Editor’s Verdict

Fidelity ranks among the most dominant global asset managers, with $4.3 trillion+ in assets under management. It provides clients with cutting-edge trading technology, extensive asset selection, plus commission-free equity and ETF trading. Fractional share dealing and no-transaction-fee mutual funds are also available. I have reviewed this financial powerhouse and industry leader to determine if its product and service portfolio deserves the praise it receives and whether you should manage your investment and retirement portfolios with Fidelity.

Overview

Fidelity levies its exceptional expertise and caters to all portfolio sizes commission-free.

I like the Fidelity approach to investing and trading, as it provides the proper tools for everyone. Active traders get a cutting-edge trading platform, while long-term investors can schedule in-person meetings with financial advisors or opt for robo-advisory services. The choice of independent research is excellent, and Fidelity is a trusted broker, allowing clients to manage portfolios worry-free.

Headquarters | United States |

|---|---|

Regulators | FINMA, SEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1946 |

Execution Type(s) | Market Maker |

Minimum Deposit | $1 |

Negative Balance Protection | |

Trading Platform(s) | Proprietary platform, ATpro platforms |

Average Trading Cost EUR/USD | Not applicable |

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | 1% maximum spread |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Funding Methods | 5 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Fidelity Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check the regulatory status and verify it with the regulator by checking the provided license with their database. Fidelity operates with oversight from the SEC and FINRA.

Is Fidelity legit and safe?

Fidelity, founded in 1979, ranks among the most established stockbrokers in the US and is a leading global financial firm. It segregates client deposits from corporate funds, and SIPC protection applies, limited to $500,000, including a $250,000 cash limit. Fidelity also launched FidSafe, a secure online storage managed by Fidelity for all essential financial documents.

I rate Fidelity among the safest and most trusted brokers. I highly recommend it to all US-based investors and traders.

Country of the Regulator | United States |

|---|---|

Name of the Regulator | FINMA, SEC |

Regulatory License Number | 8-23292, 7784 |

Regulatory Tier | 1 |

Fees

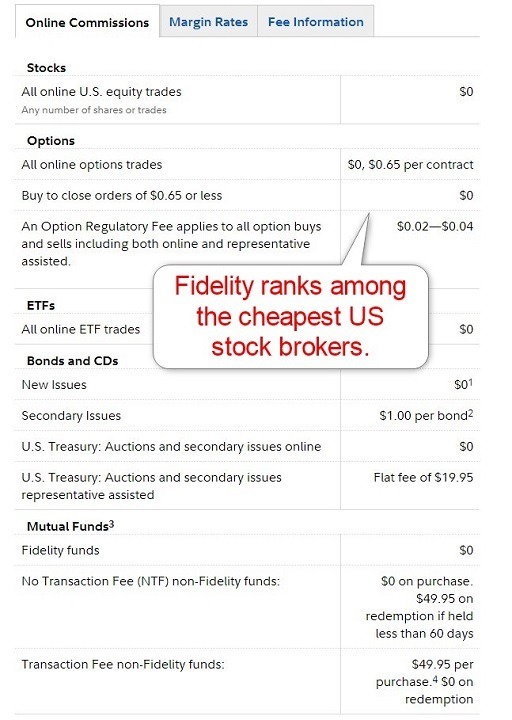

I rank trading costs among the most critical factors when evaluating a broker, as they directly impact profitability. Fidelity offers commission-free equity and ETF trading. Option trades cost $0.65 per contract plus a $0.02 to $0.04 regulatory fee. All option sell orders face an activity assessment charge between $0.01 and $0.03 per $1,000 in principal value. Non-Fidelity mutual funds cost $49.95 per purchase, a steep fee to discourage third-party funds in favor of Fidelity non-transaction fee funds, which incur a $49.95 fee if investors hold them for less than 60 days. Secondary bond issues cost $1.00, while representative-assisted US Treasury purchases have a $19.95 flat fee. Margin traders face expensive financing rates between 9.250% and 13.575%, but they still rank among the cheaper options across US-based brokers.

