Editor’s Verdict

Overview

Review

Headquarters | Italy |

|---|---|

Regulators | FCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 1999 |

Execution Type(s) | Market Maker |

Minimum Deposit | None |

Trading Platform(s) | Proprietary platform, Web-based |

Average Trading Cost EUR/USD | 1.0 pips ($10.00) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Fineco Bank is an Italian bank established in 1999. It listed in the FTSE MIB, the primary bluechip equity index in 2016, and included in the prestigious Stoxx Europe 600 index in 2017. Today it caters to over 1.35 million traders, processes more than 30.0 million orders annually, and exceeds €70 billion in net assets. Traders have access to more than 20,000 assets with a highly competitive pricing environment. This well-regulated bank and brokerage received numerous international awards, expanding its market share, and presenting committed traders an outstanding trading environment. 69.14% of retail traders operate portfolios with a loss at Fineco Bank.

At the time of this Fineco review, As of July 2021, Fineco Bank was offering 100 commission-free trades for all new clients during their first three months, which is a significant advantage for both new traders and those who want to experiment with the Fineco platform.

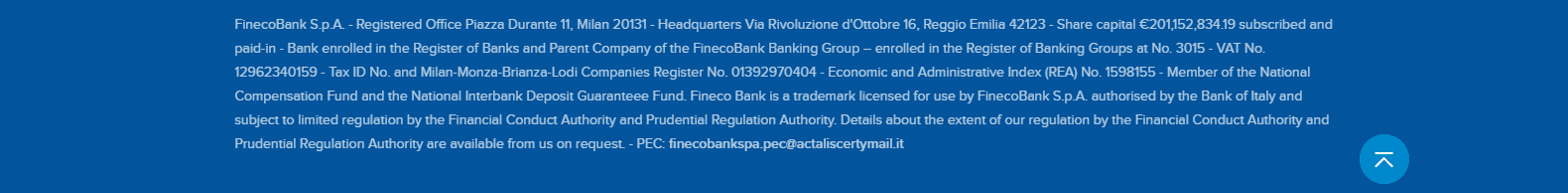

Regulation and Security

The Bank of Italy authorizes and regulated Fineco Bank. It is additionally a member of the National Compensation Fund and the National Interbank Deposit Guarantee Fund. Since 2017, it provides services in the UK, where the Financial Conduct Authority and Prudential Regulation Authority maintain limited regulatory oversight as mandated by EEA rules. Fineco Bank has a clean track record with authorities, a strong balance sheet, investment-grade debt ratings, and a secure trading environment. Since 2019, it became an independent public company, stepping out if the shadow of its previous corporate owner, Italian banking giant UniCredit Group.1111

Fineco Bank operates under authorization by the Bank of Italy.

Since 2017, the UK Financial Conduct Authority and Prudential Regulation Authority possess limited oversight, per EEA mandate, for services rendered in the UK.

Fees

Average Trading Cost EUR/USD | 1.0 pips ($10.00) |

|---|

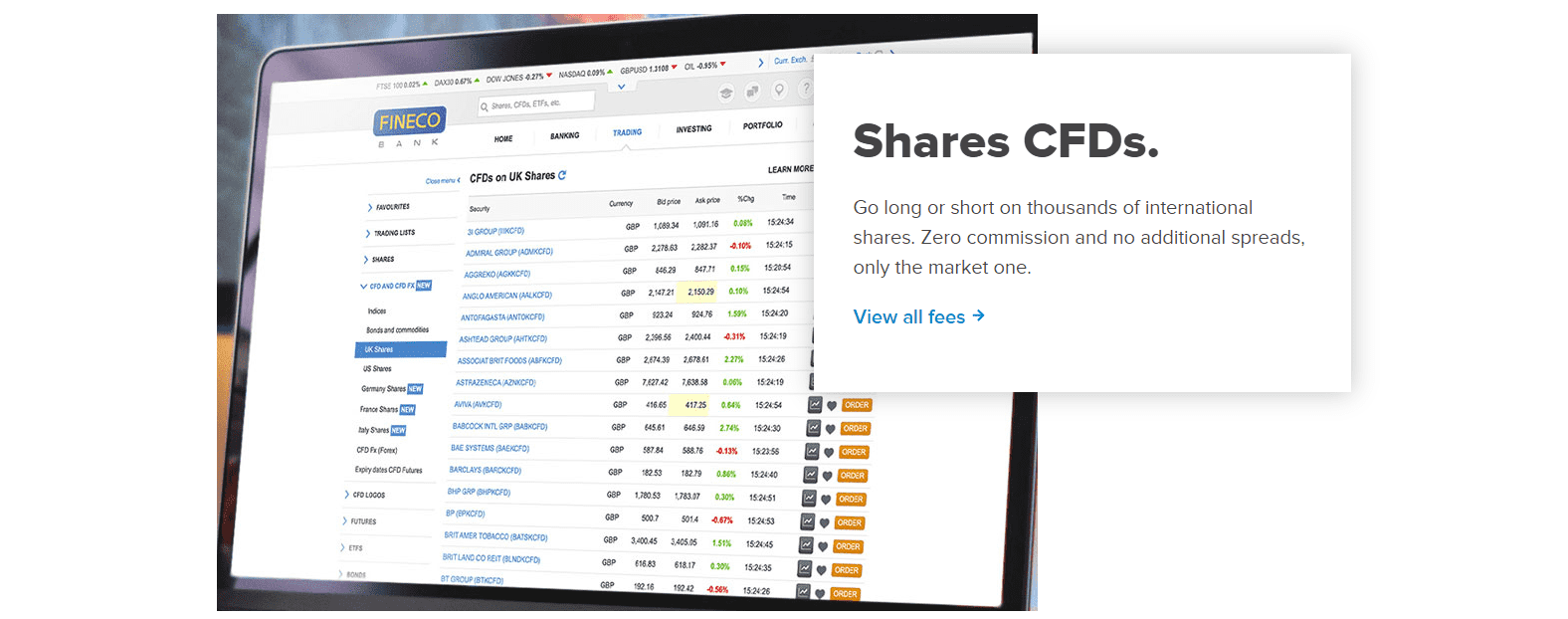

One of the slogans at Fineco Bank is "Premium is the new standard." The broker delivers in this slogan in its competitive price structure. Traders have access to commission-free equity CFD trading, without a mark-up on spreads, on UK, EU, and US names. Index CFDs carry a minimum cost of 0.4 pips. Direct share dealing and ETF trading comes at a fixed price of just £2.95 per deal ticket in the UK and $/€3.95 for US/EU markets. Futures trading is equally competitive, where the commission starts at $0.70, while options pricing is as low as $2.50. Bonds also come with a fixed cost of £6.95, and Forex trading is listed from a spread of 0.8 pips, representing the least competitive offer in the broad selection. Mutual fund management requires a 0.25% annual platform fee. No other trading costs apply, and Fineco Bank is transparent about all involved charges.

Clients have access to an extremely trader-friendly cost structure.

Fineco Bank Trading Hours

Asset Class | From | To |

|---|---|---|

Currency Pairs | Sunday 22:15 | Friday 22:00 |

What Can I Trade

Fineco Bank offers an excellent choice across the global financial spectrum, exceeding 20,000 assets. A complete list of all trading instruments is, regrettably, not maintained on the website. From the available information, over 7,850 equities and 6,000 bonds were identified, accounting for the bulk of assets. Over 50 currency pairs, and a deep selection of indices, commodities, bonds, ETFs, and mutual funds, complete the portfolio. It allows all types of traders, from new ones, through seasoned professionals and asset managers to operate well-diversified cross-asset portfolios.

Equities account for the majority of assets.

Futures trading carries maximum leverage of 1:20.

CFD trading allows for efficient portfolio management.

Options trading enhanced diversification and hedging opportunities.

Automatic ETF investments cater to passive trading strategies.

Fineco Bank maintains one of the largest bond selections.

