For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Eightcap Editor’s Verdict

A well-regulated and forward-thinking broker, Eightcap is a standout for its innovative, high-quality platforms and broad selection of cryptocurrency CFDs.

While conducting my review, I found that Eightcap’s Raw account delivered seriously competitive spreads on crypto and Forex pairs. Execution on both MT5 and TradingView was seamless, and the broker is one of the best in the business for traders demanding a flexible, modern charting and execution environment.

I was impressed by the focus on providing a wide range of quality, value-added platform tools like FlashTrader, VPS hosting, and its AI-powered economic calendar. The broker is less suitable for long-term investors, who might be put off by the lack of ETFs and limited bond offerings. However, in my opinion, for active traders across Forex, crypto, and indices, Eightcap gets top marks for delivering strong value, technology, and transparency.

Eightcap Video Review

Overview

Headquarters | Australia |

|---|---|

Regulators | ASIC, CySEC, FCA, SCB |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2009 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $100 |

Negative Balance Protection | |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Trading View |

Average Trading Cost EUR/USD | 1.0 pips |

Average Trading Cost GBP/USD | 1.2 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | $12 |

Minimum Commission for Forex | $7.00 per Round Lot |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Founded in 2009, Eightcap is a global forex and CFD broker, headquartered in Melbourne, Australia, with five offices worldwide. It offers over 800 instruments, including plenty of forex pairs, cryptocurrency CFDs, and a wide range of global stocks in addition to top-quality tools like TradingView integration and FlashTrader.

When it comes to security, Eightcap sets a high bar, regulated by multiple tier-1 authorities, ensuring a trustworthy trading environment for its global customer base. Eightcap traders enjoy a balanced asset selection from the Standard and Raw accounts on the popular MT4 and MT5 platforms. The Raw account spreads are ideal for scalpers, and high-frequency traders, while the Standard account is commission-free but features higher trading fees. Eightcap traders can access regularly published in-house research, while new traders can access an educational section filled with first-class content.

With a well-established track record, competitive pricing, modern infrastructure, support in ten languages, and a packed trading toolkit, Eightcap has earned its status as a market leader, providing a distinct advantage, particularly to short-term, crypto, and algorithmic traders.

Who Should Trade with Eightcap?

Trader Type | Rating | Summary |

Newer Traders | 4.5/5 | Valuable educational content and a strong demo environment, but no course structure to facilitate deep learning |

Copy Traders | 4/5 | Strong TradingView support and social tools, but no dedicated copy trading marketplace |

Swing Traders | 4.5/5 | A balanced asset range and solid tools for multi-day positions |

News Traders | 4/5 | An AI-powered economic calendar and rapid execution, beneficial for trading news events |

Automated Traders | 5/5 | Excellent algorithmic support via MT5, VPS hosting, and TradingView scripting tools |

Investors | 2.5/5 | No direct ownership of stocks, bonds, or ETFs presents limited opportunities for buy-and-hold investors |

Day Traders | 5/5 | Tight spreads, fast execution, and platform flexibility make it a top pick |

Scalpers | 4.5/5 | Excellent fast execution and raw spreads, but no guaranteed stop-losses |

Eightcap Highlights for [year]

- The FlashTrader plugin for MT5

- An AI-powered economic calendar for news traders.

- VPS hosting for 24/5 low-latency Forex trading

- Raw spread trading with spreads from 0.0 pips for a commission of $7.00 per 1.0 standard round lot

- A balanced asset selection, including 100+ cryptocurrencies and a growing list of trading instruments

- TradingView for social traders

- Multiple payment processors, including cryptocurrency deposits and withdrawals

- Excellent beginner services Eightcap Labs and Eightcap Trade Zone

- A quality partnership program

Eightcap Regulation and Security

How Does Eightcap Regulation Measure Up to the Competition?

At DailyForex we appreciate just how critical it is for you that you are placing your hard-earned cash in the hands of a well-regulated broker.

Brokers with at least one tier-1 entity will have a reputation to protect and will be more likely to provide the highest levels of oversight, transparency, and investor protection, across their entire operation.

Regulators like the FCA (UK), ASIC (Australia), or CFTC/NFA (US) impose strict rules relating to capital requirements, client fund segregation, and fair-trading practices. These are designed to minimize the risk of fraud and malpractice, while creating a trusted framework for traders. Tier-1 regulation gives you confidence that your funds are safe with a forex broker that is reliable, well-capitalized, and committed to operating under the most stringent global regulatory standards.

