For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Dukascopy Editor’s Review Verdict

Dukascopy is a Swiss bank and online broker offering four trading platforms, a well-balanced asset selection, and competitive trading fees. It offers its trading services via the in-house developed Swiss FX Marketplace (SWFX). This ECN proprietary technological solution connects SWFX to 20+ banks via the FIX API for deep liquidity and fast order execution. The STP/NDD/ECN trading environment and volume-based commission discounts make Dukascopy ideal for high-volume and high-frequency traders and an excellent Forex broker for algorithmic traders. My Dukascopy review evaluated the trading environment to determine the Dukascopy advantage and how it benefits traders. Is Dukascopy the right broker for your portfolio?

Overview

Dukascopy is an industry-leading, technology-focused Swiss bank and online broker.

Dukascopy Five Core Takeaways:

- MT4, MT5, the proprietary JForex trading platform, and a dedicated binary options trading platform.

- Swiss bank with its cryptocurrency coin, Dukascoin.

- Deep liquidity pools from 20+ liquidity providers.

- Regulated capital of approximately CHF 40,000,000.

- 22+ deposit currencies and gold.

Switzerland FINMA, JFSA 2004 ECN/STP $100 MetaTrader 4, MetaTrader 5, Proprietary platform, Web-based 0.3 pips ($3.00) 0.8 pips ($8.00) $0.05 $0.32 $73.95

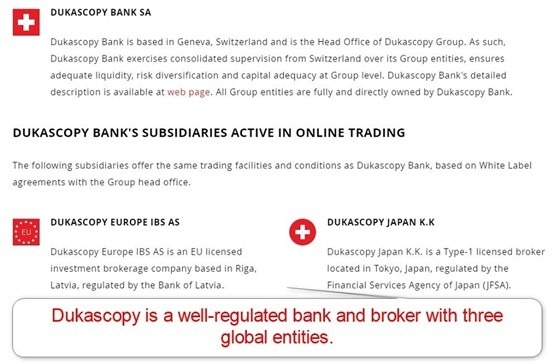

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check for regulations and verify them with the regulator by double-checking the provided license with their database. Dukascopy has three regulated entities with a clean track record and a Swiss banking license.

Is Dukascopy Legit and Safe?

My Dukascopy review found no verifiable misconduct or malpractice by this broker, which has been operational since 2004. Therefore, I can recommend Dukascopy as a legitimate and safe broker.

Country of the Regulator | Switzerland, Japan, Latvia |

|---|---|

Name of the Regulator | FINMA, JFSA |

Regulatory License Number | Undisclosed but confirmed, Undisclosed, Undisclosed |

Regulatory Tier | 1, 1, 1 |

Dukascopy regulation and security components:

- Regulated by the Swiss Financial Market Supervisory Authority, the Bank of Latvia, and the Financial Services Agency of Japan.

- Founded in 2004.

- Regulated capital of approximately CHF 40,000,000.

- Segregation of client deposits from corporate funds.

- Negative balance protection for clients of Dukascopy Europe IBS AS.

- Deposit protection up to CHF 100,000.

- External audits by KPMG.

What would I like Dukascopy to add?

Dukascopy ticks all the boxes from a security perspective, led by compliance with strict Swiss banking laws and capital requirements, and I rank it among the safest and most trusted banks and brokers.

Fees

Average Trading Cost EUR/USD | 0.3 pips ($3.00) |

|---|---|

Average Trading Cost GBP/USD | 0.8 pips ($8.00) |

Average Trading Cost WTI Crude Oil | $0.05 |

Average Trading Cost Gold | $0.32 |

Average Trading Cost Bitcoin | $73.95 |

Dukascopy offers traders a competitive, commission-based pricing environment with volume-based commission discounts. On the downside, MT4/MT5 traders must pay $1 per 1.0 standard round lot more than traders using the proprietary JForex platform.

Forex commissions start from $7.00 per 1.0 standard round lot but decrease in line with trading volume and account equity. Commissions for commodities, metals, indices, and cryptocurrencies begin at $10.50 and decrease to $1.50 per $100,000 in trading volume.

Equity commissions are 0.10% on most markets but can be as low as 0.06% and as high as 0.18%, with minimums dependent on the equity exchange. US-based equities have a $0.02 commission per share with a $10.00 minimum, matching the industry average.