Account Types

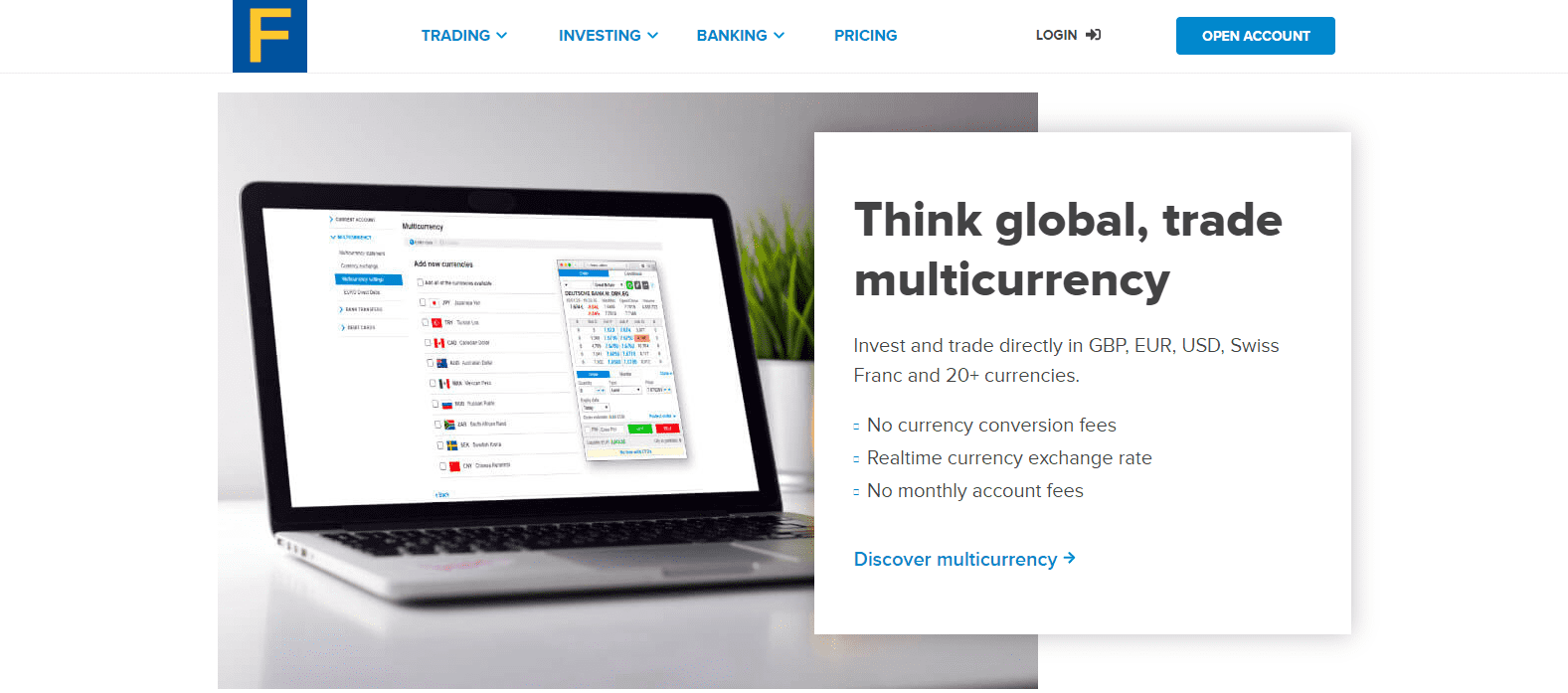

The same multi-currency trading account is available for all clients. It supports 24 currencies, free of account fees, displays real-time Forex exchange rates for proper portfolio management across numerous global markets, while currency conversion costs are non-existent. There is no upselling of superior services for more massive deposits. All portfolios receive equal treatment, adding to the excellent trading environment at Fineco Bank. Clients will be able to trade globally, from their local account in a low-cost environment.

One multi-currency account offers local traders global exposure.

