Editor’s Verdict

TopTier Trader, operational since 2018 and headquartered in Cyprus, is a proprietary Forex prop firm also providing white-label solutions allowing everyone to start a prop trading firm. With maximum leverage of 1:100 and 175 assets, it deploys a more competitive trading environment than most competitors, and the profit share between 80% and 90% places it at the top of the range. Is TopTier Trader a trustworthy prop trading firm?

The Pros & Cons of TopTier Trader

Traders should consider the pros and cons of TopTier Trader. I have summarized the ones I found stood out the most during my review.

Overview

Five years of operational history and up to 90% profit share with 20% maximum loss.

Headquarters | Cyprus |

|---|---|

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2018 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5 |

Minimum Evaluation Fee | € 149 |

Profit-share | 70% |

Daily Loss Limit | 3% |

Maximum Trailing Drawdown | 7% |

Funded Account Options | 8 |

Minimum Funded Account | $15,000 |

Maximum Funded Account | $200,000 |

Headquarters | Cyprus |

|---|---|

Year Established | 2018 |

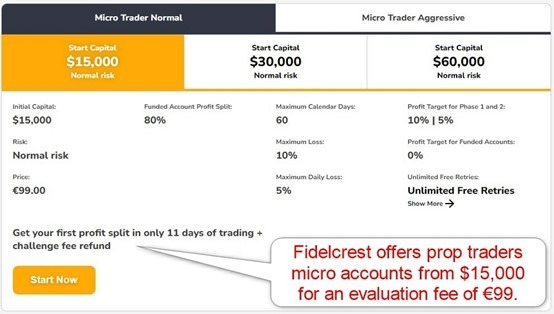

Minimum Evaluation Fee | €99 (refundable) |

Trading Platform(s) | MT4, MT5 |

Profit-share | 80% to 90% |

Daily Loss Limit | 5% to 10% |

Maximum Trailing Drawdown | 10% to 20% |

Funded Account Options | 6 |

Minimum Funded Account | $15,000 |

Maximum Funded Account | $1,000,000 |

I like the funding choices at TopTier Trader, as they allow prop traders the flexibility to manage smaller portfolios for a profit share of 80% or more substantial sums for 90%. The two-step evaluation process follows industry standards, and the “Aggressive” option is ideal for short-term traders and scalpers. I also appreciate that TopTier Trader allows algorithmic trading.

TopTier Trader Trustworthiness & Reputation

Trading with a Forex prop firm, which is an unregulated business, requires traders to ensure that a trusted brokerage handles all accounts, and that the Forex prop firm maintains an excellent reputation among its prop traders.

Is TopTier Trader Legit and Safe?

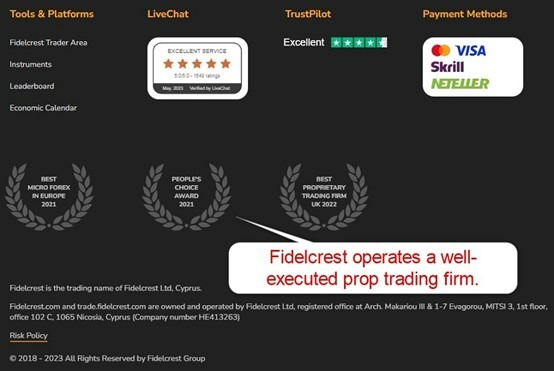

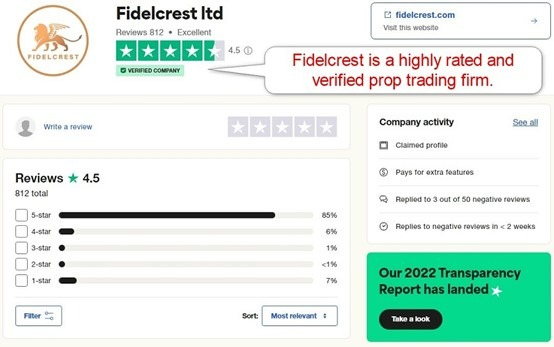

TopTier Trader, founded in 2018 and headquartered in Cyprus, does not have the operational experience of some well-established competitors but has a decent track record that allows me to recommend it to prop traders. It has a 4.5 out of 5.0 rating on Trustpilot based on 812 reviews.

It operates several subsidiaries, which include TopTier Trader Markets and Prop500. The website of the former returned a “This site can’t be reached” message, but the latter is a white-label solution offering back-office management for those interested in starting prop trading firms for as little as $3,000. It uses Foreign Exchange Clearing House for its brokerage services, and I like the overall transparency at TopTier Trader. I am only missing information concerning its management team, a flaw it shares with most prop trading firms.