Number of Tier 1 Regulators:

Eightcap | Think Markets | IC Markets |

|---|---|---|

3 | 3 | 2 |

Eightcap presents clients with four regulated entities and maintains a secure trading environment. This multi-jurisdictional regulatory structure ensures transparency and offers client fund protection mechanisms, including segregation of funds and negative balance protection. While most international clients will trade through the SCB entity, Eightcap maintains a clean operational history and high trust ratings globally.

Country of the Regulator | Australia, The Bahamas, Cyprus, United Kingdom |

|---|---|

Name of the Regulator | ASIC, CySEC, FCA, SCB |

Regulatory License Number | 391441, 40377, 246/14, 921296 |

Is Eightcap Legit and Safe?

Eightcap complies with four top-tier regulators and has maintained a clean operational record for well over a decade, establishing itself as one of the most trusted and secure multi-asset brokers industry-wide.

The FCA and CySEC subsidiaries provide an investor compensation fund, while negative balance protection and segregation of client deposits from corporate funds are provided at all five operating subsidiaries. Most international clients will either trade with Eightcap’s Bahamas subsidiary or its subsidiary in St. Vincent and the Grenadines.

Does Eightcap accept US clients?

No, Eightcap does not accept U.S. clients and is not compliant with U.S. forex regulations. See our best NFA-compliant forex brokers for Americans.

Eightcap Broker Fees

HOW WE TEST BROKER FEES

At DailyForex, we review broker fees by opening live accounts and trading multiple asset classes to assess spreads, commissions, and overall trading costs. We compare each broker’s fees against industry averages for major currency pairs. We also assess deposit, withdrawal, inactivity, and swap fees, rewarding price competitiveness and transparency. Learn more here.

How Do Eightcap Fees Stack Up to Competitors?

Competitive trading costs are hugely important when choosing a forex broker, directly impacting your bottom line, especially if you are someone who trades frequently.

The EUR/USD pair is the most liquid and heavily traded currency pair, making it the best benchmark for spreads and commissions. Any forex broker that offers consistently low costs on EUR/USD will typically provide competitive pricing across other major, minor and exotic pairs as well. Lower costs mean that more of your profits stay in your pocket, and over time this can lead to significant savings, as less of your earnings are lost to fees.

Average Trading Cost EUR/USD:

Eightcap | Think Markets | IC Markets |

|---|---|---|

1 | 1 | 0.8 |

Eightcap offers two types of accounts, with different fees and charges. The Raw account is the most competitive for active traders, with spreads that start at 0 pips and a commission that starts at $7 per round trip. The Standard account is commission-free but features spreads starting at 1 pip. During live market hours, spreads on major pairs like EUR/USD typically match the advertised levels. Eightcap also offers low-cost crypto trading and charges no inactivity fees.

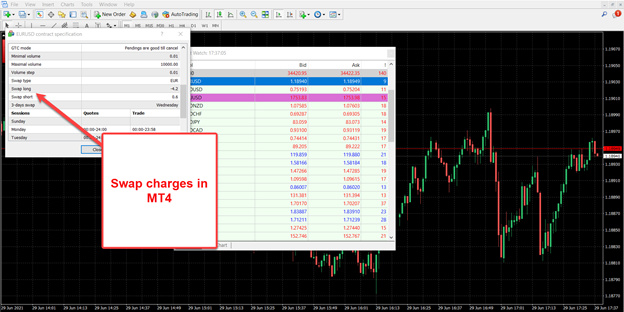

Swap fees apply for overnight trades, and traders can easily access these rates via MT4/MT5. Deposits and withdrawals are free from internal charges, though third-party payment processors may apply their own fees.