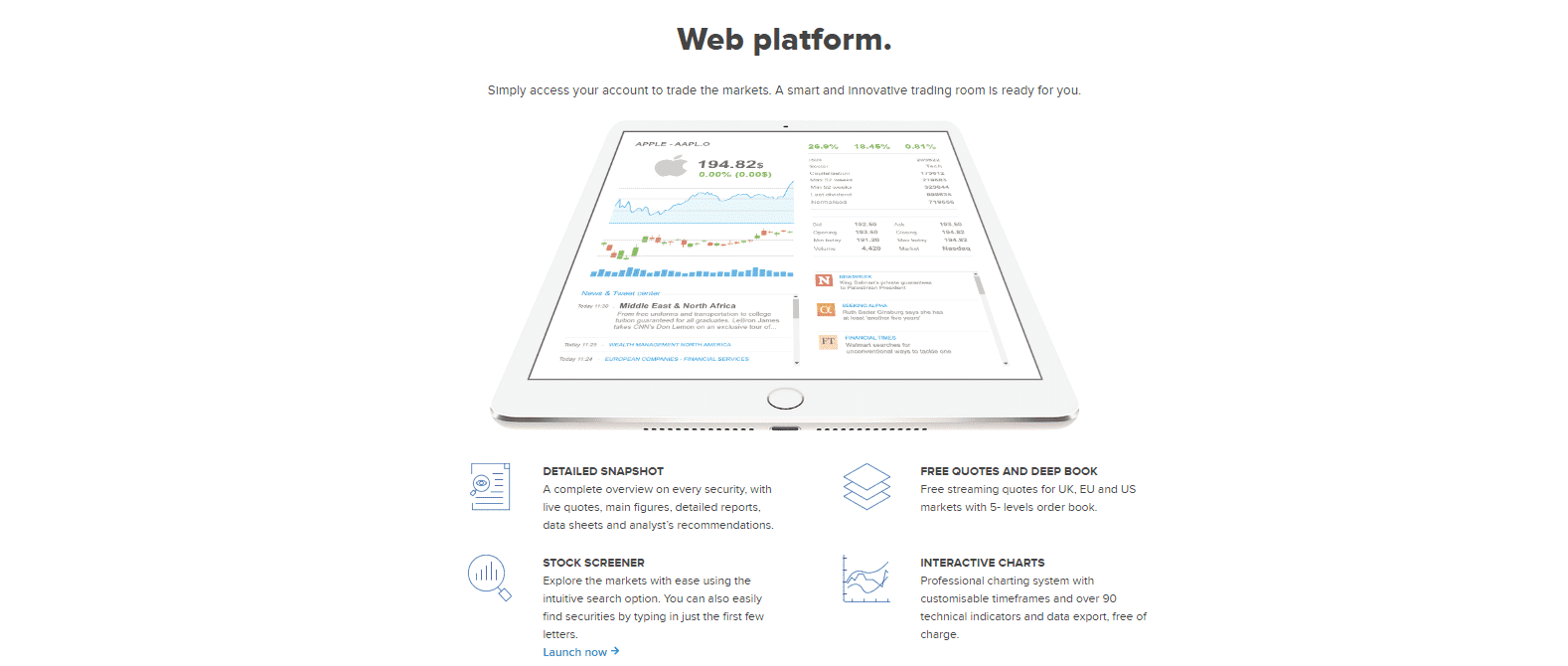

Trading Platforms

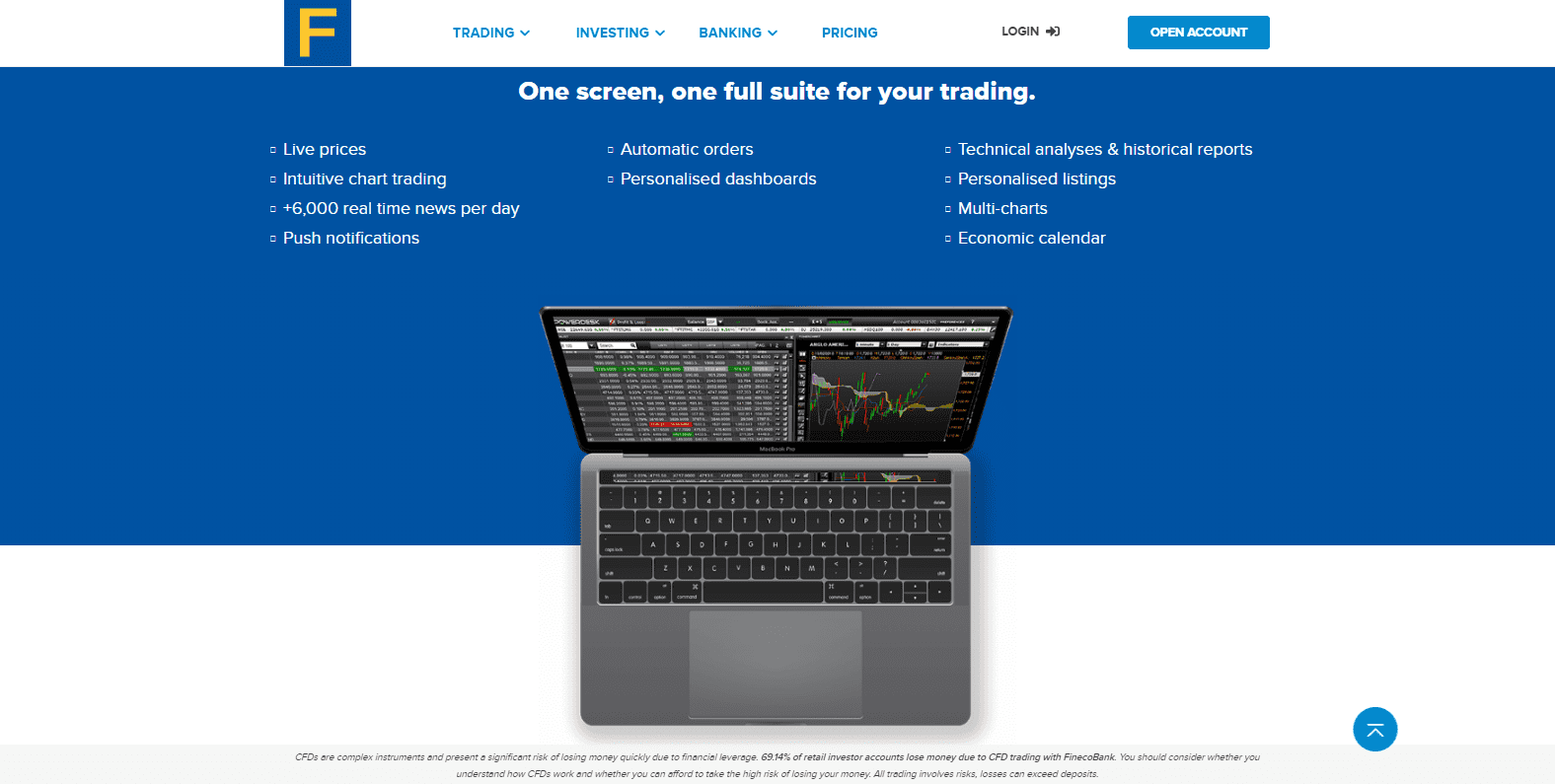

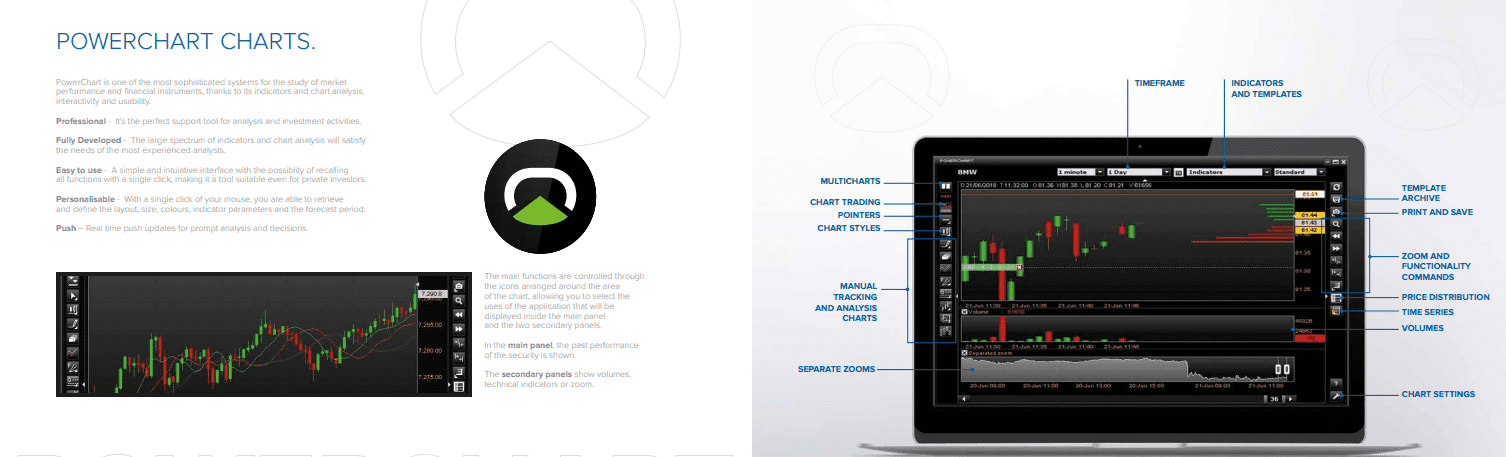

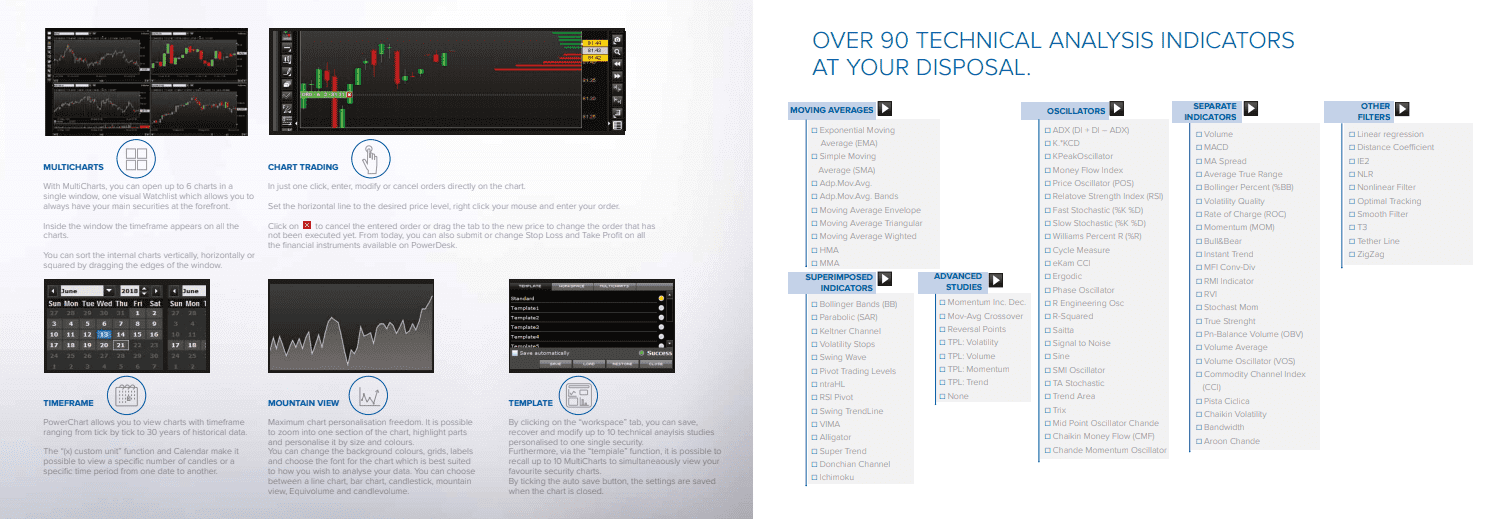

PowerDesk is the proprietary trading platform available at Fineco Bank. This advanced trading platform ranked as the number one online trading platform for executed orders in 2016, per the Comdirect/ConsorsBank "Main European Brokers Balance Sheets 2016" review. The feature-rich portal is ideal for manual traders, equipped with PowerChart and over 90 technical indicators, and delivers over 6,000 news articles daily. Support for automated trading solutions is notably missing and represents one essential area of improvement for Fineco Bank.

