Editor’s Verdict

Deriv offers clients several proprietary trading solutions and synthetic assets, including many types of CFDs. Deriv has a commission-free cost structure, and its website lists swap-free trading for all. The four Deriv principles are reliability, fairness, transparency, and responsibility. With 2.5M+ clients, I thoroughly reviewed Deriv to evaluate its trading conditions. Should you consider trading at Deriv?

Overview

An excellent choice of proprietary trading solutions and code-free algo trading.

Headquarters | Malaysia |

|---|---|

Regulators | BVIFSC, LFSA, MFSA, VFSC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1999 |

Execution Type(s) | Market Maker |

Minimum Deposit | $5 |

Trading Platform(s) | MetaTrader 5, Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 0.6 pips |

Average Trading Cost GBP/USD | 0.7 pips |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $30 |

Retail Loss Rate | 73.00% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 28 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the ability to create algorithmic trading solutions in a code-free environment, but the Deriv Bot requires a bit of learning and understanding. It is not as straightforward as beginners may need it, but you should be able to eventually figure out how it works.

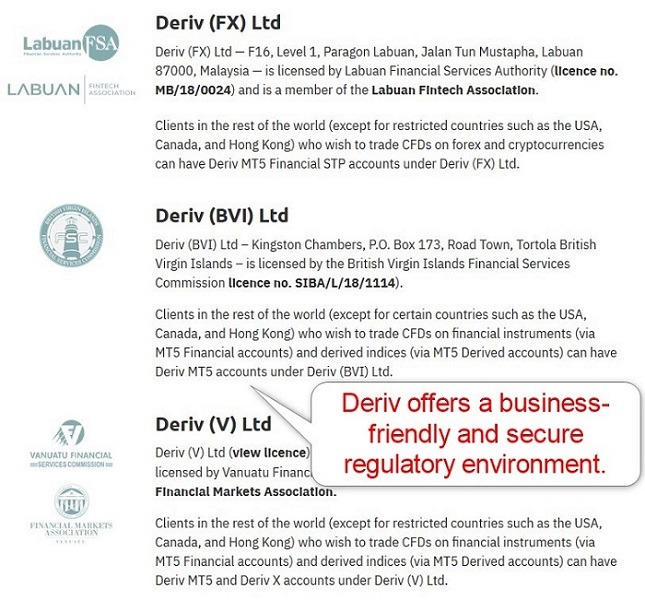

Deriv Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. Deriv presents clients with four regulated entities and maintains a secure trading environment.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Malta | Malta Financial Services Authority | 70156 |

Labuan | Labuan Financial Services Authority | MB/18/0024 |

British Virgin Islands | BVI Financial Services Commission | SIBA/L/18/1114 |

Vanuatu | Vanuatu Financial Services Commission | 14556 |

Is Deriv Legit and Safe?

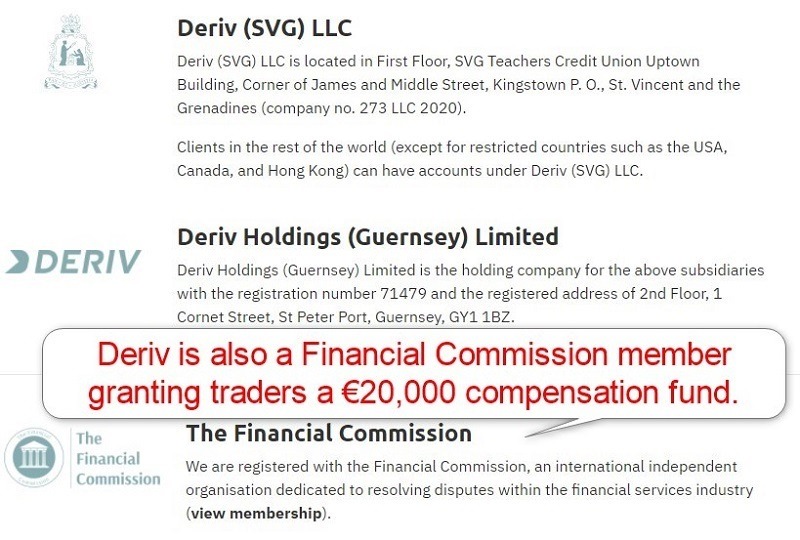

Deriv has 20+ years of operational experience, and besides the above four subsidiaries, it also operates an unregulated but duly registered subsidiary in St. Vincent and the Grenadines, company number 273 LLC 2020, while a company registered in Guernsey, Deriv Holdings (Guernsey) Limited, is the holding company for all five Deriv operating subsidiaries. Negative balance protection exists for Derived Accounts, and Deriv segregates all client deposits from corporate funds.