Average Trading Cost EUR/USD | 1.0 pips |

|---|---|

Average Trading Cost GBP/USD | 1.2 pips |

Average Trading Cost WTI Crude Oil | $0.03 |

Average Trading Cost Gold | $0.12 |

Average Trading Cost Bitcoin | $12 |

Minimum Commission for Forex | $7.00 per Round Lot |

Withdrawal Fee | |

Inactivity Fee | No |

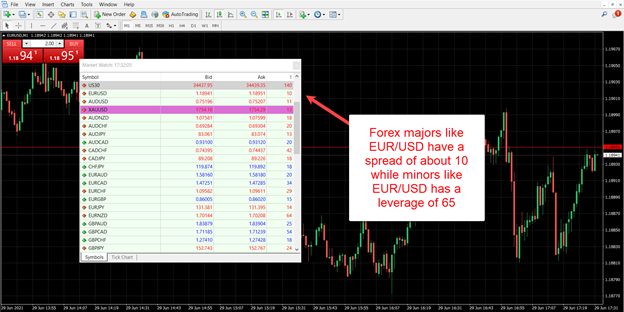

I went to the live platform to see typical spreads during the London and New York Overlap.

In this case, I saw that the EUR/USD and AUD/USD had a live spread of 1 pip (10 pipettes) each, in line with the advertised minimum, while a minor pair like EUR/HUF had a spread of 14.1.

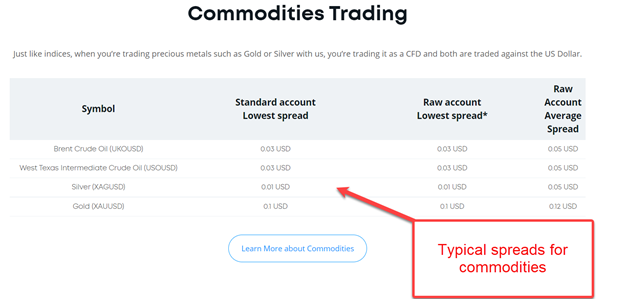

The chart below shows the typical spreads for commodities advertised by Eightcap.

You can view the swap rates in MT4/5, by right-clicking on your preferred symbol, and selecting specification. Finally, you should scroll down to see the swap rates for long and short trades.

What Can I Trade with Eightcap

Eightcap maintains a well-balanced asset selection and continues to expand it, offering 800+ instruments. These include:

- 100+ cryptocurrencies

- 590 stocks

- 56 Forex pairs

- 17 indices

- 16 commodities

While ETF and bond trading are not supported, crypto CFD variety is a major strength. MT5 users gain access to the full instrument range, while MT4 users have a more limited selection..

While Eightcap trails in its Forex, commodities, and index selection, where sufficient trading instruments are available for focused trading strategies requiring few but highly liquid assets, Eightcap continues to expand its equity CFD selection, now at 660. Traders must use the MT5 trading platform to get access to all these trading instruments, as Eightcap maintains fewer assets in MT4.

Significantly, Eightcap’s FCA-regulated entity in the UK is the only dedicated, specialist TradingView broker in the United Kingdom. It is also worth noting that while the UK entity offers CFD trading on over 600 markets across forex, indices, commodities, and shares, it does not offer crypto CFD trading.

What Would I Like to See Added?

I am missing mid-cap and small-cap alternatives from the equity CFD list. In addition, a broader selection of Forex, commodity, and index CFDs would be welcome. Finally, ETFs and bonds would be valuable additions for investors.

Asset List and Leverage Overview

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Eightcap Leverage

Eightcap offers a maximum leverage of 1:500 for Forex traders through its SCB entity. The Bahamas subsidiary also offers portfolio hedging, not available through its Australian subsidiary.

Other things to note about Eightcap’s leverage offering:

- ASIC, FCA, and CySEC-regulated traders are limited to a maximum leverage of 1:30, due to regulatory restrictions.

- Eightcap offers negative balance protection, vital for leveraged trading, as it ensures traders cannot lose more than their deposits.

- The leverage also depends on the sector and asset, with Forex usually the maximum, and equity CFDs or cryptocurrencies the lowest.

Eightcap Trading Hours (GMT +1 Server Time)

Asset Class | From | To |

|---|---|---|

Currency Pairs | Monday 00:00 | Friday 24:00 |

Cryptocurrencies | Monday 00:00 | Sunday 23:59 |

Commodities | Monday 01:01 | Friday 23:59 |

Crude Oil | Monday 01:01 | Friday 23:59 |

Gold | Monday 01:01 | Friday 23:59 |

Metals | Monday 01:01 | Friday 23:59 |

Equity Indices | Monday 01:00 | Friday 24:00 |

Stocks | Monday 10:05 | Friday 20:55 |

Noteworthy:

