Editor’s Verdict

Overview

Review

Exinity launched in June 2021 and is the third broker operated by the well-known Exinity Group, joining sister companies Alpari and FXTM. It presents traders with three exciting products, an excellent pricing environment, and high leverage, making it ideal for beginners and scalpers alike. I reviewed Exinity to gauge if its product portfolio can offer you a competitive edge. Should you open an account at Exinity?

Summary

Headquarters | Cyprus |

|---|---|

Regulators | FSC Mauritius |

Year Established | 2021 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $20 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

I like the trading conditions at Exinity as the trading costs rank among the best industry wide. I also appreciate the transparency and seven days of swap-free trading, making Exinity ideal for scalpers and short-term traders. The excellent trading tools available from within the MT4/MT5 trading platforms can offer traders an edge. I also like that Exinity created an account type specifically for mobile traders.

Exinity Main Features

Retail Loss Rate | Not applicable |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | 0.0 pips |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | $4.00 |

Commission for CFDs/DMA | Commission-free |

Commission Rebates | No |

Minimum Deposit | $20 |

Demo Account | Yes |

Managed Account | No |

Islamic Account | Yes |

Inactivity Fee | No |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 3 |

Regulation and Security

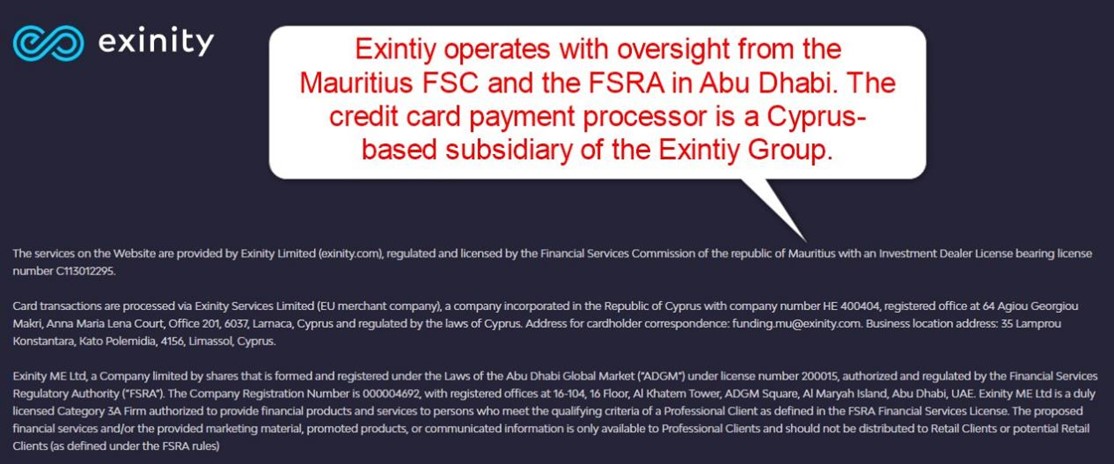

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders to check for regulation and verify it with the regulator by checking the provided license with their database. Exinity presents clients with two well-regulated entities.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Mauritius | Financial Services Commission | License Number C113012295 |

Abu Dhabi | Financial Services Regulatory Authority | Company Registration Number 000004692 |

Most international clients will trade with the Mauritius-regulated entity, operating under the oversight of the Financial Services Commission (FSC). The FSC matured into a trusted regulator for brokers. It offers a business-friendly environment allowing traders access to competitive trading conditions.

Traders from the Middle East who qualify for the Exinity Trader Pro account will trade with the Abu Dhabi subsidiary of Exinity. The Abu Dhabi Financial Services Regulatory Authority (FSRA) is a lesser known but capable regulator. It enjoys growing influence over the Middle East, with the United Arab Emirates a leading business hub for the region.

While Exinity lacks operational experience, launched in June 2021, its parent company, The Exinity Group, caters to clients for more than two decades. Both Exinity Group entities, Alpari and FXTM, have an exceptional track record.

