Editor’s Verdict

E*TRADE is a top choice among US traders, and its recent merger with Morgan Stanley elevated it to the top tier among US-based brokers. It offers commission-free trading and investing, has a cutting-edge trading platform, superb order execution speed, and excellent price improvement technology. I reviewed this broker to determine if E*TRADE can provide traders and investors a competitive edge.

Overview

E*TRADE maintains an excellent infrastructure for active traders.

Headquarters | United States |

|---|---|

Regulators | NFA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1982 |

Execution Type(s) | Market Maker |

Minimum Deposit | $0 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform, Web-based |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | $1.50 per futures contract |

Funding Methods | 2 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the E*TRADE infrastructure for active traders. It offers an average execution speed of 0.11 seconds for non-S&P500 equities, 0.08 seconds for S&P500 equities, and an average price improvement of $4.13 and $6.29, respectively. E*TRADE fills 80.83% and 82.24% of orders with an improved price. Long-term investors get a quality choice of ETFs and mutual funds. Beginners can access quality educational content and research, and the merger with Morgan Stanley added banking services.

E*TRADE Regulation & Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check a broker’s regulatory status by checking the provided license with the regulator’s database. E*TRADE operates subsidiaries under SEC, NFA, and CFTC rules and regulations.

Is E*TRADE Legit and Safe?

E*TRADE, founded in 1982, became part of Morgan Stanley in 2020, a publicly listed company in the US. All client deposits remain segregated from corporate funds, protected by the SIPC, and limited to $500,000, including a $250,000 cash limit.

I rank E*TRADE among the safest and most trusted brokers and can highly recommend it to US-based clients.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | NFA |

Regulatory License Number | 29106, 8-44112 |

Regulatory Tier | 1 |

Fees

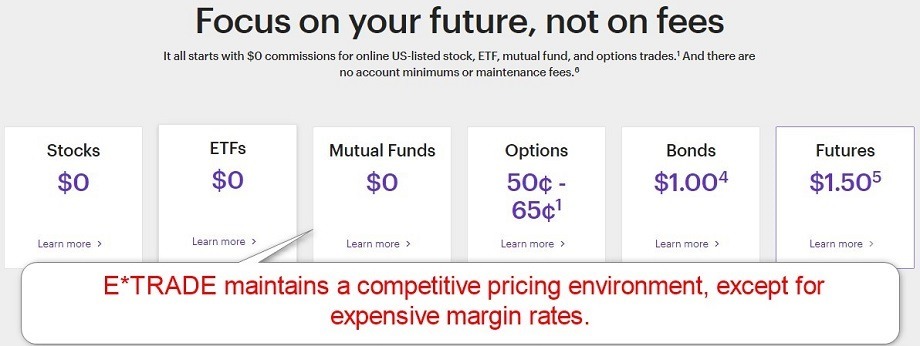

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. E*TRADE provides clients with commission-free equities, ETFs, and mutual funds. Option contracts cost between $0.50 and $0.65 per contract, bonds have a $1.00 per bond commission with a $10 minimum and a $200 maximum, and futures contracts incur a $1.50 per contract fee. Margin traders face expensive financing rates between 12.20% and 14.20%. Options traders must pay a regulatory fee, which E*TRADE presents as its blend rate of $0.0113 per option contract. An index option fee between $0.18 and $0.51 exists, and cryptocurrency futures traders pay a $2.50 commission per contract rather than $1.50. Other costs include the FINRA trading activity fee (TAF) of $0.000145, or $0.000244 for option trades and $0.000920 for bonds, and the Section 31 fee of $0.000008 per transaction. Clients who transact in securities listed in France, Italy, and Spain must pay an FTT tax of 0.30%, 0.20%, and 0.20%, respectively. E*TRADE also levies an American Depository Receipt (ADR) holding fee between $0.005 and $0.05 per share. An annual advisory fee of 0.30% applies to managed portfolios.