- Equity markets open and close each trading day and are not operational continuously like Forex and cryptocurrencies

- Some assets open and close at different times, as outlined in the specifications available from the trading platform

I recommend the following step for Eightcap MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

Pros of Eightcap Account Types | Cons of Eightcap Account Types |

|---|---|

A well-trusted broker with over a decade of experience and 13 payment processors | Islamic account unavailable |

Competitive trading costs in the commission-based Raw account | |

Deep liquidity, high leverage, and excellent order execution | |

Seven account base currencies and 17 deposit/withdrawal currencies |

Eightcap Account Types

Eightcap offers three account types - an extendable 30-day demo account, and two types of live accounts. The Raw account has tighter spreads, commission-based pricing, and is best suited for high-frequency and scalping traders due to the cost advantage. Meanwhile, the Standard account has wider spreads but no commission. Both live account types require a $100 minimum deposit and support all base currencies.

Eightcap Demo Account

The 30-day Eightcap demo account (which expires after 30 days by default) gives you risk-free access to the company’s products. Eightcap provides extensions, upon request, via customer support, making this account ideal for beginners or experienced traders who create and test trading strategies.

Live Account Types

Eightcap offers traders the more costly commission-free Standard account with minimum spreads of 1.0 pips or $10.00 per 1.0 standard round lot and a more competitively priced commission-based Raw account with spreads from 0.0 pips for a commission of $3.50 per side or $7.00 per 1.0 standard round lot. The spread is the difference between the ask and bid prices, while commissions apply to each transaction in exchange for raw market spreads.

Since the minimum deposit requirement is $100 for both the Standard and Raw accounts, and in both cases the minimum transaction size is 0.01 lots or 1,000 currency units, traders should consider the Raw account, as it features up to 30% lower trading fees. However, please note that the TradingView account is only available with the commission-free Standard account cost structure.

The maximum lot size for all Eightcap account types is 100 lots, and the account base currencies are AUD, USD, EUR, GBP, NZD, CAD, and SGD. Eightcap will issue a margin call if the account margin level drops below 80%, with an automatic stop-out level below 50%. Negative balance protection ensures traders cannot lose more than they have deposited.

Eightcap Trading Platforms

Every trader has their own style of trading and so access to a variety of trading platforms is useful because it allows you to choose the one that best fits your preferred strategies, tools, and experience level. Popular platforms like MT4, MT5, TradingView, and cTrader each offer unique features, such as advanced charting, automated trading, or social trading integrations.

In reality, each of these platforms provides all the main tools and features that most retail traders use. However, by offering a range of choices, including proprietary platforms designed in-house, a broker ensures that all different kinds of traders can benefit from a flexible and convenient trading experience. This variety and versatility allows you to switch between platforms as your strategies, capabilities, and requirements evolve.

Available Trading Platforms:

Platform | Eightcap | Think Markets | IC Markets |

|---|---|---|---|

MT4 | √ | √ | √ |

MT5 | √ | √ | √ |

C Trader | x | x | √ |

TradingView | √ | x | √ |

Eightcap supports MT4, MT5, and TradingView across desktop, mobile, and web, with the desktop clients including the widest range of features. MT5 users benefit from more instruments and analytics, while TradingView integration stands out for social and technical traders.

Eightcap’s FlashTrader add-on for MT5 and VPS hosting enhances automation and fast execution, catering especially to algorithmic traders. Meanwhile, the TradingView plugin enables order execution directly from price charts. It also offers access to 12 chart types such as Renko, Point and Figure, 100+ pre-built indicators, 100,000+ community-built indicators, 50 drawing tools, and more advanced tools. Experienced Eightcap traders can also use TradingView’s Pine Script programming language to automate and test their own strategies.

Overview of Trading Platforms

MT4 | MT5 |

|---|---|

It has fewer assets | It allows more assets like stocks |

It has fewer in-built indicators, but the rest can be downloaded and installed manually | It has more in-built technical indicators like the Variable Index Dynamic Average |

It does not have an economic calendar | It has an in-built economic calendar |

It is recommended for newer traders | It is better for advanced traders |

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Web Trading Platform

Eightcap offers the MT4 and MT5 web-based trading platforms. The initial login screen loads MT5 by default, but traders can select their platform type in the “Connect to an Account” pop-up. It also supports opening Eightcap demo accounts with full customization features.

