Editor’s Verdict

Overview

Review

EuropeFX, the trading name of MAXIFLEX LTD, offers traders an STP execution model and minimum spreads from 0.1 pips. Traders also have access to high-quality third-party trading tools but must accept a high minimum deposit and low leverage. EuropeFX also operated without a license in Australia. I reviewed EuropeFX to evaluate if their claims of a world-class trading partner are justified.

Pros | Cons |

|---|---|

Quality trading tools in TipRanks and Trading Central | $25 withdrawal fee and low retail leverage |

RoboX by Tradency for assisted automated trading strategies | Limited pricing transparency suggesting high trading costs |

STP execution model | Poor reputation regarding Australia and UK |

Comprehensive video educational section for beginner traders | High minimum deposit requirement and backward account structure |

Summary

EuropeFX Overview

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Year Established | 2014 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $200 |

Trading Platform(s) | MetaTrader 4, Proprietary platform, Web-based |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

The best features at EuropeFX are its third-party services, which is fine, but I must point out the lack of pricing transparency as EuropeFX does not list spreads on its website. EuropeFX also has one of the highest retail loss rates industry-wide, with 86.23% of traders losing money when trading with EuropeFX.

EuropeFX Main Features

Retail Loss Rate | 86.23% |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.1 pips |

Minimum Standard Spreads | Unspecified |

Minimum Commission for Forex | Commission-free |

Commission for CFDs/DMA | 7.00% |

Commission Rebates | Yes |

Minimum Deposit | $200 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | No |

Inactivity Fee | Yes, $25 monthly after three months |

Deposit Fee | No |

Withdrawal Fee | $25 plus third-party |

Funding Methods | 12 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. EuropeFX presents clients with one well-regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Cyprus | Cyprus Securities and Exchange Commission | License Number 258/14 |

Traders get negative balance protection, and deposits remain segregated from corporate funds. Since 2018, the maximum leverage for Forex retail traders is 1:30. The Cyprus Investor Compensation Fund (ICF) protects deposits up to €20,000.

What happened with this broker in Australia is worth looking into. Maxi EFX Global Pty LTD, the Australian subsidiary of MAXIFLEX LTD, claimed to operate as a regulated broker when it was not regulated in Australia. After the ASIC received 64 complaints from traders, which grew to 85, it investigated and later officially shut down EuropeFX in Australia. The investigation also includes BrightAU Capital Pty, operating under the name TradeFred. Both brokers are registered representatives of Union Standard International Group Pty Ltd, also known as USGFX, which is now under liquidation following allegations of misconduct.

The UK Financial Conduct Authority (FCA) banned EuropeFX from offering services to clients in the UK on June 15th, 2020.

Pedro Eduardo Sasso, the director of EuropeFX, verified that he would notify ASIC before leaving Australia after the ASIC issued a 19-373MR interim asset restraint order. The investigation is ongoing, with the case management hearing adjourned to August 5th, 2021.

I also want to note the relatively high $25 withdrawal fee intended to discourage and punish withdrawals. EuropeFX maintains its CySEC license for now. Given the ongoing investigations, I urge extreme caution when dealing with EuropeFX.

Fees

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

0.1 pips | $7.00 | $8.00 |

Here is a screenshot of the EuropeFX MT4 trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

.jpg)

I cannot ignore the lack of pricing transparency at EuropeFX. From the limited information available, EuropeFX levies a 7% commission on all trades. It only provides one example, using a CFD on equities. My review found the lowest spread for the EUR/USD at 0.2 pips, resulting in a minimum trading cost of $9 per round lot.

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

MT4 traders can easily access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights, in the commission based EuropeFX account.