Exinity segregates client deposits from corporate funds and provides negative balance protection. I always recommend leveraged traders to ensure it exists. Otherwise, leverage results in a high-risk adventure that can result in losses exceeding deposits. The only thing missing is an investor compensation fund or third-party insurance in case of an unlikely default or malpractice by Exinity.

Fees

Traders using the Exinity World account, specifically designed for mobile trading only, get raw spreads of 0 pips. These are commission-free for trade values below $1 million. This equals approximately 10 standard lots, dependent on the currency pair. Above the threshold, a commission of $0.04 per $1,000 or $4.00 applies. Commission-free trading with raw spreads of 0 pips is an industry-first offer. I highly recommend it but must point out that it only applies to trading via mobile phones, which excludes algorithmic trading.

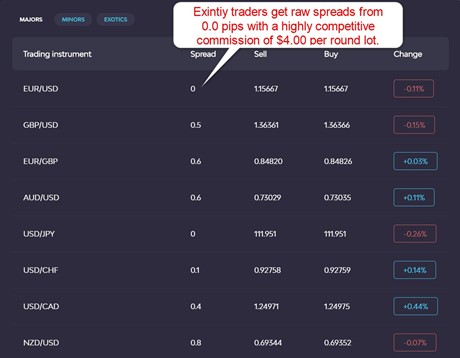

Exinity Trader and Exinity Trader Pro account holders get raw spreads from 0 pips for a commission of $4.00 per 1 standard lot, making Exinity one of the best-priced brokers. Equity trading remains commission-free with acceptable mark-ups. It is an ideal environment for all trading strategies, and I like that Exinity understands the needs of traders. The pricing transparency is excellent, mirroring the low costs, which result in higher profits for traders.

Here is a screenshot of Exinity live quotes during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

The average trading costs for the EUR/USD in the Exinity World account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $0.00 | $0.00 |

The average trading costs for the EUR/USD in the commission based Exinity Trader and the Exinity Trader Pro account:

Average Spread | Commission per Round Lot | Cost per 1 Standard Lot |

|---|---|---|

0.0 pips | $4.00 | $4.00 |

One of the most ignored trading costs is swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Exinity offers seven days of swap-free trading before a flat fee applies regardless of the direction of the trade. This makes Exinity an ideal broker for short-term traders, and the cost savings are notable.

After seven days, the applicable swap rates remain competitive and lower than some brokers. The combination of tight spreads, low commissions, and the swap-free offer combine for the best-priced broker I have reviewed to date.

MT4/MT5 traders can access swap rates from their platform by following these steps:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Swap Long and Swap Short.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and eight nights, in the Exinity World and Exinity Trader/Exinity Trader Pro account.

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night in the Exinity World account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0 pips | $0.00 | $0.00 | X | $0.00 |

0 pips | $0.00 | X | $0.00 | $0.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for eight nights in the Exinity World account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0 pips | $0.00 | -$6.70 | X | $6.70 |

0 pips | $0.00 | X | -$6.70 | $6.70 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for one night in the Exinity Trader/Exinity Trader Pro account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0 pips | $4.00 | $0.00 | X | $4.00 |

0 pips | $4.00 | X | $0.00 | $4.00 |

Taking a 1 standard lot buy/sell position, in the EUR/USD at the average spread and holding it for eight nights in the Exinity Trader/Exinity Trader Pro account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total Trading Costs |

|---|---|---|---|---|

0.0 pips | $4.00 | -$6.70 | X | $10.70 |

0.0 pips | $4.00 | X | -$6.70 | $10.70 |

I like the overall trading cost structure at Exinity, as it ranks among the best available industry wide. The seven-days swap-free trading makes a notable difference, and I rank Exinity as one of the best brokers for scalpers, high-frequency traders, and those who keep their trades open for less than seven days. The Exinity World account is the first-ever offer allowing traders commission-free trading for raw spreads of 0 pips.