The MT4/MT5 web-based trading platforms are light on system resources and feature an extensive toolset for technical analysis, but do not support algorithmic or copy trading. They are ideal for manual traders who dislike installing powerful desktop alternatives but need more than what the respective mobile app can offer.

Here are the key pros and cons of the Eightcap web trading platforms:

Pros of Eightcap Web Trading Platform | Cons of Eightcap Web Trading Platform |

|---|---|

Adapted and customized for mobile devices and touch screens | Does not support algorithmic trading |

Advanced market depth and one-click trading | Copy trading services are unavailable |

Demo and real accounts with seamless switching | |

Interface with comfortable night theme and technical analysis tools |

Mobile Trading Platform

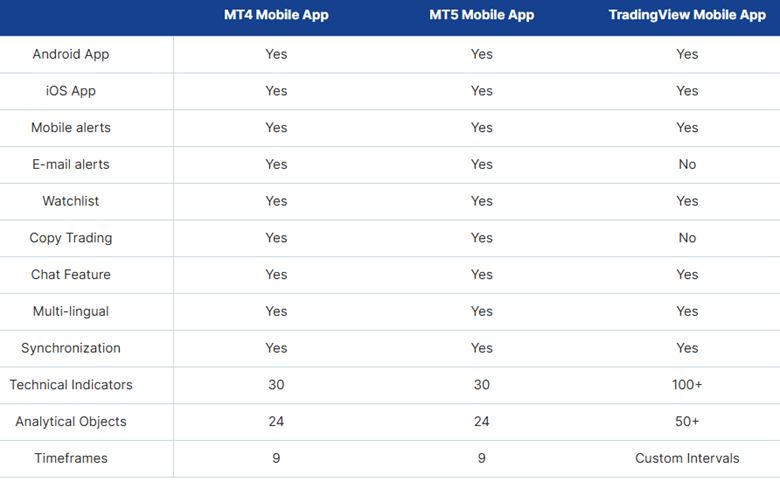

Eightcap offers the MT4, MT5, and TradingView mobile trading platforms. They are user-friendly and optimized for mobile devices and touch screens but lack secure two-step or biometric logins. Since MT4 is the most-used mobile trading platform, my review focused on it, but social traders can consider TradingView, with 30M+ active traders.

Here are the main pros and cons of the Eightcap mobile trading platforms:

Pros of Eightcap Mobile Trading Platform | Cons of Eightcap Mobile Trading Platform |

|---|---|

Adapted and customized for mobile devices and touch screens | Does not support algorithmic trading |

Mobile chat and e-mail | Copy trading services are unavailable |

Interactive charts and support for all order and trading functions | |

User-friendly interface with comfortable dark mode |

The MT4 mobile app is available on Android, iOS, and Huawei devices, and traders must download it from their respective stores for free. Following the initial launch, traders should find Eightcap easily via the search bar.

Given its widespread popularity among mobile traders, the MT4 mobile app supports the following languages:

Arabic | Chinese (Simplified) | Chinese (Traditional) | Czech | English |

French | German | Greek | Hindi | Indonesian |

Italian | Japanese | Korean | Polish | Portuguese |

Portuguese (Brazil) | Russian | Spanish | Thai | Turkish |

Ukrainian | Vietnamese |

Here are the core features of the MT4 mobile trading platform:

- User-friendly design with touchscreen support, allowing traders seamless navigation while accessing desired features

- Ease to find assets either via the search bar or by browsing through the categories

- Choice of order types, including market orders, limit orders, stop orders, GTC (good until canceled) orders, and GTT (good until time) orders

- Mobile and e-mail alerts, but traders must configure them on the desktop trading platformUnique Features

Mobile Trading Apps

While Eightcap does not provide a proprietary mobile app, as its core market remains algorithmic and advanced traders who require powerful desktop clients, traders get the MT4 and MT5 mobile apps. Traders may also use the TradingView mobile app, which connects to Eightcap.

Which Eightcap Mobile Trading Apps Are Available?

- MT4 - Well-established trading mobile app, including streaming news, mobile chat, and e-mail alerts

- MT5 - Like MT4, but with improved technical analytics and advanced trading functions

- TradingView - Ideal social trading alternative with 30M+ active traders.

How User-friendly Are the Eightcap Mobile Apps?

