For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Overview

Finansero is a Cyprus-headquartered broker offering the XCITE trading platform with a balanced asset selection, including synthetic trading instruments. Its nine-tier account structure improves trading conditions for traders with higher deposits. Therefore, I consider Finansero a suitable broker for EU-based residents who prefer a brokerage regulated under strict ESMA regulations. My Finansero broker review focused on trading fees and trading conditions. Should you open an account with Finansero?

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2013 |

Execution Type(s) | ECN/STP |

Minimum Deposit | € 200 |

Trading Platform(s) | Other, Xcite |

Average Trading Cost EUR/USD | $40.00 |

Average Trading Cost GBP/USD | $40.00 |

Average Trading Cost WTI Crude Oil | $0.14 |

Average Trading Cost Gold | $1.80 |

Average Trading Cost Bitcoin | $1110.00 |

Retail Loss Rate | 81.00% |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 4.0 pips |

Minimum Commission for Forex | Commission-free |

Funding Methods | 13 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Finansero offers a trustworthy trading environment to EU-resident traders.

Finansero Four Core Takeaways:

- Balanced asset selection, including synthetic derivatives.

- Social trading via Trading Insider is on the XCITE trading platform.

- No MT4/MT5 trading platforms.

- No algorithmic trading

Finansero Regulation & Security

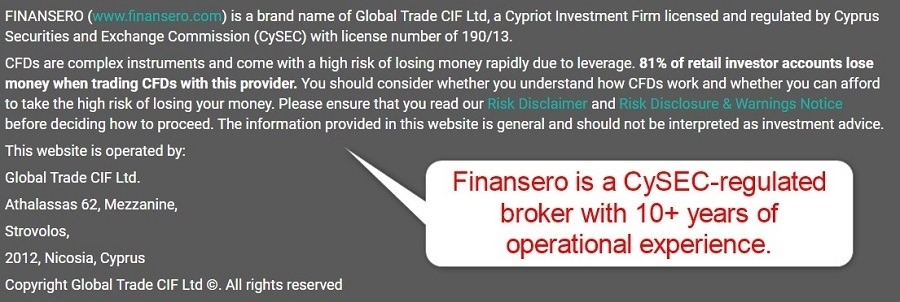

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend that traders check regulations and verify them with the regulator by double-checking the provided license with their database. Finansero has one regulated entity with a clean track record.

Country of the Regulator | Cyprus |

|---|---|

Name of the Regulator | CySEC |

Regulatory License Number | 190/13 |

Regulatory Tier | 1 |

Is Finansero Legit and Safe?

My Finansero review found no verifiable misconduct or malpractice by this broker, founded in 2013. Therefore, I recommend Finansero as a legitimate and safe broker.

Finansero regulation and security components:

- Regulated by the Cyprus Securities and Exchange Commission (CySEC)

- Founded in 2013

- Segregation of client deposits from corporate funds

- Negative balance protection

- €20,000 investor compensation fund

- MiFID II and GDPR compliant

What would I like Finansero to add?

Finansero ticks most boxes from a security perspective, but I would like it if it offered more transparency about its core management team and auditors.

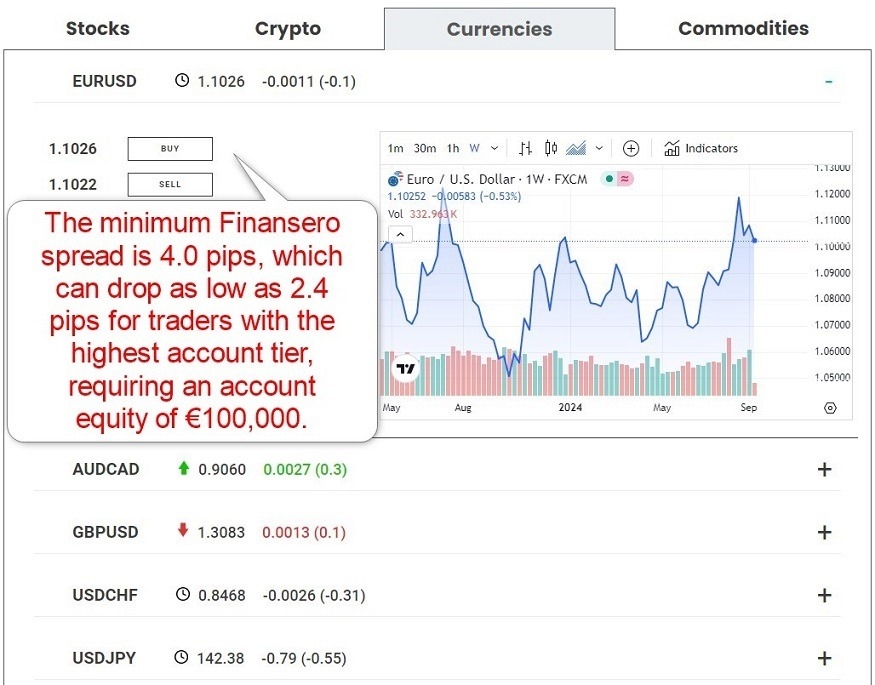

Fees

I rank trading costs among the most defining aspects when evaluating a broker, as they directly impact profitability. Finansero offers commission-free fixed spreads with minimum spreads of 4.0 pips or $40.00 per 1.0 standard round lot.