A €20,000 client compensation fund exists via membership with the Hong Kong-based Financial Commission. Deriv also lists its corporate team transparently on its website. I rate Deriv highly due to its approach to client security with a business-friendly regulatory touch, ensuring traders get a legit, safe, and competitive trading environment.

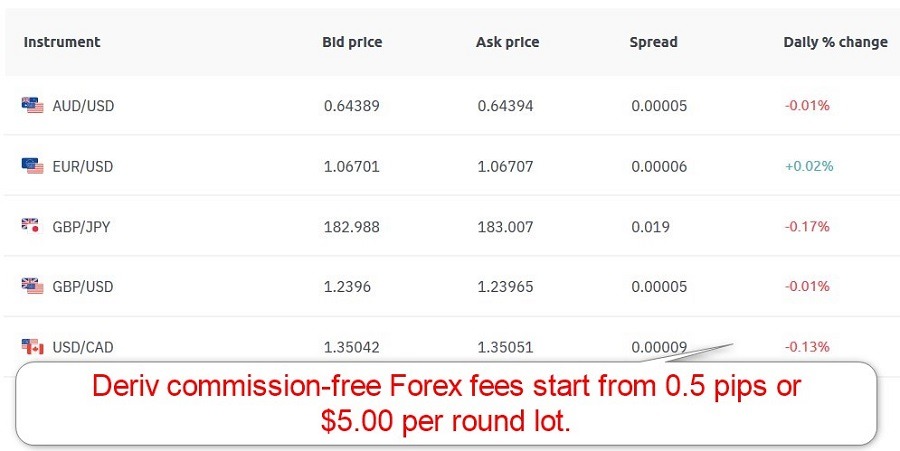

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Deriv maintains a reasonably priced commission-free Forex cost structure from 0.5 pips or $5.00 per round lot. Bitcoin is available from a 22.0+ spread, placing Deriv among the more competitively priced cryptocurrency CFD brokers, which extends to commodities and equities. I determine the overall Deriv trading fees acceptable, while swap-free trading elevates them into the competitive range.

Average Trading Cost EUR/USD | 0.6 pips |

|---|---|

Average Trading Cost GBP/USD | 0.7 pips |

Average Trading Cost WTI Crude Oil | $0.02 |

Average Trading Cost Gold | $0.29 |

Average Trading Cost Bitcoin | $30 |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Deposit Fee | |

Withdrawal Fee |

The minimum trading costs for the EUR/USD at Deriv are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.5 pips | $0.00 | $5.00 |

Here is a snapshot of Deriv trading fees:

This information is considered accurate at the time of publication. Any changes in circumstances after publication may impact its accuracy.

The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Noteworthy:

- Deriv offers swap free accounts, offering a notable advantage for traders who keep positions open for several days.

Range of Assets

The range of assets at Deriv consists of Forex, synthetics, basket indices, derived FX indices, equity CFDs, index CFDs, cryptocurrencies, and commodities. I like the 57 currency pairs and 31 cryptocurrency pairs, as they offer a broad choice in each sector. Synthetics provide a much-appreciated alternative. Commodity, equity, and index traders get a sub-standard choice of highly liquid assets without the necessary diversification opportunities, but they are sufficient for beginner traders. Overall, the Deriv asset selection is balanced, and I can recommend it to most traders.

Options and something Deriv labels “Multipliers” are also available, the latter being options with an integrated stop-loss matching the stake.

Asset List Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Futures | |

Synthetics |

Deriv Leverage

Forex traders get maximum leverage of 1:1000, and cryptocurrencies a generous 1:100. Commodities max out at 1:500, indices at 1:100, while equity CFD traders benefit from 1:50. Some synthetics trade with maximum leverage of 1:4000. I appreciate the competitive approach of leveraged trading, ideal for advanced traders. Negative balance protection exists for Derived Accounts, meaning traders can never lose more than their deposits. The Deriv leverage depends on the geographic location of traders and the regulatory environment. While traders can manage their portfolios with a competitive edge, they should deploy proper risk management to avoid magnified trading losses.