Here is a snapshot of Fidelity trading fees:

Average Trading Cost EUR/USD | Not applicable |

|---|---|

Average Trading Cost GBP/USD | Not applicable |

Average Trading Cost WTI Crude Oil | Not applicable |

Average Trading Cost Gold | Not applicable |

Average Trading Cost Bitcoin | 1% maximum spread |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | Not applicable |

Minimum Commission for Forex | Not applicable |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | no |

Range of Assets

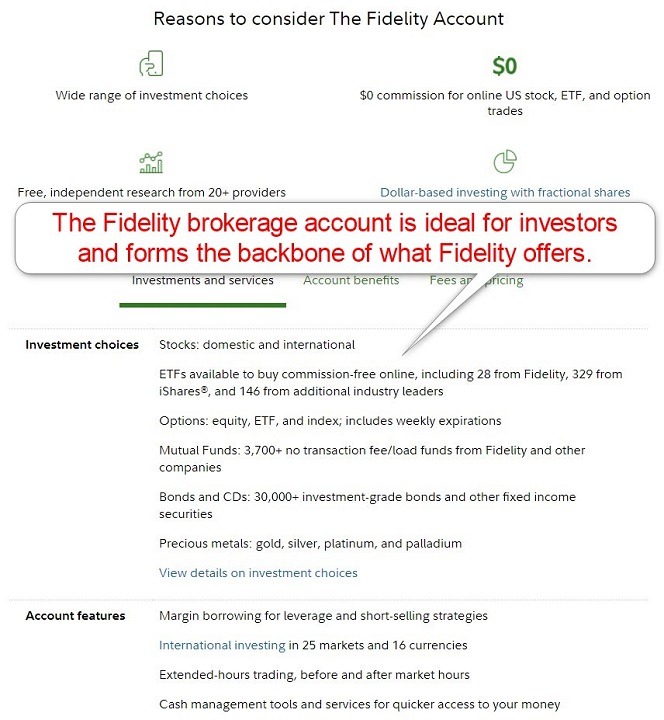

Fidelity is primarily an equity, ETF, option, and mutual fund broker with additional access to IPOs and secondary offerings. Clients can also execute fractional share investments. Bonds and other fixed-income assets are equally available. 25 countries and 16 currencies are supported, offering indirect Forex exposure, but direct Forex trading is unavailable. Mutual fund traders can choose from 10,000+ Fidelity and third-party funds, while fixed-income investors get 100,000+ choices. Fidelity also expanded into cryptocurrency trading via a dedicated account option to keep it separate from traditional investments.

Fidelity Leverage

Fidelity does not publicly disclose leverage, but the maximum under US law is 1:50, which applies to Forex transactions. Therefore, equity traders get notably less. Fidelity states that a margin account must have a minimum balance of $2,000 and that the initial margin requirement is 50%. FINRA rule 4210 requires all clients to have a minimum equity of 25%, resulting in a maximum leverage of 1:4.

Traders must always use appropriate risk management with leveraged trading to avoid magnified trading losses.

Currency Pairs | |

|---|---|

Cryptocurrencies | |

Commodities | |

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

Bonds | |

ETFs | |

Options | |

Futures | |

Synthetics |

Fidelity Trading Hours (GMT+1)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Daily 04:00 | Daily 12:00 |

Bonds | Monday 07:00 | Friday 20:00 |

ETFs | Monday 07:00 | Friday 20:00 |

Options | Monday 07:00 | Friday 20:00 |

Account Types

Fidelity offers one brokerage account to all clients, and there is no minimum deposit requirement. It is a one-stop, low-cost investment solution well-suited for investors. Joint accounts are available, and corporate options exist.

Traders can get a margin trading account, and Fidelity offers a dedicated cryptocurrency account option. The Fidelity Youth account is for teenagers between 13 and 17, where they make all investment choices, although parents have full supervision, which includes a debit card.

Other account types include IRA accounts, health savings accounts, 529 plans, and small business retirement accounts.

Fidelity Demo Account

Fidelity offers a paper trading account available on its Active Trader Pro platform. Regrettably, Fidelity does not have a direct sign-up for a demo account.

Clients must open a live account and then access the demo option from the trading platform. Fidelity provides no details about its availability and conditions, which I rate as the most notable oversight by this otherwise excellent brokerage.