Swap-free Islamic accounts face an additional fixed fee of $0.50 per $100,000, or 1.0 standard round lot dependent on the currency pair, for Forex trades and $0.75 for precious metal trading.

Dukascopy charges additional fees apply based on services traders use, for example, annual maintenance fees for gold, a currency conversion fee between 0.05% and 1.00%, bank guarantee fees, or cryptocurrency maintenance fees. An inactivity fee also applies.

The average trading costs for the EUR/USD at Dukascopy are:

Average Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.2 pips (JForex Platform) | $7.00 | $9.00 |

0.2 pips (MT4/MT5) | $8.00 | $10.00 |

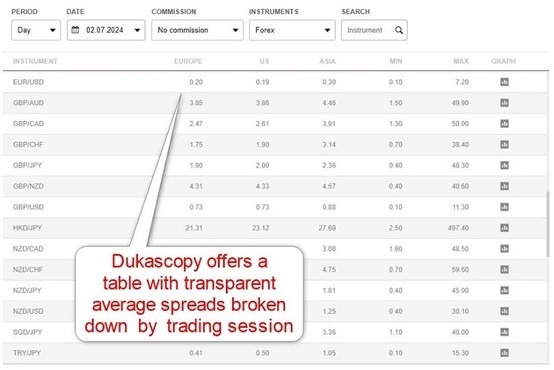

Here is a snapshot of Dukascopy’s average spreads:

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-based Dukascopy JForex account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for one night in the Dukascopy JForex account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $7.00 | $6.10 | X | -$15.10 |

0.2 pips | $7.00 | X | -$3.40 | -$5.60 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the average spread and holding it for seven nights in the Dukascopy JForex account will cost the following:

Average Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $7.00 | $42.70 | X | -$51.70 |

0.2 pips | $7.00 | X | -$23.80 | $14.80 |

Noteworthy:

- Dukascopy offers positive swap rates on qualifying assets, allowing traders to earn money, like in the example above.

Please note that fee information is subject to change. We recommend checking the broker’s official website for the most current and accurate details.

Range of Assets

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

Dukascopy offers a well-balanced asset selection, including cryptocurrencies quoted against numerous fiat currencies, making it ideal for traders who combine Forex and cryptocurrency trading. The 51 ETF CFDs complement the equity asset selection, allowing for more in-depth portfolio diversification. Dukascopy also offers binary options trading.

Dukascopy offers the following assets:

- 61 currency pairs

- 18 cryptocurrencies

- 13 commodities

- 22 indices

- 3 bonds

- 70 ETFs

- 1000+ equity CFDs listed in 19 countries

Dukascopy Leverage:

Maximum Retail Leverage | Maximum Pro Leverage |

|---|---|

1:200 for JForex and 1:100 for MT4/MT5 | 1:200 for JForex and 1:100 for MT4/MT5 |

What should traders know about Dukascopy leverage?

- Maximum Forex leverage is 1:200 for most currency pairs, except a few exotic pairs, which max out at 1:30 or 1:10.

- Commodity traders get between 1:10 and 1:50.

- Index traders can trade with leverage between 1:10 and 1:100.

- Bond traders receive 1:30 leverage.

- Equity CFD traders get maximum leverage between 1:5 and 1:20.

- ETFs leverage is 1:10.

- Cryptocurrency traders get between 1:1 and 1:5.

- Not all assets within a sector qualify for the maximum leverage.

- Negative balance protection exists through Dukascopy Europe IBS AS, ensuring clients of this entity cannot lose more than their deposit.

- Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

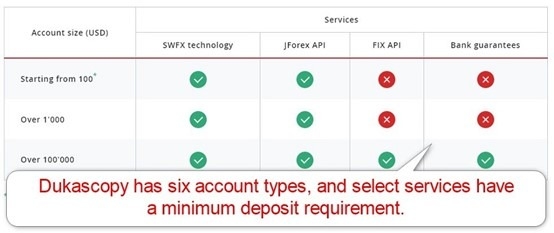

Account Types

Dukascopy offers traders six account types: JForex (ECN), MT4, MT5, Managed, LP PAMM, and binary options, with different trading fees based on the total deposit amount and monthly trading volume.

The account base currencies are:

- For JForex: CHF, EUR, USD, GBP, CAD, JPY, SGD, PLN, AUD, HKD, DKK, MXN, NOK, NZD, SEK, TRY, ZAR, CNH, CZK, HUF, ILS, RON, XAU, AED, and SAR.