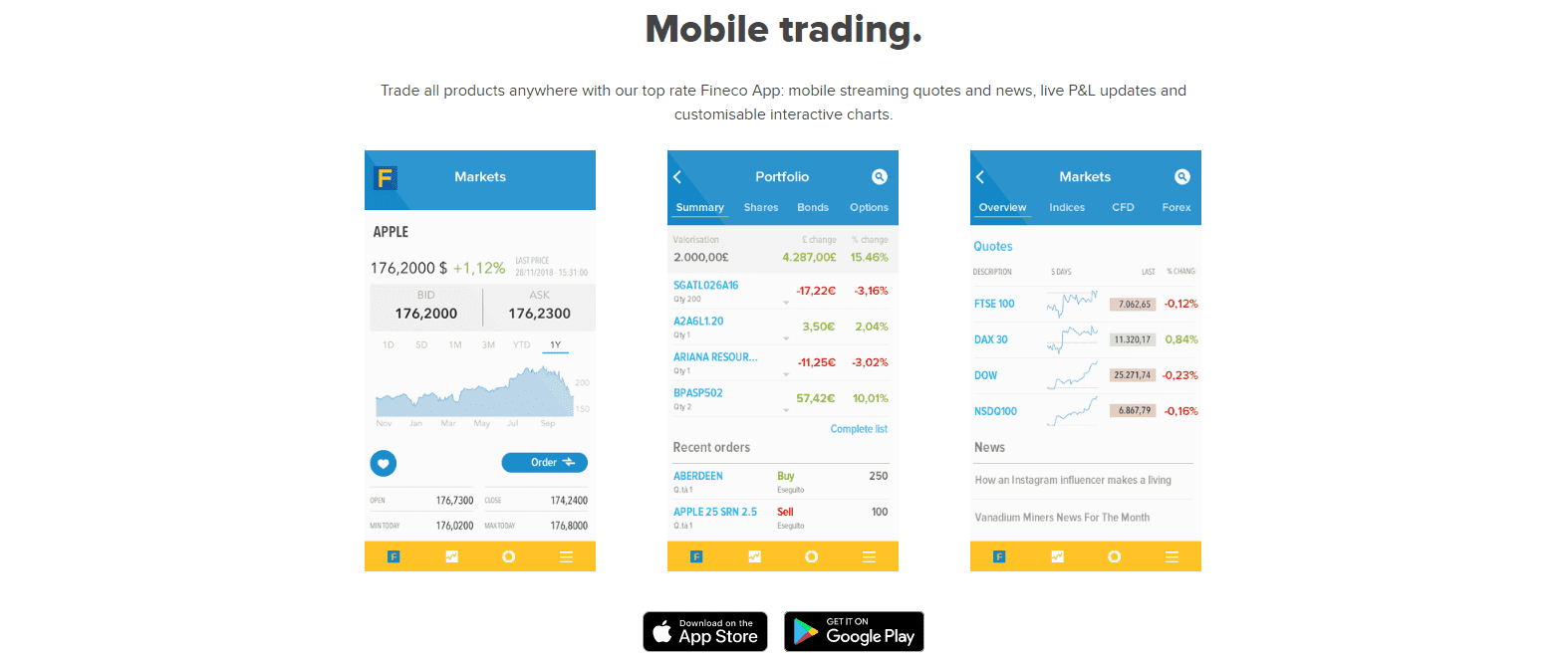

A web platform and mobile application are equally offered. The former is ideal for a light touch to trading, and new retail clients may be less overwhelmed with the professional PowerDesk. The latter supports traders who prefer to trade on the go, predominately millennial traders, and grants easy access to monitor portfolios or react to developing market dynamics when away from a proper trading desk.

PowerDesk is an excellent trading platform for manual traders.

PowerChart allows for a proper technical analysis of assets.

Over 90 technical indicators support manual analytics.

A web platform is ideally suited for new retail traders.

The mobile trading app remains popular with millennial traders.