There is no inactivity fee for the Exinity World and Exinity Trader accounts, but one exists for Exinity Trader Pro. After 90 days of dormancy, Exinity reserves the right to deduct the remaining balance and donate it to a charitable cause. With a minimum deposit requirement of $10,000, this is a shame, despite the noble intention.

What Can I Trade?

The Exinity contract specification lists 19 currency pairs, 6 commodities, 11 index CFDs, 60 equity CFDs, and 11 proprietary synthetic indices. After reaching out to customer support to inquire about the discrepancy between the contract specifications and the advertised assets of 150+ currency pairs and 1,000+ stocks, an Exinity representative confirmed that they would update contract specifications shortly.

The representative also informed me that the MT5 demo account lists all available assets. Regrettably, there was a system error preventing me from confirming this. Given the overall transparency and honesty of the Exinity Group, I trust the information provided is accurate. Therefore, Exinity presents an excellent list of trading instruments, but I note the absence of cryptocurrencies.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

ETFs |

Exinity Leverage

The maximum leverage for Exinity World is 1:1000, increased to 1:2000 for Exinity Trader, and lowered to 1:500 for Exinity Trader Pro. All three remain outstanding, and negative balance protection exists. It makes Exinity an ideal broker for scalpers and short-term traders, especially considering the seven-day swap-free trading offer.

Exinity Trading Hours (GMT -4 Server Time)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Not applicable | Not applicable |

Forex | Sunday 22:05 | Friday 21:55 |

Commodities | Sunday 23:05 | Friday 21:55 |

European CFDs | Not applicable | Not applicable |

US CFDs | Monday 14:31 | Friday 20:59 |

Please note that equity markets open and close each trading and are not operational continuously like Forex and cryptocurrencies.

I recommend the following step for MT4/MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

Three account types are available at Exinity. Traders can sign up for Exinity World for just $20, but it is a pure mobile trading account and does not support algorithmic trading. It substitutes it with the industry-first commission-free raw spread offer. I highly recommend the Exinity Trader account for algorithmic traders. It features one of the best cost structures and only requires a $100 deposit, and traders get maximum leverage of 1:2000.

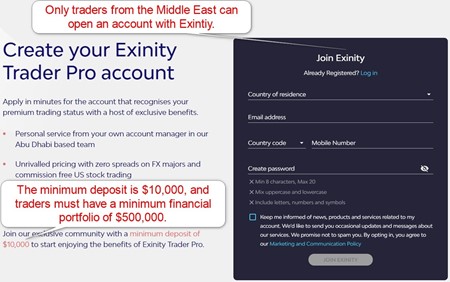

Exinity Trader Pro is offered only to traders residing in the Middle East. As the name suggests, it is for traders who qualify as professional ones as outlined under FSRA rules. Traders must have a minimum portfolio balance of $500,000 and satisfy trading experience criteria. The minimum deposit is $10,000, and the maximum leverage 1:500.

Exinity Demo Account

Traders may open MT4/MT5 demo accounts for Exinity Trader, and there is no time limit. The flexibility of MT4/MT5 allows traders to select their deposits and leverage, creating more realistic demo results. Traders should consider that no demo account can substitute live trading. Exinity will deactivate demo accounts after 60 days of inactivity.

Exinity Trader Pro clients get demo accounts with a time limit of 90 days and 15 minutes delayed quotes for equity and equity CFDs. The time limit does not grant algorithmic traders the bug-fixing tools they require for EAs, and since Exinity does not cater to retail traders, it makes the demo account of limited value. It could be why Exinity does not note it on their website and only provides details via live chat once asked about it.

Trading Platforms

Traders may choose between the out-of-the-box MT4 or MT5 trading platforms. The former remains the market leader for algorithmic traders, and I recommend it for all traders who require a versatile trading infrastructure. With more than 25,000 plugins and EAs, it is the most used trading platform. It also features an integrated copy-trading service.