Finansero fails to note internal deposit or withdrawal fees, but third-party processing costs may apply. Finansero also levies a 0.7% currency conversion fee.

The minimum trading costs for the EUR/USD at Finansero are:

Minimum Spread | Commission per Round Lot | Cost per 1.0 Standard Lot |

4.0 pips | $0.00 | $40.00 |

Here is a snapshot of Finansero’s live spreads:

Swap rates on leveraged overnight positions are the most ignored trading costs. Depending on the trading strategy, they may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs.

Below is a list of trading cost examples for buying and selling the EUR/USD, holding the trade for one night and seven nights in the commission-free Finansero account.

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for one night in the Finansero account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

4.0 pips | $0.00 | $16.5375 | X | -$56.5375 |

4.0 pips | $0.00 | X | $16.5375 | -$56.5375 |

Taking a 1.0 standard lot buy/sell position in the EUR/USD, at the minimum spread and holding it for seven nights in the Finansero account will cost the following:

Minimum Spread | Commission per Round Lot | Swap Long | Swap Short | Total TradingCosts |

4.0 pips | $0.00 | $115.7625 | X | -$155.7625 |

4.0 pips | $0.00 | X | $115.7625 | -$155.7625 |

Noteworthy:

- Finansero does not offer positive swap rates on qualifying assets, allowing traders to earn money.

Range of Assets

Finansero offers 330+ assets covering seven sectors, offering traders a balanced asset selection suitable for most trading strategies, but I want more cryptocurrency CFDs and ETFs to ensure better diversification.

Finansero offers the following assets:

- 45 Forex Pairs

- 15 Cryptocurrencies

- 22 Commodities

- 20 Indices

- 208 Equity CFDs

- 14 ETFs

- 27 Synthetic derivatives

Finansero Leverage

Maximum Retail Leverage | 1:30 |

Maximum Pro Leverage | 1:200 |

What should traders know about Finansero leverage?

- Maximum retail Forex leverage is 1:30

- Cryptocurrency traders can use 1:2

- Metals max out at 1:20

- Commodities get 1:10

- Indices max out at 1:20

- Equity and ETF CFD traders get a maximum leverage of 1:5

- Synthetic derivatives have 1:5 leverage

- Not all assets within a sector qualify for the maximum leverage

- Finansero has an automatic stop-out at 50%

- Negative balance protection ensures traders cannot lose more than their deposit.

- Traders should always use appropriate risk management with leveraged trading to avoid magnified trading losses.

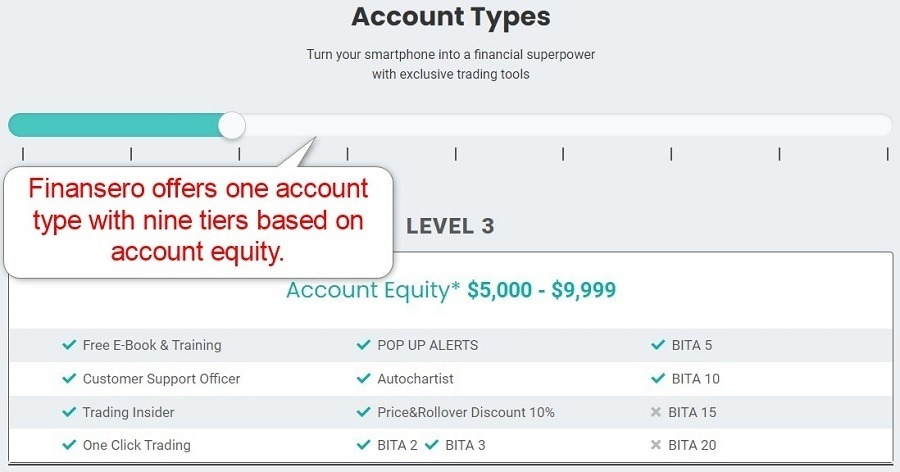

Account Types

Finansero has one account type with nine levels based on account equity. A swap-free Islamic account was unavailable. I appreciate Finansero basing its account tiers on equity rather than deposits, allowing traders to trade up to improved trading conditions.

My observations concerning the Finansero account types:

- The minimum deposit is $200

- Account base currencies are EUR, GBP, and USD

- The maximum retail leverage is 1:30

- The nine account tiers reduce trading fees up to a maximum of 40% to 2.4 pips or $24.00 per 1.0 standard round lot.

Finansero Demo Account

Finansero offers a demo account in its trading platform that is perfectly adequate for familiarization and testing.

Trading Platforms

Finansero offers XCITE, a lightweight, web-based, manual-only trading platform. It also comes as a user-friendly mobile app and includes actionable trading signals by Autochartist, Trading Insider for social traders, and an economic calendar.