The easy-to-use Eightcap MT4/MT5 mobile apps are ideal for monitoring portfolios on the go, managing existing positions, and copy trading. Despite supporting technical analysis, mobile apps are better for portfolio management than for complex trade analysis, given the relatively small screen. The TradingView mobile app packs the most comprehensive technical analysis toolbox. Algorithmic trading is unsupported in all three Eightcap mobile apps.

What Charting Tools Exist on the Eightcap Mobile Apps?

The Eightcap mobile apps have a similarly advanced charting package to the more powerful desktop versions. However, the screen size, and absence of multi-screen support, make conducting complex analytics a challenge.

What Trading Tools Are Offered by Eightcap Mobile Apps?

Mobile apps cater more to portfolio management, up-to-date developments, and copy trading, for which the Eightcap mobile apps have the necessary tools, including economic calendars, streaming news, and watch lists. They do not support the cutting-edge trading tools Eightcap offers for desktop trading platforms.

Eightcap Mobile Apps Comparison

Unique Features

Trade Zone is Eightcap’s latest initiative, an exclusive educational resource for its clients. Here, Eightcap invites market experts to provide key insights and market updates, as well as deliver timely and engaging weekly webinars. This provides traders with ideas for diversifying portfolios, while enabling them to learn from market professionals, gain valuable insights and pick up tips on trading the financial markets. Eightcap offers weekly webinars with guest speakers for the Trading Week Ahead, which is a live forecast with a guest speaker who points out potential volatility for the coming week. Eightcap also offers a Live Market Update, which assesses the mid-week forecasts, to see how these predictions shaped up, as well as end-of-week reviews.

Eightcap Labs can help traders develop their skills with a comprehensive collection of essential materials, expertly designed by professional traders.

Eightcap offers Flash Trader, integrated with its MetaTrader 5 trading platform, allowing for sophisticated and instant position sizing, stop, and limit order targets with a single click. In addition, the broker offers Acuity’s AI-driven economic calendar, that filters events by location and likely impact to provide fundamental insights, predictions, historical data analysis, and real-time news updates.

Finally, Eightcap offers four useful calculators through its client portal:

- Margin Calculator

- Profit Calculator

- Currency Conversion Calculator

- Pip Calculator

Research and Education

The broker delivers quality educational resources through Eightcap Labs and the Eightcap Trade Zone, with nearly 300 articles, eBooks, and regular webinars. Content is divided into beginner, intermediate, and advanced levels, offering something for every stage of a trader’s journey. Eightcap’s economic calendar powered by AI (via Acuity) has an educational component helps traders assess upcoming events with real-time news and impact analysis.

Eightcap’s educational section features plenty of quality content on topics, including swing trading and technical analysis. This content, however, is not structured as a course, and I recommend beginners start with the existing content before seeking more in-depth coverage from alternative sources, available for free online. The education page is only available in the English version of the website and has three categories: MetaTrader Guides, Fundamentals, and Trading Strategies.

Eightcap also has a market analysis page offering insights on the trading day. The page is divided into Crypto News, CFD News, Forex News, and Market Updates. These analyses are in both video and text formats. The content is top-notch and offers beginners trading ideas, while seasoned traders get a quality read.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |           |

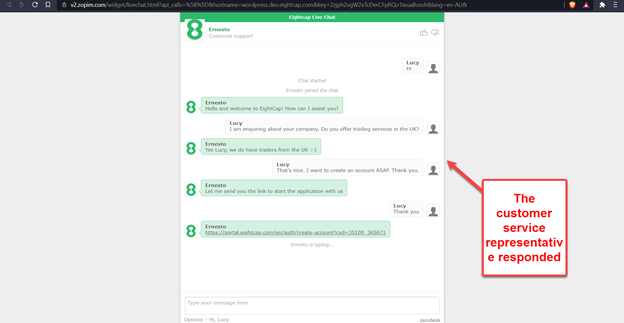

Customer support at Eightcap is responsive and available via live chat, email, and phone during 24/5 market hours. The support site is available in 10+ languages.

I tested all three options, finding fast response times - there was no long queue when I called. Similarly, my email messages were replied to within seconds, and I found the customer service representatives to be helpful and knowledgeable.

Bonuses and Promotions

Eightcap neither offers bonuses nor promotions but has a partnership program allowing traders to earn passive income. The availability may have geographic restrictions.