Here is a snapshot of E*TRADE trading fees:

Minimum Raw Spreads | Not applicable |

|---|---|

Minimum Standard Spreads | Undisclosed |

Minimum Commission for Forex | $1.50 per futures contract |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | false |

E*TRADE Trading Hours

Asset Class | From | To |

|---|---|---|

Stocks (non-CFDs) | Monday 07:00 | Friday 20:00 |

Bonds | Monday 07:00 | Friday 20:00 |

ETFs | Sunday 20:00 | Friday 20:00 |

Options | Sunday 17:00 | Friday 16:00 |

Futures | Sunday 18:00 | Friday 17:00 |

Range of Assets

E*TRADE offers stocks, ETFs, mutual funds, options, bonds, futures, and managed portfolios. Direct Forex and cryptocurrency trading is unavailable but possible via futures trading. Commodity and index traders must rely on futures contracts. Investors can choose from 6,000+ mutual funds, and some ETFs are available for 24/5 trading, including automatic investments for as little as $25. Four prebuilt mutual fund portfolios are also available, and bond investors can choose from 50,000+ offerings from 200+ providers. Managed portfolios, which E*TRADE labels Core Portfolios, require a minimum commitment of $500 and face a 0.30 advisory fee. I like the range of assets at E*TRADE but would like more details about its equity offering. IPO investments and other securities offerings are excellent, but fractional share investments are unavailable.

E*TRADE Leverage

Maximum Retail Leverage | 1:2 |

|---|---|

Maximum Pro Leverage | 1:4 |

E*TRADE notes a maximum leverage of 1:2 for equity traders but states that accounts with $100,000 may qualify for more. FINRA rule 4210 requires all clients to have a minimum equity of 25%, resulting in a maximum leverage of 1:4. Clients must also have a minimum account balance of $2,000 to qualify for a margin account.

Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

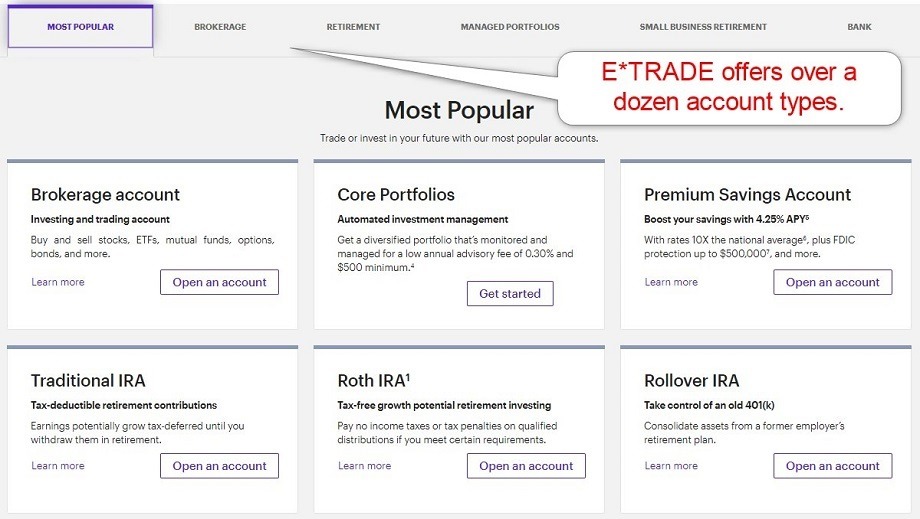

Account Types

E*TRADE provides clients with several account types dependent on their financial goals.

Available E*TRADE account types are:

- Brokeragel Coverdell ESA

- Custodiall Rollover IRA

- Roth IRA

- Traditional IRA

- Beneficiary IRA

- E*TRADE Complete IRA

- IRA for Minors

- Core Portfolios (managed accounts)

- Individual and Roth Individual 401(k) (small business)

- SIMPLE IRA (small business)

- SEP IRA (small business)

- Investment-Only Account

- Premium Savings Account (Morgan Stanley Private Bank)

- Max-Rate Checking (Morgan Stanley Private Bank)

- Checking (Morgan Stanley Private Bank)

- Line of Credit (Morgan Stanley Private Bank)

There is no minimum deposit requirement, but some products and services have minimum capital requirements.

E*TRADE Demo Account

E*TRADE does not offer a direct sign-up for a demo account. However, it notes paper trading capabilities within its platforms and singles out a tool labelled "Options Income Backtester." Any reference I found regarding demo trading was for options only. The Power E*TRADE trading platform has a short introduction noting paper trading. Still, it is unclear if it extends beyond options trading.

I want to caution beginner traders when using demo trading as an educational tool, and they should consider the limitations. Demo trading does not expose traders to the psychological impact of trading with real money and can create unrealistic expectations.