Deriv Trading Hours (GMT)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Sunday 00:00 | Saturday 23:59 |

Forex | Sunday 21:05 | Friday 20:55 |

Commodities | Sunday 22:00 | Friday 22:00 |

European Equities | Not applicable | Not applicable |

US Equities | Monday 13:30 | Friday 20:00 |

Noteworthy:

- Equity markets open and close each trading session, unlike Forex, and commodities, which trade 24/5

- Deriv offers 24/7 CFD cryptocurrency trading.

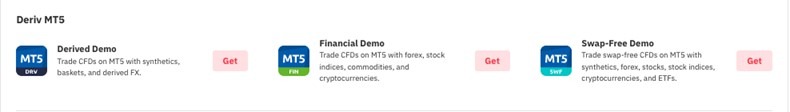

Account Types

Deriv notes three account types, but the details are in the community section rather than transparently on its website. The Deriv Financial account is a standard CFD account, the Deriv Derived account offers traders access to synthetics and the Deriv Swap-free account – note that this may be suitable as an Islamic account, being a swap-free account. Traders can open sub-accounts. The minimum deposit starts from $5, and there is no upselling of better trading conditions for higher deposits, which I appreciate. A volume-based rebate program would be excellent but is missing at Deriv, however, I like the overall offering.

Deriv Demo Account

Deriv only asks traders for a valid e-mail address to open a demo account. After clicking the verification link, traders must confirm their residence, and Deriv opens a $10,000 demo account. There are no time restrictions on the demo account if traders use it. Deriv will delete inactive MT5 demo accounts after 30 days of dormancy.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations.

Trading Platforms

Besides the out-of-the-box MT5 trading platform, available as a desktop client, web-based alternative, and mobile app, which supports algorithmic and signals, Deriv lists seven proprietary trading platforms.

The Deriv X trading platform is a user-friendly, web-based trading platform with feature-rich charts, superior to the MT5 web-based platform , while SmartTrader and Deriv Trader cater to options traders.

Mobile traders can use Deriv GO, while Deriv Bot allows algorithmic trading in a code-free environment.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

I like the swap-free trading environment at Deriv and the code-free algorithmic trading solutions, but most traders may find the learning-curve steep and the tutorials insufficient. Deriv offers five calculators, which are useful, but I would like them integrated into the trading platforms to increase the efficiency and effectiveness of the trading tools.

Research & Education

Deriv provides weekly market news and dedicates a section to introducing how traders can sign-up for trading signals from MT5. I find the approach acceptable, and given the abundance of third-party providers, I do not consider the absence of actionable research negative.

Beginners will find educational content on the Deriv blog, but a dedicated course or approach to education will be coming soon.

I recommend beginners seek education from third parties, start with trading psychology to deepen their foundation, and avoid paid-for courses before funding a Deriv account.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |              |

Deriv offers 24/7 via live chat. It relies on its FAQ section and community.Live chat responded fast during my review but could not answer questions about its trading environment. Deriv explains its products and services well, and I doubt many traders will require much assistance, but I am missing a direct line to the finance department, where most issues can arise.

Bonuses and Promotions

Deriv neither offered bonuses nor promotions during my review.

Opening an Account

Deriv only asks for a valid e-mail to start the registration process. The “Create free demo account” includes creating the Deriv back office. It is the reason why demo traders must confirm their country of residence. Deriv allows new clients to register via their Google, Facebook, or Apple IDs. I like the swift account registration process, and Deriv does not collect unnecessary personal details or data mining.

Account verification is mandatory, as Deriv complies with four regulators and strict AML/KYC requirements. Most traders will satisfy it by uploading a government-issued ID and one proof of residency document. Deriv might ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at Deriv is $5.

