Editor’s Verdict

Overview

Review

Headquarters | United Kingdom |

|---|---|

Year Established | 1998 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Trading Platform(s) | MetaTrader 4 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

FIBO (Financial Internet Brokerage Online) Group, founded in 1998, is a Forex and CFD broker headquartered in the British Virgin Islands, and regulated in Cyprus under CySEC. They are one of the oldest players in marginal internet trading. They provide a trading platform that offers traders a wide range of assets for trading in spot metals, indices, ETFs and individual stocks, and Forex currency pairs across both major and minor financial markets.

Accounts

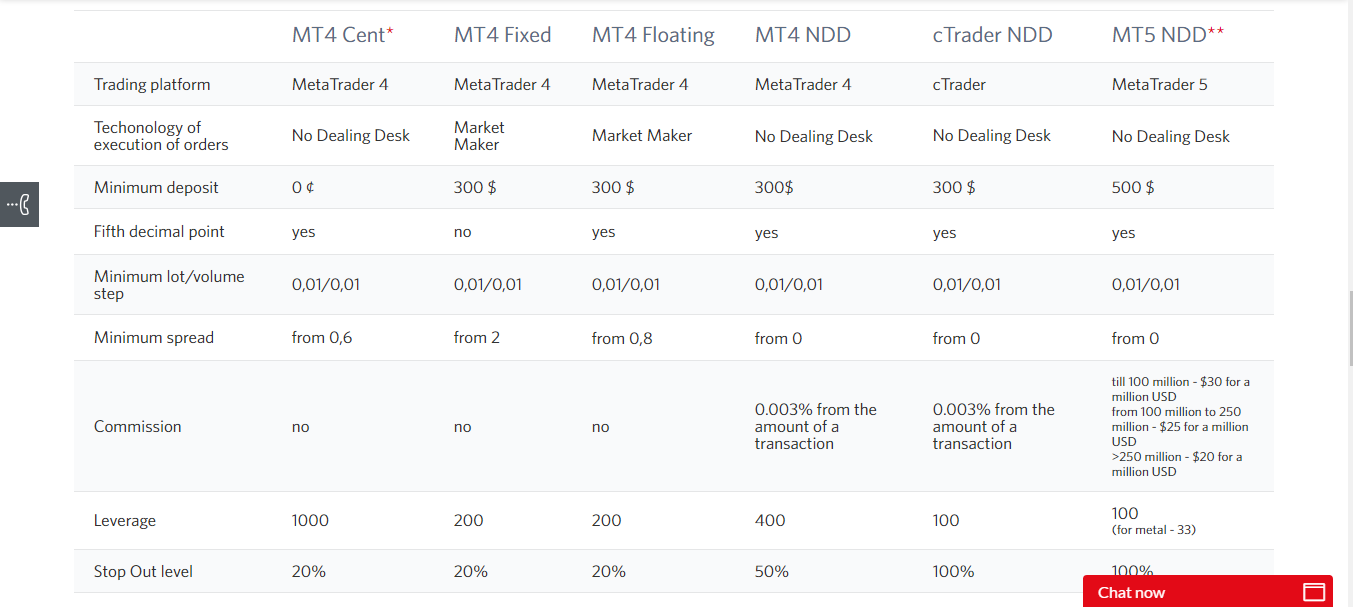

There are six different account types to choose from with FIBO Group. The MT4 Cent account requires no minimum deposit whatsoever, and allows trading with floating spreads starting at a minimum of 0.6 pips. Maximum leverage of 1000 to 1 is available in this account. This account is ideal for automated trading in very small quantities. The MT4 Fixed account requires a minimum deposit of $300 and allows trading with fixed spreads starting at a minimum of 2 pips. Maximum leverage of 200 to 1 is available in this account. This account is ideal for manual trading with fixed spreads. The MT4 Floating account requires a minimum deposit of $300 and allows trading with variable spreads starting at a minimum of 0.8 pips. Maximum leverage of 200 to 1 is available in this account. This account is ideal for long-term trading with variable spreads. The MT4 NDD account requires a minimum deposit of $300 and allows trading with low floating spreads with no minimums, plus a commission of 0.003% of the amount traded. Maximum leverage of 400 to 1 is available in this account. This account is ideal for scalpers. The cTrader NDD is the same, but utilizes the cTrader platform instead of the Metatrader 4 platform, and the maximum leverage available is 100 to 1. The MT5 NDD account requires a minimum deposit of $500 and allows trading with low floating spreads with no minimums, plus a commission of 0.003% of the amount traded up to $100 million, and lower rates beyond that. The maximum leverage available is also 100 to 1. This account is ideal for large volume traders.

The different accounts are easy to understand and transparent from this description. The accounts labeled “NDD” are no dealing desk type accounts, the other accounts are market maker type. All accounts offer minimum trade sizes of 1 microlot (0.01 lots). CFDs are only available for trading in the MT4 type accounts, except the MT4 Cent Account.

A demo account is available, as is typical with nearly all spot Forex brokers.

A wide range of Forex currency pairs, spot metals, indices, ETFs and individual stocks may be traded with the FIBO Group.

Features

One of the most notable features of the FIBO Group is that they allow trading in up to 8,000 individual shares. This is an unusually wide offering, and makes us sit up and take notice.