Trading Platforms

E*TRADE features two proprietary trading platforms and two mobile apps. The lightweight, web-based E*TRADE trading platform is the original. It offers casual traders streaming real-time quotes, news, charts, and daily market commentary. It also includes research services by TipRanks, Thompson Reuters, and other third-party providers. E*TRADE promises option traders a suite of professional-grade screeners, optimizers, backtesters, and analyzers unavailable to equity or ETF traders. Power E*TRADE is a cutting-edge trading platform for active investors and traders. It includes technical pattern recognition, an earnings-move analyzer, risk/reward probabilities, custom and preset screens, powerful charts, an exit plan tool, and paper trading. Both trading platforms are available as mobile apps on Android and iOS devices. They offer identical features to the web-based and desktop alternatives, and clients can share watchlists. However, neither mobile app supports chart trading.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

E*TRADE offers banking services via Morgan Stanley Private Bank, allowing clients to benefit from a one-stop financial solution and FDIC-insured accounts from a trusted, publicly listed financial institution.

Research & Education

E*TRADE offers research provided by its corporate owner, Morgan Stanley. Clients also get TipRanks analytics and buy/sell recommendations integrated within the trading platforms. The website features a “Markets News” section, where E*TRADE publishes daily content to facilitate more informed decision-making.

E*TRADE has plenty of educational content on its website, with 14 categories in its library. While the written content presents beginners with quality material, a classroom-style format remains absent. I recommend it to get an introduction to various topics or investment ideas. However, in-depth content is unavailable, and the section lacks structure and engagement opportunities. Webinars at E*TRADE may offer more educational value.

Therefore, I advise beginners to use what E*TRADE has but learn how to trade elsewhere via online educational resources available for free. Beginners should start with trading psychology and the relationship between leverage and risk management while avoiding paid-for courses and mentors.

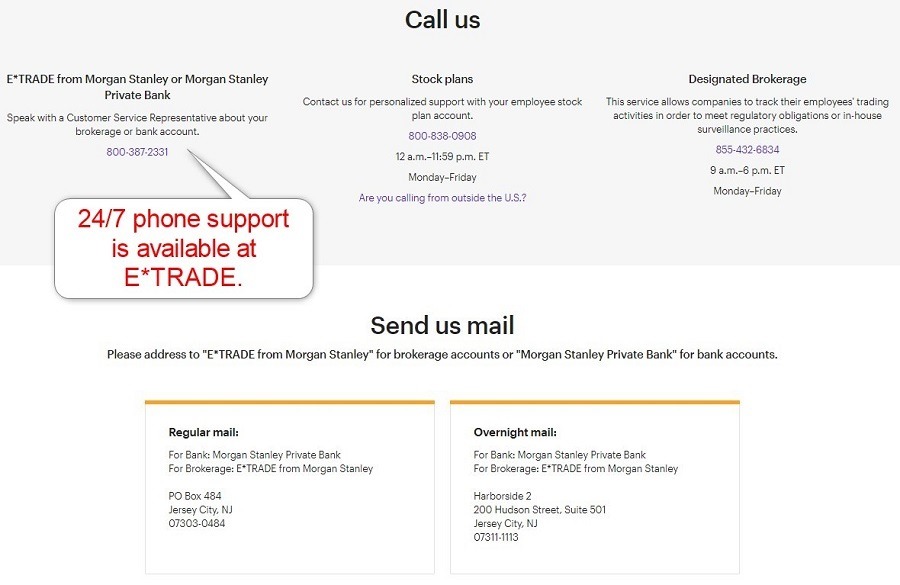

Customer Support

E*TRADE provides 24/7 customer support via phone, and clients can mail non-urgent matters. The FAQ section answers many questions, and E*TRADE explains its products and services well, minimizing the need to request assistance. I would have liked to see a direct line to the finance department, where most issues can arise. Live chat was unavailable during my review, and the page suggested searching the FAQ section.

Customer Support Methods |  |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

Bonuses and Promotions

E*TRADE neither offered bonuses nor promotions during my review.

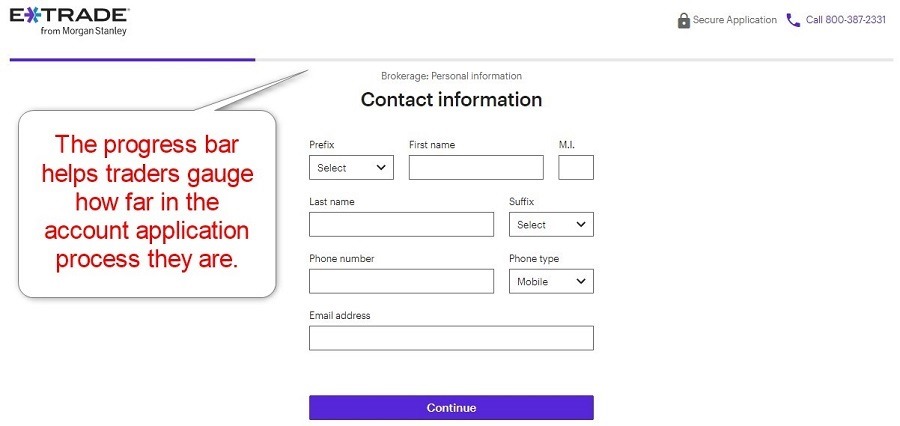

Opening an Account

E*TRADE features a multi-step online application form following well-established industry standards. It should take new clients at most five minutes to complete.

