase Deposit Time

The Coinbase deposit time depends on the payment processor, as Coinbase credits the account as soon as the payment clears. Bank wires generally take between three to five business days. It can stretch to between seven and ten calendar days due to weekends and holidays. It is an unacceptably long time for any trader or investor to wait for funds. Clients can check the status from their dashboard. Credit and debit card deposits appear on the Coinbase account instantly, but traders must consider the 3.99% fee per transaction. On a $1,000 deposit it equals $39.99. By comparison, bank wires face a $10 deposit cost and a $25 withdrawal fee. While the high-cost payment alternatives remain similar for European clients, the EU SEPA system features deposit times of two to three business days. The UK Faster Payments alternative leads the way with one business day. Coinbase added PayPal as an option, where costs are 1.50% for a $1,000 cryptocurrency transaction or $15.00 plus a 0.50% conversion spread for a total of $20.00. The processing time is instant when depositing fiat currency and dependent on the network when sending cryptocurrencies from PayPal to Coinbase.

Since Coinbase offers only limited deposits and withdrawals options, the Coinbase deposit time remains uncompetitive. While US traders face restricted choices related to the unfriendly trading environment created by US regulators, Coinbase caters to traders in 32 countries where low-cost and fast payment options outside of banking institutions and credit or debit card providers exist. Since Coinbase fails to incorporate them, most international traders will find a superior product and services portfolio at international multi-asset brokers offering cryptocurrencies and digital asset exchanges. Asking traders and investors to wait days or pay astronomical fees for faster access to capital is unacceptable. The Coinbase deposit time and cost structure create an uncompetitive trading environment for active traders.

Summary

Coinbase is a well-known digital currency exchange operating out of the US, with more than 35 million traders from over 100 countries. Despite significant shortfalls, including a sub-standard trading portal and excessive fees, its success can largely be attributed to an easy-to-use interface which allows new traders to buy cryptocurrencies. It does offer a series of institutional services, where it invested the bulk of over $500 million in received funding, but the retail sector represents the backbone of operations.

Most aspects are significantly behind those of well-established international competitors, but Coinbase excels in its approach to education. Instead of charging new traders or even offering it for free, Coinbase awards up to $115 in cryptocurrency assets to each trader who completes all of the educational sections. It complements its focus on first-time traders perfectly, allowing them to create a well-diversified cryptocurrency portfolio with eleven assets. Coinbase is extremely popular among US-based traders, and features proper security protocols; however, most international clients will find a superior overall exchange elsewhere. Yes, it is a legit US-based digital currency exchange with all relevant licenses in jurisdictions where it operates. Traders can rest assured that Coinbase deploys excellent security features. It stores 98% of assets offline and carries an insurance policy. Withdrawal options consist of bank wires, credit/debit cards, and PayPal. Well-known scams are using Coinbase, particularly load-up scams. Traders should be aware that they are responsible for all transactions under their name as Coinbase does not accept fault for a scam. Yes, Coinbase does report to the IRS. In 2018, it forwarded information from 13,000 US traders to the IRS. Whenever a trader receives a 1099-K form, the IRS also receives a copy. Coinbase is not a wallet but offers a cryptocurrency wallet to traders in 190 countries. Coinbase is primarily a cryptocurrency broker and maintains a digital asset exchange in Coinbase Pro. It also aims to become a more full-featured financial services firm with cryptocurrencies and digital assets as its base. It remains an excellent choice for first-time cryptocurrency traders but an unacceptable one for advanced and high-frequency clients.FAQs

Is Coinbase legit?

Is it safe to buy on Coinbase?

How do I get my money out of Coinbase?

Can you get scammed on Coinbase?

Does Coinbase report to the IRS?

Is Coinbase a Wallet?