Trading Platforms

Fidelity offers the cutting-edge Active Trader Pro platform for Microsoft and Apple devices. It includes tools like Trade Armor, allowing clients to visualize trade and risk management strategies, and the Daily Dashboard, which displays real-time news, earnings announcements, and economic events relevant to open positions. Additionally, Active Trader Pro provides actionable trading ideas via its integrated real-time analytics function. Active Trader Pro allows clients to customize layouts and assign hotkey functions. However, it does not support algorithmic trading, its most significant drawback. Fidelity also features a user-friendly and popular mobile app, which includes bill-paying functionality.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

DOM? | |

One-Click Trading |

Unique Features

Fidelity offers a solution for most requirements, with few exceptions. While its wealth management unit requires a minimum portfolio of $250,000, I recommend Fidelity Go, its robo-advisory service. There is no advisory fee for clients with sub-$25,000 portfolios and a low 0.35% annual fee for accounts above $25,000. Investors also get unlimited 30-minute 1-on-1 coaching phone calls. Clients can start investing via Fidelity Go for $10. Fidelity Managed FidFolios is another excellent service for passive investors, available from $5,000, while $500,000 includes an advisor. I also want to note the outstanding price improvement technology at Fidelity, which increases the profit potential of each transaction.

Research and Education

Fidelity research tools lead the industry and feature a wealth of in-house and independent research from 25 sources. The Stock Screener, consisting of 140 criteria, allows investors to search based on independent expert strategies. The Stock Dashboard is another valuable research tool featuring services by Recognia, a social sentiment score, to help navigate social media trends and independent research reports. The Equity Summary Score combines multiple research reports into one score and allows investors to navigate financial markets in a simplified manner from a trusted source.

Fidelity provides quality educational content for beginners via well-written articles, short videos, webinars, live events, and seminars. Fidelity aims to assist clients with life’s big moments and features a hands-on approach. A vibrant social media portfolio and a metaverse presence ensure that clients get the education they require and have their advisors available on their favorite platforms.

Despite the excellent educational offering at Fidelity, I advise beginners to learn about trading psychology and the relationship between leverage and risk management from free third-party providers while avoiding paid-for courses and mentors.

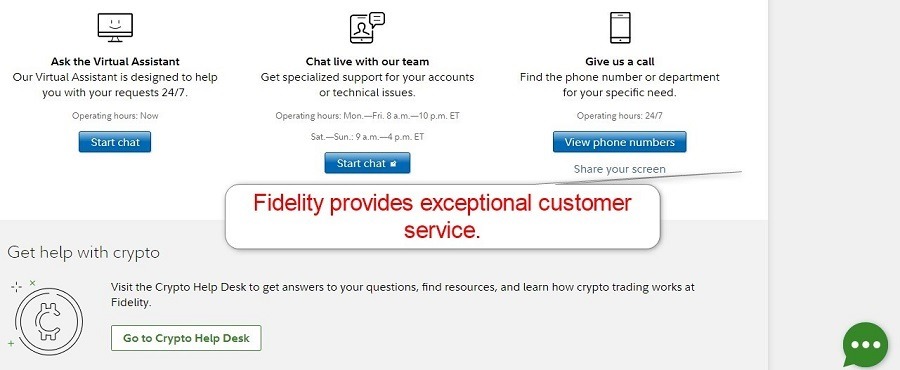

Customer Support

Fidelity customer support via virtual assistance is available 24/7. A customer support representative answers questions Monday through Friday between 8 a.m. and 10 p.m. (EST) and Saturday through Sunday between 9 a.m. and 4 p.m. via live chat or e-mail.

24/7 phone support is also available, but the broker lacks a direct line to the finance department, where most issues can arise. Fidelity explains its products and services well, and in-person support is also available. I rate the customer support infrastructure at Fidelity among the industry leaders.

Customer Support Methods |   |

|---|---|

Support Hours | 24/7 |

Website Languages |  |

Bonuses and Promotions

Fidelity offers three promotions. Customers who download the Fidelity Bloom app and deposit $50 receive a $100 bonus. The same applies to new account registrations for the Fidelity Account, Fidelity Cash Management Account, Roth IRA, Traditional IRA, and Fidelity Go. Each Fidelity Youth account gets a welcome bonus of $50.

Terms and conditions apply, and I recommend that traders read and understand them before requesting any bonus or promotion.

Fidelity also has two active trader programs, where clients qualify for cheaper commissions, margin rates, and additional perks.