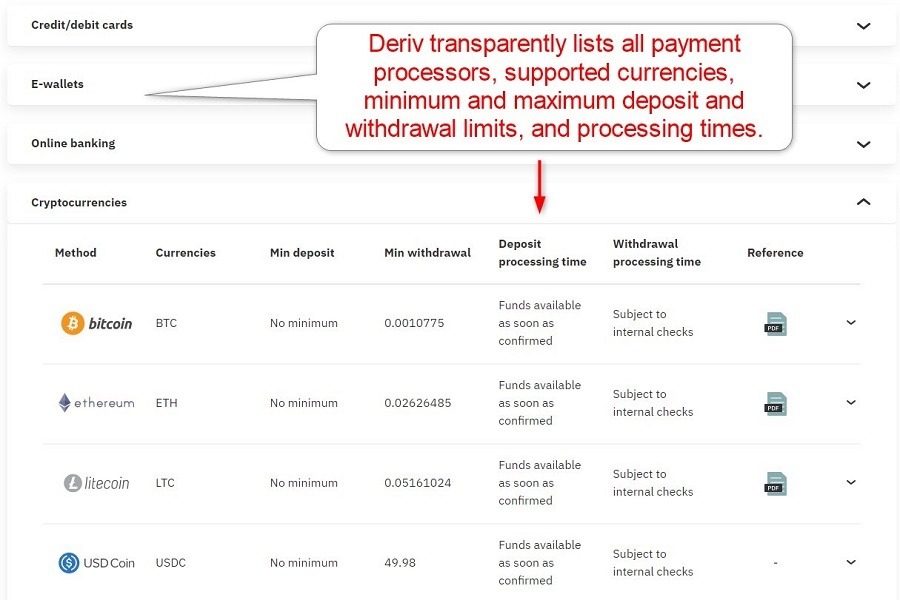

Payment Methods

Deriv supports bank wires, including localized options, credit/debit cards, 17 e-wallets, including FasaPay, Perfect Money, Skrill, Neteller, WebMoney, PaySafe card, Jeton, SticPay, and AstroPay, five cryptocurrencies, three cryptocurrency exchanges as a fiat onramp, and Deriv P2P. Payment methods vary according to client jurisdiction.

Accepted Countries

Deriv does not accept traders resident in the following countries: Alderney, Belarus, Canada, the Cayman Islands, Guernsey, Hong Kong, Israel, Jersey, Jordan, Malaysia, Malta, Rwanda, Paraguay, Singapore, the United Arab Emirates, the United Kingdom, the United States of America, Vanuatu, Myanmar, Cook Island, Iran, American Samoa, North Korea, Northern Mariana Island, Cuba, Puerto Rico, Syrian Arab republic, United states Minor outlying Island, Virgin Islands, Isle man, or any country that has been identified by the Financial Action Task Force (FATF) as having strategic deficiencies.

Deposits and Withdrawals

The secure Deriv back office manages all financial transactions for verified clients.

Traders get 28 payment methods, but the availability depends upon the geographical location of the account owner. The back office will only list the ones available. The Deriv minimum deposit is between $5 and $10 for most payment processors, except for $500 for Deriv P2P, while cryptocurrencies have no minimum requirements. Minimum withdrawals also depend on the payment processor.

Internal deposit processing times are instant to near-instant for most methods, while Deriv processes most withdrawals within one business day. Only verified trading accounts can deposit and withdraw, and the name on the payment processor must match the Deriv account name.

Note: Payment methods may vary depending on the client’s country of residence.

Is Deriv a good broker?

I like the trading environment at Deriv as it features swap-free trading by default and includes algorithmic trading in a code-free environment via two of its seven proprietary trading solutions. Besides 60+ currency pairs and 30+ cryptocurrency pairs, Deriv offers synthetic assets, creating more trading opportunities. The minimum deposit of $5 and 28 payment processors ensures broad-based accessibility. The commission-free cost structure is reasonable, and I rate Deriv among the most competitive brokers with a promising future. Deriv has 20+ years of experience, complies with four regulators, and operates out of 20 offices. Therefore, traders should consider Deriv trustworthy. Success depends on the trader’s knowledge, experience, and risk appetite. The Deriv leverage depends on the asset and the geographic location of traders, but Forex traders get a maximum of 1:1000. No, Deriv does not accept traders residing in the UK.FAQs

Is Deriv a trustworthy broker?

Do people make money on Deriv?

What is the leverage of Deriv?

Is Deriv in the UK?