Eightcap Opening an Account

The user-friendly online application form onboards new traders. Opening an account takes a few minutes and follows well-established industry standards. The mandatory account verification, as stipulated by regulators in compliance with global AML/KYC rules, usually takes a few hours and can take up to 24 hours. Most traders will be verified after uploading a copy of their government-issued ID and one proof of residency document.

A responsive customer service team stands by to assist, which is helpful for traders from countries with verification issues or a less-established system to source the necessary documents.

Eightcap Minimum Deposit

The minimum deposit at Eightcap for both the Raw and Standard accounts is $100.

Eightcap Payment Methods

Eightcap does not charge any deposit or withdrawal fees. However, the various payment providers may charge their own transaction fees. In most cases, the payment will be reflected in your account instantly. Some deposit options like wire transfer will usually take a little time to be processed.

Withdrawal options |       |

|---|---|

Deposit options |       |

Eightcap Awards

Eightcap has won numerous awards, including:

Year | Award | Presented by |

|---|---|---|

2024 | Best CFD Broker | Top Forex Brokers Review / Forex Penguin |

2024 | Best Global CFD/Forex Broker (by asset classes) | TradingView Broker Awards (user-voted) |

2023 | Broker of the Year | Global Forex Awards (Retail, Africa region) |

2023 | Most Innovative Affiliate Program | Global Business Review |

2023 | Best Crypto Broker | AtoZ Markets |

2023 | Annual Review Award | International Business Magazine |

Eightcap Deposits and Withdrawals

Eightcap Deposits

Eightcap offers multiple ways for customers to deposit and withdraw their funds. The available deposit methods are bank wires, credit/debit cards, BPAY, China UnionPay, Skrill, Neteller, cryptocurrencies, PayPal, Worldpay, FasaPay, PSP Virtual Account, and Pay Retailers. The debit and credit card deposit options accept payments in AUD, USD, GBP, EUR, NZD, CAD, and SGD. Traders can also fund their accounts with Bitcoin and Tether. Overall, Eightcap supports 13 deposit methods and 17 deposit currencies. The deposit option is free and available 24/7. A bank wire transfer takes 1-5 business days to complete.

BPay only accepts AUD, while China Union Pay only accepts RMB. PSP Virtual Accounts cater to Southeast Asian clients and Pay Retailers to traders from Brazil. There are no charges for depositing and withdrawing funds, although some options have external costs, including potential currency conversion fees.

I used PayPal to fund my account, and the process was very smooth, taking less than 5 minutes to complete.

Eightcap Withdrawals

The withdrawal process was also swift. Traders just need to go to their client area, select the payment option, select the trading account from which to withdraw funds, and confirm the details.

The broker typically asks several questions and seeks documents for first-time customers to comply with KYC and AML laws. This is common practice among Forex / CFD brokers.

Eightcap processes withdrawals within 1-2 business days. The speed at which the funds reach the client once it is approved depends on the payment method used.

Bottom Line

Eightcap has stood the test of time, with an exceptional regulatory track record and a reputation as a cutting-edge and trustworthy multi-asset broker.

After reviewing Eightcap’s trading environment, pricing, and platform offering, I can confidently say it’s one of the best brokers for cryptocurrency CFD trading and platform innovation. Traders who prioritize execution speed, social charting, and algorithmic setup will find a feature-rich experience at Eightcap. However, long-term investors seeking traditional products like ETFs or bonds may find the asset range limited.

- Excellent crypto CFD offering with over 100 pairs

- The Raw account featuring narrow spreads and low fees

- TradingView integration for social and technical traders

- An AI-powered economic calendar that enhances news trading

- MT5 and FlashTrader and VPS - a strong setup for algo traders

- A limited offering for long-term investment products (no ETFs or bonds)

- Regulation by ASIC, FCA, CySEC, and SCB - a high trust level

- Demo and two live account types with a $100 minimum deposit requirement

How We Make Money

DailyForex generates revenue by publishing promotional materials from paying brokers and service providers, which has no impact on the objectivity of our reviews. Our mission is to offer clear, accurate, and transparent evaluations of Forex and CFD brokers, using a rigorous, data-driven approach. Our partners may be placed highly within certain areas of the site, but our broker ratings are always based on objective analysis. Find out more here.