- For MT4: CHF, EUR, USD, GBP, PLN.

- For MT5: CHF, EUR, USD, GBP, CAD, JPY, SGD, PLN, AUD, AED, HKD, DKK, MXN, NOK, NZD, SEK, TRY, ZAR, CNH, CZK, HUF, ILS, RON, SAR.

- Binaries / Managed / LP PAMM: CHF, EUR, USD, GBP, CAD, JPY, SGD, PLN, AUD, HKD, DKK, MXN, NOK, NZD, SEK, TRY, ZAR, CZK, HUF, ILS, RON.

Demo accounts are available for all accounts except for LP PAMM, and Dukascopy offers swap-free Islamic accounts. For a $1,000 minimum deposit, traders can register for the Dukascopy account management service catering to passive traders.

Since Dukascopy is a bank, traders can open a bank account and take advantage of a multi-currency account, which is ideal for traders who want to keep their banking and trading with one provider.

Dukascopy Demo Account

Demo trading does not grant exposure to trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations.

What stands out about the Dukascopy demo account?

- Dukascopy offers demo accounts for all of its trading platforms.

- Traders can set the demo account base currency and the demo account balance during the registration process. They also have the option to choose maximum leverage between 1:100 and 1:200 for JForex accounts.

- Five base currencies in MT4, twenty-four in MT5 and twenty-five in JForex. For binaries, there are twenty-one base currencies.

- A demo account requires registration but not account verification.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Traders can use the MT4/MT5 trading platforms, but Dukascopy increases trading fees by $0.50 per 1.0 standard lot, as it prefers traders use its in-house developed JForex trading platform. Dukascopy also offers mobile apps.

MT4, MT5, and JForex can choose powerful desktop clients, lightweight web-based alternatives for JForex 3, and popular mobile apps. I recommend the desktop client, as they offer all the functions, including algorithmic trading. Traders can upgrade MT4 via 25,000+ custom indicators, templates, and EAs, while MT5 features 10,000+. Dukascopy maintains the JStore, featuring 59 upgrades for JForex.

Some of the core features of the JForex trading platform are:

- 1,200+ assets covering eight asset classes

- User-friendly interface

- Tick-by-tick price history with volume information

- Real-time Level 2 price quotes with ten levels of bid and ask quotes

- Ability to set maximum slippage with each pending order

- Algorithmic trading and the Visual JForex Strategy Builder

- Back-testing tool for algorithmic trading solutions

- FIX API and JForex API for advanced algorithmic trading solutions

- Chart trading

- Economic calendar and news feed

- 10+ order types

- 250 indicators and chart studies

- Hedging and scalping allowed

- Multi-lingual trading platform

Unique Features

Two unique features that stood out during my Dukascopy review were the gold-denominated account options and the in-house cryptocurrency coin as part of the cryptocurrency infrastructure. Dukascopy allows borrowing up to 50% of the value of BTC and ETH held in cryptocurrency portfolios for instant cash usage without restrictions.

Research and Education

Dukascopy offers in-house research sub-divided into Market News and Research, Fundamental Analysis, Technical Analysis, Expert Commentary, News, Trade Pattern Ideas, and Trading Ideas. Traders can search by keywords or select dates to find what they seek. The content is well-written, and the analysts explain each trading idea. Traders also get plenty of helpful research tools. I rate the Dukascopy in-house research among the better options industry-wide.

What about education at Dukascopy?

Beginners are not the core trader group at Dukascopy, but they receive educational introductory material via video tutorials and webinars.

My conclusion:

- Beginners can start with the limited Dukascopy educational content.

- I recommend beginners seek in-depth education from third parties focusing on trading psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |             |

Dukascopy offers 24/7 customer support via e-mail, phone, and live chat. I had no reason to contact customer support during my Dukascopy review, as Dukascopy explains its products and services well.

Bonuses and Promotions

During my Dukascopy review, Dukascopy maintained five bonus programs and an income-generating program for its Dukascoin. I recommend the Experience Sharing referral bonus, as it rewards the referrer and referee for the lifetime of the account. The former receives 50% of the referee commissions, and the latter a 10% cashback. Terms and conditions apply, and traders must read and understand them.