Unique Features

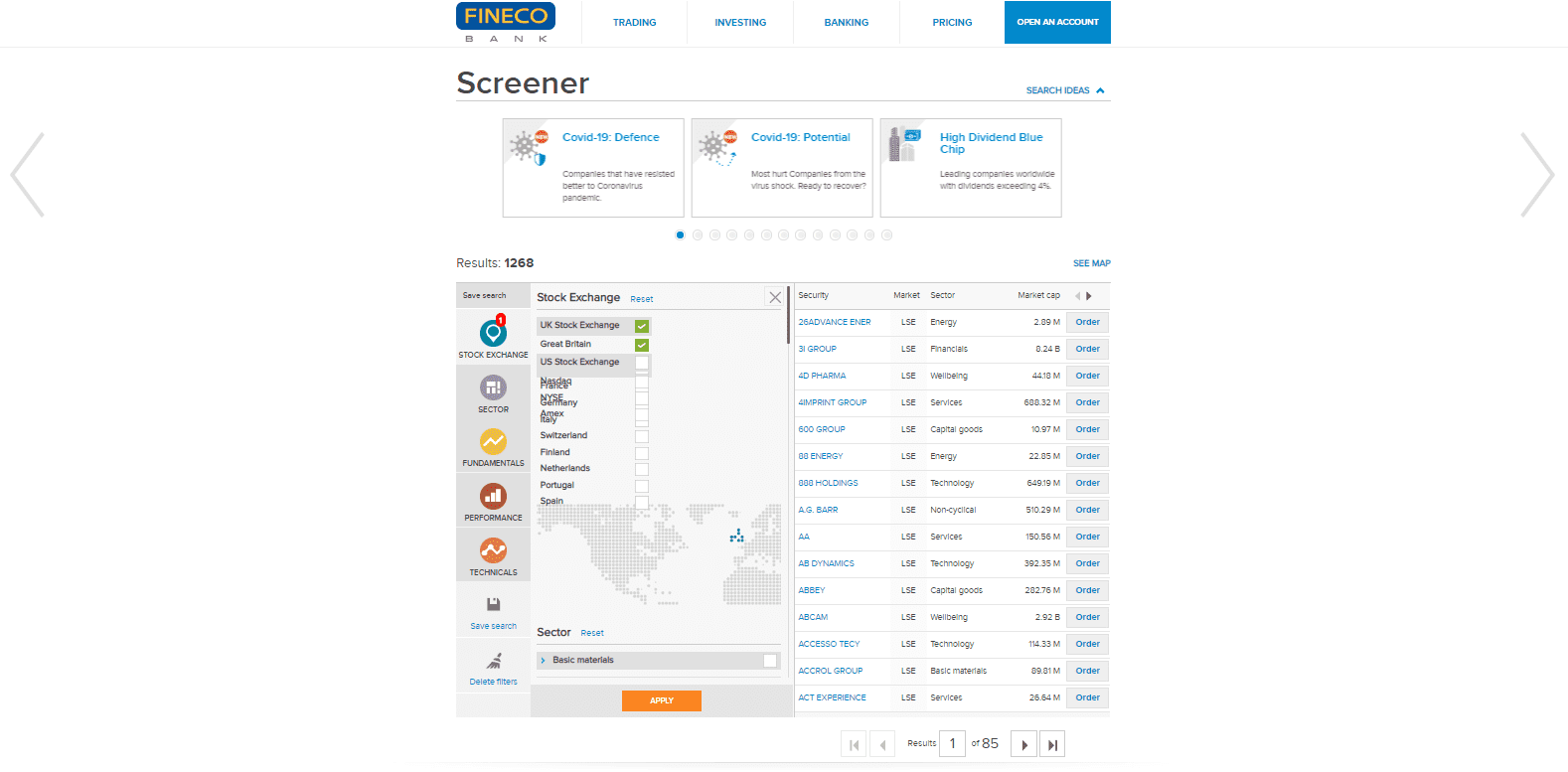

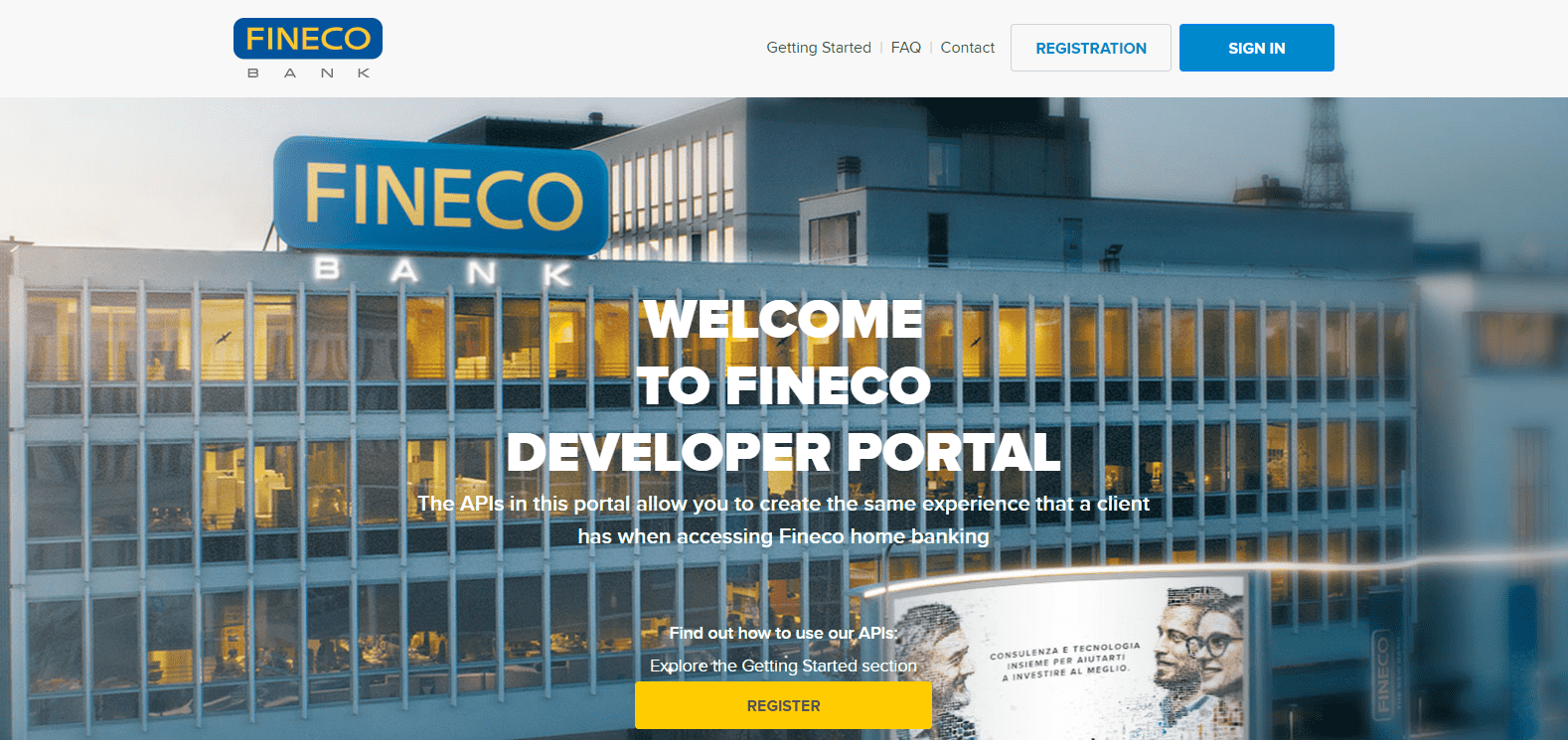

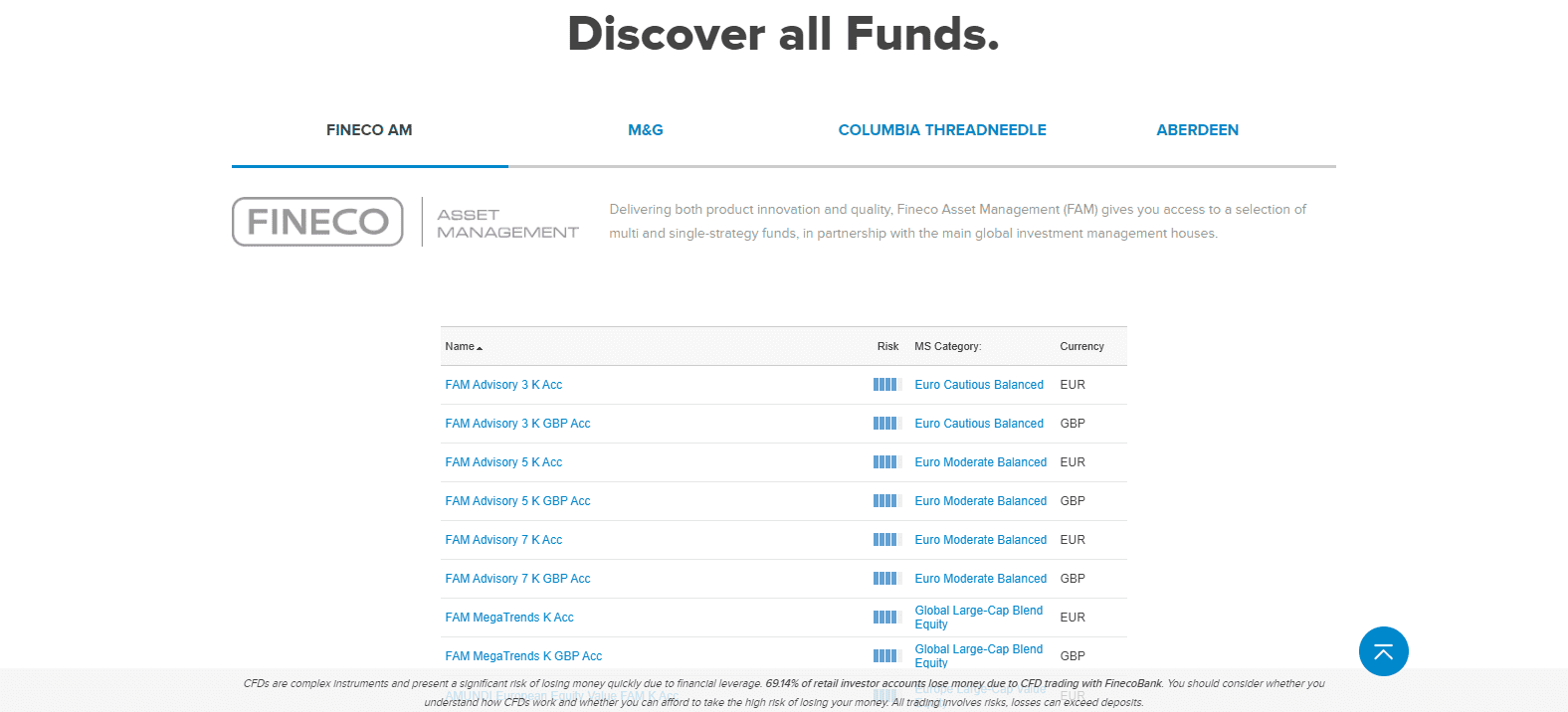

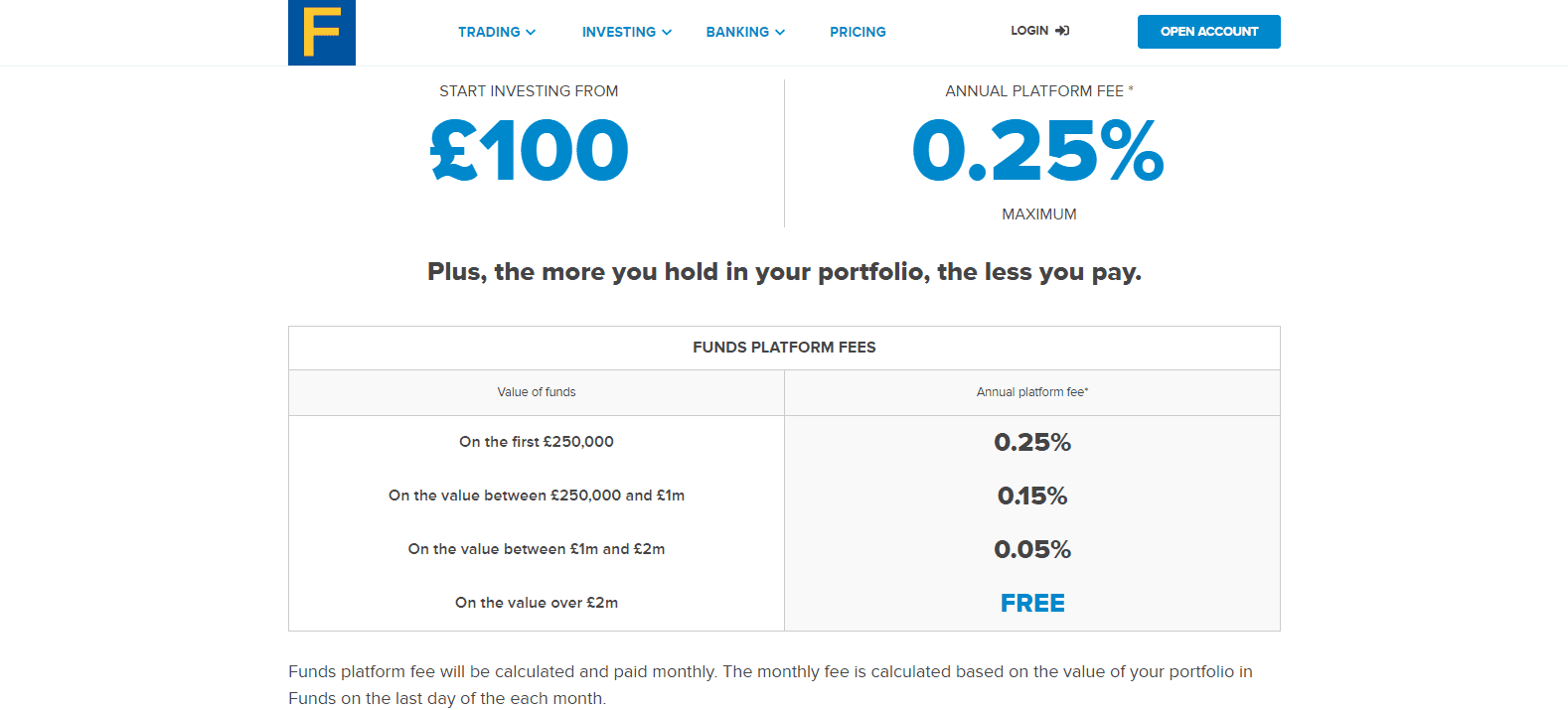

The Stock Screener allows manual traders an option to narrow the list of trading opportunities, an essential tool considering the massive asset selection. A multitude of filters ensures the appropriate group of assets is displayed swiftly. Adding value to the services maintained by this broker is full support for third-party developers, via the developer portal. The popularity of mutual fund investing did not go unnoticed, as evident by Fineco Asset Management (FAM) unit. Products created by FAM, together with a growing list of competing products is available at the Fineco fund platform. The minimum deposit is just £100, while the maximum annual fee is limited to 0.25%.

One essential tool for manual traders remains the Stock Screener.

The developer portal supports the creation of third-party solutions.

Mutual funds investing is offered via the fund portal.

A minimum deposit of £100 and a maximum fee of 0.25% ensures affordable access.

Research and Education

As a bank and well-established online brokerage, the absence of in-house research is surprising. The Newsroom hosts third-party content regarding financial markets and related content. A Trading Ideas sub-category is maintained in the video library, but research is unavailable. In its place is general information on how to navigate the trading platform. Not generating research by an operation, the size, and scope of Fineco Bank and failure to source third-party alternatives is a significant error.