Demo Account | Yes |

|---|---|

Managed Account | Yes |

Islamic Account | No |

Other Account Types | Yes |

OCO Orders | Yes |

Interest on Margin | No |

E*TRADE requires mandatory account verification in compliance with global AML/KYC requirements. Uploading a copy of their government-issued ID will allow most clients to satisfy account verification.

Minimum Deposit

There is no E*TRADE minimum deposit requirement.

Payment Methods

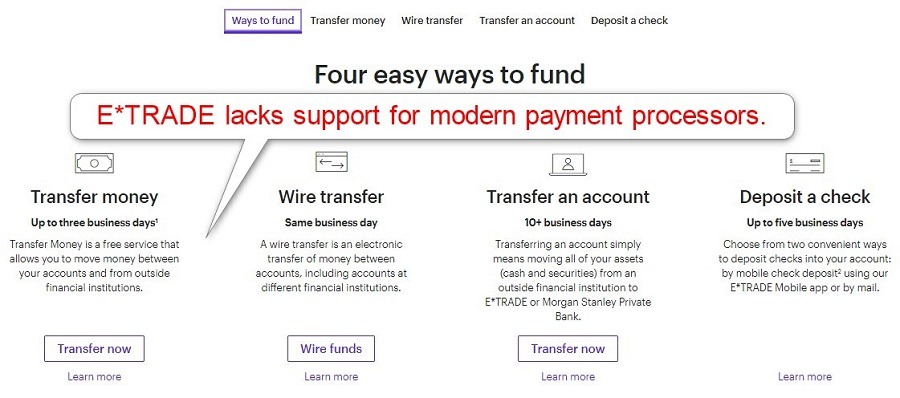

E*TRADE accepts bank wires and checks.

Accepted Countries

E*TRADE only caters to US residents.

Deposits and Withdrawals

The secure E*TRADE back office handles all financial transactions for verified clients.

E*TRADE lacks transparency concerning deposits and withdrawals. There are minimum or maximum deposit or withdrawal amounts, but E*TRADE only accepts bank-related options, which are slow. The lack of modern payment processors is unfortunate, and E*TRADE prefers clients to use banking services provided by its corporate owner, Morgan Stanley. I require more details and choices and rate the E*TRADE approach unsatisfactory.

Withdrawal options |  |

|---|---|

Deposit options |  |

Is E*TRADE a Good Broker?

I like the E*TRADE trading environment for its low transaction fees, excellent price improvement technology, and cutting-edge trading platform. Clients also get valuable research, and the asset selection caters to many trading and investing strategies. The absence of algorithmic trading and direct Forex and cryptocurrency trading remains notable. Nevertheless, equity investors, traders, and retirement planners get a superb infrastructure. The acquisition by Morgan Stanley has added banking services and elevated E*TRADE to a prime broker for US clients. I rate E*TRADE highly and recommend that US residents consider this bank broker one of their top choices.

E*TRADE is easy for beginners, particularly via its web-based trading platform. It also offers valuable educational content and research capabilities. Morgan Stanley owns E*TRADE. E*TRADE has no minimum requirements. Therefore, it depends on the financial capabilities and goals of individual clients. Verified clients can withdraw money from E*TRADE, but withdrawal payment processors are limited to bank-related options. There are no monthly fees at E*TRADE, but advisory services incur an annual cost. People still use E*TRADE. It is a prime broker in the US with an expanding footprint following its acquisition by Morgan Stanley. E*TRADE only caters to US residents. Trading fees only apply to options, futures, and bonds. Other assets are commission-free, but regulatory costs apply. E*TRADE can be trusted. It is owned by Morgan Stanley and is one of the most trusted US-based banks and brokers.FAQs

Is E*TRADE easy for beginners?

Who owns E*TRADE?

How much money do you need for E*TRADE?

Can I withdraw money from E*TRADE?

Does E*TRADE have monthly fees?

Do people still use E*TRADE?

Can non-US persons trade with E*TRADE?

Does E*TRADE have trading fees?

Can E*TRADE be trusted?