The formula EuropeFX uses is:

(100,000*1*(swap rate/100))/360

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for one night will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $7.00 | -$7.0902 ($25.5247) | X | $34.5247 |

0.2 pips | $7.00 | X | -$2.2234 ($6.1761) | $15.1761 |

Taking a 1.0 standard lot buy/sell position, in the EUR/USD at the tightest spread and holding it for seven nights will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.2 pips | $7.00 | -$7.0902 ($178.6729) | X | $187.6729 |

0.2 pips | $7.00 | X | -$2.2234 ($43.2327) | $52.2327 |

Futures contracts face a rollover fee, calculated as follows:

Rollover Fee Sell:

(Contract_new - Contract_old)*Number of Contracts - (Spread of Contract_new * Number of Contracts)

Rollover Fee buy:

(Contract_old - Contract_new)*Number of Contracts - (Spread of Contract_new * Number of Contracts)

I also want to note the monthly inactivity fee of $25 after just three months of dormancy. Overall, EuropeFX remains one of the most expensive brokers I have reviewed.

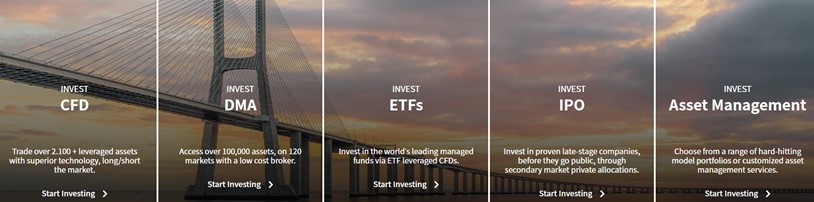

What Can I Trade

EuropeFX provides traders with 50 currency pairs, 20 cryptocurrency pairs, 15 commodities, 128 equity CFDs, 14 index CFDs and 28 ETFs. While the cryptocurrency selection is higher than at many brokers, the overall asset selection remains average but suitable for new retail traders.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Leverage

Retail traders get maximum leverage of 1:30, per CySEC restrictions. I like to use higher leverage but to be fair to EuropeFX, as they are regulated only in Cyprus, they cannot offer higher leverage to retail traders.

Trading Hours

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Monday 00:00 | Sunday 24:00 |

Forex | Monday 00:00 | Thursday 24:00 |

Forex | Friday 00:00 | Friday 22:58 |

Commodities | Monday 01:02 | Friday 22:58 |

European CFDs | Monday 10:00 | Friday 18:30 |

US CFDs | Monday 16:32 | Friday 22:59 |

I recommend the following step for MT4 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

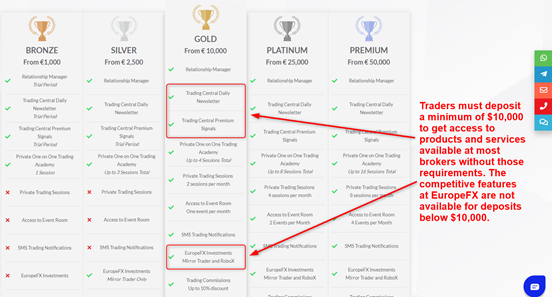

I cannot recommend any of the accounts at EuropeFX, as they follow a backward structure, denying new retail traders beneficial services and offering them to traders who do not require them. A $100,000 demo account exists, but it does not reflect accurate trading conditions for retail traders. I could not find a time limit on using it. Overall, EuropeFX seems to display a lack of understanding of what retail Forex traders really want and need.

Trading Platforms

EuropeFX offers the core MT4 trading platform with the Acuity upgrade, consisting of six quality add-ons. MT4 remains the best choice for traders, as it supports extensive upgrades, algorithmic trading and its integrated copy-trading platform. The proprietary EuroTrader 2.0 is a sub-standard web-based alternative, which lacks advanced features. It lists just five technical indicators, and I find it ranks among the worst trading platforms I have encountered.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | No |

cTrader | No |

Proprietary Platform | Yes |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Proprietary mobile trading app |