FAQs

How much capital do I need to trade with Eightcap?

The minimum deposit is $100 or a currency equivalent, but the total required capital depends on the trader and desired assets. Forex trading carries significantly lower entry requirements than equity trading.

What is the maximum leverage at Eightcap?

Maximum leverage at Eightcap Pty Ltd is 1:30. Maximum leverage for clients trading with Eightcap Global Ltd is 1:500. Leverage is also asset dependent.

Does Eightcap offer a demo account?

Yes, traders may request a demo account from Eightcap. While it expires after 30 days, traders may request an unlimited one by contacting customer support.

How do I open a live account with Eightcap?

An online form processes new account openings. The application button, located in the top-right corner of the website, opens a brief registration form. Account verification is mandatory to comply with AML stipulations. The process follows well-established industry standards.

What can I trade on Eightcap?

Eightcap offers more than 800 assets across Forex, commodities, equity, and index CFDs.

Is Eightcap regulated?

Yes. Eightcap is regulated by the Australian Securities and Investment Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC).

Is Eightcap a market maker?

Yes. Eightcap is a safe broker. It has been in the industry for more than a decade and I did not find any complaints about its safety. It also has a good rating in TrustPilot.

Is Eightcap a good broker?

Eightcap offers a choice of two account types with differing execution models. One is Raw, the other is Standard. Standard brokers are not strictly speaking market makers but tend to offer similar pricing and execution to market makers.

What is the maximum leverage in Eightcap?

Eightcap has a maximum leverage of 500:1 for its VFSC offering and 30:1 for its ASIC offering.

How much capital do I need to trade with Eightcap?

Eightcap requires a minimum deposit of $100 or its currency equivalent.

Is Eightcap FCA-regulated?

Yes, Eightcap has an FCA-regulated subsidiary.

Does Eightcap allow scalping?

Yes, Eightcap allows scalping and maintains a competitive trading environment, including high leverage, deep liquidity, excellent order execution, MT4, and Capitalise AI.

Who owns Eightcap?

Eightcap is a privately-owned company, and ownership details are not available. Joel Murphy founded the company. He also serves as its Director and CEO. Other notable individuals are Lori Johnson, another Eightcap Director, Christa Jerome, the Eightcap Manager of Self-Sufficiency Programs, and Steve Powell, the Eightcap Information Technology Supervisor in a non-management role.

What is the minimum deposit for Eightcap?

The Eightcap minimum deposit requirement is $100, or a currency equivalent, for all Eightcap account types.

How much is Eightcap’s fee per trade?

Eightcap fees depend on the asset and the account type. The lowest Forex trading fee is for the EUR/USD in the commission-based Raw account, which is as low as $7.00 per 1.0 standard round lot. The same currency pair in the commission-free Standard alternative starts from $10.00, but the minimum deposit requirement is the same.

What are the benefits of Eightcap?

The benefits of Eightcap include competitive trading fees, an excellent trading infrastructure ideal for algorithmic trading, cutting-edge trading tools like Capitalise AI, a secure and trustworthy trading environment, quality education and research for beginners, and a well-balanced asset selection.

How long does it take to get a withdrawal from Eightcap?

Eightcap processes withdrawals the same day if it receives requests by 01:00 PM AEST/AEDT Monday to Friday. Otherwise, it will process them on the following business day. Depending on their payment processor and geographic location, traders may have to wait several days for bank wires or credit/debit card withdrawals.

Is Eightcap a legit broker?

Yes, Eightcap is a legit and trustworthy broker, compliant with five regulators, where it maintains a clean operational track record.

Is Eightcap available in Nigeria?

Yes, Eightcap accepts Nigerian-resident traders via its three international subsidiaries (Bahamas, Seychelles, St.Vincent and the Grenadines).

Does Eightcap have fees?

Opening an Eightcap account is free, but trading incurs fees, as with any broker. The most notable trading fees are spreads and commissions, followed by swap rates on leveraged overnight positions and currency conversion fees if traders place trades in a currency that differs from the account base currency.

Is Eightcap legal?

Eightcap is legal, well-regulated, and has an excellent track record, positioning it among the leading Forex brokers.

Can I withdraw all my money from Eightcap?

Verified traders can withdraw all their money from Eightcap after they close all open positions and wait for trades to settle to show a cash balance in their Eightcap trading account.