While XCITE caters well to manual traders, the absence of MT4/MT5 for algorithmic traders is notable.

MT4 | |

|---|---|

MT5 | |

MT4/MT5 Add-Ons | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Social/Copy Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

During my Finansero review, no unique features stood out. Finansero focuses on its core trading environment.

Research

Finansero offers research via third-party Autochartist, which provides competent analytics and actionable trading signals.

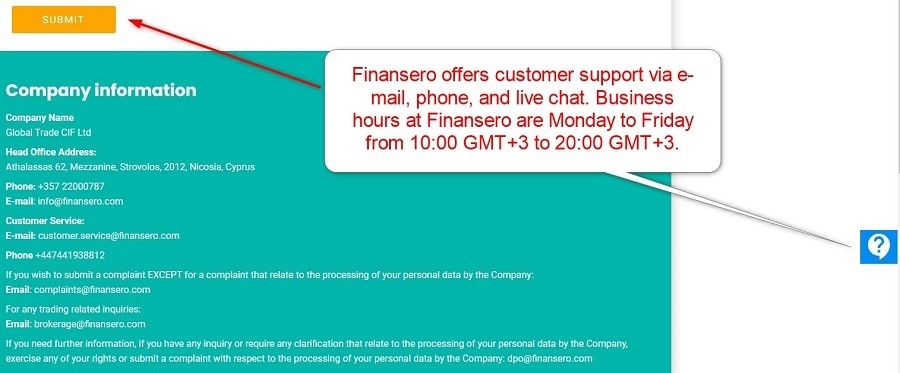

Customer Support

Traders can contact Finansero customer support via e-mail, phone, and live chat. The FAQ section answers a few questions, but I had no reason to contact customer support during my Finansero review. Finansero business hours are Monday to Friday from 09:00 GMT to 18:00 GMT.

Customer Support Methods |    |

|---|---|

Support Hours | Monday to Thursday 10:00 am to 20:00 pm GMT+3 and Friday 10:00 am to 19:00 pm GMT +3 |

Website Languages |      |

Bonuses and Promotions

During my Finansero review, neither bonuses nor promotions were available. They are banned under EU law.

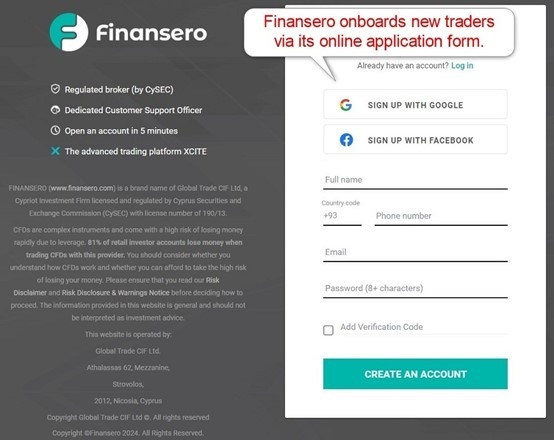

Opening an Account

Finansero offers a swift online application requiring a name, phone number, e-mail address, and desired password. Traders may also use their Facebook or Google IDs to register at Finansero. Per ESMA regulations, Finansero engages in data mining as part of the registration process.

What should traders know about the Finansero account opening process?

- Finansero complies with global AML/KYC requirements.

- Account verification is mandatory.

- Most traders pass verification by uploading a copy of a government-issued ID and one proof of residency document.

- Finansero may ask for additional information on a case-by-case basis.

Minimum Deposit

The minimum deposit at Finansero is $200.

Payment Methods

Finansero accepts Bank wires, credit/debit cards, Skrill, P24, Apple Pay, and Google Pay.

Withdrawal options |       |

|---|---|

Deposit options |       |

Accepted Countries

Finansero does not publish a detailed list of accepted countries.

Deposits and Withdrawals

The secure Finansero back office and user-friendly Finansero app handle financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Finansero?

- The minimum deposit is $200.

- The account base currency is EUR.

- Finansero does not list a minimum withdrawal amount.

- External processing times and fees depend on the payment processor.

- Finansero processes withdrawal requests within 24 hours.

- In compliance with AML regulations, the name of the trading account and payment processor must be the same

- Finansero will return the deposit amount to the funding source before traders can request excess withdrawals to an additional payment processor.

Is Finansero a good broker?

Finansero offers EU-resident traders an ESMA-regulated broker. The XCITE trading platform includes Autochartist and Trading Insider but does not support automated trading. The balanced asset selection caters to most strategies, and I appreciate the overall transparency at Finansero. Therefore, I recommend Finansero for EU-resident hobbyist traders, as the trading environment is safe, and Finansero has stood the test of time with 10+ years of operational experience. Finansero processes withdrawals within 24 hours, but depending on the payment processors and traders' geographical locations, it can take several days for traders to receive their funds. The Finansero minimum deposit requirement is $200. Finansero is a legit broker with 10+ years of experience and a license issued by the CySEC.FAQs

How long does it take to withdraw from Finansero?

What is the minimum deposit at Finansero?

Is Finansero a scam or legit?