I like the Market Analyzer available for Exinity Trader. Traders can use it from their MT4/MT5 trading platform. It transforms MT4/MT5 into a competitive trading portal and separates Exinity from competitors who offer only the core version. The Market Analyzer is not available for Exinity Trader Pro clients.

Exinity also developed a proprietary mobile trading app for its Exinity World account. It is where traders get an industry-first commission-free Forex trading offer with access to raw spreads as low as 0 pips.

Overview of Trading Platforms

MT4 | Yes |

|---|---|

MT5 | Yes |

cTrader | No |

Proprietary/Alternative Platform | Yes (mobile-only) |

Automated Trading | Yes |

Social Trading / Copy Trading | Yes |

MT4/MT5 Add-Ons | Yes |

Guaranteed Stop Loss | No |

Negative Balance Protection | Yes |

Unique Feature One | Excellent trading costs |

Unique Feature Two | Market Analyzer for MT4/MT5 |

Research and Education

Exinity generates daily in-house market commentary, trading ideas, and other relevant content in a well-presented format. Traders can use these to attempt to verify their own analysis. The search function allows traders swift access to any of the six categories. A well-designed economic calendar is equally available, the most user-friendly one I have ever encountered from a broker. Exinity rounds up its research tools with an Opportunity Indicator published on its website, based on technical and fundamental indicators.

An Analyst Sentiment indicator is available for Exinity World, the mobile-only trading account at Exinity. I like the overall research at Exinity, as it remains a broad mix of quality tools centered around the Market Analyzer for MT4/MT5.

Beginner traders get educational value via workshops and on-demand videos, but the section remains undeveloped. Numerous high-quality services exist to educate new traders free of charge, and Exinity has been operational for less than six months. Therefore, I do not consider this an issue. There is also an abundance of educational value embedded in the research, and I recommend traders consider this and learn from it.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5, Saturday 0800 - 1300, Sunday 0900 - 1700 |

Website Languages |   |

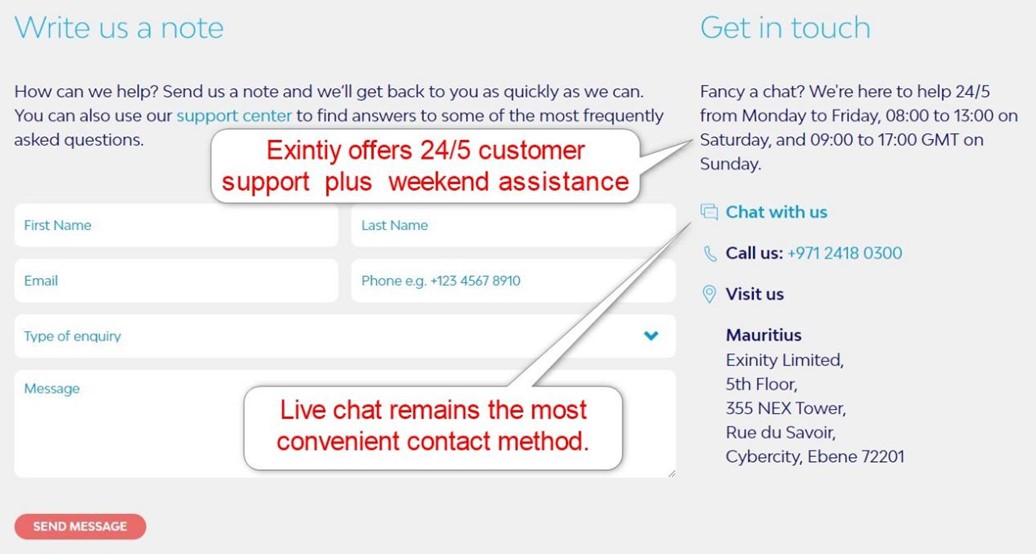

The customer support team operates out of Mauritius and Abu Dhabi. It is available 24 hours from Monday through Friday, Saturday from 0800 to 1300 GMT, and Sunday from 0900 to 1700 GMT. The most convenient method to contact a representative for non-urgent matters is live chat, which response fast and friendly.