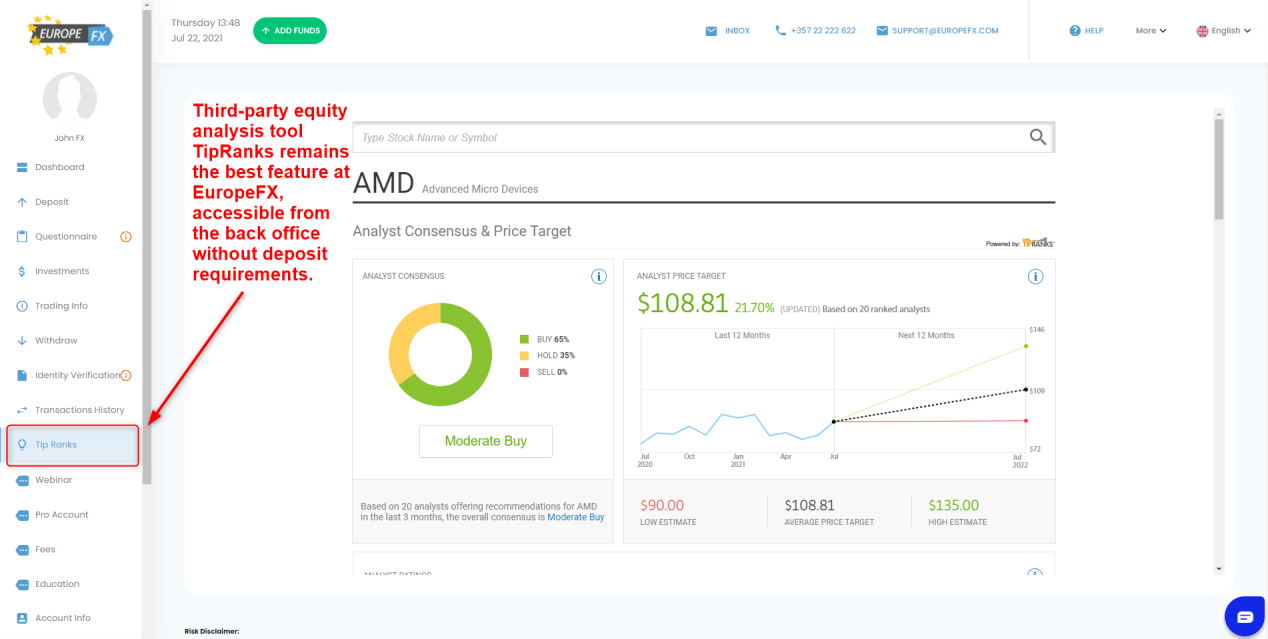

Unique Feature Two | TipRanks |

Mobile Trading

Mobile traders may use the well-known MT4 mobile app or opt for the proprietary eFXGO alternative. Both provide traders with everything they need to trade on the go and are available on Android and iOS devices. The MT4 mobile app shows a user rating of 4.6 on the Google Play Store versus 3.1 for eFXGO. I recommend traders trust the MT4 app, as it packs more features.

Unique Features

While EuropeFX offers Mirror Trader and RoboX, they are available from a deposit of $2,500 and $10,000, respectively. Therefore, they are out of reach for most retail traders, especially RoboX. It makes TipRanks the best feature, but it only serves equity traders.

Research and Education

Traders get market commentary from EuropeFX in written format and videos, plus trading ideas from FX Street. I can recommend the daily Market Review, which offers traders a quick overview in less than three minutes. The Trader Tools section provides a range of tools, but I would prefer them as MT4 plug-ins.

EuropeFX presents beginner traders with a video academy, which I found surprisingly well structured. It covers six topics with numerous sub-topics, and I recommend new traders begin their Forex journey there. The rest of the educational offering, consisting of articles, tutorials, and webinars, remains limited and unsatisfactory.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | Unspecified |

Website Languages |     |

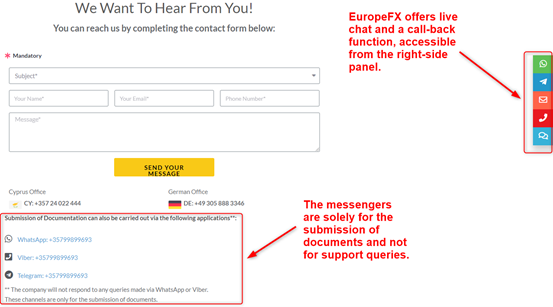

Customer support is available in English and German via live chat, e-mail, web form, phone and call-back. The three messengers are for the submission of documents only. EuropeFX does not state its operating hours, but the FAQ section answers many questions.