Awards

Dukascopy has dozens of industry awards. The three most recent ones include the Leading Bank Broker Switzerland 2024 award by World Business Outlook, the Best Bank Broker 2023 award by Traders Union Awards, and the JForex4—Most User-Friendly Trading Experience at Rimini IT Forum 2023 award by itorum.it.

Opening an Account

The Dukascopy account application only asks for a name, e-mail, phone number, and language during the first step. Clicking “Continue” starts the five-step process, where Dukascopy collects personal data and engages in data mining.

What should traders know about the Dukascopy account opening process?

- Dukascopy complies with global AML/KYC requirements.

- Account verification is mandatory, and Dukascopy insists on a video call.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document and showing the documents via video call to an onboarding member.

- Dukascopy may ask for additional information on a case-by-case basis.

Minimum Deposit

The Dukascopy minimum deposit requirement is $100.

Payment Methods

Withdrawal options |        |

|---|---|

Deposit options |        |

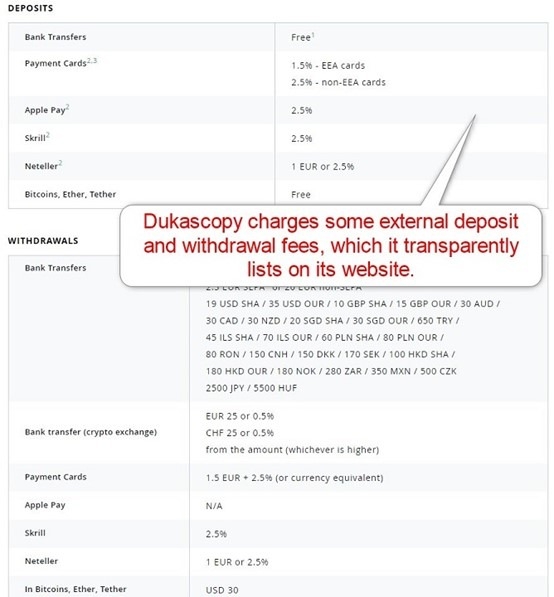

Dukascopy accepts bank wires, credit/debit cards, Skrill, Neteller, Apple Pay, and cryptocurrencies (Bitcoin, Ethereum, Tether).

Accepted Countries

Dukascopy does not provide a detailed list of accepted countries, but the footer of its homepage lists Belgium, Israel, Russia, Turkey, Canada, and the UK as restricted countries.

Deposits and Withdrawals

The secure Dukascopy trader’s cabinet handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Dukascopy?

- Dukascopy levies some deposit and withdrawal fees, disclosed on its website. Internal transfers, wire deposits, and deposits in crypto are not subject to any fees from Dukascopy.

- The minimum deposit requirement is $100.

- Deposit currencies are AUD, USD, CHF, EUR, GBP, CAD, CZK, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, CNH, SEK, SGD, TRY, AED, SAR, DKK, and ZAR (SEPA transfers are in EUR only).

- A currency conversion fee applies, dependent on the conversion amount, ranging from 0.05% to 1.00%.

- Credit/debit card deposits have an $18,000 limit per single transaction.

- Dukascopy does not list a minimum withdrawal amount.

- The finance department processes withdrawals within 48 hours.

- Traders may face third-party payment processing charges.

- The availability of payment processors depends on the geographic location of traders.

- The name on the payment processor and Dukascopy trading account must match in compliance with AML regulations.

Is Dukascopy a good broker?

I like the trading environment at Dukascopy for high-volume algorithmic traders due to the commission discounts, which can make Dukascopy the cheapest Forex broker in Europe. Dukascopy offers deep liquidity and maintains a technology-centred, cutting-edge STP/NDD/ECN trading environment. Therefore, I rate Dukascopy among the most competitive Forex brokers, and I can highly recommend it to active, demanding traders. Verified clients can make a withdrawal request via the Dukascopy trader’s cabinet. The Dukascopy minimum deposit requirement is $100. Andre Duka and his partner Veronika Duka founded Dukascopy and remain the majority shareholders. Dukascopy is a reliable Swiss bank founded in 2004 with a regulated capital of approximately CHF 40,000,000.FAQs

How do you withdraw money from Dukascopy?

What is the minimum deposit for Dukascopy?

Who is the owner of Dukascopy Bank?

Is Dukascopy a reliable Bank?