My review did not uncover any negatives about TopTier Trader, as I dismiss the bulk of negative reviews and scams as disgruntled traders or competitors attempting to tarnish its reputation.

TopTier Trader Features

TopTier Trader follows best practices duplicated across the Forex prop firm industry, which remains in its infancy.

The most notable features at TopTier Trader are:

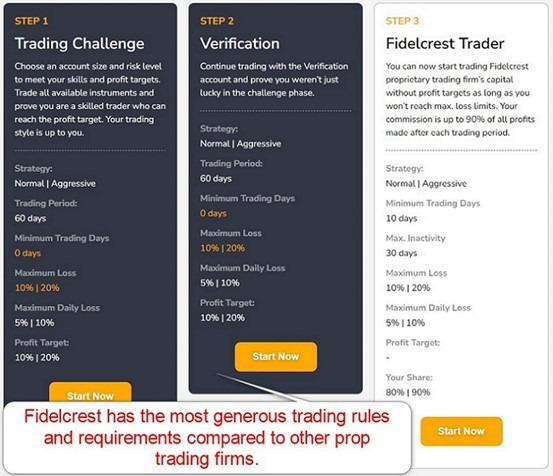

- A two-step evaluation period with a profit target between 5% and 15%

- No minimum trading days requirement during the 60-day evaluation period

- MT4 and MT5 trading platforms with algorithmic trading permitted following approval by the TopTier Trader risk management department.

- Manual copy trading allowed.

- Maximum leverage of 1:100

- A 5% to 10% daily loss limit

- A 10% to 20% trailing drawdown limit

- Unlimited retrials if traders fail to reach the profit target and have not violated the trading rules.

- Refundable evaluation fee for all traders who qualify as prop traders.

- Fast customer support

- 175+ assets

- Fast customer support response time, available 24/5

- No minimum withdrawal amounts.

- No profit target for funded accounts

Evaluation Fees & Profit-Share

Minimum Evaluation Fee | €99 |

|---|---|

Maximum Evaluation Fee | €2,999 |

Profit-share | 80% to 90% |

The TopTier Trader one-time evaluation fee applies on each requested evaluation period ranging from €99 to €2,999. Unlike most prop trading firms, TopTier Trader grants 60 days to reach the 10% to 20% profit target, twice the time and a more attainable goal. Traders who fail to reach the profit target but have not violated the trading rules can try again, as TopTier Trader offers unlimited retrials. All approved traders will get a full refund of their evaluation fee from the first profit-share payment.

TopTier Trader ranks at the top of the profit share range, ensuring prop traders get the highest levels industry-wide, between 80% to 90%.

The minimum evaluation fee at TopTier Trader for a fully upgraded $15,000 MT4 account is:

Type of fee | Fee (without discounts) |

|---|---|

One-time evaluation fee for a $10,000 funded account (the smallest one) | €99 |

Hold-over-the-weekend | €0 |

Double leverage | Not applicable |

Stop-loss not required at trade entry. | Not applicable |

Total one-time fees for a $10,000 MT4 account | €99 |

Account Types

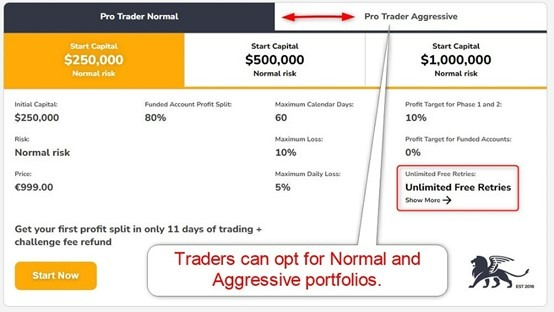

TopTier Trader offers three micro accounts, Normal and Aggressive, and three Professional Normal and two Aggressive accounts. Normal accounts have a profit share of 80% and prop traders in the Aggressive portfolios 90%.

A scaling plan can double assets under management in twelve months. The account type and desired balance determine the evaluation fee, which traders cannot change once approved. TopTier Trader offers the most generous trading terms of any prop trading firm I have reviewed.

What are the Trading Rules at TopTier Trader?

The 60-day evaluation period starts after interested prop traders choose their preferred evaluation account settings, pay the evaluation fee, and place their first trade.

The Normal micro accounts have a profit target of 10% in phase one and 5% in phase two, with a maximum daily loss of 5% and a maximum drawdown of 10%. Traders who choose Aggressive get an increase in both metrics to 10% and 20%, respectively, while the profit target increases to 15% for phases one and two. Unlike most prop firms that grant 30 days to achieve those targets, TopTier Trader provides 60 days.