Bonuses and Promotions

The EU bans Forex brokers from offering bonuses and promotions, but EuropeFX maintains a VIP program where traders get lower trading costs. It is unavailable to German traders, and its existence raises a red flag, as it violates regulatory restrictions. It also requires a minimum deposit of $10,000, making it unavailable for most retail traders.

Opening an Account

I was able to open an account in about 30 seconds, and the online onboarding process was swift. It asked me for my name, e-mail, desired password, country of residency, and mobile phone number. I also had to confirm three statements. New traders must verify their trading account in the back office by submitting a copy of their ID and one proof of residency document, satisfying KYC/AML requirements. EuropeFX also asks for payment proof, which I find odd, as most brokers do not ask for it.

Minimum Deposit

The minimum deposit at EuropeFX is $200, but the recommendation is $1,000. Traders must commit $10,000 for access to all trading tools. I find the account structure backward and unsuitable for retail traders.

Payment Methods

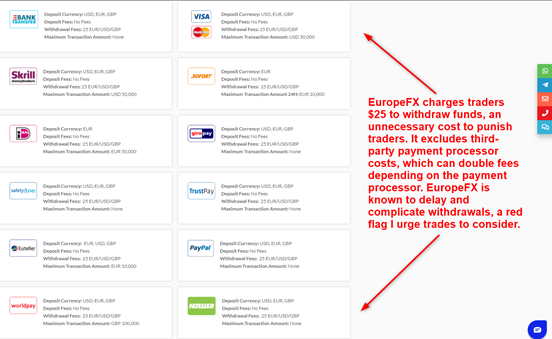

EuropeFX offers bank wires, credit/debit cards, Skrill, Sofort, iDEAL, Giro Pay, Safety Pay, TrustPay, Euteller, PayPal, World Pay and Neteller.

Deposits and Withdrawals

While the available payment methods at EuropeFX offer flexibility, I have come across many complaints about withdrawals. Its unregulated Australian entity acted in the same manner, which brought EuropeFX to the attention of regulators. There are no deposit fees, but EuropeFX levies an unacceptable $25 internal withdrawal fee. It punishes traders for withdrawing funds, a red flag I cannot ignore.

Third-party payment processor charges also apply, making it an expensive procedure to request funds. I urge traders to exercise extreme caution, as EuropeFX is known to make withdrawing funds a burdensome and frustrating request.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

Bottom Line

The trading experience at EuropeFX is not one I can recommend due known reputational issues, high fees, and withdrawal complications. With the ASIC having shut down the unauthorized Australian subsidiary and given the issues at the Cyprus unit, I believe it may be a matter of time until CySEC removes its license. The UK FCA banned EuropeFX from offering services in the UK.

On paper, EuropeFX presents itself as a competitive broker, but my review found that traders must deposit a minimum of $10,000 and accept high swap rates on leveraged overnight positions. Even the discounts, which EU regulators ban, do not lower trading costs into a competitive range. There are too many red flags at EuropeFX, and traders will find a more trustworthy and secure broker elsewhere. EuropeFX is a CySEC-regulated broker. However, its Australian entity was shut down by the Australian regulator ASIC. The UK’s FCA banned EuropeFX from offering services in the UK, and German-resident traders do not have access to all services. EuropeFX is a Forex and multi-asset broker primarily focused on the EU. EuropeFX operated wrongly in Australia, and the ASIC shut it down with ongoing court proceedings. EuropeFX has offices in Cyprus and Germany.FAQs

Is EuropeFX legitimate?

What is EuropeFX?

Is EuropeFX a con?

Where is EuropeFX based?