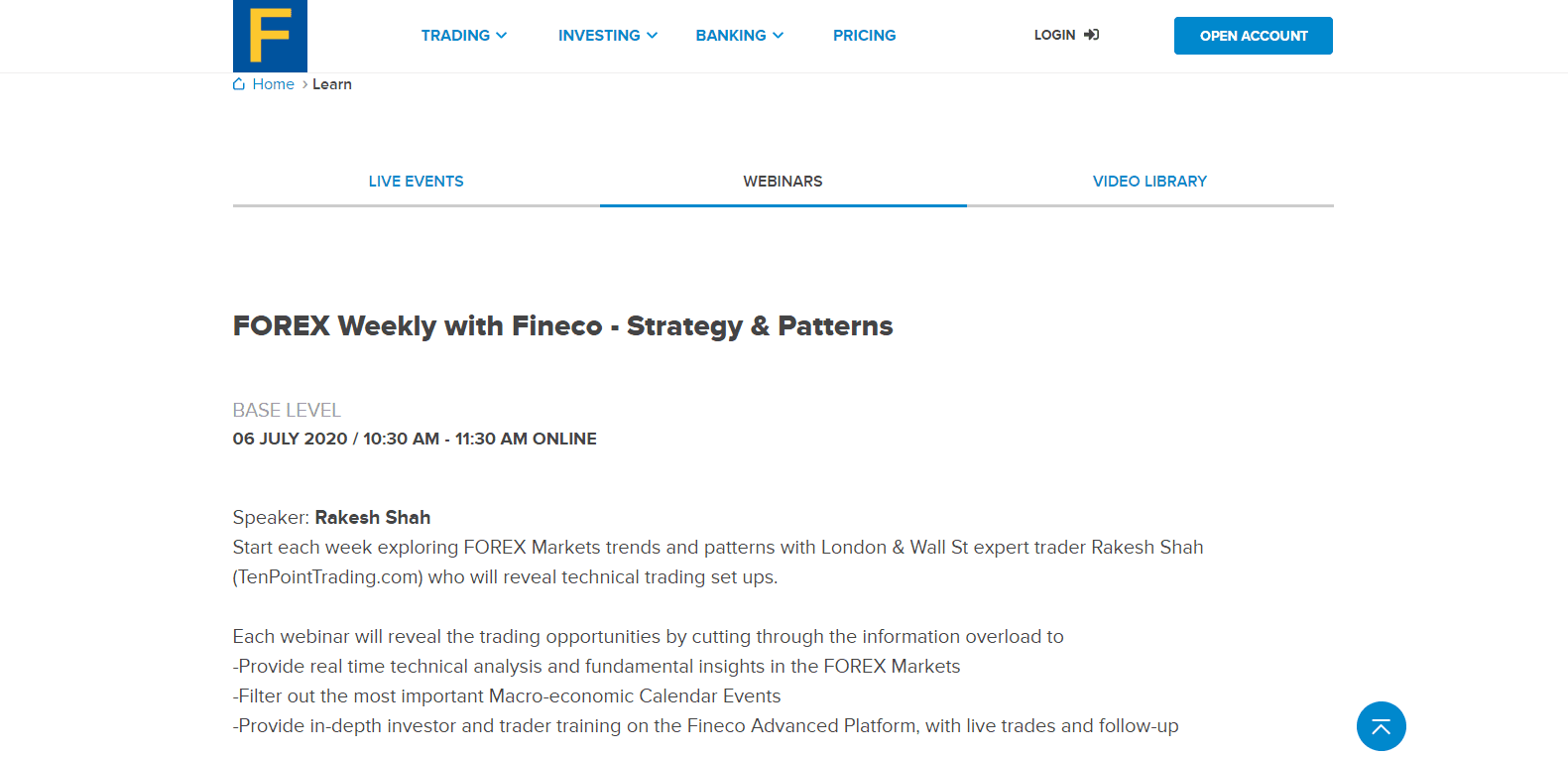

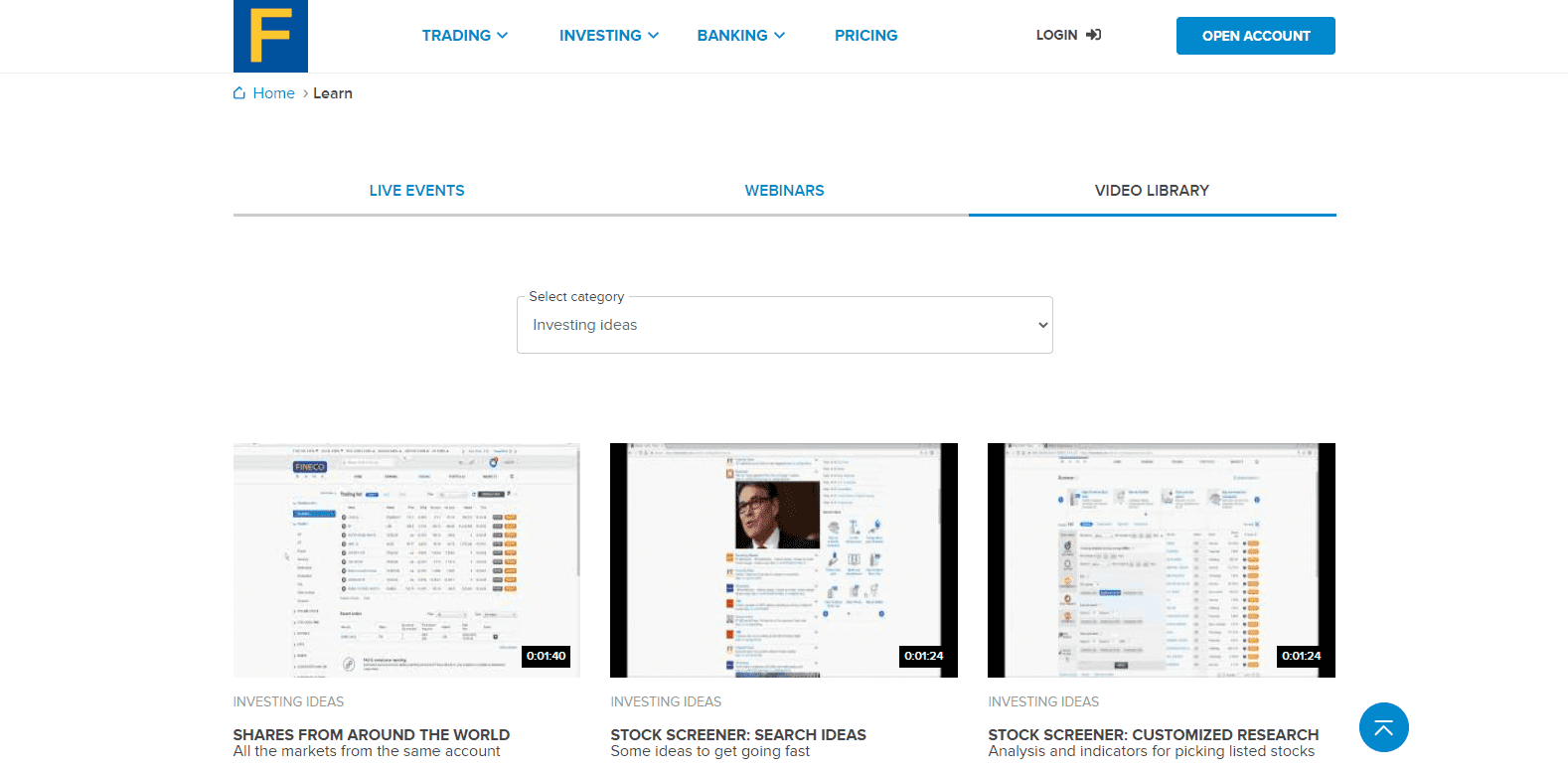

Education consists of live events, webinars, and a video library. Written content is exclusively published in the Newsroom. At the time of this review, live events were not available. Free webinars, available as a beginner and advanced lessons, are hosted weekly. The video library features additional educational material, which offers a basic overview of most products and services. Overall, the educational value remains a sub-standard service, distinctively of lesser quality as compared to competing brokers.

The Newsroom consists of third-party market commentary.

No live events were listed.

Free weekly webinars are maintained.

The video library covers tutorials of products and services at Fineco Bank.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F, 8 am - 9pm |

Website Languages |   |

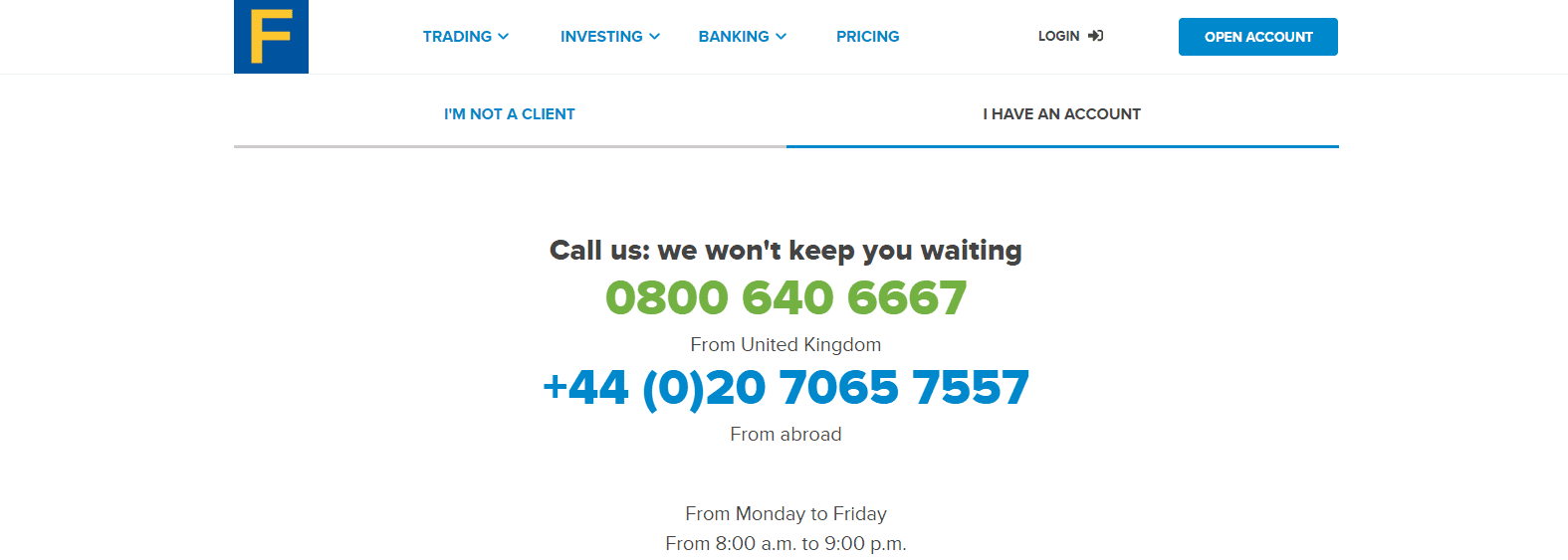

Customer support is available Monday through Friday between 8 am and 9 pm. Non-clients have to, while existing clients may communicate via live chat. An FAQ section is missing, and the overall approach to customer support is rather minimal but sufficient. The video library guides new clients through the usage of the trading services, a glossary is accessible, and Fineco Bank remains a well-managed brokerage where most traders are unlikely to require further assistance.

Bonuses and Promotions

Fineco Bank does not provide bonuses or grant special promotions.