The pro normal are identical to the micro normal, except the profit target is 10% for phase one and two, while the aggressive requires 20%. There is no profit target for funded accounts.

Violating the trading rules results in account closure, but traders who fail to meet the profit target but never violate the trading rules can try again.

The trading rules for the TopTier Trader Challenge are:

- 5% daily loss limit (Normal), 10% daily loss limit (Aggressive)

- 10% trailing drawdown limit (Normal), 20% trailing drawdown limit (Aggressive)

Trading Platforms

Foreign Exchange Clearing House offers MT4 and MT5 trading accounts for TopTier Trader, and TopTier Trader allows algorithmic trading after the risk management department approves them.

Traders must e-mail answers to the following questions to get approval to dmitry.potapenko@toptiertrader.com and CC solomon@toptiertrader.com:

- What would be the account size?

- Does EA use grid and martingale strategies?

- Please explain the trading strategy and risk parameters. We need to understand these.

- And what is the average holding time for a position? (Seconds, minutes, hours, or days?)

- What is the name of the EA?

The maximum leverage is 1:100, but a double your leverage add-on exists during promotions, and TopTier Trader provides 24/7 account monitoring.

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

DOM? | |

One-Click Trading |

Education

TopTier Trader does not provide educational content, which I appreciate, as beginners have no place in the ultra-competitive, fast-paced, high-stress, result-driven professional trading environment. TopTier Trader states that it seeks traders who understand how to trade but that its prop traders are likely to learn and improve their risk management as TopTier Trader prop traders.

Customer Support

Customer support is available 24/5 via e-mail and live chat. The Q&A section answers most questions, and TopTier Trader explains its products well. I am missing phone support, which I deem essential for prop traders, who are independent contractors.

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |  |

How to Get Started with TopTier Trader

Traders can start by clicking “Start Now” on the TopTier Trader homepage. This loads the registration screen, which asks traders for their name, e-mail address, and phone number, which determines their country of residence automatically.

TopTier Trader is a highly rated and verified prop trading firm. It also conducts interviews published under Latest Updates and adds prop traders to its Telegram channel. I can highly recommend TopTier Trader for traders who are serious about prop trading.

Minimum Evaluation Fee

The minimum evaluation fee at TopTier Trader is €99.

Payment Methods

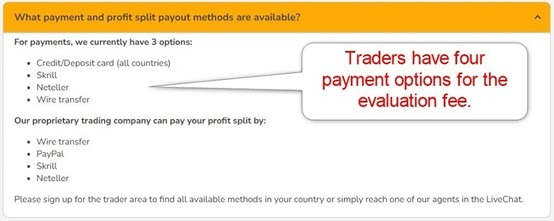

TopTier Trader supports bank wires, credit/debit cards, Skrill, Neteller, and PayPal. TopTier Trader also notes that traders can contact customer support to inquire about additional options if available.

Accepted Countries

TopTier Trader claims 6,000 traders from almost every country and does not list any geographical restrictions.

How to Pay the Evaluation Fee?

Prop traders can pay their evaluation fee via bank wires, debit/credit cards, Skrill, and Neteller. Withdrawal methods for the 80% to 90% profit share at TopTier Trader include PayPal but exclude credit/debit cards.

Bottom Line - Is TopTier Trader a Good Forex Prop Firm?

I like TopTier Trader for its trading rules, which place it far ahead of most of its competitors. It is a transparent and highly rated prop trading firm with a profit split between 80% and 90%, which elevates it to the top of the industry. Its funded account options cater to all types of traders and strategies, and it allows algorithmic trading and manual copy trading.

The only information missing from TopTier Trader concerns its management team, but overall, I rate TopTier Trader among the most competitive and transparent prop trading firms. I can recommend it to traders who can achieve 5% in monthly profits, and I like the fact that once prop traders are approved, there are no monthly profit targets. TopTier Trader is a legit prop trading firm headquartered in Cyprus since 2018 with a high rating on Trustpilot. Foreign Exchange Clearing House provides brokerage services to TopTier Trader. TopTier Trader allows manual copy trading. TopTier Trader has its headquarters in Nicosia (Cyprus), with offices in London, Kingstown, Tallinn, Cluj-Napoca, Santiago, Madrid, and Singapore.FAQs

Is TopTier Trader prop firm legit?

Which broker does TopTier Trader use?

Does TopTier Trader allow copy trading?

Where is TopTier Trader located?