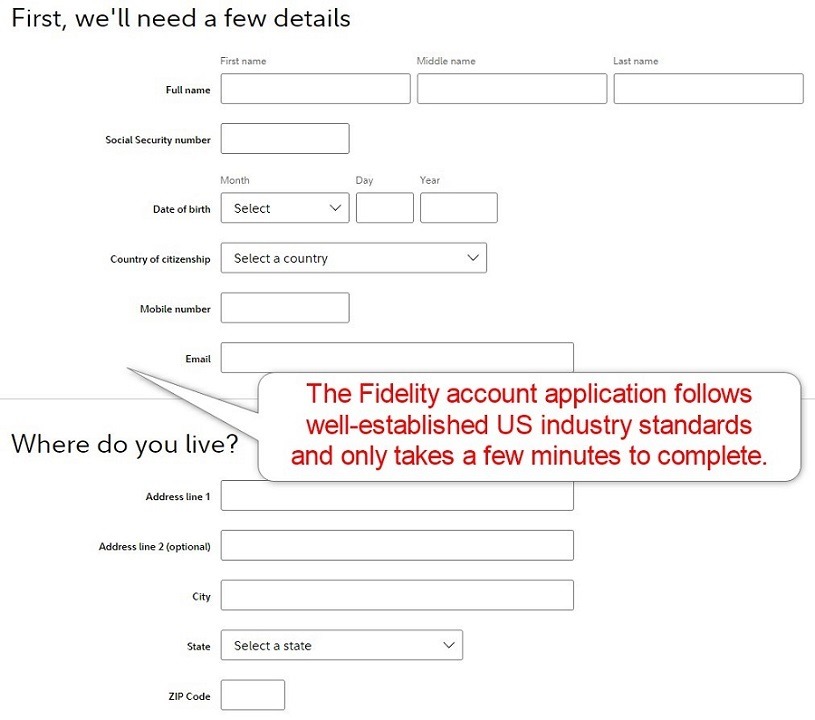

Opening an Account

Fidelity maintains an online application in line with other US-based brokers. The process requires new clients to submit standard personal information, and they should be able to complete it within a few minutes.

Account verification is mandatory at Fidelity, in compliance with global AML/KYC requirements. Fidelity conducts a soft credit check to verify some details, and traders must upload a copy of their government-issued ID.

Minimum Deposit

There is no Fidelity minimum deposit requirement, but certain services require a minimum balance.

Payment Methods

Fidelity accepts bank wires, checks, direct payroll deposits, Venmo, and PayPal.

Accepted Countries

Fidelity only caters to US residents, with a unit dedicated to Canadian residents.

Deposits and Withdrawals

The secure Fidelity back office or mobile app handles all financial transactions for verified clients.

Fidelity provides few details about its deposit and withdrawal process, which relies heavily on bank-related methods. It takes one to three business days for electronic fund transfers to arrive and four to six days before clients can withdraw them. The minimum deposit amount is $1 for non-retirement accounts and $10 for retirement accounts.

The daily deposit maximum is $250,000, and a $100,000 withdrawal maximum exists. Clients who require more than the upper limit can contact customer support to arrange the transfer. Withdrawal processing times are one to three business days via bank transfer and four to six business days via check.

Is Fidelity a Good Broker?

I like the Fidelity investing environment for its choice of ETFs, research, and robo-advisory offering. While traders get a cutting-edge trading platform, the absence of algorithmic trading is a notable drawback. Fidelity established itself among the leading US stockbrokers with superb retirement planning and wealth management. Beginners get an outstanding educational section and a user-friendly mobile app.

The commission-free pricing environment and price improvement technology provide a competitive edge. Fidelity is one of the pioneers in embracing the metaverse. I rate Fidelity among the best one-stop financial solutions in the US, offering a compelling suite of products and services and combining a top-notch online brokerage with an industry-leading brick-and-mortar backbone. The minimum deposit is $1 for non-retirement accounts and $10 for retirement accounts. No, Fidelity is transparent about its fees and lists them on its website. There are no hidden fees. Fidelity does not offer Forex or commodity trading, and some services have high minimum capital requirements. The superb educational offering, fractional share dealing, asset selection, and absence of minimum deposit requirements make Fidelity an ideal choice for beginners. Fidelity is an excellent way to invest due to its low fees and choice of products and services. Operational since 1946, Fidelity has established itself as an industry leader and dominant global financial firm, ranking among the most trusted and recognized names in finance.FAQs

How much money do I need for Fidelity?

Does Fidelity have hidden fees?

What is the downside to fidelity?

Is Fidelity a good investment for beginners?

Is Fidelity a good way to invest?

How trustworthy is Fidelity?