A phone number is also available together with e-mail support. The FAQ section answers most of the common questions, and Exinity describes its products and services well. Therefore, I doubt traders will require additional assistance, but Exinity ensures its availability.

Bonuses and Promotions

At the time of this review, Exinity neither offered bonuses nor promotions to clients. I find the low trading costs superior to any bonus or promotion Exinity could offer. One thing missing is a volume-based rebate program like what the Exinity Group provides to traders under its Alpari and FXTM brands.

Opening an Account

Opening an account at Exinity takes less than 30 seconds for access to the secure back office. The online form asks for a country of residence, e-mail address, mobile phone number, and desired password. Traders who want an Exinity World account can scan a QR code to get the app for their mobile phone, available on Android and iOS devices.

The Exinity Trader Pro is only available to residents of the Middle East. Traders must also have a minimum financial portfolio of $500,000 and have sufficient trading experience. Exinity reserves the right to ask for additional documents, but the overall application process remains swift and hassle-free.

Account verification is mandatory for all accounts, generally satisfied by sending a certified copy of the ID and one proof of residency document.

Minimum Deposit

Traders can get started with only $20 at Exinity World and $100 at Exinity Trader. The minimum deposit for Exinity Trader Pro is $10,000, the highest industry wide. Exinity only accepts traders from the Middle East that qualify as professional traders with adequate experience and a minimum portfolio size above $500,000.

Payment Methods

Exinity only offers bank wires, credit/debit cards, and Neteller as payment methods. It may expand its offering in the future. Unfortunately, as not all traders have access to Neteller, costly bank wires may be the sole option for some.

Accepted Countries

Most international traders can open accounts with Exinity World and Exinity Trader. Exinity Trader Pro only admits traders resident in the Middle East. Neither is available to traders from the USA, Japan, Canada, Mauritius, Haiti, Hong Kong, Suriname, the Democratic Republic of Korea, Puerto Rico, or Northern Cyprus.

Deposits and Withdrawals

The secure back office of Exinity handles all financial transactions, but only bank wires, credit/debit cards, and Neteller are available. Depending on the geographic location, some traders may only have bank wires as an option. I find this unfortunate, as it represents the most expensive and time-consuming method. It also does not allow traders to keep day-to-day banking separate from trading-related activities, which I highly recommend.

Exinity lists processing times at between instant and five business days. I recommend traders check with their payment processor for withdrawal times and costs, which can add up to an additional three to ten business days to this process.

Bottom Line

I like the trading environment at Exinity due to its competitive trading costs. Exinity is ideal for all trading strategies. I recommend Exinity World to all traders who trade manually, as it is the only account where raw spreads as low as 0 pips meet a commission-free trading environment. Algorithmic traders will get one of the best trading conditions in the Exinity Trader account. The pricing environment is superb, and the upgraded MT4/MT5 trading platforms complement the broad asset selection and cost structure.

Regrettably, Exinity Trader Pro only caters to professional traders from the Middle East in a growing niche, but the core offer mirrors Exinity Trader. Overall, I confidently rank Exinity as one of the best Forex brokers in the market today.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

FAQs

Is Exinity legit?

Exinity exists for less than six months, but its owner, the Mauritius-based Exinity Group, has more than two decades of experience. It also owns well-known brands Alpari and FXTM, making Exinity a legit broker.

Should you trust Exinity?

Exinity operates with oversight from the Mauritius Financial Services Commission and the Abu Dhabi Financial Services Regulatory Authority (FSRA). It also has a seasoned management team, and traders can trust Exinity.

Is Exinity a safe broker?

Given the excellence of the Exinity parent company, this broker ranks as one of the safest and most transparent ones.

Is Exinity a scam?

Exinity is not a scam but a duly registered and regulated broker out of Mauritius and Abu Dhabi.