This broker offers a wide range of trading platforms that are offered for clients to use. The well-known and popular Metatrader 4 and Metatrader 5 platforms are available, as is the cTrader, which is compatible with an interesting associated feature known as cAlgo. The cAlgo add-on allows traders to create trading robots and their own customized indicators for technical analysis, using the language C#. Additionally, the cMirror add-on allows an easy compatibility with mirror trading, either as a provider or subscriber.

The FIBO Group offers facilities in PAMM, Automated Trading (including signals), and even Asset Management.

Education

The FIBO group offer no educational content as such, but does offer what it describes as “Analytics” which we believe to be a superior offering, from which newer or less experienced or confident traders can certainly learn. Up-to-date market analysis is provided on current market conditions and events which are dominant fundamental and sentimental factors. The website includes a section on Long-Term Forecasts, which at the time of this review was empty. A competent calendar of events likely to influence markets is included for easy time-based reference. A free charting tool with live instrument prices is also placed within the Analytics section. Finally, a table of current interest rates in force in the more important global economies is included, which can be useful in fundamental analysis.

Bonuses and Promotions

At the time of writing, no bonuses and promotions are offered, as CySEC, the Cypriot regulator, has banned new bonuses and promotions. As far as we are aware, the FIBO Group has never offered bonuses or promotions, which we find refreshing as we feel this is often the mark of a more serious broker.

Deposits/Withdrawals

Depositing funds into a FIBO Group account is an easy and secure process. Funding can be done using a wide range of methods, including credit cards, Skrill, CashU, WebMoney, Neteller, and wire transfers. Withdrawals can be made through Neteller, Skrill, Webmoney, wire transfers.

The FIBO Group imposes any minimums or maximum requirements on deposits or withdrawals, but the channels themselves may do so.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 9/5 |

Website Languages |        |

Customer support is based in Cyprus, but there are dedicated lines and email addresses listed on the FIBO Group’s website allowing communication with their offices in Shanghai, Singapore, and Limassol.

Conclusion

The FIBO Group has a well-rounded and professional offering for traders looking to trade a wide range of assets, particularly Forex currency pairs and individual shares. Fans of fixed spread trading and traders looking for a choice of NDD and DD type accounts, as well as signals/mirror trading/PAMM services will find their offer especially interesting, and quite probably attractive enough to open an account.

The spreads offered seem to be competitive.

Features

In terms of features, the stand-out strengths of this broker’s offerings are:

- A wide choice of account types, including both market-maker and ECN-type accounts, plus an Islamic option.

- A choice of the two major and generally most popular trading platforms in the industry: Metatrader 4 and 5, as well as cTrader.

- An unusually wide range of instruments available for trading: all the major and minor Forex currency pairs, as well as several exotics; also, a huge range of individual stocks, plus some commodities and global equity indices wrapped as CFDs.

- Regulated by a major industry center (CySEC).

- The market-maker type account can be opened with either fixed or variable spread regimes.

- PAMM

- Dedicated Automated Trading services, including signals provision

- Asset Management

Platforms

MetaTrader4

The MetaTrader 4 is an independent trading platform, developed for trading FX, commodities and other products and is one of the most advanced and easy platforms to use. It remains the gold standard of trading platforms.

In addition to the wide range of markets available to trade, the MT4 platform provides traders with a multilingual interface, instant execution, built in help guides for MT4 and MetaQuotes Language 4, a complete technical analysis package including a wide range of in-built indicators and charting tools, various custom indicators and time periods and more.

Automated trading is also offered through the MetaTrader 4 platform where traders can create and test their automated trading strategies by using the MetaEditor, Strategy Tester and Compiler tools within the MT4 platform.

With this automated trading system clients may create Expert Advisors, software programs enabling traders to constantly monitor the markets. Custom Indicators help traders to predict future price movements by analyzing past and current price information. And the Scripts feature gives traders the opportunity to set up an automatic repetition of specific operations such as closing all positions with a single keystroke.

MetaTrader 5

Traders can also choose to use MetaTrader 5, the cutting-edge improved trading platform. The MetaTrader5 offers increased work speed, powerful programming environment MQL-5, enhanced security and data encryption, advanced technical analyses, the ability to buy Stop Limit and Sell Stop Limit deferred orders and more.

Metatrader Mobile

The MetaTrader 4 and MetaTrader 5 platform web apps can be used on iPhones, iPads, Multi-Terminal, and all Android devices.

cTrader

The cTrader platform is an award-winning trading platform with a professionally designed interface. This user-friendly web platform, used by thousands of people worldwide daily, is fully customizable to suit the exact needs of the trader, ensuring that the entire trading experience is fluid and hassle-free.

There are a variety of drawing tools that enable you to customize your charts by switching from a multi-chart mode to single-chart mode, add horizontal or vertical lines to your chart and include arrows, text and shapes. You can also access technical indicators and apply them to your chart.

Setting up and logging in to your account is easy. Once you receive your confirmation email, simply log in using your designated username and password.

cTrader Mobile

cTrader mobile trading can be done from an iPhone and Android or other mobile devices. These apps can be downloaded from Play Store or IOS App Store.