Opening an Account

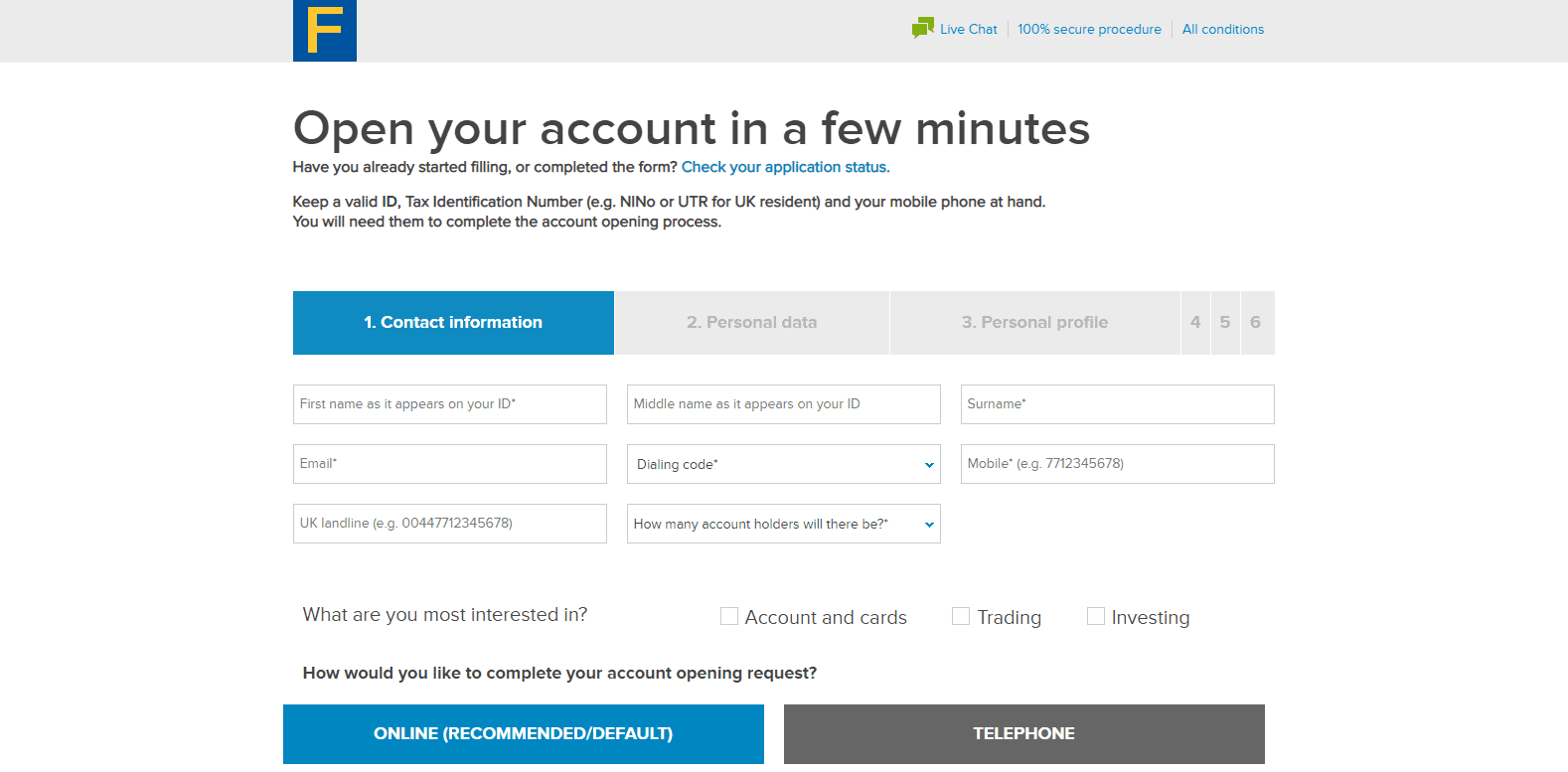

Per global industry standards, an online application processes new account applications, but Fineco Bank has a rather long six-step process to complete it. Live chat is on stand-by for assistance with the account opening process. The trader’s ID and tax identification number are mandatory, together with a valid mobile phone number. It appears the entire application will include the regulator mandated AML/KYC procedure, as a completion time between eight and fifteen minutes is noted. Fineco Bank maintains a highly secure and trustworthy operation, allowing traders to trust it with personal details and capital.

The six-step application process takes between eight and fifteen minutes to complete.

Deposits and Withdrawals

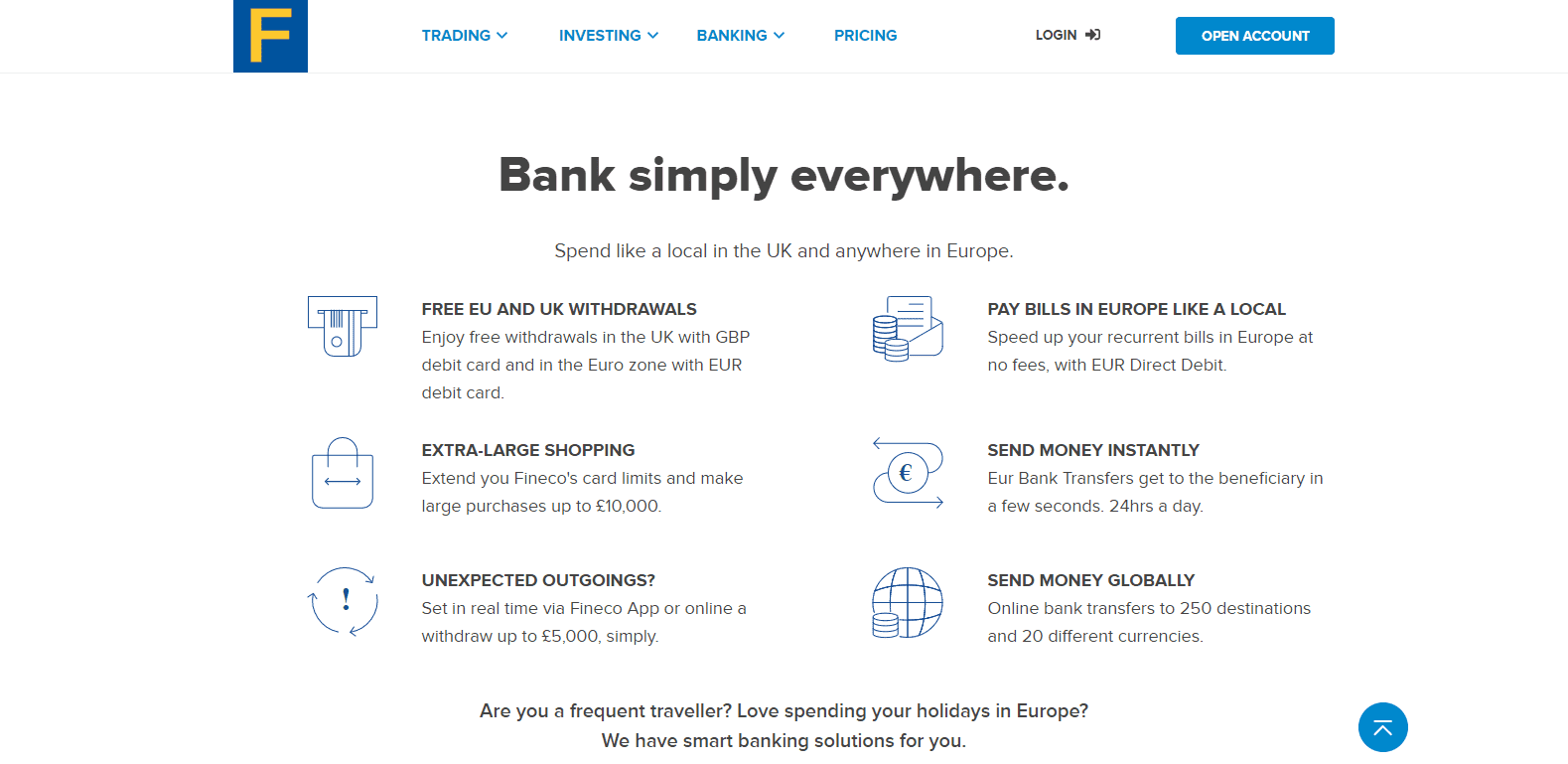

While no precise details on deposits and withdrawals exist, as a bank, it does support bank wires. Fineco Bank also issues debit cards, which can be used to manage finances. It appears that third-party processors are not supported, and more information may be available from inside the trading platform. The apparent limited deposit and withdrawal choice is a disappointment, together with the lack of complete details.

Fineco Bank appears to maintain a limited choice of deposit and withdrawal capabilities.

Trading Platform

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Summary

Fineco Bank is a well-established bank and online brokerage, operational since 1999, and quickly expanding its market share across the globe with a focus on Europe. Already home to over 1.35 million traders and more than 30.0 million processed orders annually, it features one of the most extensive asset selection of any online broker, exceeding 20,000 names. The pricing structure is extremely competitive and geared towards trader profitability, while the transparent and secure trading environment adds to the appeal of this broker.

Portfolios are managed from the proprietary PowerDesk trading platform, a feature-rich terminal with an advanced charting package, over 90 technical indicators, and more than 6,000 news items daily. While it is an outstanding gateway to financial markets for manual traders, together with the Stock Screener, it does not support automated trading solutions, a regrettable oversight in an otherwise excellent core trading environment at Fineco Bank.

Another significant oversight remains the absence of a proper research division. Third-party market commentary is available in the Newsroom, but it does not substitute for actual trading ideas and signals. The educational content also remains sub-standard as compared to other prime brokers. Fineco Bank is, therefore, rather unsuitable for new traders. Advanced traders, professionals, and asset managers will find it an excellent choice. The support for third-party developers allows the connection of existing automated trading solutions, making Fineco Bank a must-have as part of a well-diversified brokerage strategy. Fineco Bank is an Italian bank and online broker, expanding globally, listed on the Borsa Italiana, where it is a member of FTSE MIB. It is also a constituent of the Stoxx Europe 600 index. Fineco Bank is a very safe, well-regulated, independent bank. Until 2019, it was part of the UniCredit Group. It is authorized by the Bank of Italy, with limited regulatory oversight by the UK Financial Conduct Authority and Prudential Regulation Authority. Fineco Bank developed its proprietary PowerDesk trading platform. It is an advanced platform, ideally suited for manual traders, equipped with a charting package, more than 90 technical indicators, and over 6,000 daily news items. While it lacks support for automated trading solutions, it represents a superior choice for manual traders as compared to most other trading platforms. The Fineco Bank multi-currency trading account offers traders an efficient solution to trade global assets, is free of currency conversion costs, and the only trading platform offered. Fineco Bank offers an extremely cost-friendly trading environment and an excellent asset selection from a state-of-art trading platform. Therefore, it remains one of the primary choices in the online brokerage category, with an additional benefit as a sound banking choice.FAQs

What is Fineco Bank?

Is Fineco Bank safe or a scam?

What is the Fineco Bank trading platform?

What is the Fineco Bank multi-currency trading account?

Should you trade, invest, or bank with Fineco Bank?